We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Dealing with 2 x deaths, one with a will and one without

Comments

-

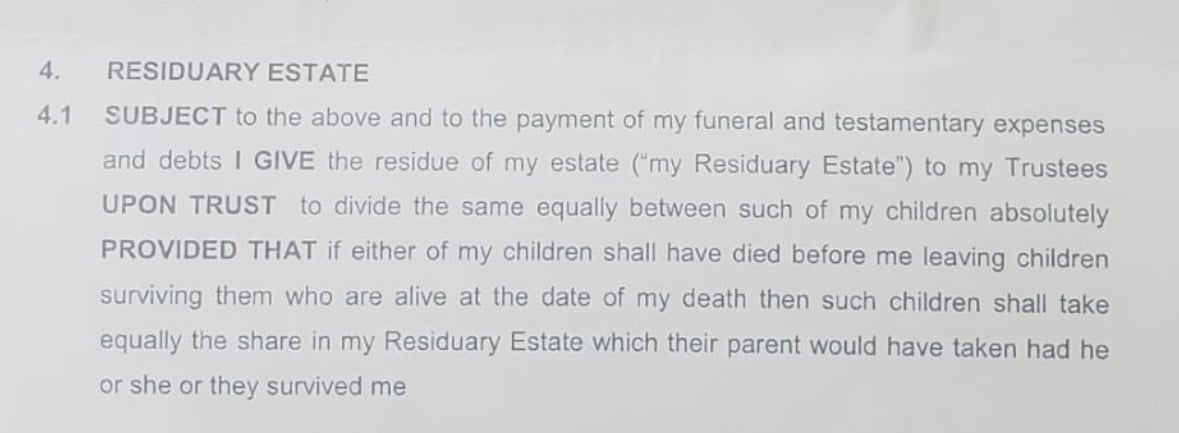

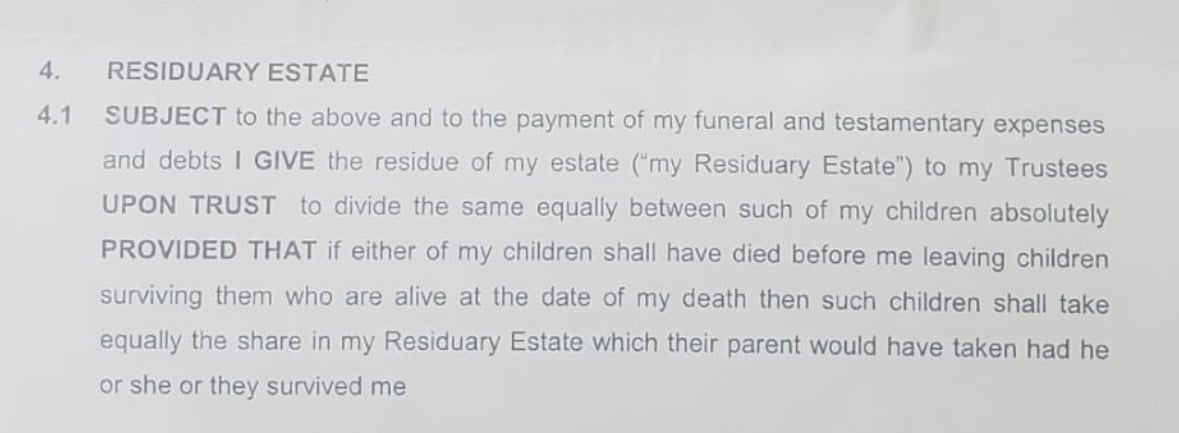

@tooldle Annoyingly it would appear that there is no "survivorship clause" on the will, this was something myself and my mum had read online and we felt perhaps she had made a very basic will and not been given great advice. I dont know if its worth me going back to the solicitor who did the will and who is doing the POA to ask them?

I have attached a photo "Residuary estate" I cant really decipher what this means.

@RAS

My sister is still very much helping with phonecalls and other jobs, i am just thinking ahead and planning for her situation in 8 weeks when she will very much be preoccupied with a new baby.

I was about to just open up two new bank accounts, do they need to be special executor accounts?

Thanks you have offered some really good advice so far.

My brother does receive benefits, good point we plan to get some advice around how my brother might receive any inheritance.

House insurance is still active on both houses and we are checking them regularly. All utilities for both have been contacted

I should get my POA legal document by monday afternoon for be to then make a start on the next steps.

@Keep_pedalling

You mentioned my nans estate being under 650k - does this only apply if she was married? I thought it would be 325K for her?

My dads is over 325k (500k) with the house so yes we do expect that it will go over 500 territory."With the deaths so close together it is possible for his administrator to make a deed of variation passing his inheritance directly to his children which will prevent what would have been his inheritance with a substantial IHT liability"

So in this case, I presume I am going to be the administrator, Yes? How do I go about looking into this. Sorry I have so much going on in my head and it feels quite complex at times0 -

@tooldle Attached photo - "Residuary estate"

1

1 -

Any other insurance to pay off dad's mortgage?If you've have not made a mistake, you've made nothing0

-

@RAS he did not have a mortgage0

-

Ah, brilliant.

In which case, a DOV is definitely a good idea on nan's estate. It would mean dad didn't inherit from her so reduce his estate's IHT liability.

As a widow, nan inherits her husband's IHT allowances unless he left lots to people other than her? So up to £650k plus the house value but you'd need to fill in IHT forms to prove there's none to pay if you use the residential allowance.

A DOV needs to be done within 2 years of nan's death, so there is time to sort it out.If you've have not made a mistake, you've made nothing0 -

Agree both KP and RAS, a deed of variation of Nan's estate executed by the beneficiaries entitled under father's intestacy ( ie his children) is the way to go. This will prevent Nan's estate from being amalgamated with father's estate for IHT purposes.

However it's my experience that not all 'low level' solicitors firms are familiar with this form of DOV drafting in these circumstances.

Indeed in a similar scenario (an intestate child's estate falling into a surviving parent's estate who then died 6 month later) it was necessary for me to refer a friend to a STEP qualified solicitor to draft the appropriate DOV since the solicitor handling the mother's estate was out of their depth. In that case the cost was £1,700 for the DOV but avoided £75k IHT.

3 -

Yes her estate has any unused NRB that can be transferred from her husband’s estate unless he did not leave her the bulk of his estate.Olivia2018 said:

@Keep_pedalling

You mentioned my nans estate being under 650k - does this only apply if she was married? I thought it would be 325K for her?

My dads is over 325k (500k) with the house so yes we do expect that it will go over 500 territory.1 -

Thanks for clarifying. I asked as wondering if Nan’s bequest would bypass Dad’s estate completely (making things simpler). I’m no expert but, interpret this (assuming there is no other clause giving additional instruction) as Dad and his sibling will inherit. You would only inherit from Nan if Dad had died before Nan.Olivia2018 said:@tooldle Attached photo - "Residuary estate" 1

1 -

@RAS do you have experience with DOVs?

It definitely looks positive for us as the next way to go, i think I am going to make contact with a solicitor who is STEP tomorrow and get a little more info as I have a few questions.

I don’t mind paying the fee if it means a chunk of inheritance isn’t swallowed up by IHT

I did wonder, the beneficies of my nans will I presume are myself and two siblings and my auntie (my nans daughter) would we all need to agree to this or just me and two siblings agree? As her portion of inheritance is not being affected by the DOV. And do you know can I do the DOV myself?

0 -

Olivia2018 said:

@RAS do you have experience with DOVs?

It definitely looks positive for us as the next way to go, i think I am going to make contact with a solicitor who is STEP tomorrow and get a little more info as I have a few questions.

I don’t mind paying the fee if it means a chunk of inheritance isn’t swallowed up by IHT

I did wonder, the beneficies of my nans will I presume are myself and two siblings and my auntie (my nans daughter) would we all need to agree to this or just me and two siblings agree? As her portion of inheritance is not being affected by the DOV. And do you know can I do the DOV myself?

Answer to your last question is no, the wording and terminology to ensure you and siblings have correctly varied your Nan's Will does require careful drafting to ensure you have replaced yourselves (rather than your father ) as direct inheritors of 50% of Nan's estate.

As for your Aunt none of this concerns her, so she will not be a party to the DOV since as you indicated her half share of the estate is unaffected and she has also deferred to you ( as her attorney) sole executorship of your Nan's estate.

Be guided by the STEP solicitor, and hopefully everything will go smoothly and IHT avoided under these unfortunate circumstances.

Better to spend a few bob and get it right 1st time. Re DOVs HMRC does not permit a 2nd bite of that particular cherry.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards