We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

IG Promotion - Invest £50 or more and get between £40 to £200 in bonus shares

pecunianonolet

Posts: 1,891 Forumite

Hi,

Just came across this promotion and having read the T&C's I am not fully clear.

https://www.ig.com/uk/bonus-shares-promotion-oct-25

1. Open the account e.g. S&S ISA or GIA and pay at least £50 in

2. Buy some shares and use up the full £50 in one transaction, ideally you make 2 small extra trades (higher pay in required) to avoid any custody fees

3. Get free shares awarded

4. Hold initial investment until 30th November and sell (hopefully with profit) on 1st December all shares if you wish or make a portfolio transfer to another provider

5. Transfer cash to bank account

6. Close down account if not required further

Is that in essence what needs to be done for a bit of free cash or am I missing something?

To reduce market fluctuations risk it is probably best to buy a "boring" MMF?

Just came across this promotion and having read the T&C's I am not fully clear.

https://www.ig.com/uk/bonus-shares-promotion-oct-25

1. Open the account e.g. S&S ISA or GIA and pay at least £50 in

2. Buy some shares and use up the full £50 in one transaction, ideally you make 2 small extra trades (higher pay in required) to avoid any custody fees

3. Get free shares awarded

4. Hold initial investment until 30th November and sell (hopefully with profit) on 1st December all shares if you wish or make a portfolio transfer to another provider

5. Transfer cash to bank account

6. Close down account if not required further

Is that in essence what needs to be done for a bit of free cash or am I missing something?

To reduce market fluctuations risk it is probably best to buy a "boring" MMF?

3

Comments

-

Thanks for this but looks like ended 30 September. Link doesn't work and this:

0 -

Maybe empty your cache, promotion started only yesterday but looks like it was just extended from previous month based on your link.drphila said:Thanks for this but looks like ended 30 September. Link doesn't work and this:

0 -

Hi if it's the same terms as their last offer there's a quarterly £24 fee. However, you can avoid it by making three trades per quarter. Buying a very low value share would do.2

-

When I did the other promotion, I went with FWRG (FTSE All World), since it was about £6 a share, and you can’t buy fractional shares. It’s unlikely to drop but if it did, I can’t imagine it’d be too dramatic. You could probably buy 9 shares for £55 ish for your first trade to be safe. I’d probably trade 3 times on the first month and once every after month to waive the custody fee since the quarterly part seems a bit ambiguous to me at least.The only MMF fund I was aware of, CSH2, is ~£1200 a share so didn’t work for me.3

-

pecunianonolet said:

Maybe empty your cache, promotion started only yesterday but looks like it was just extended from previous month based on your link.drphila said:Thanks for this but looks like ended 30 September. Link doesn't work and this:

Your link is working for me now without me doing anything, so I guess it must have been a technical glitch at the time I checked

1 -

Would the first £50 trade before 31 Oct and 2 other smaller trades before 30 Nov not be enough to waive the quarterly fee?orange-juice said:When I did the other promotion, I went with FWRG (FTSE All World), since it was about £6 a share, and you can’t buy fractional shares. It’s unlikely to drop but if it did, I can’t imagine it’d be too dramatic. You could probably buy 9 shares for £55 ish for your first trade to be safe. I’d probably trade 3 times on the first month and once every after month to waive the custody fee since the quarterly part seems a bit ambiguous to me at least.The only MMF fund I was aware of, CSH2, is ~£1200 a share so didn’t work for me.

Is it calendar quarter Oct, Nov, Dec?

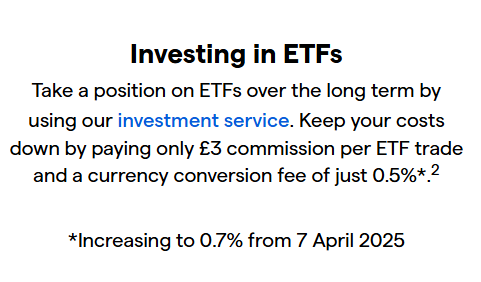

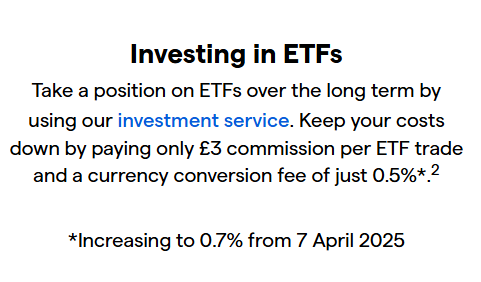

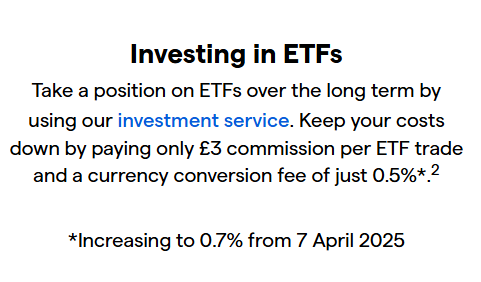

Also is there £3 commission per ETF trade?

0 -

I’m not sure how they determine the quarterly bit hence my trading strategy.Aidanmc said:

Would the first £50 trade before 31 Oct and 2 other smaller trades before 30 Nov not be enough to waive the quarterly fee?orange-juice said:When I did the other promotion, I went with FWRG (FTSE All World), since it was about £6 a share, and you can’t buy fractional shares. It’s unlikely to drop but if it did, I can’t imagine it’d be too dramatic. You could probably buy 9 shares for £55 ish for your first trade to be safe. I’d probably trade 3 times on the first month and once every after month to waive the custody fee since the quarterly part seems a bit ambiguous to me at least.The only MMF fund I was aware of, CSH2, is ~£1200 a share so didn’t work for me.

Is it calendar quarter Oct, Nov, Dec?

Also is there £3 commission per ETF trade?

Similarly, unsure where you are seeing the bit about ETFs, but I’ve never paid that. Maybe those are limit orders or something.1 -

IG's website is a bit of a mess and that might be old data. If you follow the link in your screenshot it takes you to a page stating it's zero commission for shares and ETFs:Aidanmc said:

Would the first £50 trade before 31 Oct and 2 other smaller trades before 30 Nov not be enough to waive the quarterly fee?orange-juice said:When I did the other promotion, I went with FWRG (FTSE All World), since it was about £6 a share, and you can’t buy fractional shares. It’s unlikely to drop but if it did, I can’t imagine it’d be too dramatic. You could probably buy 9 shares for £55 ish for your first trade to be safe. I’d probably trade 3 times on the first month and once every after month to waive the custody fee since the quarterly part seems a bit ambiguous to me at least.The only MMF fund I was aware of, CSH2, is ~£1200 a share so didn’t work for me.

Is it calendar quarter Oct, Nov, Dec?

Also is there £3 commission per ETF trade?

https://www.ig.com/uk/investments

The page which states £3: https://www.ig.com/uk/etfs0 -

IG work with calendar quarter as I had to ask about this after using a previous promotion.Aidanmc said:

Would the first £50 trade before 31 Oct and 2 other smaller trades before 30 Nov not be enough to waive the quarterly fee?orange-juice said:When I did the other promotion, I went with FWRG (FTSE All World), since it was about £6 a share, and you can’t buy fractional shares. It’s unlikely to drop but if it did, I can’t imagine it’d be too dramatic. You could probably buy 9 shares for £55 ish for your first trade to be safe. I’d probably trade 3 times on the first month and once every after month to waive the custody fee since the quarterly part seems a bit ambiguous to me at least.The only MMF fund I was aware of, CSH2, is ~£1200 a share so didn’t work for me.

Is it calendar quarter Oct, Nov, Dec?

Also is there £3 commission per ETF trade?

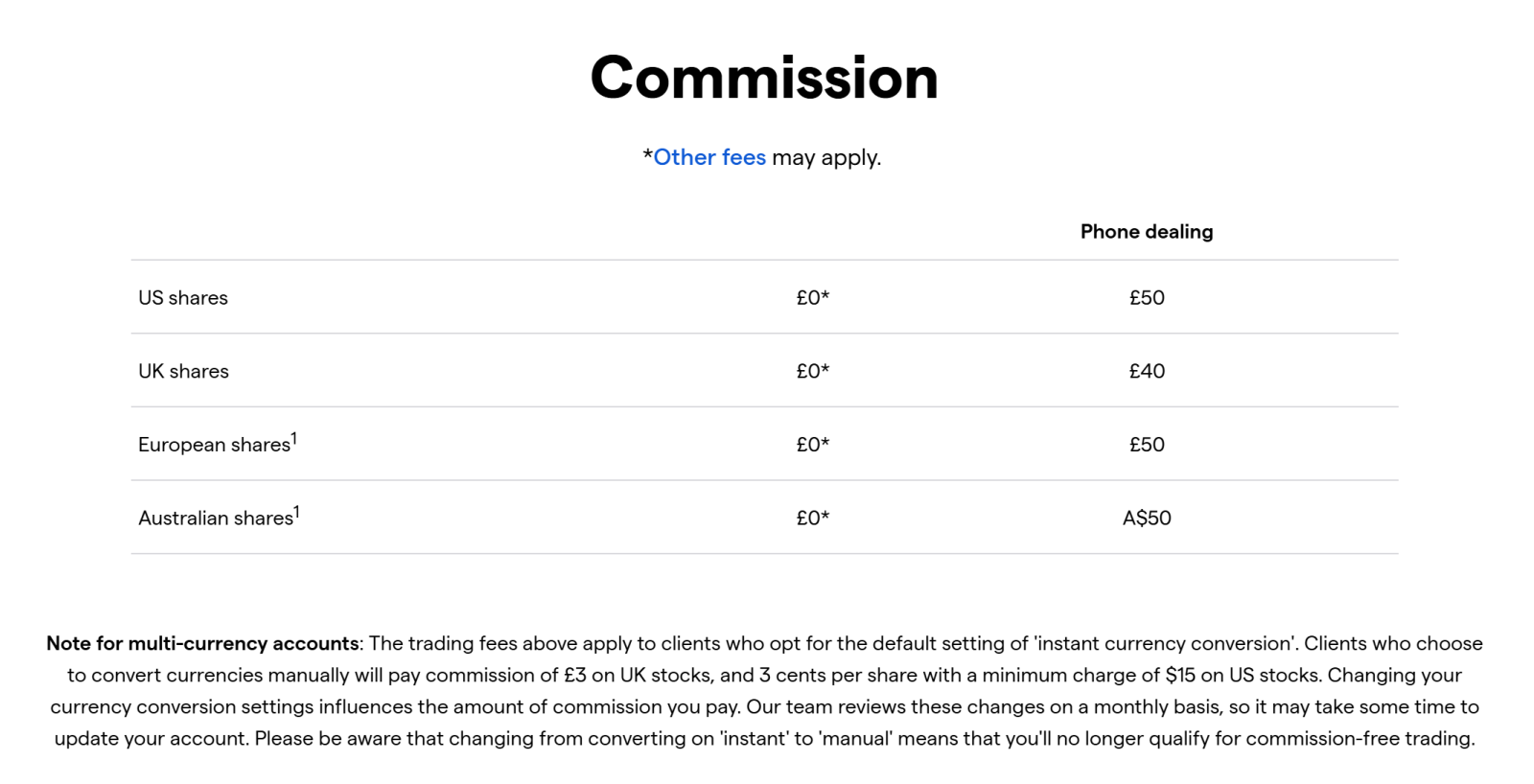

The ETF £3 fee should not apply in normal cases as this is for manual currency conversion (see image below and see the following link Our Commissions and Charges on Share Dealing - IG UK)

Added this for clarity on commission on S&S ISA

There is also no limit on how small your trade has to be so three small trades before 1st January would prevent the quarterly fee. But yes the first being >£50 would get you the promo.1 -

I basically just have to follow the above steps so it should be a rather straight forward promotion to get some free cash. I hold a few shares with Trading212 so I should be able, instead of selling shares bought and allocated, to transfer my portfolio to T212? Don't see a reason why I would stay with IG after.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards