We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

One accidental missed payment halved credit rating

GratefulDude42

Posts: 3 Newbie

My wife has had no missed payments or anything else to damage her credit rating for decades. But following some confusion over who was continuing to pay Octopus for her late mother's account, and therefore one accidentally missed payment, the TransUnion credit agency halved her rating. The other two agencies did not. This has resulted in her bank reducing her credit card facility from several thousand to a few hundred. The bank says it will take 14 months to regain her original rating.

Is there anything that anything that can be done to rectify her rating quicker? It seems crazy that an excellent track record of many years can be wrecked by an accidental non-payment, which has been paid as soon as she became aware of the issue.

Is there anything that anything that can be done to rectify her rating quicker? It seems crazy that an excellent track record of many years can be wrecked by an accidental non-payment, which has been paid as soon as she became aware of the issue.

0

Comments

-

The "made up number" produced by TransUnion and the other CRAs has absolutely NO bearing on what her bank has done, in fact they cannot even see it.

If your wife hasn't been using her several thousand pounds of credit then it is not at all unusual for them to reduce the available credit in line with actual usage.

It might even completely coincidental they have done it rather than being triggered by a single missed payment.0 -

Well she phoned the bank and they told her they had reduced the available credit directly as a result of the change in credit rating. Also she has used a couple of thousand earlier this year, so unlikely to be because of non-usage. The bank said, in fact, that the reduction happened automatically following the halved credit rating.Ayr_Rage said:The "made up number" produced by TransUnion and the other CRAs has absolutely NO bearing on what her bank has done, in fact they cannot even see it.

If your wife hasn't been using her several thousand pounds of credit then it is not at all unusual for them to reduce the available credit in line with actual usage.

It might even completely coincidental they have done it rather than being triggered by a single missed payment.0 -

Will repeat again, no one else but you can see your made up credit rating.0

-

What they saw was the missed payment. Not the number. I do agree that it's unfortunate that a single issue has caused them to react like this. I'm guessing that it might be Barclaycard as they are well known for dropping credit limits for any reason. And I'd also guess that the customer service person she talked to knows very little about credit ratings versus credit records and so, like a lot of people, assumed they are one and the same.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅0 -

Ayr_Rage said:The "made up number" produced by TransUnion and the other CRAs has absolutely NO bearing on what her bank has done, in fact they cannot even see it.

If your wife hasn't been using her several thousand pounds of credit then it is not at all unusual for them to reduce the available credit in line with actual usage.

It might even completely coincidental they have done it rather than being triggered by a single missed payment.

Sorry, just to be clear, the bank didn't say they had reduced her available credit because they had seen TransUnion credit rating number, they said it was because of the reduction in TransUnion's rating.1 -

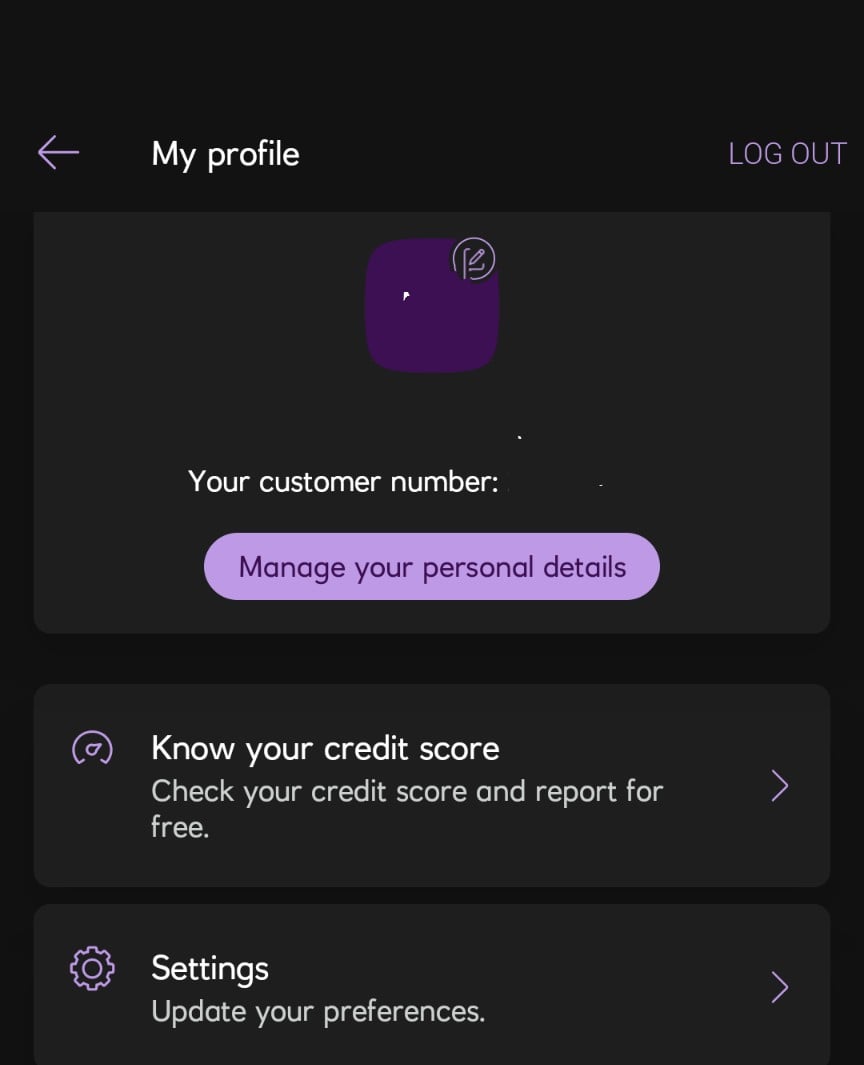

In the NatWest online banking app, there is a feature called "know your credit score" and it does show you your latest credit score and report from TransUnion.Now whether NatWest can view this, I do not know.

1 -

Whereabouts is this feature as I can't find it?vienna28 said:In the NatWest online banking app, there is a feature called "know your credit score" and it does show you your latest credit score and report from TransUnion.

Make £2025 in 2025

Prolific £841.95, Octopoints £6.64, TCB £456.58, Tesco Clubcard challenges £89.90, Misc Sales £321, Airtime £60, Shopmium £52.74, Everup £95.64 Zopa CB £30

Total (1/11/25) £1954.45/£2025 96%

Make £2024 in 2024

Prolific £907.37, Chase Int £59.97, Chase roundup int £3.55, Chase CB £122.88, Roadkill £1.30, Octopus ref £50, Octopoints £70.46, TCB £112.03, Shopmium £3, Iceland £4, Ipsos £20, Misc Sales £55.44Total £1410/£2024 70%Make £2023 in 2023 Total: £2606.33/£2023 128.8%1 -

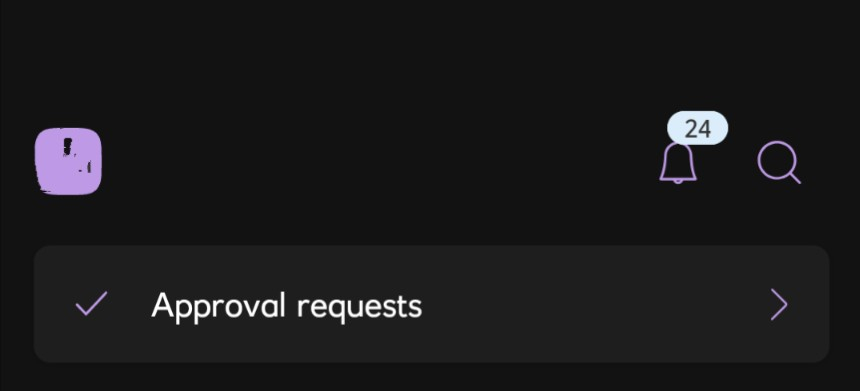

Slinky said:Whereabouts is this feature as I can't find it?On opening the app you should see your "name initials", far left, where the purple symbol is in my screenshot:

When I click it I can see the link to "know your credit score".

When I click it I can see the link to "know your credit score". If that doesn't work. Then in the first screenshot you'll also see the search feature, press that and where it says "what are you looking for". Type in "know your credit score".Hopefully you'll find it either way. 👍1

If that doesn't work. Then in the first screenshot you'll also see the search feature, press that and where it says "what are you looking for". Type in "know your credit score".Hopefully you'll find it either way. 👍1 -

I can find it either from insights or by clicking on my initials in top left corner and choosing 'know your credit score'1

-

Go to 'Apply' then 'View credit report'Slinky said:

Whereabouts is this feature as I can't find it?vienna28 said:In the NatWest online banking app, there is a feature called "know your credit score" and it does show you your latest credit score and report from TransUnion.I consider myself to be a male feminist. Is that allowed?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.6K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.7K Work, Benefits & Business

- 601.6K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards