We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Income and Dividend taxes

GenX0212

Posts: 233 Forumite

Hi all,

Looking for a little bit of guidance/confirmation on estate taxes (not IHT) liable on gains/losses between the date of death and the date of final distribution(s).

Roughly speaking the estate comprises of:

A) £260k in bank accounts/cash ISA

B ) £10k in National Savings - interest reinvested prior to death

C) £20k in Premium Bonds - wins reinvested prior to death

D) £100k in stocks shares ISA

E) £80k in investment savings account (GIA) - dividends paid in cash prior to death

F) £10k in shares - dividends paid in cash prior to death

Looking for a little bit of guidance/confirmation on estate taxes (not IHT) liable on gains/losses between the date of death and the date of final distribution(s).

Due to the sums involved it's likely there will be tax owing to HMRC at some point.

My understanding is that we will have to pay tax at 20% on any interest/growth and 8.75% on any dividend payments.

The estate gets split 50/50 between daughter and son with daughter as sole executor.

All payments will go into a new non-interest bearing current account.

My understanding is that we will have to pay tax at 20% on any interest/growth and 8.75% on any dividend payments.

The estate gets split 50/50 between daughter and son with daughter as sole executor.

All payments will go into a new non-interest bearing current account.

Roughly speaking the estate comprises of:

A) £260k in bank accounts/cash ISA

B ) £10k in National Savings - interest reinvested prior to death

C) £20k in Premium Bonds - wins reinvested prior to death

D) £100k in stocks shares ISA

E) £80k in investment savings account (GIA) - dividends paid in cash prior to death

F) £10k in shares - dividends paid in cash prior to death

Questions/Assumptions:

1) 20% rate will apply to any interest growth on A and B

2) What happens with any Premium Bonds wins (C)?

1) 20% rate will apply to any interest growth on A and B

2) What happens with any Premium Bonds wins (C)?

3) 20% rate will apply to any growth on D

4) 20% rate will apply to any growth on E

5) What happens with any dividend distributions from E now added back to the account?

6) 20% rate will apply to any capital gains on F

7) 8.75% will also apply to dividends received from F

4) 20% rate will apply to any growth on E

5) What happens with any dividend distributions from E now added back to the account?

6) 20% rate will apply to any capital gains on F

7) 8.75% will also apply to dividends received from F

I presume there are no reasons not to calculate the tax owing on each different source as it comes into the current account, keep the tax to one side and then distribute the rest of the money immediately?

many thanks.

many thanks.

0

Comments

-

1) Yes, except that interest on the cash ISA remains tax-free (see 3 below). And I assume that B doesn't comprise NS&I tax-free products like Savings Certificates.

2) Premium bond winnings are tax-free as advised in your earlier thread.

3) No, the ISA remains free of both income tax and CGT for up to 3 years after death, until it is closed.

4) Not sure what E is exactly, but the CGT rate for deceased estates rose to 24% at the last budget (30 October 2024), with an annual allowance against gains of £3,000.

5) Are these distributions taxable as dividends or interest? The estate pays 8.75% or 20% respectively, as you mentioned.

6) No, 24% as above.

7) Yes.

I would be inclined to hold some extra cash back until you're sure that HMRC agree your figures for tax due. And that's assuming that no other debts or claims pop up unexpectedly. There was a thread today with solicitors complaining how slowly HMRC now deal with this:

https://trustsdiscussionforum.co.uk/t/delay-in-informal-route-with-hmrc/279430 -

Thank you. much appreciated.probate_slave said:1) Yes, except that interest on the cash ISA remains tax-free (see 3 below). And I assume that B doesn't comprise NS&I tax-free products like Savings Certificates.

2) Premium bond winnings are tax-free as advised in your earlier thread.

3) No, the ISA remains free of both income tax and CGT for up to 3 years after death, until it is closed.

4) Not sure what E is exactly, but the CGT rate for deceased estates rose to 24% at the last budget (30 October 2024), with an annual allowance against gains of £3,000.

5) Are these distributions taxable as dividends or interest? The estate pays 8.75% or 20% respectively, as you mentioned.

6) No, 24% as above.

7) Yes.

I would be inclined to hold some extra cash back until you're sure that HMRC agree your figures for tax due. And that's assuming that no other debts or claims pop up unexpectedly. There was a thread today with solicitors complaining how slowly HMRC now deal with this:

https://trustsdiscussionforum.co.uk/t/delay-in-informal-route-with-hmrc/27943- re the NS&I savings it's a Guaranteed Growth Bond

- re CGT I had assumed it to be 20% based upon this statement on the gov.uk website: https://www.gov.uk/probate-estate/managing-and-selling-assets "Estates do not get any allowances on savings, income or dividends. Estates pay tax at the basic rates of 8.75% on dividends and 20% on any other income.". I guess then that the page is out of date?

- re the GIA dividends. The fund is a "BNY Mellon - Newton UK Income Fund". I believe the dividends are reinvested as DRIP and hence it is the total plan value subject to CGT

- Yes. good idea re holding back an amount of cash

0 -

re CGT perhaps the page is correct and the rate is 20% as a capital gain is not income, it’s a capital gain and subject to CGT.1

-

OK, the NS&I interest is taxable as you thought.

The gov.uk site is well maintained and up to date. But gains from realising assets are quite distinct from income, and separately taxed. The rate is at the end of this linked page:

https://www.gov.uk/capital-gains-tax/rates

Your 'BNY Mellon - Newton UK Income Fund' appears to be an equity investment. So the dividends are subject to 8.75% income tax, but the fund itself, when you sell it, will suffer 24% CGT on growth since probate value. For an accumulating fund you are allowed to reduce the gain by any dividends received since death, avoiding double taxation.1 -

Just reread the page and yes you are correct.relaxtwotribes said:re CGT perhaps the page is correct and the rate is 20% as a capital gain is not income, it’s a capital gain and subject to CGT.Also noted that there is a CGT allowance of £3000 available as the Personal Representative (Executor)0 -

The only thing I would add relates to your question 4 and any investment income received on the £80k GIA investment portfolio.

To assist you with the identification exercise your deceased parent will have received a consolidated tax certificate of interest and dividends received in the 2024/25 tax year from the investment platform concerned. This certificate will assist in the identification process.

You seem to indicate the GIA portfolio comprises just one single investment in Newton UK Income Fund, with income reinvested on DRIPs.

If you can you should terminate DRIPs ASAP, since continuing with this arrangement complicates your tax computations ( income tax on the dividends themselves and potential CGT on additional units purchased with the DRIPs).

One further point, although you may be entitled to utilise HMRC's informal letter approach to report the estate tax payable ( assuming total taxes are below the £10k threshold) I would be inclined to suggest you report via a formal SA900 estate tax return when the time comes.

The reason for this, is at end of the estate administration period you will have to prepare estate tax deduction certificates R185 detailing the respective shares of net estate income distributed to the beneficiaries. This is because depending on their respective personal income tax thresholds they may be entitled to income tax refunds on estate tax paid on the income, or liable to higher rate tax thereon.

Preparing the formal SA 900 should help assist with completion of the R185s - see below the R185 template:

https://assets.publishing.service.gov.uk/media/65e5aeb57bc329e58db8c1b9/R185Estate-Income.pdf

1 -

Hi all (again),

Pressing on with probate and for the most part all ok however after notifying Equitini of the death with regards to share holdings they have replied with a letter confirming the share holdings (which we already knew) but they haven't given any valuation for the shares as at the date of death.

How do we get this info, will they provide it later or is there some (reliable) website where we can look it up?

Thanks.0 -

If you google the company or fund you will find various free sites giving historic price information. It's easiest if you know the ticker/ISIN/SEDOL (eg GB00B7NCQK32). For instance this might be your Mellon - Newton fund, but there are numerous similar classes with different values:

https://markets.ft.com/data/funds/tearsheet/historical?s=GB00B7NCQK32:GBX

If there is a range of values given for the day, you apply the quarter-up method described here:If any shares are marked ex-dividend (XD) at date of death, the dividend is regarded as accrued income and therefore included in the estate for IHT purposes, even though paid after death. It is also taxable as income on the executor.1 -

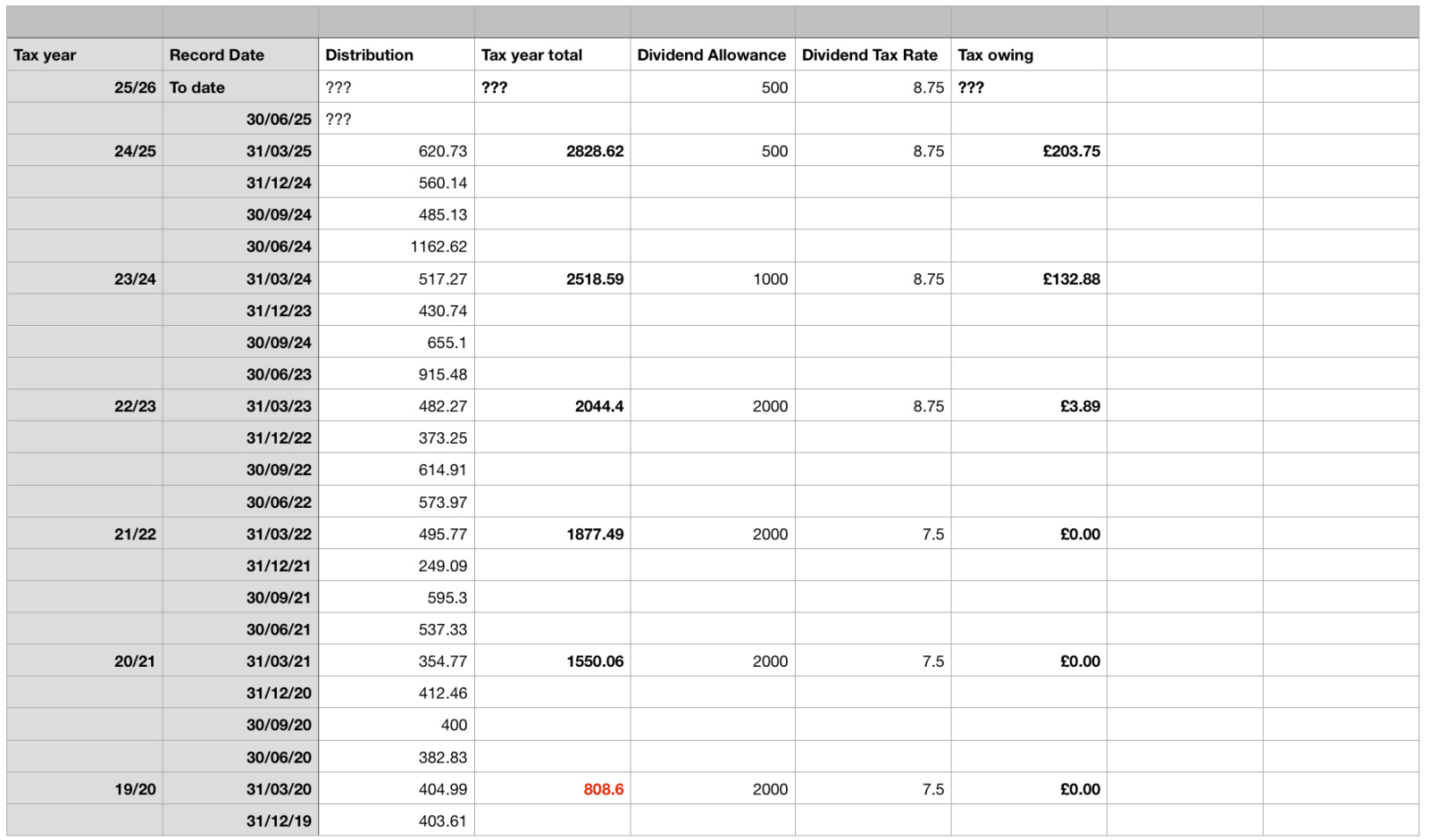

I have been digging into the the BNY Mellon Newton Income fund a little more and have realised that there is most likely Dividend Tax owing to HMRC for the last couple of years. The dividends are described as 'Distribution Reinvestment' on the documents received.

I have managed to trace back the dividends as far as 2020 and believe there is tax owing to HMRC as follows: What's the best way of reporting this to HMRC?

What's the best way of reporting this to HMRC?

I suspect Dividend Tax income catches a few people out, the documentation from BNY Mellon whilst stating that records should be kept for tax purposes isn't exactly obvious that tax is payable and there was no communication to highlight that the allowances had dropped significantly in the last couple of years.0 -

If you were submitting self assessment returns for your mother, once you've told HMRC that you are the PR, they will send you a tailored return for 2025-death which has to posted. At that point a covering letter explaining the tax owed from previous years should be enough. Alternatively you could adjust the 23/24 and 24/25 returns online using her old UTR.

Otherwise call the new HMRC bereavement helpline (0300 322 9620). The old line was unusually well staffed, and I imagine this one is too.

This is probably stating the obvious, but your table should also include dividends from the other small shareholdings (F in your original list)

https://www.att.org.uk/managing-income-tax-deceased-estate

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards