We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Index-Linked Savings Certificates Growth Calculation

RSTime

Posts: 130 Forumite

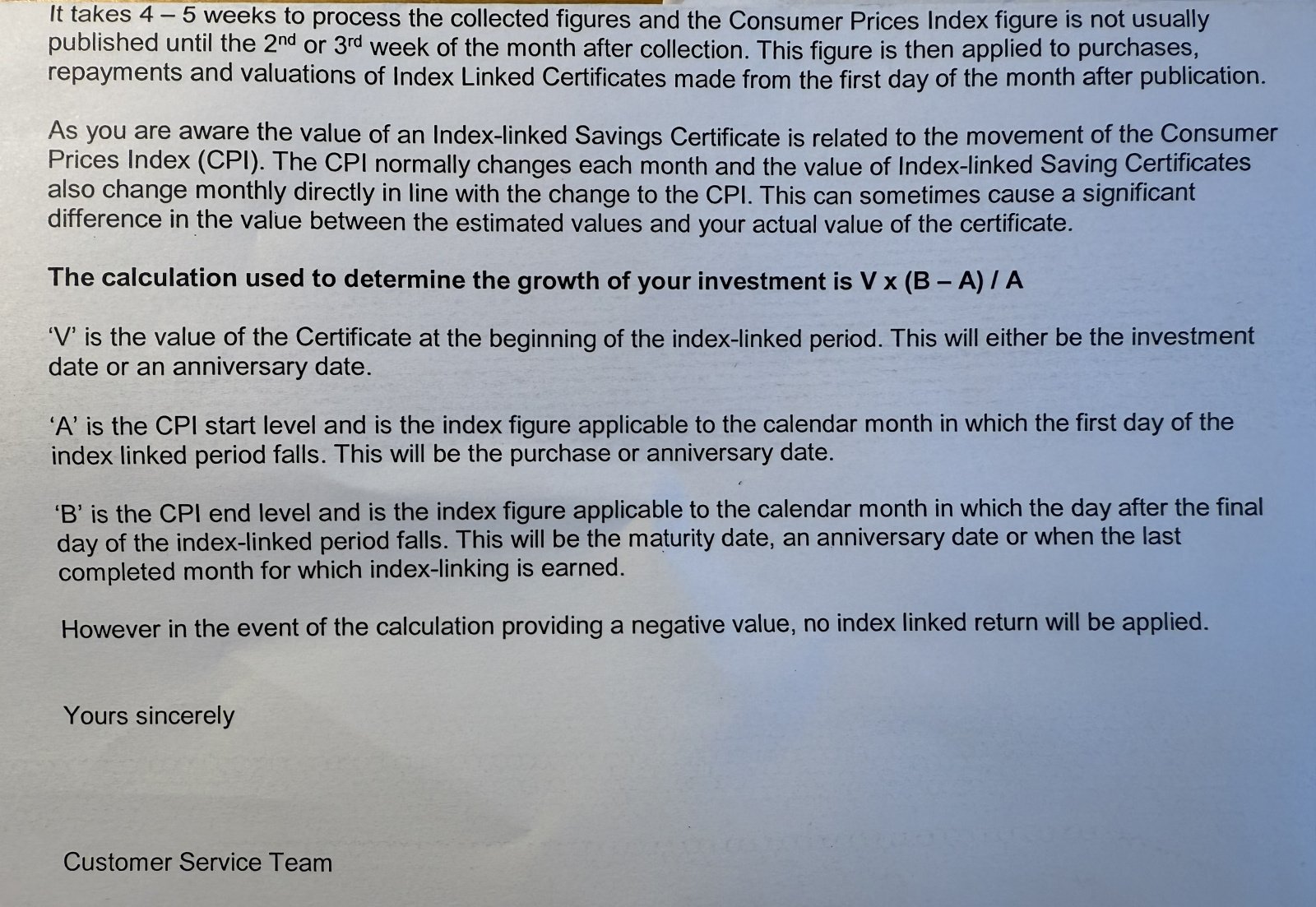

I appreciate that I am probably in the dying-breed of people hanging onto Index-Linked Savings Certificates, however, I do not understand how the growth is calculated (I thought I did!). One of my certificates recently matured and the growth seemed rather low. I queried how growth is calculated and received the attached calculation, which I do not understand (I may be having a senior moment!). Can anyone explain to me how this calculation works e.g. if CPI at investment (A) is 5% and the end is 5%, what is my expected growth? According to this letter it would be zero growth, or am I missing something?

0

Comments

-

The Consumer Price Index is number not a percentage. The CPI is published monthly. You can download the numbers from here:2

-

You're confusing the CPI index itself with its annual rate of change.RSTime said:Can anyone explain to me how this calculation works e.g. if CPI at investment (A) is 5% and the end is 5%, what is my expected growth? According to this letter it would be zero growth, or am I missing something?

The latter is the percentage figure typically labelled as the inflation rate, but the ILSC calculation is based on the change in the underlying index between start and end dates, without any reference to annual change percentages:

Index: CPI INDEX 00: ALL ITEMS 2015=100 - Office for National Statistics

Annual inflation rate: CPI ANNUAL RATE 00: ALL ITEMS 2015=100 - Office for National Statistics1 -

Just so that I am clear how the equation works. If for example I invest £10,000 when the index is 120 and on maturity the index is 140, my investment would grow by £1,666.67 ie £10,000 x (140-120)/120 ?

EDIT: The calculation is done annually so I assume it is the index at the start and end of each calendar year that should be used.

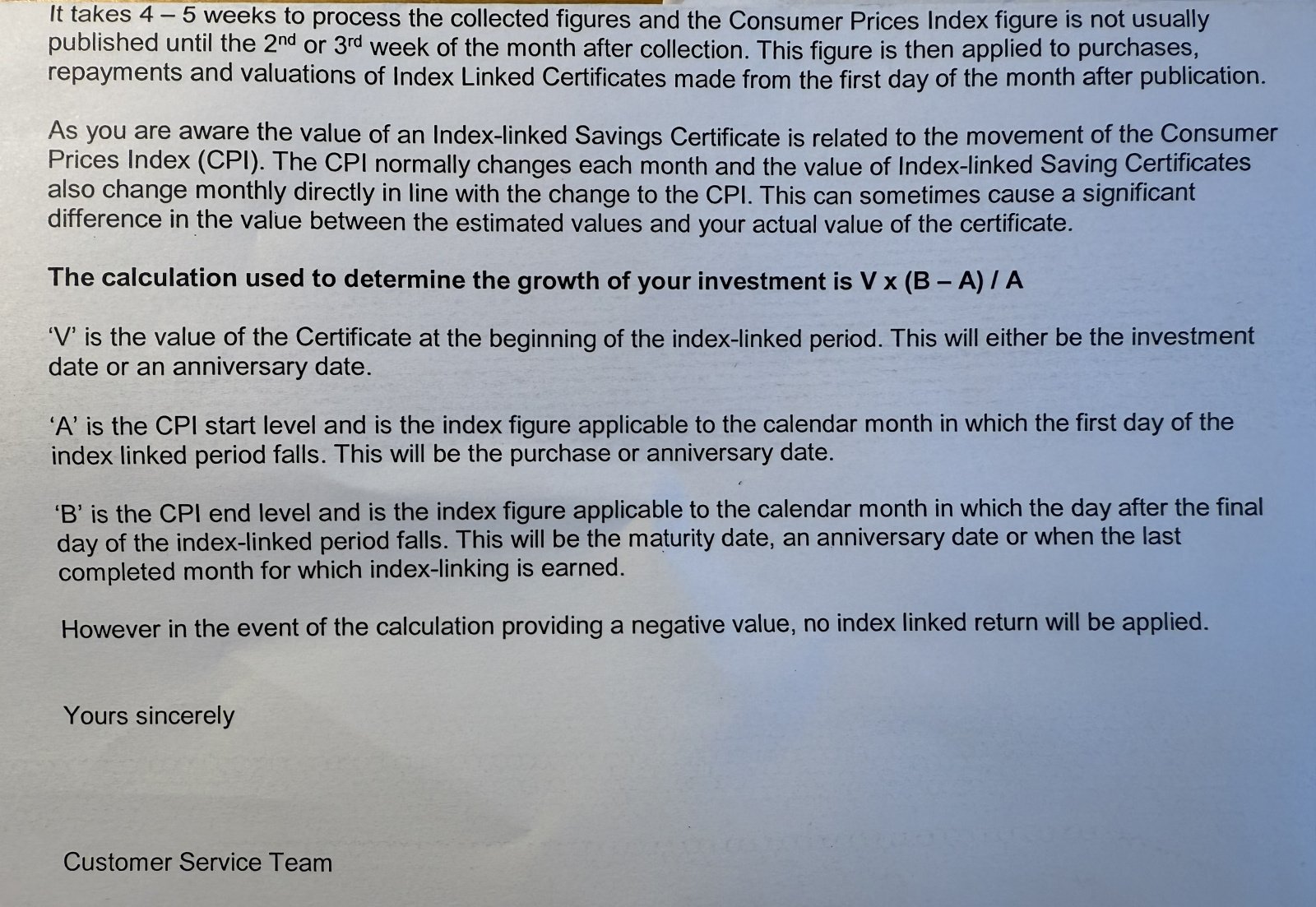

EDIT 2: I still do not understand the calculation. My certificate was worth £10,695.68 on the 30th May 2024. At maturity on the 30th May 2025 I received an index-linked return of £274.25. Can someone could show me the calculation that results in this return? For information, my initial investment in May 2020 was £8,506.29.0 -

Don't you get a letter explaining it? I got a statement in May for year 1 of an ILSC which had a section headed Index Linking for year 1 and had the following lines

CPI start level (March 2024) 133.00

CPI end level (March 2025) 136.50

Percentage change in CPI 2.63%

0 -

Answers inline above....RSTime said:Just so that I am clear how the equation works. If for example I invest £10,000 when the index is 120 and on maturity the index is 140, my investment would grow by £1,666.67 ie £10,000 x (140-120)/120 ?

Yes, that's right.

EDIT: The calculation is done annually so I assume it is the index at the start and end of each calendar year that should be used.

No, as explained in the letter, the dates for the calculation are purchase/anniversary dates, not calendar years.

EDIT 2: I still do not understand the calculation. My certificate was worth £10,695.68 on the 30th May 2024. At maturity on the 30th May 2025 I received an index-linked return of £274.25. Can someone could show me the calculation that results in this return? For information, my initial investment in May 2020 was £8,506.29.

I can't reconcile those figures with the published index values in 2024 and 2025, either for May or April (published in May), didn't they include the relevant index figures in the maturity letter?0 -

I have attached the final statement I received. Interest on these certificates is calculated on an annual basis.

As the statement details, interest was calculated at 2.63%, which is the % change in the CPI. Thanks for all the responses...I wonder how many people still have these certificates, I keep them as part of my portfolio, not exciting, but do well when inflation is high. 0

0 -

From that photo, your balance @ 30/5/24 was £10421.23

NOT £10696.72. That was the balance @ 30/5/251 -

My wife and I still have them, but will be letting them go at maturity (mid-2026).RSTime said:I wonder how many people still have these certificates, I keep them as part of my portfolio, not exciting, but do well when inflation is high.

They're about £50k in total.I am one of the Dogs of the Index.0 -

Not as attractive now that money cannot be accessed for the whole term, but still sheltered from tax which is a bonus if you are on higher rate. I will keep them until I need access to the funds, particularly given the uncertainty around ISAs.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.4K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards