We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Virgin Money ISA closue

Comments

-

And just for fun ..... to really bring home the potential .....

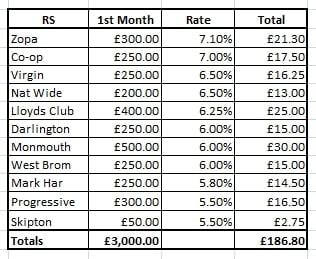

What if you opened, say, a selection of the best RS's all at the same time, all allowing missing monthly payments and dumped all of the £3000 into them in month 1? Thereafter, no funding in following months. You could turn that annual figure of ~£160 into ~£187 .... that's quite a bit more than the ~£120 the £3000 would make in the 4% Fix!

Example:

Now I'm not suggesting anyone should actually do this, but they could if they wanted to. Well, maybe not someone who is yet to be convinced that RS's are not a con! I ran this through a spreadsheet just to see what the £3000 could generate through RS's (a selection of!).

Keep in mind that dumping the £3000 into X number of RS's in month 1 means that all the ~£187 is generated from RS interest only, none through the (un-needed) Fix.

Regular (Ha!) forumites with a passion for RS's will already know all this, and some hold several 10's of RS's at any one time. Some are funding monthly in the high 4 figures (anyone into 5 figures monthly?).

The possibilities are many-fold depending on your funding availability and your ability/wish to administer.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum2 -

Er.......Bobblehat said:

Now I'm not suggesting anyone should actually do this, but they could if they wanted to.

You forgot First Direct £300 @ 7%

Monthly RS funding now bit over £7k, but that's gonna have to give sometime soon.0 -

For the record, I do understand how these things stack up. To avoid this becoming about who's stupid or not. I want to focus on two points which are:

-

Don’t be blinded by the headline rate — you need to factor in the admin time involved, both for getting your money back, and for sending it out.

-

Always do the maths — work out the cash difference for your own circumstances.

Virgin Money require you to visit a branch (25 miles away) or call to close accounts (that took me 40 minutes). By contrast, other providers simply credit the final balance back to your nominated account. In my case, closing my VM accounts freed me up to make £175 from a Barclays switch.

On paper the best rate is the best rate. In reality you can achieve the same or very close elsewhere without the hassle factor.

0 -

-

Well it's good that you no longer believe that regular savers pay half the quoted rate.mar7t1n said:For the record, I do understand how these things stack up. To avoid this becoming about who's stupid or not. I want to focus on two points which are:

-

Don’t be blinded by the headline rate — you need to factor in the admin time involved, both for getting your money back, and for sending it out.

-

Always do the maths — work out the cash difference for your own circumstances.

Virgin Money require you to visit a branch (25 miles away) or call to close accounts (that took me 40 minutes). By contrast, other providers simply credit the final balance back to your nominated account. In my case, closing my VM accounts freed me up to make £175 from a Barclays switch.

On paper the best rate is the best rate. In reality you can achieve the same or very close elsewhere without the hassle factor.

Re: closing VM accounts - the cash ISA you reference in your OP that you opened and didn't fund? Don't bother, effort required = zero.

The 10% RS? let it pay out interest at end September and transfer it all out online. Effort required = 30 seconds.

Closing your VM current account means you can't access their RS paying 6.5% APR on £250/mth but I guess that £175 1-off is fair enough.0 -

-

I'd challenge you to find a way of achieving the £187 you can manage with @Bobblehat's excellent spreadsheet.mar7t1n said:On paper the best rate is the best rate. In reality you can achieve the same or very close elsewhere without the hassle factor.

I disagree that you can get the same elsewhere. But you can get close-ish. And then it's a personal decision as to whether the extra admin is worth the extra interest.1 -

I didn'tflaneurs_lobster said:

Er.......Bobblehat said:

Now I'm not suggesting anyone should actually do this, but they could if they wanted to.

You forgot First Direct £300 @ 7%

Monthly RS funding now bit over £7k, but that's gonna have to give sometime soon. ... according to Bridlington1 (he who shall be believed!), you can't miss any months with FD

... according to Bridlington1 (he who shall be believed!), you can't miss any months with FD  Compiler of the RS League Table.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum2 -

Doh! of course, you are right. Apols.Bobblehat said:

I didn'tflaneurs_lobster said:

Er.......Bobblehat said:

Now I'm not suggesting anyone should actually do this, but they could if they wanted to.

You forgot First Direct £300 @ 7%

Monthly RS funding now bit over £7k, but that's gonna have to give sometime soon. ... according to Bridlington1 (he who shall be believed!), you can't miss any months with FD

... according to Bridlington1 (he who shall be believed!), you can't miss any months with FD  1

1 -

I don't believe that the sort of forumites who advocate using RS's are the sort of people who are blinded by the headline rate ... they've been there probably a long time ago and got over it/ got pointed in the right direction ... and made their mind up how much effort they are willing to put in after working out the returns (your 2nd point). They understand the maths.mar7t1n said:For the record, I do understand how these things stack up. To avoid this becoming about who's stupid or not. I want to focus on two points which are:

-

Don’t be blinded by the headline rate — you need to factor in the admin time involved, both for getting your money back, and for sending it out.

-

Always do the maths — work out the cash difference for your own circumstances.

Virgin Money require you to visit a branch (25 miles away) or call to close accounts (that took me 40 minutes). By contrast, other providers simply credit the final balance back to your nominated account. In my case, closing my VM accounts freed me up to make £175 from a Barclays switch.

On paper the best rate is the best rate. In reality you can achieve the same or very close elsewhere without the hassle factor.

Just look at the range of comments you've garnered ... do the posters seem like people who are blinded by the headline rate? Or haven't bothered to do the maths? Still, if it's not for you, then fine .... each to their own methods!

But I'm always willing to learn new tricks ... so if you'd like to expand on how you would turn interest on £3000 into better than ~£187, then I'm all ears!

p.s. I didn't need to visit a Virgin branch or make a phone call to close my Virgin RS .... I just had to fill in a simple online form and be patient for about a week. Was the effort worth ~£164 interest (not including interest from drip-feed account) ... I think so. So much a glutton for punishment, I opened the new 6.5% Virgin RS too!Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum1 -

-

I feel people are missing my main point. Virgin Money deliberately make the closure process difficult, whereas other providers I’ve used do not — which is why I’m taking my business elsewhere.

I’m not against Regular Savers. As @Bobblehat notes, there are plenty of alternatives, and if you order them by total interest you can already place £2,000 a month elsewhere before even considering VM. The cash difference is negligible if you choose to skip VM.

VM have no simple “click-to-close.” You have to phone, visit a branch, or write in. Meanwhile, balances and accrued are rolled into a follow on saver account at poor rates. Interest is credited on their schedule, not aligned to your account maturity. They presumably rely on this friction to keep customers locked in. Before you know it, that extra 0.5% interest you thought you were getting has been gone. Or at least 40 mins of your time will have as their call centre is busy, presumably handling all the people seeking to close their accounts.

0 -

The account closure thing is a bit of an issue, and people have been wasting their own time phoning VM's call centre. But I think everyone has been able to withdraw their money without a problem? So no loss of interest after maturity.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards