We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Will recent "events" cause a rethink of DC pensions?

Comments

-

Absolutely. When I was doing my 6% and getting double contributions it was costing me around £180 in my pocket to get £1,000 of contributions. I am now doing 40%, so the cap on employer contributions dilutes the gain but it is still the most efficient way to invest, especially when taking the risk level right down. In fact if you do that you 100% will have more than you would have received as a net wage.BikingBud said:With pension contributions is there not the gain from employers contribution and saved tax to be taken into account as well.

Even if the unit price has dropped you may still have more in your fund than you would have received as net wage.0 -

Keep calm and carry on.

IMO there is nothing fundamentally wrong with the world economy, just this spanner that he-who-shall-remain-nameless threw into the gears and from where he is now backtracking. It will eventually amount to nothing more than a blip.

I've bought another 5% more equities. Markets have not been cheap but they are not a bubble either.3 -

It's not news that we have to plan for downs as well as ups in the market. What's an eye opener in this case is that it's not been caused by world events. It's one person doing it on a whim. I can't see any reason the events of the last couple of weeks couldn't be repeated at any random times over the next four (or eight) years.2

-

The world economy has become highly interconnected with complex global supply chains. The signs are that even if globalisation is not totally over there will be restructuring and continuing investment uncertainty all of which comes at a cost.MetaPhysical said:

IMO there is nothing fundamentally wrong with the world economy,

2 -

Not looking likely. After a bit of positivity yesterday, a flattish day expected but I guess a couple of days of a stable market could be seen as a 'win' at the moment! The FTSE has done OK over the past week and pretty much back to where it was 6 months ago.QrizB said:Cobbler_tone said:That is what I was alluding to yesterday afternoon. My prediction is that we will see gains next week and we will back to where we were before the tariff announcement.Just so we're all clear in what you're predicting, you think the S&P 500 will be back above 5600 by the end of trading on the 18th?If not, could you make a clear statement of what your prediction is?

Then again, who knows when the next tweet is coming?1 -

Cobbler_tone said:

Not looking likely. After a bit of positivity yesterday, a flattish day expected but I guess a couple of days of a stable market could be seen as a 'win' at the moment! The FTSE has done OK over the past week and pretty much back to where it was 6 months ago.QrizB said:Cobbler_tone said:That is what I was alluding to yesterday afternoon. My prediction is that we will see gains next week and we will back to where we were before the tariff announcement.Just so we're all clear in what you're predicting, you think the S&P 500 will be back above 5600 by the end of trading on the 18th?If not, could you make a clear statement of what your prediction is?

It'll definitely be interesting to see where we are at the end of the week. Only time will tell!N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill Coop member.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.0 -

Bostonerimus1 said:Stock markets have suddenly become very volatile. What does this mean for DC pension strategies in both the accumulation and spending phases? Those of us either retired, or close to it, have lived through the decline of the DB pension and rise of the DC pension based on individual exposure to equities and fixed income. The investment and withdrawal strategies have always included some nod to volatility, but after the UK bond crisis of a few years ago and the current fall in markets are you reassessing things...or is this all covered by your plan?

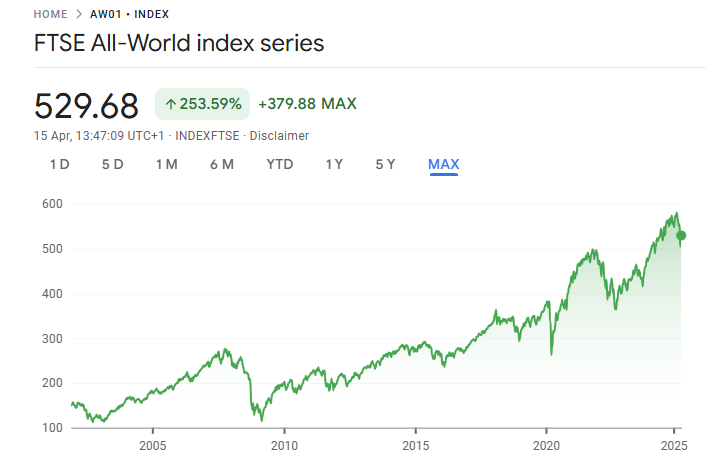

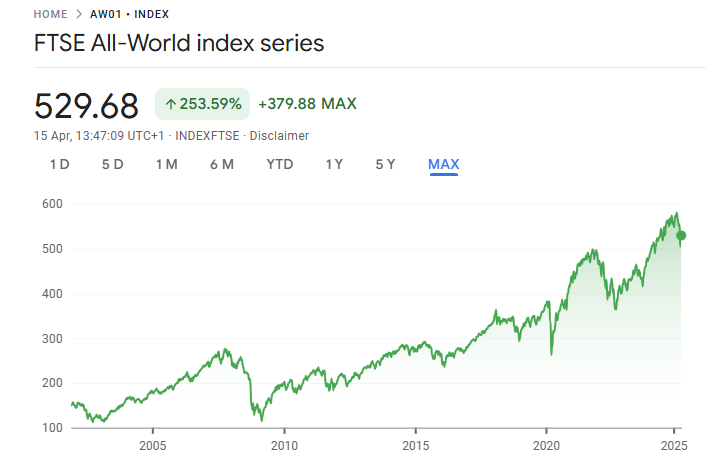

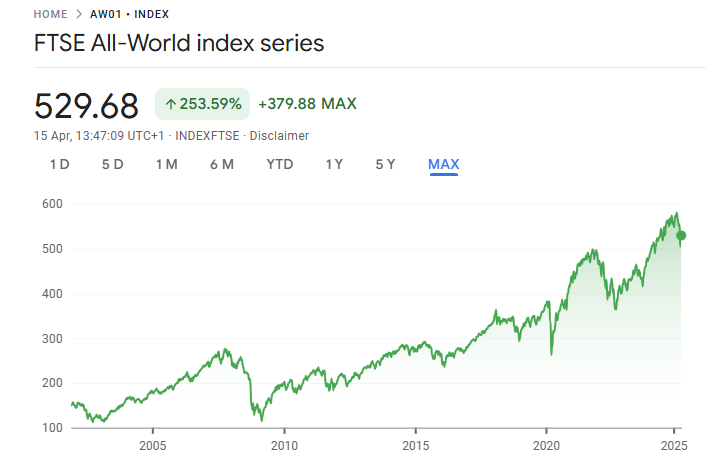

I guess the first thing to do is establish the definition of "suddenly" and "very volatile"

• The rich buy assets.

• The poor only have expenses.

• The middle class buy liabilities they think are assets.2 -

TBF most single share holdings will also paint a picture like that. Well actually my share shows a 1686% increase since 1986 or 100% over the past 10 years. In fact it is green over any period of time currently, from a day, a week, a month, 3m, 6m, YTD etc.vacheron said:Bostonerimus1 said:Stock markets have suddenly become very volatile. What does this mean for DC pension strategies in both the accumulation and spending phases? Those of us either retired, or close to it, have lived through the decline of the DB pension and rise of the DC pension based on individual exposure to equities and fixed income. The investment and withdrawal strategies have always included some nod to volatility, but after the UK bond crisis of a few years ago and the current fall in markets are you reassessing things...or is this all covered by your plan?I guess the first thing to do is establish the definition of "suddenly" and "very volatile"

The dips however can be very 'sudden', 'volatile' and real, depending when you need to access it.

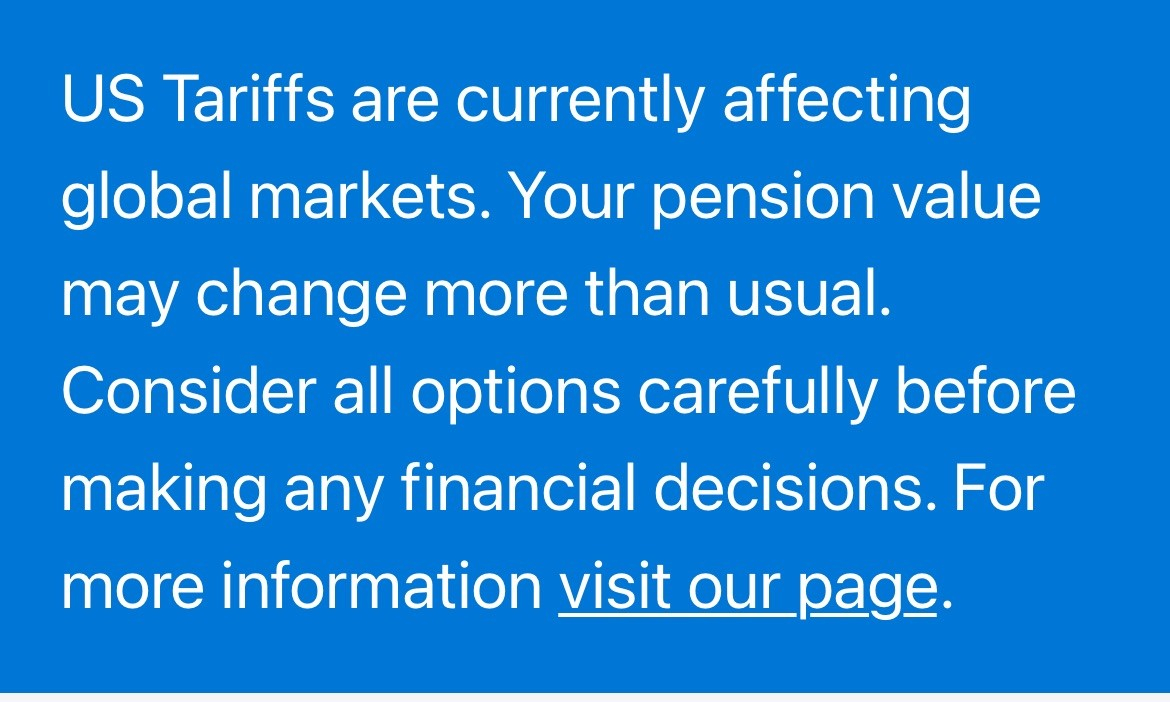

It is volatile enough for L&G to offer this trigger warning at the moment.

1 -

Yes, I've had the same from Hargreaves Lansdown, Interactive Investor, Trading212 and others.Cobbler_tone said:

TBF most single share holdings will also paint a picture like that. Well actually my share shows a 1686% increase since 1986 or 100% over the past 10 years. In fact it is green over any period of time currently, from a day, a week, a month, 3m, 6m, YTD etc.vacheron said:Bostonerimus1 said:Stock markets have suddenly become very volatile. What does this mean for DC pension strategies in both the accumulation and spending phases? Those of us either retired, or close to it, have lived through the decline of the DB pension and rise of the DC pension based on individual exposure to equities and fixed income. The investment and withdrawal strategies have always included some nod to volatility, but after the UK bond crisis of a few years ago and the current fall in markets are you reassessing things...or is this all covered by your plan?I guess the first thing to do is establish the definition of "suddenly" and "very volatile"

The dips however can be very 'sudden', 'volatile' and real, depending when you need to access it.

It is volatile enough for L&G to offer this trigger warning at the moment.

I think the difference this time is that the news is ALL about the effect on world markets, and because almost everyone can now download an app and be trading in 10 minutes, there are so many more novice and potentially reactionary investors now who can buy and sell on a whim in 10 seconds, many of whom will have never experienced a fall of any significance in their short trading lives... and the companies above are acutely aware of this.

In 2020 during COVID, the effects on the economy were (rightly) way down the newsreel running order.

In 2008, far fewer people had online trading accounts, and smartphones were virtually unheard of, plus drawdown wasn't even a thing then so you didn't have hundreds of thousands of twitchy retirees or soon to be retirees managing their own portfolios.

So the landscape has shifted, but in my opinion, this dip is still just another of many dips (albeit a larger one) but it is also one that can be far more easily remedied than previous dips should those who caused it be inclined to do so.

• The rich buy assets.

• The poor only have expenses.

• The middle class buy liabilities they think are assets.2 -

Average age of a Robinhood app user in the USA is 31. Make many of them 13 or under when the GFC started......

Recency bias in spades.2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards

I guess the first thing to do is establish the definition of "suddenly" and "very volatile"

I guess the first thing to do is establish the definition of "suddenly" and "very volatile"