We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Money left to children

blokeandbird

Posts: 21 Forumite

My father recently passed away. In his will it states that his estate is to be split equally between his grandchildren and this is to be held in trust until they reach 21 (currently 16, 14 and 11. Is this something I have to arrange or would the solicitor arrange it? If it is something I could do, any advice where to start. Thankyou

0

Comments

-

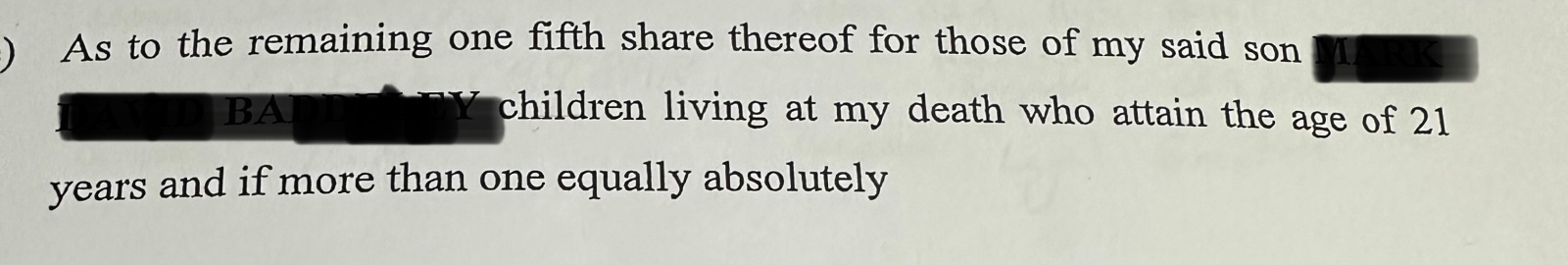

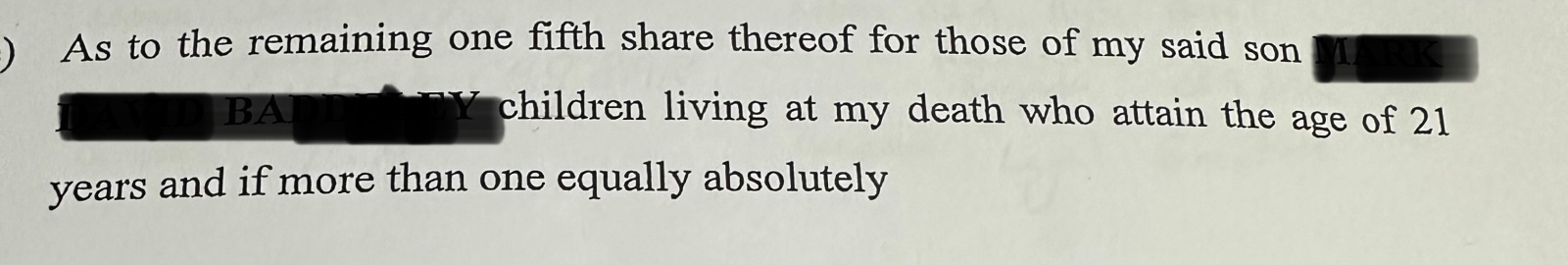

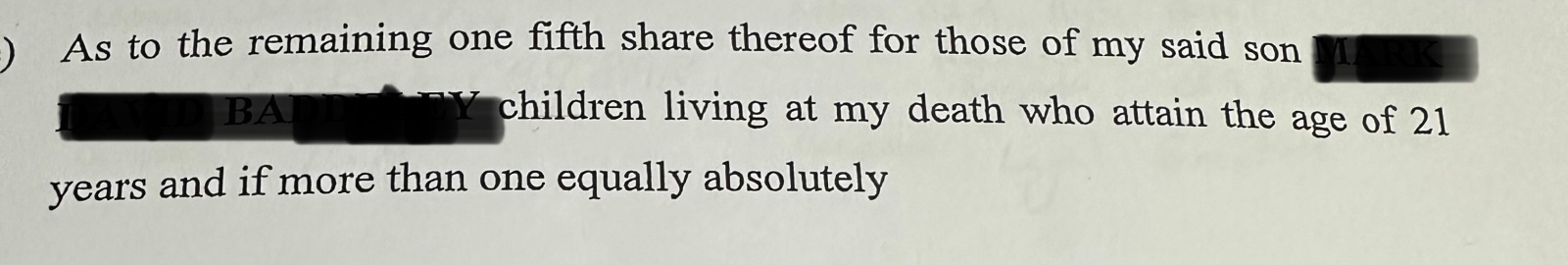

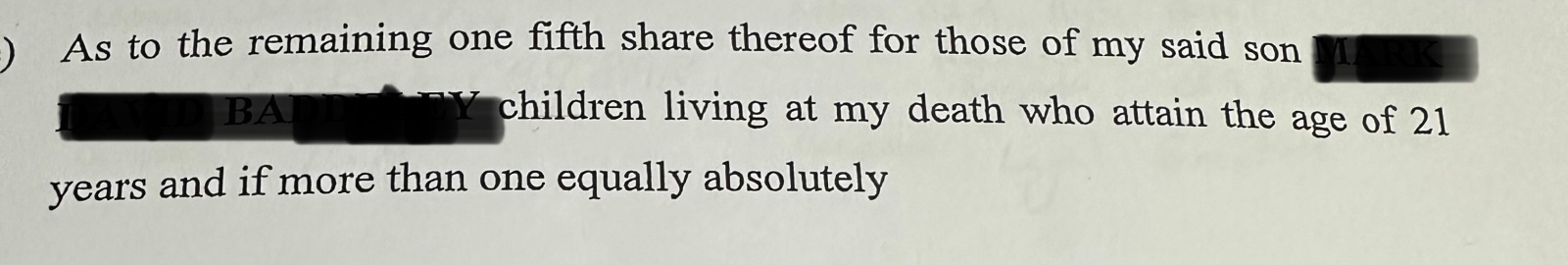

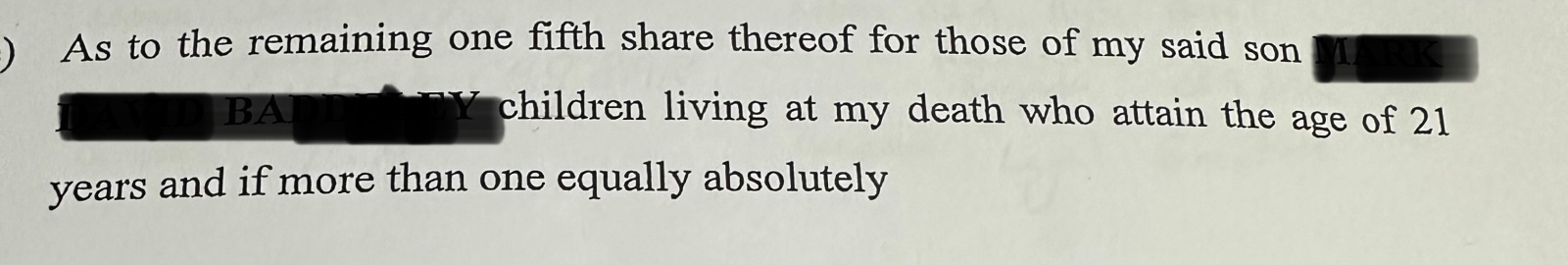

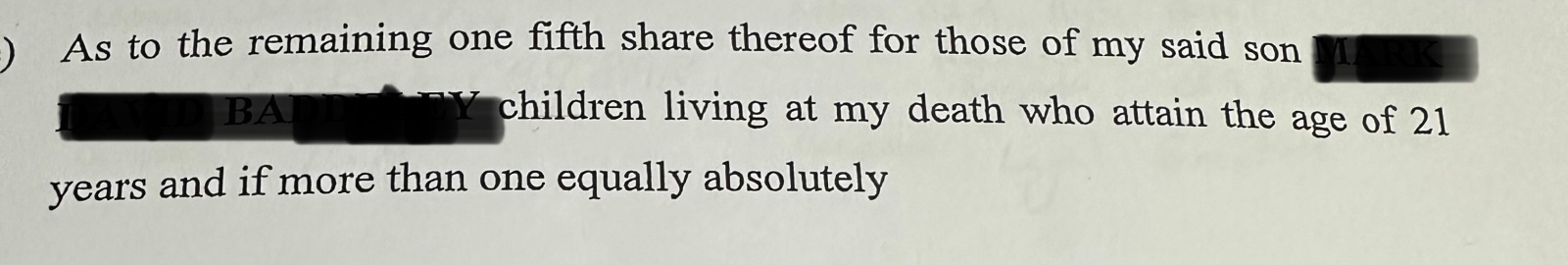

Can you provide the exact wording in the will (redact any personal info) with regard to the age limit and trust please?

Because of the complications and expenses involved with discretionary trusts, most clauses that stipulate that the beneficiaries don’t get their inheritance until they reach a certain age are in reality unenforceable wishes and the children are actually entitled to the inheritance one they reach their 18th birthday (16th in Scotland).

How much will each of them be inheriting?1 -

agree - also do they get one third at today's rates? one third at the time the first one reaches 18/21 - meaning that the younger ones could get more?Keep_pedalling said:Can you provide the exact wording in the will (redact any personal info) with regard to the age limit and trust please?

Because of the complications and expenses involved with discretionary trusts, most clauses that stipulate that the beneficiaries don’t get their inheritance until they reach a certain age are in reality unenforceable wishes and the children are actually entitled to the inheritance one they reach their 18th birthday (16th in Scotland).

How much will each of them be inheriting?0 -

Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou0 -

And who are the executors?blokeandbird said:Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou1 -

probably be the solicitors who will charge for setting up and running the trustMands said:

And who are the executors?blokeandbird said:Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou0 -

My husband and his brothersMands said:

And who are the executors?blokeandbird said:Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou0 -

Flugelhorn said:

probably be the solicitors who will charge for setting up and running the trustMands said:

And who are the executors?blokeandbird said:Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou

The solicitors have asked where we want it invested so wasn’t sure if they would do it or not. Early days yet but just wanted to know what we need to do. ThanksFlugelhorn said:

probably be the solicitors who will charge for setting up and running the trustMands said:

And who are the executors?blokeandbird said:Basically the whole estate is split between 5 children. My husbands part has been left to his children instead of him. Hope that makes sense Thankyou on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

on the notes the solicitor has made is also states that the gift for them is contingent on them attaining the age of 21 and the funds they are due will need to be held in trust by the acting executors until they are 21

it will be around 25-30k each. Thankyou0 -

Unfortunately you have been lumbered with managing a trust for 10 years. You might want to take professional advice on what your responsibilities are with regard to registering the trust and taxation.2

-

Regrettably as pointed out by Keep_pedalling you have indeed been lumbered with a formal trust for the grandchildren by virtue of the unfortunate contingency attached to the legacies.blokeandbird said:My father recently passed away. In his will it states that his estate is to be split equally between his grandchildren and this is to be held in trust until they reach 21 (currently 16, 14 and 11. Is this something I have to arrange or would the solicitor arrange it? If it is something I could do, any advice where to start. Thankyou

This virtually exact situation arose for another OP this time last year see link below-

https://forums.moneysavingexpert.com/discussion/6515865/money-left-to-under-18s-in-will#latest

You will see from my responses on 25 and 26 March the extent of the burden imposed on you, both administratively and in terms of annual tax compliance if the trust monies are invested conventionally.

If none of what I raised in that thread has ever been raised by your father's solicitors then they are the wrong people to continue advising you ( they lack sufficient specialist knowledge). That said, if it is their (poor) will drafting that has placed you ( as trustee ) in such an invidious position, then as regards further advice from qualified specialists, I would consider it fair that they should pay for it.

I would suggest you consult a STEP qualified lawyer to confirm ( or otherwise) my summation of your father's trust as outlined in the thread. STEP is The Society of Trust and Estate Practitioners, and their membership constitutes the higher level of competency and expertise in area of trusts and estates. Link to their website below-

https://www.step.org/about-step/public

Finally one way to avoid complex accounting and tax administration for the children's funds (especially 45% income tax ) is to invest in life company investment bonds, as suggested in the thread. This will require referral to an independent financial adviser with experience of advising trustees, and also the follow through by way of tax structuring advice for bond encashment when each child attains their contingent age of entitlement. Hopefully a STEP lawyer maybe able to make a suitable referral in that direction.

See below an article on investment bonds for these form of trusts albeit in the context of statutory BMT trusts-

https://www.moneymarketing.co.uk/analysis/finding-alternatives-to-burdensome-bereaved-minors-trusts/#:~:text=While Alfie is under 18,a tax return each year

I do wonder that if will testators had the slightest inkling of the trouble these contingent gifts to minors can cause, they would think again before embedding them in their wills. Depending on the amounts involved one should either opt for bare trusts terminating at age 18, or formal 18 to 25 type trusts with all the appropriate trustee 'belt and braces' powers.

4 -

Would a deed of variation work? Only those who potentially lose out would have to agree to it.I'm a Forum Ambassador on the housing, mortgages & student money saving boards. I volunteer to help get your forum questions answered and keep the forum running smoothly. Forum Ambassadors are not moderators and don't read every post. If you spot an illegal or inappropriate post then please report it to forumteam@moneysavingexpert.com (it's not part of my role to deal with this). Any views are mine and not the official line of MoneySavingExpert.com.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.7K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.6K Spending & Discounts

- 245.8K Work, Benefits & Business

- 601.8K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 15.9K Discuss & Feedback

- 37.7K Read-Only Boards