We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Covered call ETFs like XYLD etc

mark_cycling00

Posts: 771 Forumite

Trying to assess the risk Vs reward of these. Found YouTubes that explain that your exposure to stock market gains is limited. But not much about other risks or volatility.

Tempting to think that if we're near the peak of the cycle then one could accept the limited gain risk in return for 10% return. Any other risks?

Would only invest fun amounts <1% for a little income.

Thanks

Tempting to think that if we're near the peak of the cycle then one could accept the limited gain risk in return for 10% return. Any other risks?

Would only invest fun amounts <1% for a little income.

Thanks

0

Comments

-

-

Thanks. I'd only seen his more recent one about "can you retire on 200k" which touched on them.

he doesn't explain it the level of dividends could drop for periods of time. I assume that the options prices change to ensure the dividends stay about the same.

0 -

mark_cycling00 said:Thanks. I'd only seen his more recent one about "can you retire on 200k" which touched on them.

he doesn't explain it the level of dividends could drop for periods of time. I assume that the options prices change to ensure the dividends stay about the same.I doubt that happens. The options are sold on a market so they can only be priced at what purchasers are willing to pay for them. I am trying to decide whether to buy Vanguard FTSE UK Equity Income Index or Schroder Income Maximiser for an income portfolio. Over the last five and ten years Schroder has achieved a slightly higher total return than Vanguard. Looking at the dividends over the last five years they are:2020/21. Vanguard 6.29%, Schroder 9.67%2021/22. Vanguard 5.61%, Schroder 7.25%2022/23. Vanguard 5.44%, Schroder 7.94%2023/24. Vanguard 6.69%, Schroder 8.36%2024/25. Vanguard 5.95%, Schroder 8.17%So the additional dividend generated by the covered calls - and, remember, by Schroder's active choice of which companies to hold and which to offer for covered calls - varied between 1.64% and 3.38%.1 -

That sort of analysis was really missing from the pension craft and other YouTubers!

It varies but generally still higher than some more standard income funds.

I might do a similar comparison to

Artemis income including charges since this seems to perform well

Thanks.

0 -

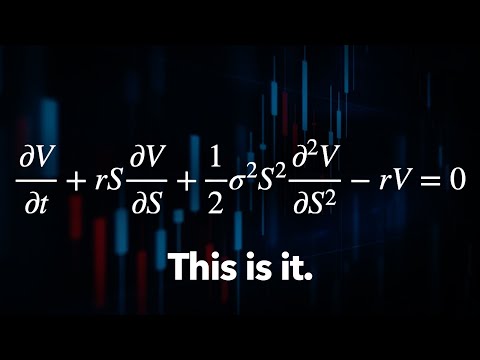

The price of options depends on the implied volatility for the duration of the option. It does not depend on the dividends or on what the market is willing to pay. Options do not need do not need to be bought from or sold to other traders. A market maker can replicate any options position by trading the underlying investments. The trillion dollar equation:aroominyork said:mark_cycling00 said:Thanks. I'd only seen his more recent one about "can you retire on 200k" which touched on them.

he doesn't explain it the level of dividends could drop for periods of time. I assume that the options prices change to ensure the dividends stay about the same.I doubt that happens. The options are sold on a market so they can only be priced at what purchasers are willing to pay for them.3 -

I believe in keeping things simple and easy to understand,

I also believe that when managers start to make things complicated, it is so they can transfer more of their investors money, into their own pockets.

I also suspect, those who think up these things are worried about risk to themselves should things go wrong & little to nothing about risks to others.

Am always suspicious when anyone is happy to go on about how much I can gain from something but avoids explaining all the risks involved in getting that gain.

I will not be buying these ETF's0 -

There is no free lunch here. You get a higher income at the expense of your capital, and pay higher costs for the privilege.Eyeful said:I believe in keeping things simple and easy to understand,

I also believe that when managers start to make things complicated, it is so they can transfer more of their investors money, into their own pockets.

I also suspect, those who think up these things are worried about risk to themselves should things go wrong & little to nothing about risks to others.

Am always suspicious when anyone is happy to go on about how much I can gain from something but avoids explaining all the risks involved in getting that gain.

I will not be buying these ETF's0 -

I have been saying for years "that there is no such thing as a free lunch, that someone has to pay for it"GeoffTF said:

There is no free lunch here. You get a higher income at the expense of your capital, and pay higher costs for the privilege.Eyeful said:I believe in keeping things simple and easy to understand,

I also believe that when managers start to make things complicated, it is so they can transfer more of their investors money, into their own pockets.

I also suspect, those who think up these things are worried about risk to themselves should things go wrong & little to nothing about risks to others.

Am always suspicious when anyone is happy to go on about how much I can gain from something but avoids explaining all the risks involved in getting that gain.

I will not be buying these ETF's

I would not chose to get higher income via covered call ETF's.

If I wanted income from my investing a simple low cost passive global dividend fund would do fine.

I just prefer simplicity and distrust fancy mumbo, jumbo, financial engineering thought up by someone in order to extract more money from me.

0 -

GeoffTF said:

The price of options depends on the implied volatility for the duration of the option. It does not depend on the dividends or on what the market is willing to pay. Options do not need do not need to be bought from or sold to other traders. A market maker can replicate any options position by trading the underlying investments. The trillion dollar equation:aroominyork said:mark_cycling00 said:Thanks. I'd only seen his more recent one about "can you retire on 200k" which touched on them.

he doesn't explain it the level of dividends could drop for periods of time. I assume that the options prices change to ensure the dividends stay about the same.I doubt that happens. The options are sold on a market so they can only be priced at what purchasers are willing to pay for them.What a fantastic video. Maths, physics, psychology, and a great history lesson. Many thanks.

That's fine, but when you buy your next mobile phone (or shirt, or whatever), remember it was thought up by someone to extract more money from you.Eyeful said:

I have been saying for years "that there is no such thing as a free lunch, that someone has to pay for it"GeoffTF said:

There is no free lunch here. You get a higher income at the expense of your capital, and pay higher costs for the privilege.Eyeful said:I believe in keeping things simple and easy to understand,

I also believe that when managers start to make things complicated, it is so they can transfer more of their investors money, into their own pockets.

I also suspect, those who think up these things are worried about risk to themselves should things go wrong & little to nothing about risks to others.

Am always suspicious when anyone is happy to go on about how much I can gain from something but avoids explaining all the risks involved in getting that gain.

I will not be buying these ETF's

I would not chose to get higher income via covered call ETF's.

If I wanted income from my investing a simple low cost passive global dividend fund would do fine.

I just prefer simplicity and distrust fancy mumbo, jumbo, financial engineering thought up by someone in order to extract more money from me.So far as covered calls go, it's a classic example of only buying things you understand. The options market is large enough to suggest that, unless the owners of trillions of dollars have been hoodwinked, they fulfil a useful role. Just ask Thales of Miletus.0 -

It is tool for speculators. Speculators provide price discovery and liquidity.aroominyork said:The options market is large enough to suggest that, unless the owners of trillions of dollars have been hoodwinked, they fulfil a useful role.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

https://www.youtube.com/watch?v=-mCIiLJ5Cyc

https://www.youtube.com/watch?v=-mCIiLJ5Cyc

https://www.youtube.com/watch?v=A5w-dEgIU1M

https://www.youtube.com/watch?v=A5w-dEgIU1M