We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Potential CIFA marker - gambling

Comments

-

I posted yesterday but I’m so stressed but this. So posting again incase anyone else can offer advice.Please please help.tuesday, Kroo messaged me on the app to say they were closing my account with immediate effect following review of my account. For the past few months I have been depositing money from my Santander to my kroo account and using it on a gambling platform (mystake). I was in a stressful situation, trying to make money (stupid mistake I know). I had absolutely no idea that what I was doing was wrong. The bank have never called to say what’s going on or blocked anything. So I really did not know I was doing wrong. Any winnings I received were being put back into my normal Santander account.I have been up two nights and not eating, worrying that a cifa marker will be added. I had no idea about these until reading something on Tuesday when I googled about having a bank account closed. I’m beyond stressed. With a mortgage due for renewal end of this year, a family and a small business.Is it likely I will get a cifa marker?I don’t know what to do.As mentioned the bank haven’t phoned or asked me what was happening. Just immediately closed my account. Tuesday night I put a request in to see if I have a cifa which I know may be too soon.I can’t think of anything else right now, just absolutely scared and worried about the impact.I have no debt with Santander or kroo.Any help or advice would be appreciated.0

-

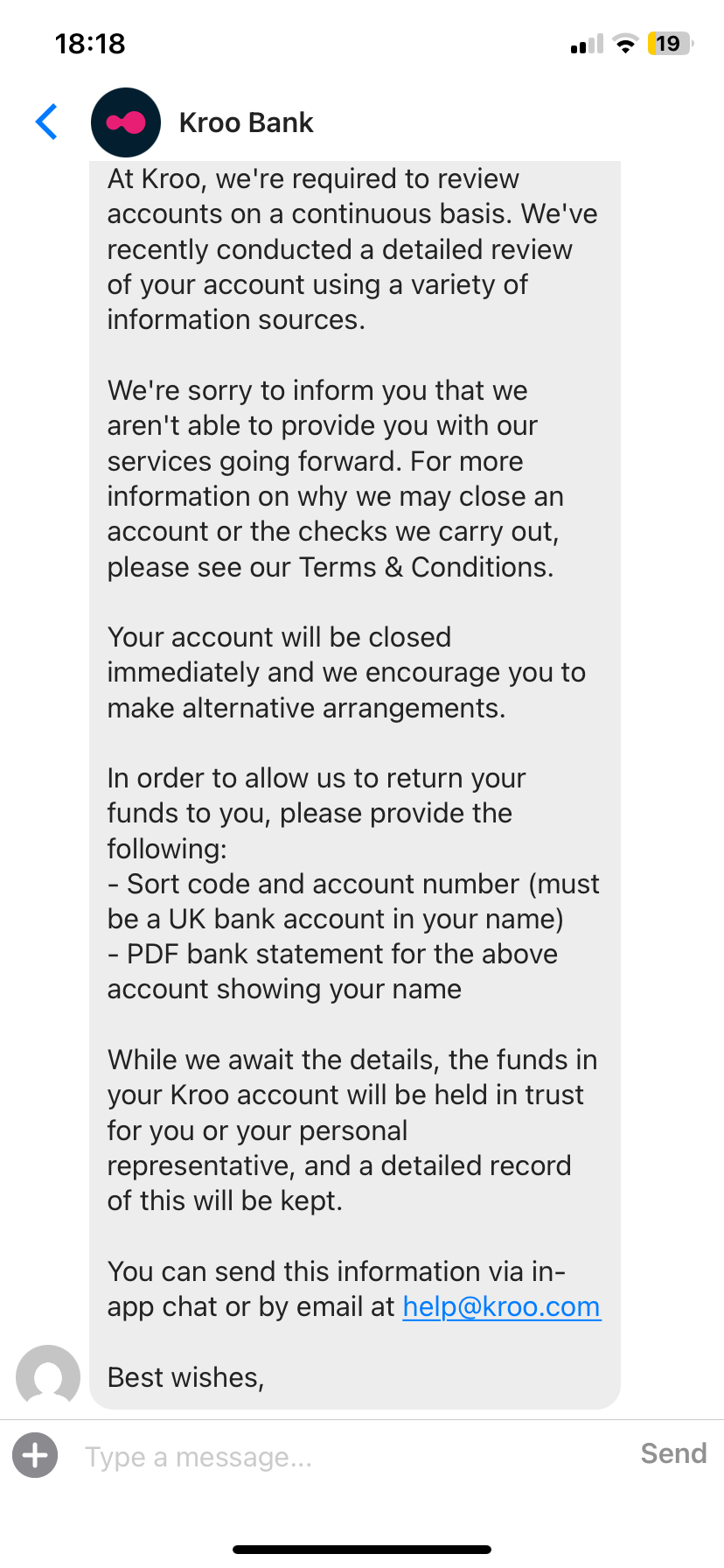

This is the message I received

0

0 -

Try to calm down. Go back to the post from yesterday and re-read what others have said. I would think it should be of comfort to you.

Any markers that will be publicly visible will take time to appear on your credit history so maybe you should see about opening up a new account sooner rather than later. But only if you actually need one and only if you're not going to use it for gambling. Perhaps some support from an organisation such as Gam-anon would help? For one thing they will have more knowledge overall than some of us about how banking transactions will reflect on your credit history.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

Thanks Brie. I literally cannot think about anything else. Just if I do get a cifa my world will fall apart. I had no idea about these things and the impact they have on people. I’m so scared.Brie said:Try to calm down. Go back to the post from yesterday and re-read what others have said. I would think it should be of comfort to you.

Any markers that will be publicly visible will take time to appear on your credit history so maybe you should see about opening up a new account sooner rather than later. But only if you actually need one and only if you're not going to use it for gambling. Perhaps some support from an organisation such as Gam-anon would help? For one thing they will have more knowledge overall than some of us about how banking transactions will reflect on your credit history.I haven’t gambled for over a week now. And I don’t think I ever will again after reading about cifas and what may happen now.I’m worried Santander will close my account. My business account with Monzo will be shut. And I don’t know what I will do. Then I’ll have to tell my partner.0 -

Better to cross that bridge now.twiggie44 said:

Thanks Brie. I literally cannot think about anything else. Just if I do get a cifa my world will fall apart. I had no idea about these things and the impact they have on people. I’m so scared.Brie said:Try to calm down. Go back to the post from yesterday and re-read what others have said. I would think it should be of comfort to you.

Any markers that will be publicly visible will take time to appear on your credit history so maybe you should see about opening up a new account sooner rather than later. But only if you actually need one and only if you're not going to use it for gambling. Perhaps some support from an organisation such as Gam-anon would help? For one thing they will have more knowledge overall than some of us about how banking transactions will reflect on your credit history.I haven’t gambled for over a week now. And I don’t think I ever will again after reading about cifas and what may happen now.I’m worried Santander will close my account. My business account with Monzo will be shut. And I don’t know what I will do. Then I’ll have to tell my partner.

Hiding your gambling addiction (if that is what it is) is not helping you at all.Life in the slow lane0 -

You are worrying about something that isnt going to happen. Gambling isnt fraud.1

-

This is what I keep telling myself. But on their t&cs it mentions something about not using your account for excessive gambling. I assume they have closed it because of this (although what is classed as excessive gambling)?la531983 said:You are worrying about something that isnt going to happen. Gambling isnt fraud.And therefore have I violated t&cs which could lead to a cifa? I’ve probably done too much googling I know.0 -

excessive is a subjective term. the rules are normally sensible and will allow some but not a lot and not escalating over a long period of time getting the individual into debt.I’m a Forum Ambassador and I support the Forum Team on Debt Free Wannabe, Old Style Money Saving and Pensions boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.

Click on this link for a Statement of Accounts that can be posted on the DebtFree Wannabe board: https://lemonfool.co.uk/financecalculators/soa.php

Check your state pension on: Check your State Pension forecast - GOV.UK

"Never retract, never explain, never apologise; get things done and let them howl.” Nellie McClung

⭐️🏅😇🏅🏅🏅1 -

That still isnt "fraud". Its just a term and condition of their account, they dont like how much gambling you do and therefore they dont want you as a customer.twiggie44 said:

Thats it. No fraud has taken place. No fraud marker

You are working yourself into a right tizz. Banks reserve the right to choose who they have as a customer as long as they aren't basing it on a protected characteristic. They could close your account merely if you started wearing Crocs. They dont close accounts just for "fraud".2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards