We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Mothers IHT Threshold

nxdmsandkaskdjaqd

Posts: 875 Forumite

I know the answer may not be simple, but wanted to get an idea on mother IHT liability. Her are the facts as I know them:

Husband died 2002. I deed of variation put 50% of the house in to the 4 children. Tenants in Common arrangement. Land registry document states ownership as mother and 4 children.

Mother has now passed away.

House value £477507 (50% of this is the children's)

So her IHT threshold £500,000? (£325000 nil rate band plus £175000 residence nil-rate band)?

Husband died 2002. I deed of variation put 50% of the house in to the 4 children. Tenants in Common arrangement. Land registry document states ownership as mother and 4 children.

Mother has now passed away.

House value £477507 (50% of this is the children's)

So her IHT threshold £500,000? (£325000 nil rate band plus £175000 residence nil-rate band)?

0

Comments

-

Did the deed of variation give your mother a life interest in his share? If it did then a trust was created and the whole house firms part of her estate, but this would not have used any of his NRB so that would be transferable to her estate.

If the DoV gave the children an absolute share then only half the house falls within her estate but it would have used up the bulk of his NRB. Doing it this way has also left each of you with a CGT liability.0 -

Unless all the children were normally resident with mum, they acquired an IHT liability when the deed of variation was made. Who advised that was a good idea?

If there had not been a deed of variation the IHT allowance would have been £1m, providing the house was valued at £350k or above and dad didn't leave anything to anyone other than mum, or make gifts in the 7 years before he died.If you've have not made a mistake, you've made nothing0 -

Thanks for the replies. I know this was going to go over my head.

In answer:

Mother lived on here own since her husband died in 2002

The siblings understand there is a CGT liability from 2002 to todays date that need. to be paid with in 60 days.

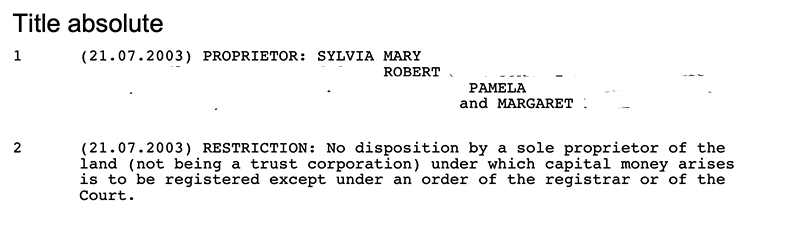

I have attached the appropriate details from the land registry documents, does this help?

0 -

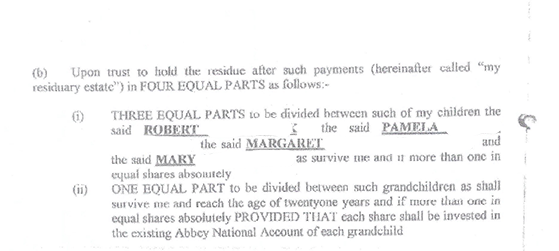

I also have this if it helps:

0 -

From what you have provided a trust was not created so your mother’s estate comprises of 1/2 the house plus any other assets she owned. Her own allowances are for £500k plus any unused NRB from her husband’s estate and his residential NRB.If you can avoid using any of the residential NRBs you will avoid having to do an IHT return.0

-

Thank you. So mother has 500K of allowances. Could you explain the bit "plus any unused NRB from her husband’s estate and his residential NRB." Sorry just need more of an understanding.Keep_pedalling said:From what you have provided a trust was not created so your mother’s estate comprises of 1/2 the house plus any other assets she owned. Her own allowances are for £500k plus any unused NRB from her husband’s estate and his residential NRB.If you can avoid using any of the residential NRBs you will avoid having to do an IHT return.0 -

You've not told us the value of the other assets?

She personally has an allowance of £325k NRB plus £175k RNRB, given her half share of the house exceeds £175k. You can off-set the remaining value of the house against her NRB if the total value is less than £500k.

If it exceeds £500k, you may be able to use the remnants of her deceased husband's NRB and RNRB allowances, which rather depends on the value of the house at the time he died and any other assets he left to anyone other than your mother, or gifted to anyone in the previous seven years.

If the total value of the two estates is less than the two NRB allowances, you don't need to use the RNRB allowances or do an IHT return. If it exceeds that amount, even if there is no IHT to pay, you need to do an IHT return.

If you've have not made a mistake, you've made nothing1 -

Got it, I understand. ThanksRAS said:You've not told us the value of the other assets?

She personally has an allowance of £325k NRB plus £175k RNRB, given her half share of the house exceeds £175k. You can off-set the remaining value of the house against her NRB if the total value is less than £500k.

If it exceeds £500k, you may be able to use the remnants of her deceased husband's NRB and RNRB allowances, which rather depends on the value of the house at the time he died and any other assets he left to anyone other than your mother, or gifted to anyone in the previous seven years.

If the total value of the two estates is less than the two NRB allowances, you don't need to use the RNRB allowances or do an IHT return. If it exceeds that amount, even if there is no IHT to pay, you need to do an IHT return.0 -

Per the extract of the will you supplied distributing parts of residue to children and grandchildren, depending on how much that was in total when your father died in 2002, that determines how much (if any) of his nil rate band can be transferred to your mother on her death.nxdmsandkaskdjaqd said:

Thank you. So mother has 500K of allowances. Could you explain the bit "plus any unused NRB from her husband’s estate and his residential NRB." Sorry just need more of an understanding.Keep_pedalling said:From what you have provided a trust was not created so your mother’s estate comprises of 1/2 the house plus any other assets she owned. Her own allowances are for £500k plus any unused NRB from her husband’s estate and his residential NRB.If you can avoid using any of the residential NRBs you will avoid having to do an IHT return.

However since the nil rate bands were either £242k or £250k in 2002 ( depending on actual date of father's death), the value of gifts to children/grandchildren would have to have been markedly below the relevant NRB for there to be any meaningful % of father's NRB available to transfer to your mother.

For example, if the £250k NRB in 2002 was in point, and gifts to children/grandchildren only valued £150k, that would have used 60% of his NRB. Therefore 40% of the current £325,000 NRB (£130,000) would be available to add to your mother's NRB.

However as pointed out by Keep_pedalling and Ras and on what you have disclosed so far of the extent of your mother's estate ( 50% of house valued at £477k = £238k ), unless your mother had any other sizeable assets you have chosen not to mention to take her upto and beyond her personal £325k NRB, I am unclear what ( if any ) are your concerns.

Certainly if her estate value is pretty much £238k, much of the points made in this thread may perhaps be of academic interest to others, but appear to have no relevance to the circumstance you are dealing with.

Finally, and just out of curiosity, did you not folliw through and consult a solicitor last year on aspects related to your father's will and how it impacted on property ownership issues per thread below ?

https://forums.moneysavingexpert.com/discussion/6563158/sale-of-property#latest1 -

I do have a solicitor working on my mothers probate now, but I am less than impressed with their Quality of Service.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards