We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Failure to respond to KYC resulting in ‘Arrangement to Pay’

Comments

-

Why are you deliberately evading every question about what the letters actually said? Is it because they state clearly what would happen if you failed to comply with KYC and failed to repay in full if your account was closed?

If, as it seems we all suspect, the letters clearly state what will happen and you take this to the ombudsman, they will side with Amex regardless of what you claim a customer service representative said (even if they did say it). You need to consider where you go from here, but your options are likely to be wait a year and then go to a specialist mortgage lender, or engage in a lengthy and futile process trying to get your credit file amended.0 -

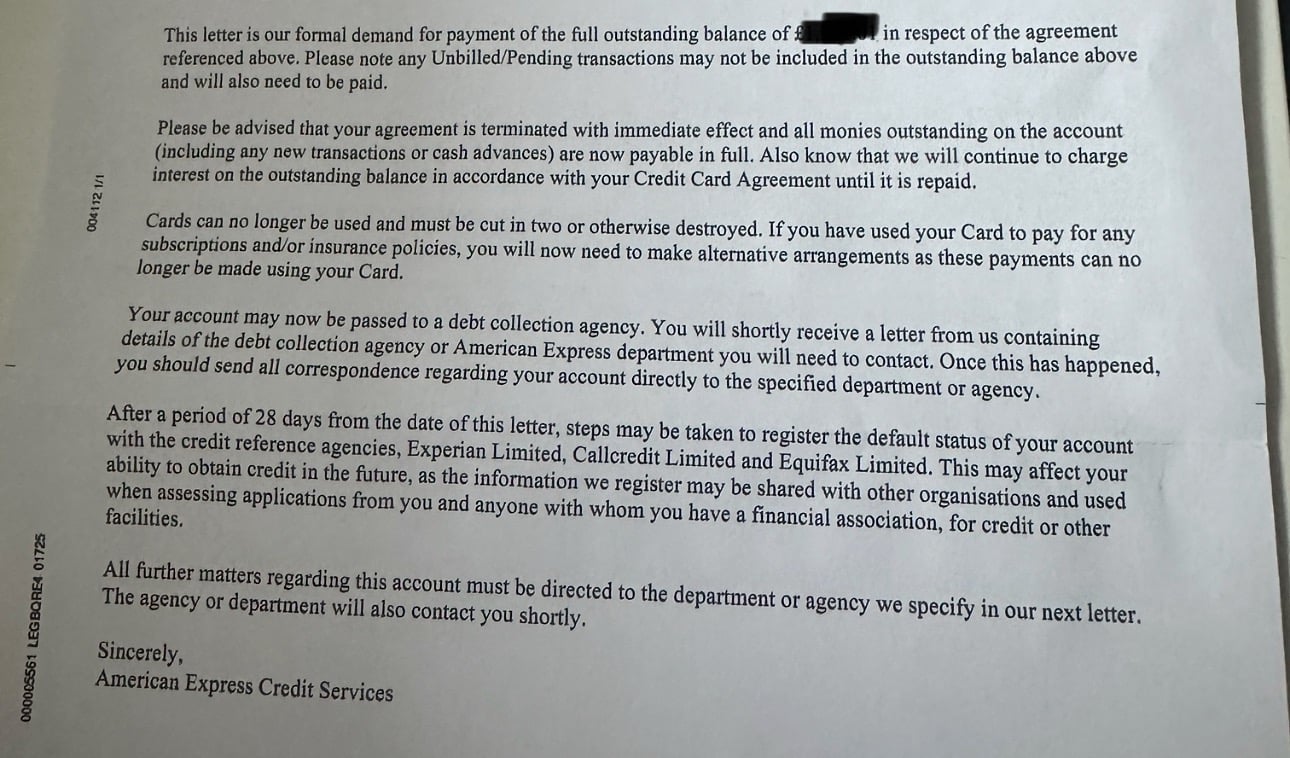

This was the only letter. I called the day I received this letter (the first and only written letter I received, all other KYC correspondence was sent via email apparently) and I was told on the phone that ‘as long as I continued to make monthly payments, there would be no impact on my credit file’. I was also told the account hadn’t been passed to a debt collector yet (this was 22nd January, the day the letter arrived).Then a debt collection agency called shortly after this letter. I co-operated and agreed to make a payment, although very confused.I called Amex the day the debt collection agency called me, as I wasn’t expecting this based on previous conversation with Amex. Amex told me they did not know why it was sent to a third party, she said she had been working there 20 years and hadn’t seen a case like this. Account has been open 10 years, always kept up to date with payments etc. She opened a case internally to get it looked it.The balance was fully paid within 6 weeks of receiving the letter, no default has been listed, just an ‘Arrangement to Pay’ in February (not in March or beyond). It’s also only listed on 2 of the 3 reference agencies. Showing as settled and to ‘AR’ marker on Experian.

This was the only letter. I called the day I received this letter (the first and only written letter I received, all other KYC correspondence was sent via email apparently) and I was told on the phone that ‘as long as I continued to make monthly payments, there would be no impact on my credit file’. I was also told the account hadn’t been passed to a debt collector yet (this was 22nd January, the day the letter arrived).Then a debt collection agency called shortly after this letter. I co-operated and agreed to make a payment, although very confused.I called Amex the day the debt collection agency called me, as I wasn’t expecting this based on previous conversation with Amex. Amex told me they did not know why it was sent to a third party, she said she had been working there 20 years and hadn’t seen a case like this. Account has been open 10 years, always kept up to date with payments etc. She opened a case internally to get it looked it.The balance was fully paid within 6 weeks of receiving the letter, no default has been listed, just an ‘Arrangement to Pay’ in February (not in March or beyond). It’s also only listed on 2 of the 3 reference agencies. Showing as settled and to ‘AR’ marker on Experian.

Don’t like the accusations of ‘deliberately evading’ questions. New to the forum, uncomfortable with posting contents of a personal letter and just very confused and concerned given the impact of a KYC is going to have on my family. For someone who has always kept on top of their payments on this account.0 -

KYC is something all financial institutions have to take very seriously, they face huge fines for not doing so and customers are required to comply.thecontrastdude2022 said: This was the only letter. I called the day I received this letter (the first and only written letter I received, all other KYC correspondence was sent via email apparently) and I was told on the phone that ‘as long as I continued to make monthly payments, there would be no impact on my credit file’. I was also told the account hadn’t been passed to a debt collector yet (this was 22nd January, the day the letter arrived).Then a debt collection agency called shortly after this letter. I co-operated and agreed to make a payment, although very confused.I called Amex the day the debt collection agency called me, as I wasn’t expecting this based on previous conversation with Amex. Amex told me they did not know why it was sent to a third party, she said she had been working there 20 years and hadn’t seen a case like this. Account has been open 10 years, always kept up to date with payments etc. She opened a case internally to get it looked it.The balance was fully paid within 6 weeks of receiving the letter, no default has been listed, just an ‘Arrangement to Pay’ in February (not in March or beyond). It’s also only listed on 2 of the 3 reference agencies. Showing as settled and to ‘AR’ marker on Experian.

This was the only letter. I called the day I received this letter (the first and only written letter I received, all other KYC correspondence was sent via email apparently) and I was told on the phone that ‘as long as I continued to make monthly payments, there would be no impact on my credit file’. I was also told the account hadn’t been passed to a debt collector yet (this was 22nd January, the day the letter arrived).Then a debt collection agency called shortly after this letter. I co-operated and agreed to make a payment, although very confused.I called Amex the day the debt collection agency called me, as I wasn’t expecting this based on previous conversation with Amex. Amex told me they did not know why it was sent to a third party, she said she had been working there 20 years and hadn’t seen a case like this. Account has been open 10 years, always kept up to date with payments etc. She opened a case internally to get it looked it.The balance was fully paid within 6 weeks of receiving the letter, no default has been listed, just an ‘Arrangement to Pay’ in February (not in March or beyond). It’s also only listed on 2 of the 3 reference agencies. Showing as settled and to ‘AR’ marker on Experian.

Don’t like the accusations of ‘deliberately evading’ questions. New to the forum, uncomfortable with posting contents of a personal letter and just very confused and concerned given the impact of a KYC is going to have on my family. For someone who has always kept on top of their payments on this account.

The reason for the deliberately evasive statement is because you were asked multiple times what the letter said after being told that was what mattered, not the phone call, yet you kept ignoring that and referring back to the phone call. Now you have posted the letter it has clarified things and we can see they have been clear what will happen.

The second paragraph makes clear the debt is repayable immediately, the fifth paragraph makes clear what will happen if you do not, although they did not go as far as a full default, only an arrangement to pay. On that basis your claim to the ombudsman will fail.0 -

It is likely to be partially upheld on the basis a telephone member of staff did give poor advice but it will be token on the basis that the formal letter was very clear.MattMattMattUK said:

The second paragraph makes clear the debt is repayable immediately, the fifth paragraph makes clear what will happen if you do not, although they did not go as far as a full default, only an arrangement to pay. On that basis your claim to the ombudsman will fail.0 -

It's the law. Data Protection Act 2018. Commonly known as GDPR.thecontrastdude2022 said:

Do Amex have to provide the recordings of my calls if I request them?eskbanker said:If your case is going to hinge on discrepancies between what you were told in writing and what was said verbally in phone calls, have you secured copies of those recordings?I consider myself to be a male feminist. Is that allowed?1 -

I hadn't noticed the question when originally posted, but yes, call recordings are regarded as personal data and therefore within scope of a subject access request, with the possibly significant caveat that they can only be shared if the company still has copies of them, which may not be the case for calls made in January....surreysaver said:

It's the law. Data Protection Act 2018. Commonly known as GDPR.thecontrastdude2022 said:

Do Amex have to provide the recordings of my calls if I request them?eskbanker said:If your case is going to hinge on discrepancies between what you were told in writing and what was said verbally in phone calls, have you secured copies of those recordings?1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards