We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Not eligible for a 0% Credit Card?

Beaumont176

Posts: 35 Forumite

in Credit cards

Good afternoon,

My current 0% Credit Card (Purchases) with Barclaycard is about to end within the next 6 months.

Im in a position where my balance is almost paid off. I thought i would take the opportunity to apply for another long term 0% Card as per the recommendations on MSE.

I have filled out the eligibility form on M&S, Tesco and Lloyds bank. All of which have come back as pre approved but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?

My current 0% Credit Card (Purchases) with Barclaycard is about to end within the next 6 months.

Im in a position where my balance is almost paid off. I thought i would take the opportunity to apply for another long term 0% Card as per the recommendations on MSE.

I have filled out the eligibility form on M&S, Tesco and Lloyds bank. All of which have come back as pre approved but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?

0

Comments

-

What do you think you are missing? You've presumably done soft searches on 3 card issuers and they've said right now they arent prepared to lend to you. You could try other soft searches or check again a month after clearing your current outstanding balance.Beaumont176 said:My current 0% Credit Card (Purchases) with Barclaycard is about to end within the next 6 months.

Im in a position where my balance is almost paid off. I thought i would take the opportunity to apply for another long term 0% Card as per the recommendations on MSE.

I have filled out the eligibility form on M&S, Tesco and Lloyds bank. All of which have come back as pre approved but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?2 -

Beaumont176 said:but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?If you're not eligible for a 0% card for whatever reason, you may as well just see if you can get an ordinary interest-charging card that gives you rewards of some kind, and use that for your day-to-day spending. So long as you always repay in full every month, the high interest rate is irrelevant.If you're wanting a 0% card for stoozing purposes then, as suggested above, give it 6 months or so and try again.As well as the fact that any application is assessed against your current financial situation and credit history, a lender's marketing strategy (and, to a lesser extent, their risk appetite/target customer base) can change over time in response to general market conditions. So it may be that if you're not accepted for a particular card today, you may get accepted in a year's time or whatever - even if your financial circumstances have not changed all that much.

0 -

Why do you want another 0% card if your balance is almost paid off already? What MSE "recommendations" are you referring to? The mantra is always borrow as little as you need, and if the debt is almost paid off then do you still need to borrow?Beaumont176 said:Good afternoon,

My current 0% Credit Card (Purchases) with Barclaycard is about to end within the next 6 months.

Im in a position where my balance is almost paid off. I thought i would take the opportunity to apply for another long term 0% Card as per the recommendations on MSE.

I have filled out the eligibility form on M&S, Tesco and Lloyds bank. All of which have come back as pre approved but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?1 -

Thanks for your concern. I always have a 0% Credit Card that I use for daily expenses have done for the last 10 years, house renovation, holidays, expensive resteraunts. I save / invest most of my salary. I just load it up and chip away at it every month. This is the first time I've had an issue trying to renew it. Has never been a problem before.PRAISETHESUN said:

Why do you want another 0% card if your balance is almost paid off already? What MSE "recommendations" are you referring to? The mantra is always borrow as little as you need, and if the debt is almost paid off then do you still need to borrow?Beaumont176 said:Good afternoon,

My current 0% Credit Card (Purchases) with Barclaycard is about to end within the next 6 months.

Im in a position where my balance is almost paid off. I thought i would take the opportunity to apply for another long term 0% Card as per the recommendations on MSE.

I have filled out the eligibility form on M&S, Tesco and Lloyds bank. All of which have come back as pre approved but there are zero 0% cards as options they are all standard credit cards with high interest rates......am I missing something?

1 -

It would be worth checking your credit reports (if you haven't done so already). Either something may have changed that you are respoinsible for, or there is a mistake somewhere which you could then get corrected.1

-

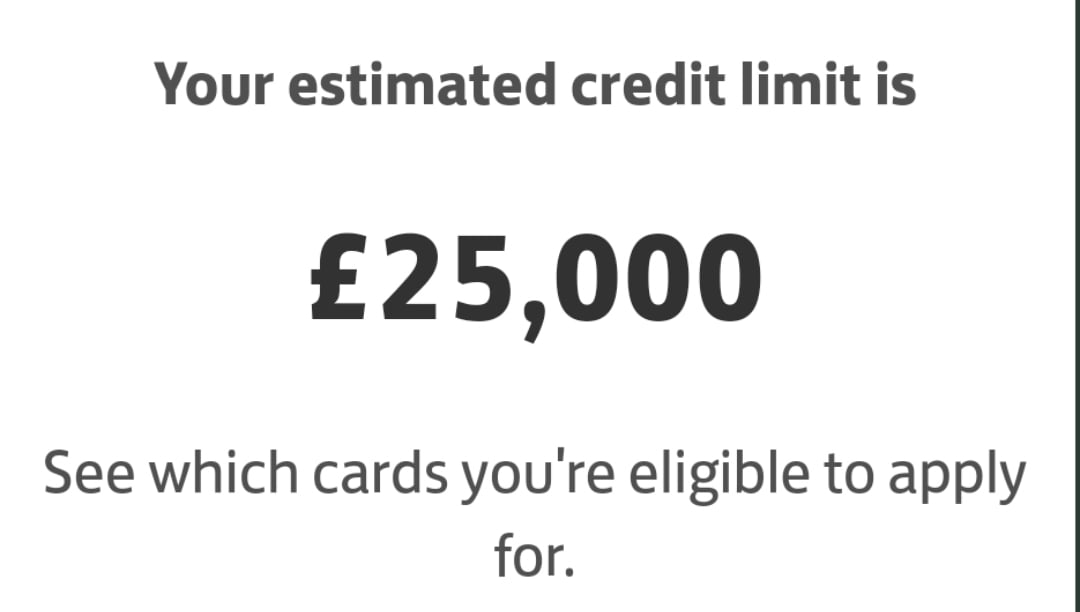

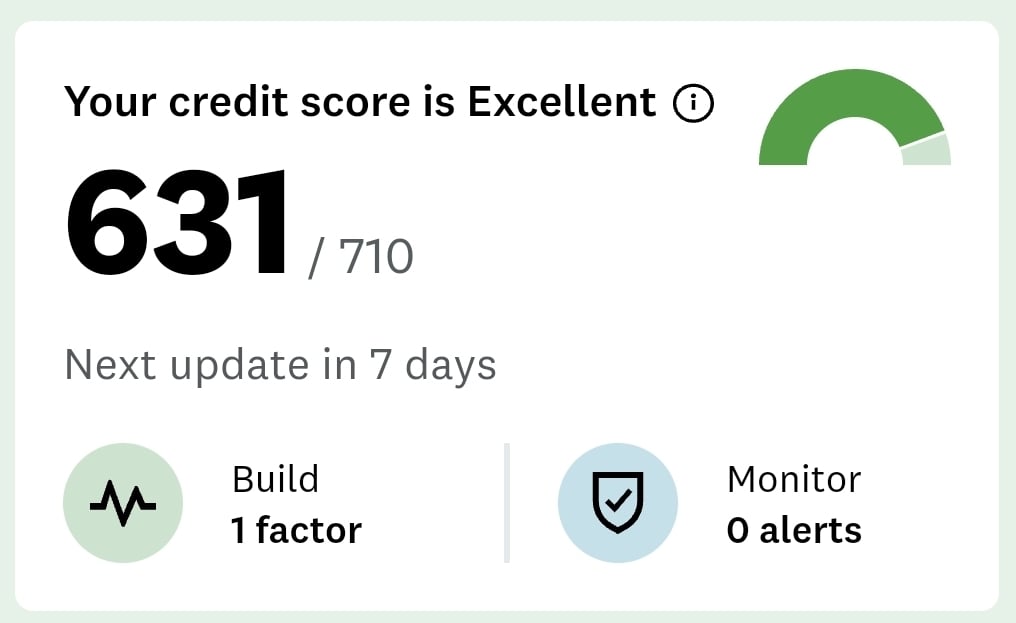

Nothing untoward with my credit score and the credit limit available is very high it's just the 0% offer on purchases that i don't seem to eligible for which is annoying.Wyndham said:It would be worth checking your credit reports (if you haven't done so already). Either something may have changed that you are respoinsible for, or there is a mistake somewhere which you could then get corrected.

0 -

Beaumont176 said:

Nothing untoward with my credit score and the credit limit available is very high it's just the 0% offer on purchases that i don't seem to eligible for which is annoying.Wyndham said:It would be worth checking your credit reports (if you haven't done so already). Either something may have changed that you are respoinsible for, or there is a mistake somewhere which you could then get corrected.Ignore your score - it's just a marketing gimmick that's not even visible to lenders. And since the CRAs have no visibility of each lender's lending criteria, how can they possibly know what limit you'll be offered? It is, at best, an extremely crude guesstimate based upon averages.What you need to be doing is checking that all the underlying data they have recorded for you are correct. On all 3 CRAs, ideally, as different lenders use different CRAs.

1 -

PRAISETHESUN said:The mantra is always borrow as little as you need ...Not if you're stoozing, it isn't.If you're stoozing the mantra is more like "run up as much 0% debt as you possibly can but keep enough cash in instant access accounts that you can pay it off overnight if you need to".N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.1 -

Exactly 👍QrizB said:PRAISETHESUN said:The mantra is always borrow as little as you need ...Not if you're stoozing, it isn't.If you're stoozing the mantra is more like "run up as much 0% debt as you possibly can but keep enough cash in instant access accounts that you can pay it off overnight if you need to".

That run has come to an end for me 🤣1 -

Are you now reapplying to previous used finance houses?Beaumont176 said:

Thanks for your concern. I always have a 0% Credit Card that I use for daily expenses have done for the last 10 years, house renovation, holidays, expensive resteraunts.

Very different world now to 10 years ago when money was literally being given away to borrowers.....0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards