We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

My understanding of IHT, gifts and when a person dies penniless

Comments

-

UnsureAboutthis said:

You missed the fundamental point. The person has NO money at the time of his death.[Deleted User] said:

Does this help?UnsureAboutthis said:

Clearly not and if you had, you would not have posted what you did. I'm not sure what the confusion is but I'll give it another go.p00hsticks said:

We most definitely have understood you.UnsureAboutthis said:I'm not sure if you have understood me.

Gifts made within 7 years of the death are added back into the estate for IHT calculation purposes.

If there are enough assets left in the estate to cover the IHT bill then it should be paid from the estate, but if not then HMRC will expect the beneficiaries of the gifts to foot the bill.

If it were that easy to circumvent IHT everyone would be doing it - it's the reason the seven year rule exists.

I'll ask for the last time and hoping that someone can answer the question.

No one is talking about x/y/z etc but the simple scenario as per my original posts, IE.

Someone decided to give away 2/3/7/etc million away and dies within the next 2 years. The person decided

to live a simple life and their income covers the rent and the bills/food etc but no savings. So, the person dies the next day or before 7 years. If the person had assets, then I'm sure the taxman would chase/want the tax. However, no one has understood what I am saying and asking. The person died penniless and had a big, fat, zero worth of assests.

Where does the taxman receive his money from and if you still feel he will collect when the person, when he/she died had zero to their names - direct me to a HMRC link how the taxman would seek to recover money from the 1 to 100 people he gave his money away to.

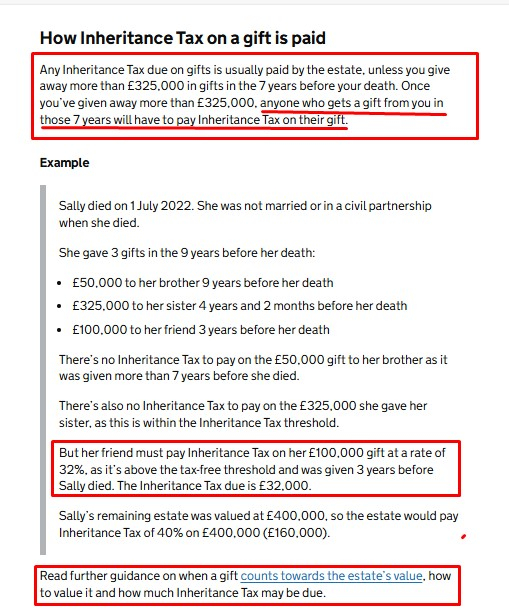

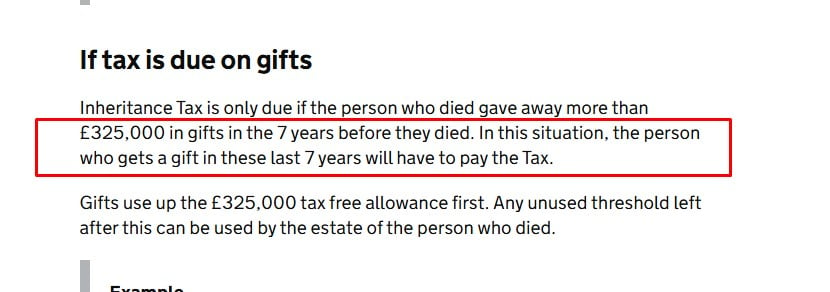

https://www.gov.uk/inheritance-tax/gifts

Specifically:How Inheritance Tax on a gift is paid

‘Once you’ve given away more than £325,000, anyone who gets a gift from you in those 7 years will have to pay Inheritance Tax on their gift.’

Important fact, IHT is only paid after death and this person at death had NO money - so, please forget the thresholds, as they are irrelevant in this scenario.

no you seem unable to accept facts presented to you on a plate. You are the one missing the fundamentals.UnsureAboutthis said:

Thank you.kimwp said:They are not missing the point. You are not understanding the law or the posts in response to your question.

If someone gives away everything they have to other people and dies the next day, for inheritance tax purposes their estate is considered to have the same value that it had before the deceased gave everything away. HMRC will pursue those who received the estate for the tax.

However, are you, or anyone else for that matter, direct me to the HMRC site where it is specifically stated that HMRC would go after those who received the gift/s?

Many thanks.

when given a link that explains how thresholds operate please have the courtesy to read it, and, where relevant, go on to read pages that are linked off it, your question was answered in the link given in the 4th reply in this thread.

admitting you did not understand it would be fair enough, but repeatedly claiming everyone who replied is wrong is ....

had you read the extra pages you would have found the specific statement....: 2

2 -

Playing Devil's Advocate for a moment...

What would happen if no one administers the estate, or applies for probate??

At what stage do HMRC get involved?

I realise they have the ability to "follow the money", but when/how would they realise there is any to follow 😉

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

When the recipients have tax to declare or a change in lifestyle and hmrc investigates the source of their funds. I don’t know who then has to administer the estate.Sea_Shell said:Playing Devil's Advocate for a moment...

What would happen if no one administers the estate, or applies for probate??

At what stage do HMRC get involved?

I realise they have the ability to "follow the money", but when/how would they realise there is any to follow 😉I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0 -

if the death is never registered then obviously no one is going to know or do anything until the body is found rotting away in their homeSea_Shell said:Playing Devil's Advocate for a moment...

What would happen if no one administers the estate, or applies for probate??

At what stage do HMRC get involved?

I realise they have the ability to "follow the money", but when/how would they realise there is any to follow 😉

Joyce Vincent: The woman who lay dead in her flat for three years - Thought Leader0 -

The other take away from this thread is...

Beware friends or family bearing gifts 😉

Your gift might just be the one that exceeds their allowance.

Theoretically, they might only gift you their last £100, BUT, if that would otherwise be taxable, you could be chased for £40 of it.

How's it going, AKA, Nutwatch? - 12 month spends to date = 2.60% of current retirement "pot" (as at end May 2025)0 -

Sea_Shell said:Playing Devil's Advocate for a moment...

What would happen if no one administers the estate, or applies for probate??

At what stage do HMRC get involved?

I realise they have the ability to "follow the money", but when/how would they realise there is any to follow 😉I've seen one a bit about like that which ended up much like The Joyce Vincent story but only a matter of a month or two rather than the years in her case.The first problem is that there was no one who fufilled the legal requirement to be able to register the death. In our village's case the executor was on long term assignment abroad so while they could subcontract the executorship to a local solicitor they could not register the death in person. With no family, being owneroccupier of thier house, no one present at death etc none of the of the "legally acceptable" could be be found. I've no idea what happened in the end. Possibly the local council/registrar was requested to have an attitude re-adjustment and permit some local villager to register it otherwise no one was going to do anything and it would become the council's problem to sort out - which is the last they they would want!If no one administers the estate or the executors decline to act (most likely because they are given nowt in the will and the deceased's finances are a total shambles!) eventually it will be done by someone who is owed money - as you say maybe in the end HMRC/HMG as a "bona vacatia" estate where the money left to no one with no surviving relatives and passes by default to the crown. I suppose in reality HMG appoints a local solicitor to actually 'do' the work. They face the same issues as I did as an executor walking into the deceased house with no knowledge at all of any of their finances and needing to sort it out. A great great deal of time!The lists of BV estates can be found here. https://www.gov.uk/government/statistical-data-sets/unclaimed-estates-list

1 -

The solicitor or funeral director should have been able to register the death as someone " in charge of making funeral arrangements" after having that role delegated to them by the executor.x44 said:Sea_Shell said:Playing Devil's Advocate for a moment...

What would happen if no one administers the estate, or applies for probate??

At what stage do HMRC get involved?

I realise they have the ability to "follow the money", but when/how would they realise there is any to follow 😉I've seen one a bit about like that which ended up much like The Joyce Vincent story but only a matter of a month or two rather than the years in her case.The first problem is that there was no one who fufilled the legal requirement to be able to register the death. In our village's case the executor was on long term assignment abroad so while they could subcontract the executorship to a local solicitor they could not register the death in person. With no family, being owneroccupier of thier house, no one present at death etc none of the of the "legally acceptable" could be be found. I've no idea what happened in the end. Possibly the local council/registrar was requested to have an attitude re-adjustment and permit some local villager to register it otherwise no one was going to do anything and it would become the council's problem to sort out - which is the last they they would want!If no one administers the estate or the executors decline to act (most likely because they are given nowt in the will and the deceased's finances are a total shambles!) eventually it will be done by someone who is owed money - as you say maybe in the end HMRC/HMG as a "bona vacatia" estate where the money left to no one with no surviving relatives and passes by default to the crown. I suppose in reality HMG appoints a local solicitor to actually 'do' the work. They face the same issues as I did as an executor walking into the deceased house with no knowledge at all of any of their finances and needing to sort it out. A great great deal of time!The lists of BV estates can be found here. https://www.gov.uk/government/statistical-data-sets/unclaimed-estates-list1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards