We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Being nosey... How many Regular Saver accounts do you have?

Comments

-

Excellent!n15h said:

I am truly impressed by the number of accounts that many of the posters have! I never understood the benefit of regular savings until more recently, and now I'm wishing I started earlier - looks like I've caught the bug. I only have 2 so far (N/wide and Virgin) and will be applying for a 3rd one this week (the Progressive RS launched this week). I'll be paying more attention to the RS threads for new RS products and one day i'll hopefully be a part of the double digit club. As the saying goes, the best time to start was yesterday. The next best time is today (ok i may have paraphrased!)Bobblehat said:Some more additions ...

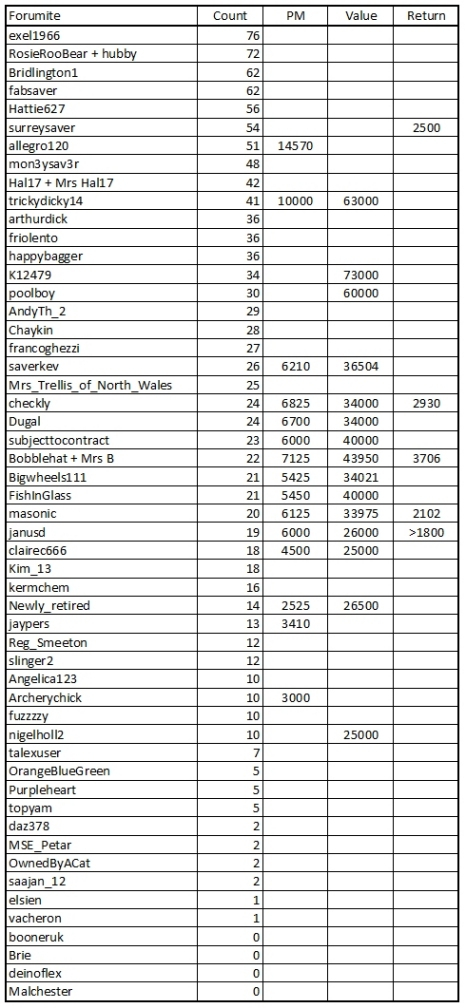

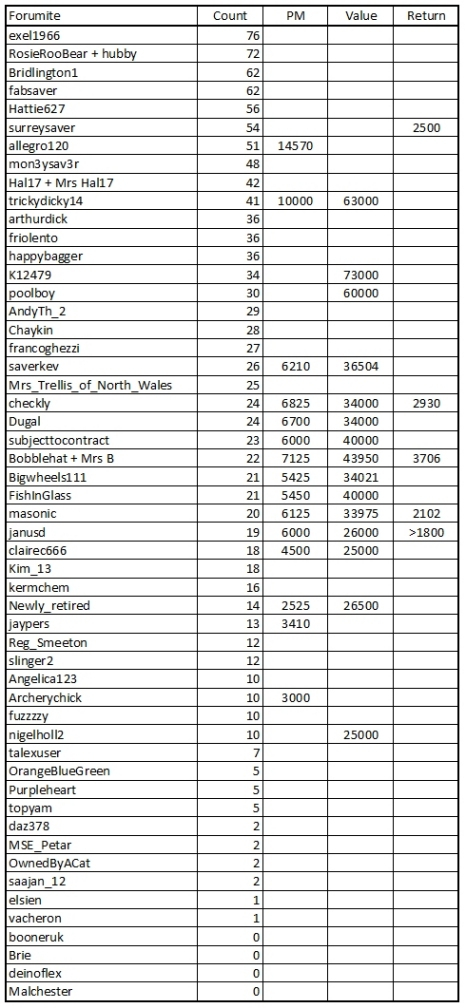

Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

A lot would depend on an individual's opinion of "successful". Is it who is squeezing out the most profit from RSs in a given period? Would it be pre- or post tax profit? Is it who has the most money in RSs in a given period? What would the period be? Is it who has the best balance between RS cash savings and investments/pensions? Would there be an age handicap, or a handicap based on mortgage and/or other financial commtments? Would the amount in RSs be relative to a person's income? etc etc etc.clairec666 said:I don't know how we'd measure it, but I wonder from our little league table who is the most successful at spreading their regular savers throughout the year.

As you say, how would we measure it? And more importantly, why would we measure, and publish, it?

1 -

Principality and YBS are the usual Christmas providers, with the latter not being that competitive. Monmouthshire offered a good one in 2022 but haven’t for the last two years. We might see something from Principality this month as last year’s accounts start maturing, but YBS have form for launching in January with a shorter term.topyam said:Just started a few months here.

Been picking the high rates just atm. Anything 7% or over is getting snapped up. And the odd ones that are 6% and over with a large monthly deposit limit (eg First Trust).

I suspect I will have a lot maturing around the same time next year.I guess it takes a while before you get to that ideal scenario of having ones maturing each month.

For those who have been at it a while, are particular months better than others for RS being offered?

Also - do many offer Christmas ones?1 -

True, we all have our own aims with our regular saver collections, and my idea of success could be different from others. I guess the original idea of banks offering these accounts is for someone who wants to put a bit of money aside for something special, a holiday or whatever, they could save a couple of hundred each month and when it matures they'll have a nice chunk of interest on top of what they put in.friolento said:

A lot would depend on an individual's opinion of "successful". Is it who is squeezing out the most profit from RSs in a given period? Would it be pre- or post tax profit? Is it who has the most money in RSs in a given period? What would the period be? Is it who has the best balance between RS cash savings and investments/pensions? Would there be an age handicap, or a handicap based on mortgage and/or other financial commtments? Would the amount in RSs be relative to a person's income? etc etc etc.clairec666 said:I don't know how we'd measure it, but I wonder from our little league table who is the most successful at spreading their regular savers throughout the year.

As you say, how would we measure it? And more importantly, why would we measure, and publish, it?

For me, it's more about making my long-term savings work in the best way possible, so spreading the maturities means that my money's earning the best possible rates for the longest possible proportion of the time. Ideally.

Or it could just be an excuse to make a spreadsheet and mess around with numbers

No need to add any new columns to Bobblehat's spreadsheet, it's fine as it is without bring tax complications into the mix!3 -

In my experience over the past 15 years or so at the RS game the second half of the year seems to be more prevalent, particularly the months of Sept to Dec as it is again for me this year with 23 maturities in that period. Quietest months seem to be Jan and Feb.topyam said:Just started a few months here.

Been picking the high rates just atm. Anything 7% or over is getting snapped up. And the odd ones that are 6% and over with a large monthly deposit limit (eg First Trust).

I suspect I will have a lot maturing around the same time next year.I guess it takes a while before you get to that ideal scenario of having ones maturing each month.

For those who have been at it a while, are particular months better than others for RS being offered?

Also - do many offer Christmas ones?

A handful of BS such as YBS/Principality/Monmouth/Furness offer what they call 'XMAS' RS, however the name Xmas is a nothing more than a marketing tool in reality trying to catch those who will need extra funds at that time of year. They tend to be available to open from Oct to Jan

1 -

Sorry newbie question here...once my first direct finishes...can you start a new regular saver straight away0

-

Generally you can apply as soon as you see the existing account disappear at the start of the maturity process (which can take a few days to complete).daz378 said:Sorry newbie question here...once my first direct finishes...can you start a new regular saver straight away1 -

Just tried opening a darlington..account...got through it gave me an application number.. but no email acknowledgement or text...did not make a note of it ... might ring tomorrow if not heard anything0

-

@n15h I'd go Principality before Provincialn15h said:

I am truly impressed by the number of accounts that many of the posters have! I never understood the benefit of regular savings until more recently, and now I'm wishing I started earlier - looks like I've caught the bug. I only have 2 so far (N/wide and Virgin) and will be applying for a 3rd one this week (the Progressive RS launched this week). I'll be paying more attention to the RS threads for new RS products and one day i'll hopefully be a part of the double digit club. As the saying goes, the best time to start was yesterday. The next best time is today (ok i may have paraphrased!)Bobblehat said:Some more additions ...

Higher rate and when you choose maturity options that allow you to have duplicate accounts you are quids in!

I'm on 4 Principally accounts now even thought the 'rules' suggest you can only have 1.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards