We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Bank miscalculated interest due at end of fixed rate investment - Lessons learnt?

Comments

-

I've been a quid or two out on a few accounts over the years and I've heard all sorts of excuses. The most memorable was being told that the deposit was after 3pm so did not get credited to the account until the next day. So I showed them their own T&Cs and they instantly backed down and gave me an extra £20 to shut me up. But they never explained the real error and allowing for their imaginary cut-off point did not make the numbers correct.

And yes, I imagine most people don't bother to check the interest calculations because it can be tricky to do when multiple deposits are concerned.2 -

Are you sure it's the right amount?masonic said:The best way for individuals to learn is through the dissection of real world examples in my view. I've got very low interest in conjecture or speculation about the possibility of a mistake without facts and figures to support it. 3

3 -

You can't get to lessons learnt without a clue as to what went wrong. Eg its a whole different lesson whether its rounding vs basic mistyping vs no interest on certain days.Economme said:masonic said:Would you be willing to share their workings for the new figure? We might be able to back-calculate how they may have arrived at the original figure that was £8.39 less.I'm more interested in the general 'lessons learnt', rather than pursuing my own individual case (very low interest! - on many levels)For example, is mis-calculation common?; what could be the general reasons?; any lessons for the individual?; any lessons for the industry watchdogs?; for the industry; for the public?(I also feel quite imaginative with possible methods of calculation - It is a fairly simple scenario, after all. What is missing, is something only Sainsbury's Bank could supply (their actual 'reasoning'), which I doubt they will/ or is not worth pursuing).

Don't share if you don't want to, but then fully expect this thread to die.2 -

Economme said:I'm more interested in the general 'lessons learnt', rather than pursuing my own individual case (very low interest! - on many levels)If you are only interested in the general issue of interest payments, and how often and why errors are made, then I think it's inappropriate to name the organisation you had an issue with, given you aren't willing to provide any real illumination as to what has happened and what you believe has gone wrong, to enable readers to judge who has got things wrong and why. Were you willing to give some details of course naming the organisation is reasonable.I happen to check every interest payment I receive, it's just part of how I record what money I have saved. Errors are few and far between, and when there are errors they tend to be for the reasons masonic states. Where errors happen, certainly on best buy accounts, then usually someone will spot it and post up on these forums. And those are the protective mechanisms we as savers have against errors happening. I don't think most systems are set up to provide independent print-offs of how interest has been calculated and so it is understandable when organisations are asked to provide precise calculations of interest calculations that they struggle a bit.

I came, I saw, I melted2 -

SnowMan said:Economme said:I'm more interested in the general 'lessons learnt', rather than pursuing my own individual case (very low interest! - on many levels)I don't think most systems are set up to provide independent print-offs of how interest has been calculatedBut the info for this must be stored in the systems because most accounts state "interest accrues daily " so it shouldn't be rocket science to add a field to statements that shows these accrued amounts.If you could see how much interest accrues between transactions, it would be quite easy to work out how these figures are arrived at.

1 -

You could in theory have a daily statement or preferably a downloadable spreadsheet with a row for each day showing balance, balance for interest, daily rate, accrued interest. However, such a system to create that customer report would need to be created and some not inconsiderable cost. The question is whether there would be sufficient demand to justify it. I would like it, but many wouldn't.1spiral said:SnowMan said:Economme said:I'm more interested in the general 'lessons learnt', rather than pursuing my own individual case (very low interest! - on many levels)I don't think most systems are set up to provide independent print-offs of how interest has been calculatedBut the info for this must be stored in the systems because most accounts state "interest accrues daily " so it shouldn't be rocket science to add a field to statements that shows these accrued amounts.If you could see how much interest accrues between transactions, it would be quite easy to work out how these figures are arrived at.3 -

Economme said:masonic said:

Would you be willing to share their workings for the new figure? We might be able to back-calculate how they may have arrived at the original figure that was £8.39 less.

I'm more interested in the general 'lessons learnt', rather than pursuing my own individual case (very low interest! - on many levels)

For example, is mis-calculation common?; what could be the general reasons?; any lessons for the individual?; any lessons for the industry watchdogs?; for the industry; for the public?

(I also feel quite imaginative with possible methods of calculation - It is a fairly simple scenario, after all. What is missing, is something only Sainsbury's Bank could supply (their actual 'reasoning'), which I doubt they will/ or is not worth pursuing).

What is missing are the fundamental figures of your individual case; you can't expect others to arrive at your conclusion without first providing the necessary information that lead you to form it as the basis for a discussion of speculative consequence.

You already mentioned the name of the provider, the product type, the fact that the account balance constituted three deposits spaced several days apart, yet you're unwilling to divulge the remaining details that would allow others to contribute beyond conjecture. It's through analysis of individual cases and further reasoning that we, collectively as a community, discover overall patterns of behaviour—whether human or programmed— and learn of the exceptional cases that warrant further substantive action as a response.

In my case, HSBC did not calculate interest incorrectly; the interest discrepancy was due to an idiosyncrasy in their systems that they could not (or be bothered to) explain. I was compensated for their terrible handling of my query, and the eventual spreadsheet breakdown I did receive contained only raw data with no accompanying contextual prose.

2 -

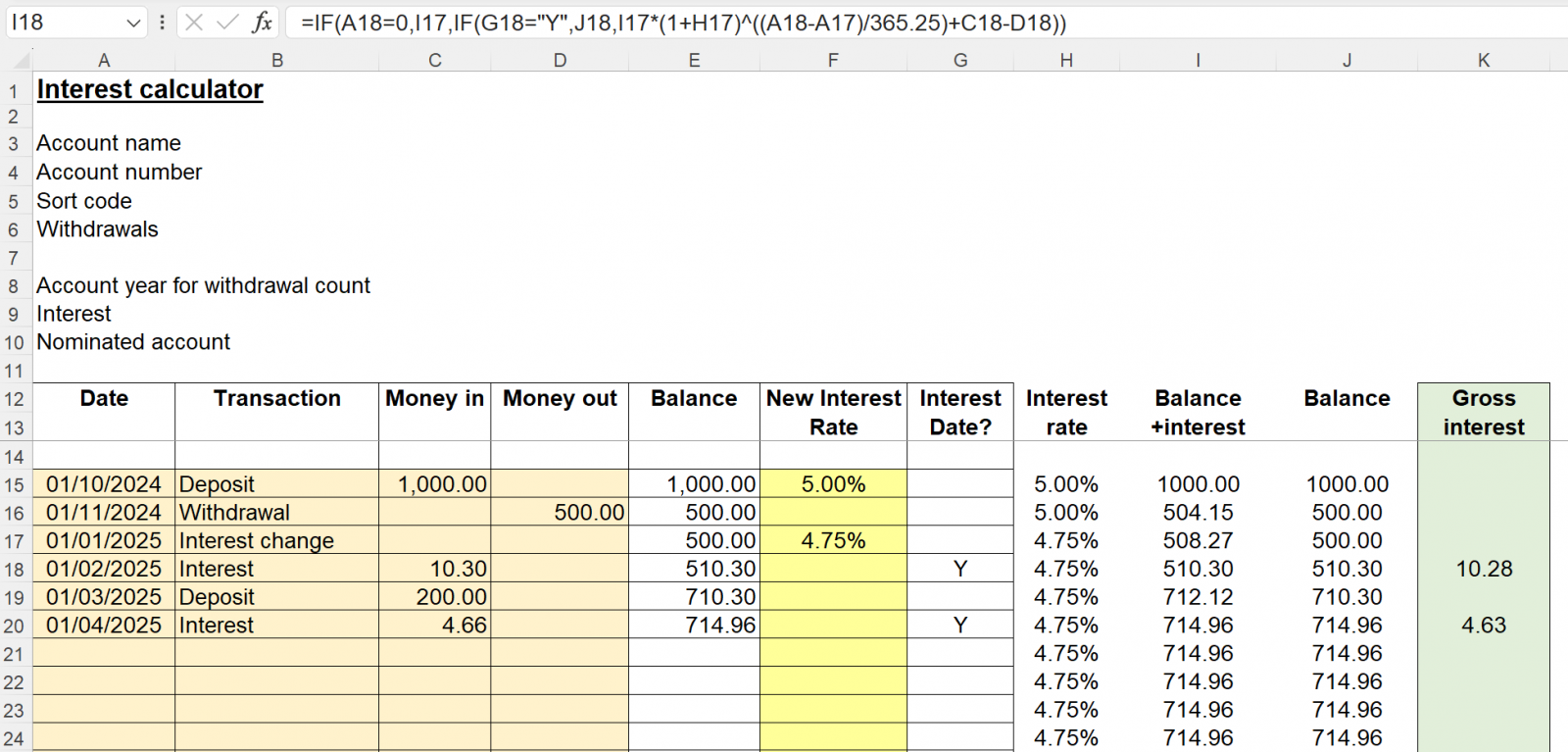

In terms of checking interest payments this is a screenshot of the template I use for recording my savings accounts transactions in case it helps.I just input date, transaction (type), and amount in or out and any change in interest rate (by which I mean AER). Each time there is an interest payment the spreadsheet estimates the interest payable which I check against the amount actually paid.It works by keeping a running amount of balance and interest and balance (in columns I and J) and each time there is an interest payment resets the accrued interest to zero.So in this made up example on 1st February 2025, £10.30 interest was paid against £10.28 estimated, and you can see how the balance plus interest has been estimated from the previous date (and how the balance plus interest is reset to zero following an interest payment) in the formula bar for cell I18.

The gross interest estimate of £10.28 has been calculated using the formula=IF(G18="Y",I17*(1+H17)^((A18-A17)/365.25)+C18-D18-J18," ")And the interest date? indicator in column G is calculated as Y when the transaction type is selected as 'Interest'I came, I saw, I melted2

The gross interest estimate of £10.28 has been calculated using the formula=IF(G18="Y",I17*(1+H17)^((A18-A17)/365.25)+C18-D18-J18," ")And the interest date? indicator in column G is calculated as Y when the transaction type is selected as 'Interest'I came, I saw, I melted2 -

Thanks, I like that layout. Interesting that you are using 365.25 in the calculation. I've found that banks vary in their handling of leap years and have tended to base my calculations on a 365 day year in non-leap years. How accurate do you find your approach?1

-

masonic said:Thanks, I like that layout. Interesting that you are using 365.25 in the calculation. I've found that banks vary in their handling of leap years and have tended to base my calculations on a 365 day year in non-leap years. How accurate do you find your approach?I use 365.25 for simplicity because I occasionally use the spreadsheet over long periods (so it avoids systematic errors) but for most accounts 365 would be better at least in non leap years (as I think most use 365 in non leap years and a few even appear to give you a free day's interest in leap years)I find it fairly accurate typically at most £2 or £3 pounds difference, and slightly more 'overpayments' than 'underpayments' overall. So for example randomly picking 5 interest payments I've received recently from different institutions £162.03 actual (vs £161.85 estimated), £393.78 (vs £396.42), £180.40 (vs 177.69), £103.90 (vs £102.44) and £10.22 (vs £10.40).Where there is a minor underpayment you typically find an overpayment on the subsequent interest date.The £393.78 (vs £396.42) 'underpayment' I think was losing a days interest on closing a West Brom account (because it's done next day and you lose the interest I think although I didn't look at it carefully as it's near enough for me) but that's fairly unusual.

I came, I saw, I melted2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.5K Banking & Borrowing

- 253.7K Reduce Debt & Boost Income

- 454.5K Spending & Discounts

- 245.5K Work, Benefits & Business

- 601.5K Mortgages, Homes & Bills

- 177.6K Life & Family

- 259.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards