We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

My understanding of IHT, gifts and when a person dies penniless

Comments

-

we understood you perfectlyUnsureAboutthis said:Ok

I'm not sure if you have understood me.

Let's say a person gave away everything the days before he/she passed away - IE everything as in the 3million.

The above are gifts to family and friends. The person is then left penniless.

So where will the taxman collect the tax from as the estate value would be one big zero pence?

I'm sure the taxman won't chase those that received the gift/monet etc.

the link previously given explains it, did you read the relevant section.....?How Inheritance Tax on a gift is paid

0 -

Bookworm225 said:

we understood you perfectlyUnsureAboutthis said:Ok

I'm not sure if you have understood me.

Let's say a person gave away everything the days before he/she passed away - IE everything as in the 3million.

The above are gifts to family and friends. The person is then left penniless.

So where will the taxman collect the tax from as the estate value would be one big zero pence?

I'm sure the taxman won't chase those that received the gift/monet etc.

the link previously given explains it, did you read the relevant section.....?How Inheritance Tax on a gift is paid

Sorry, but you and the others are missing the fundamental point, IE, the parson gifting the 2/3/7 etc., million has

given EVERYTHING away -That IS, the person is peniless when he/she dies before the 7 years

I'll make it simpler:

The person had sold everything he had and from the sales and other money he/she had in the bank, he/she had 3 million pounds. The next day he/she gives away the 3 million and has no assets left in his/her name. This person could die the next day/week/year but before the 7 years.

Therefore, assuming the person was previously married, they'd have a 1 million exemption. On the other 2 million, The IHT would be close to 800k. The persons' estate at the time of their death was ZERO pounds and ZERO pence.

So, where does the taxman get the approximate 800k IHT?

Most still don't get it by stating the " IHT "allowances." The fact is when you make a gift, you don't normally pay tax on it unless there is CGT. IHT is paid after the death of the person and it it important to note, as stated in my OP, this person is penniless.

Am I clear?0 -

You missed the fundamental point. The person has NO money at the time of his death.[Deleted User] said:

Does this help?UnsureAboutthis said:

Clearly not and if you had, you would not have posted what you did. I'm not sure what the confusion is but I'll give it another go.p00hsticks said:

We most definitely have understood you.UnsureAboutthis said:I'm not sure if you have understood me.

Gifts made within 7 years of the death are added back into the estate for IHT calculation purposes.

If there are enough assets left in the estate to cover the IHT bill then it should be paid from the estate, but if not then HMRC will expect the beneficiaries of the gifts to foot the bill.

If it were that easy to circumvent IHT everyone would be doing it - it's the reason the seven year rule exists.

I'll ask for the last time and hoping that someone can answer the question.

No one is talking about x/y/z etc but the simple scenario as per my original posts, IE.

Someone decided to give away 2/3/7/etc million away and dies within the next 2 years. The person decided

to live a simple life and their income covers the rent and the bills/food etc but no savings. So, the person dies the next day or before 7 years. If the person had assets, then I'm sure the taxman would chase/want the tax. However, no one has understood what I am saying and asking. The person died penniless and had a big, fat, zero worth of assests.

Where does the taxman receive his money from and if you still feel he will collect when the person, when he/she died had zero to their names - direct me to a HMRC link how the taxman would seek to recover money from the 1 to 100 people he gave his money away to.

https://www.gov.uk/inheritance-tax/gifts

Specifically:How Inheritance Tax on a gift is paid

‘Once you’ve given away more than £325,000, anyone who gets a gift from you in those 7 years will have to pay Inheritance Tax on their gift.’

Important fact, IHT is only paid after death and this person at death had NO money - so, please forget the thresholds, as they are irrelevant in this scenario.0 -

The person who dies has no money, but the people they gave money to are still alive - hmrc will go after those still alive people.UnsureAboutthis said:

You missed the fundamental point. The person has NO money at the time of his death.[Deleted User] said:

Does this help?UnsureAboutthis said:

Clearly not and if you had, you would not have posted what you did. I'm not sure what the confusion is but I'll give it another go.p00hsticks said:

We most definitely have understood you.UnsureAboutthis said:I'm not sure if you have understood me.

Gifts made within 7 years of the death are added back into the estate for IHT calculation purposes.

If there are enough assets left in the estate to cover the IHT bill then it should be paid from the estate, but if not then HMRC will expect the beneficiaries of the gifts to foot the bill.

If it were that easy to circumvent IHT everyone would be doing it - it's the reason the seven year rule exists.

I'll ask for the last time and hoping that someone can answer the question.

No one is talking about x/y/z etc but the simple scenario as per my original posts, IE.

Someone decided to give away 2/3/7/etc million away and dies within the next 2 years. The person decided

to live a simple life and their income covers the rent and the bills/food etc but no savings. So, the person dies the next day or before 7 years. If the person had assets, then I'm sure the taxman would chase/want the tax. However, no one has understood what I am saying and asking. The person died penniless and had a big, fat, zero worth of assests.

Where does the taxman receive his money from and if you still feel he will collect when the person, when he/she died had zero to their names - direct me to a HMRC link how the taxman would seek to recover money from the 1 to 100 people he gave his money away to.

https://www.gov.uk/inheritance-tax/gifts

Specifically:How Inheritance Tax on a gift is paid

‘Once you’ve given away more than £325,000, anyone who gets a gift from you in those 7 years will have to pay Inheritance Tax on their gift.’

Important fact, IHT is only paid after death and this person at death had NO money - so, please forget the thresholds, as they are irrelevant in this scenario.

Edited to add - and if the people who received the money have died, then the hmrc will go after the people who received the money from those now deceased people, etc, etc.5 -

They are not missing the point. You are not understanding the law or the posts in response to your question.

If someone gives away everything they have to other people and dies the next day, for inheritance tax purposes their estate is considered to have the same value that it had before the deceased gave everything away. HMRC will pursue those who received the estate for the tax.Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.4 -

You’re saying that the estate value is NIL because there’s no money in it? You are not adding back the gifts made in the final seven years?UnsureAboutthis said:

You missed the fundamental point. The person has NO money at the time of his death.[Deleted User] said:

Does this help?UnsureAboutthis said:

Clearly not and if you had, you would not have posted what you did. I'm not sure what the confusion is but I'll give it another go.p00hsticks said:

We most definitely have understood you.UnsureAboutthis said:I'm not sure if you have understood me.

Gifts made within 7 years of the death are added back into the estate for IHT calculation purposes.

If there are enough assets left in the estate to cover the IHT bill then it should be paid from the estate, but if not then HMRC will expect the beneficiaries of the gifts to foot the bill.

If it were that easy to circumvent IHT everyone would be doing it - it's the reason the seven year rule exists.

I'll ask for the last time and hoping that someone can answer the question.

No one is talking about x/y/z etc but the simple scenario as per my original posts, IE.

Someone decided to give away 2/3/7/etc million away and dies within the next 2 years. The person decided

to live a simple life and their income covers the rent and the bills/food etc but no savings. So, the person dies the next day or before 7 years. If the person had assets, then I'm sure the taxman would chase/want the tax. However, no one has understood what I am saying and asking. The person died penniless and had a big, fat, zero worth of assests.

Where does the taxman receive his money from and if you still feel he will collect when the person, when he/she died had zero to their names - direct me to a HMRC link how the taxman would seek to recover money from the 1 to 100 people he gave his money away to.

https://www.gov.uk/inheritance-tax/gifts

Specifically:How Inheritance Tax on a gift is paid

‘Once you’ve given away more than £325,000, anyone who gets a gift from you in those 7 years will have to pay Inheritance Tax on their gift.’

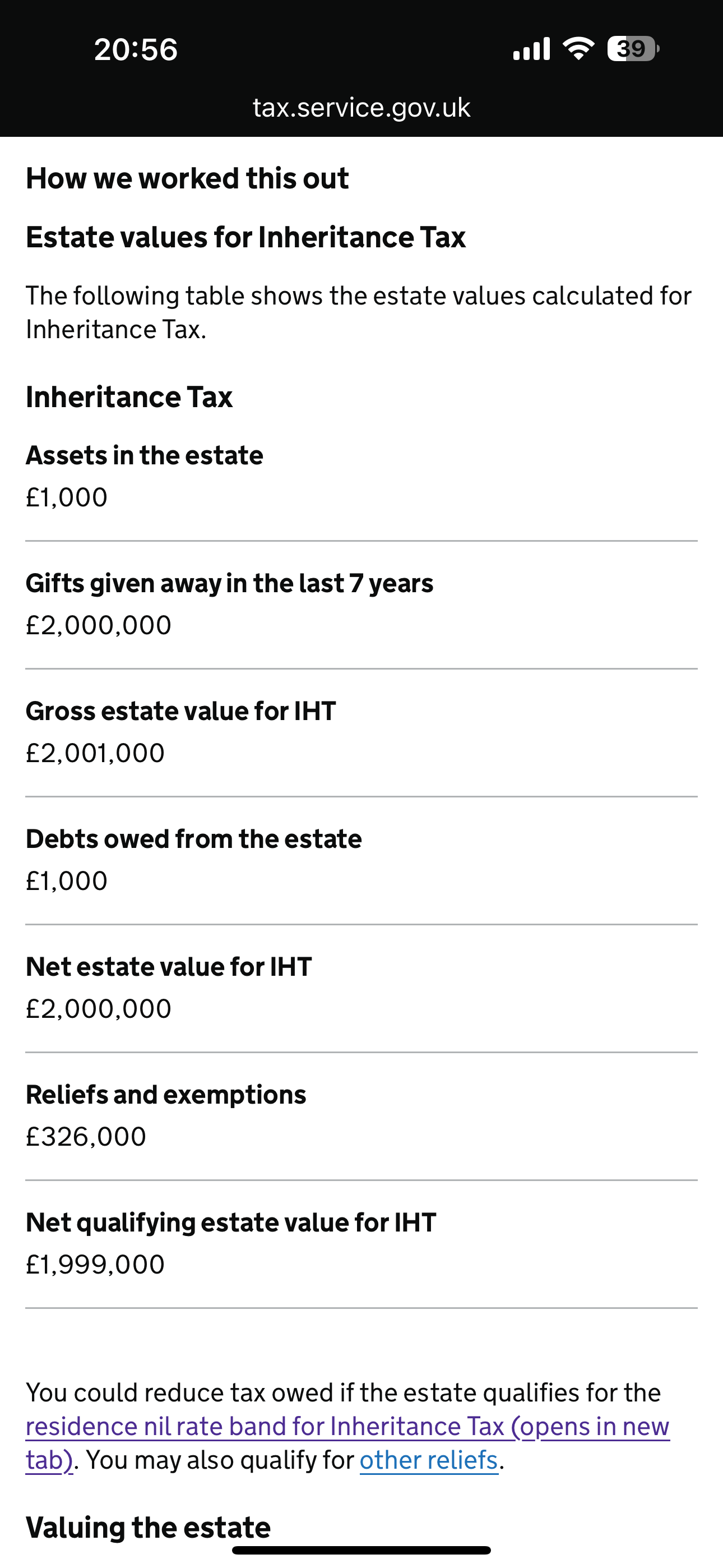

Important fact, IHT is only paid after death and this person at death had NO money - so, please forget the thresholds, as they are irrelevant in this scenario.I went through the IHT wizard just for you. Value of estate £1000 less expenses £1000 - Net value zero. Gifts within last seven years is 2 million. 1

1 -

Thank you.kimwp said:They are not missing the point. You are not understanding the law or the posts in response to your question.

If someone gives away everything they have to other people and dies the next day, for inheritance tax purposes their estate is considered to have the same value that it had before the deceased gave everything away. HMRC will pursue those who received the estate for the tax.

However, are you, or anyone else for that matter, direct me to the HMRC site where it is specifically stated that HMRC would go after those who received the gift/s?

Many thanks.0 -

Nomunnofun1 has already given you one hmrc webpage: https://www.gov.uk/inheritance-tax/gifts where it says:UnsureAboutthis said:

Thank you.kimwp said:They are not missing the point. You are not understanding the law or the posts in response to your question.

If someone gives away everything they have to other people and dies the next day, for inheritance tax purposes their estate is considered to have the same value that it had before the deceased gave everything away. HMRC will pursue those who received the estate for the tax.

However, are you, or anyone else for that matter, direct me to the HMRC site where it is specifically stated that HMRC would go after those who received the gift/s?

Many thanks.

Any Inheritance Tax due on gifts is usually paid by the estate, unless you give away more than £325,000 in gifts in the 7 years before your death. Once you’ve given away more than £325,000, anyone who gets a gift from you in those 7 years will have to pay Inheritance Tax on their gift.

Edited to add: perhaps you could specify the webpages that you believe back up your understanding that the hmrc would just let the inheritance tax bill slide.1 -

It being specifically stated somewhere that HMRC would pursue it is a bit irrelevant. HMRC are allowed to pursue payment of inheritance tax (or any other tax due) and they do.UnsureAboutthis said:

Thank you.kimwp said:They are not missing the point. You are not understanding the law or the posts in response to your question.

If someone gives away everything they have to other people and dies the next day, for inheritance tax purposes their estate is considered to have the same value that it had before the deceased gave everything away. HMRC will pursue those who received the estate for the tax.

However, are you, or anyone else for that matter, direct me to the HMRC site where it is specifically stated that HMRC would go after those who received the gift/s?

Many thanks.Statement of Affairs (SOA) link: https://www.lemonfool.co.uk/financecalculators/soa.phpFor free, non-judgemental debt advice, try: Stepchange or National Debtline. Beware fee charging companies with similar names.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards