We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

New 2025/26 ISA

Comments

-

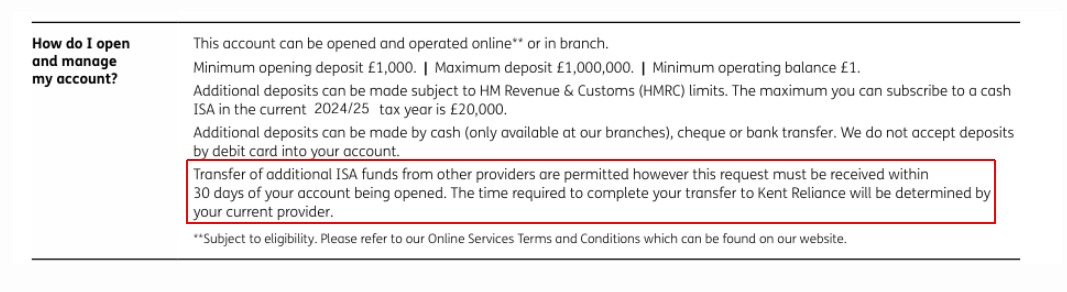

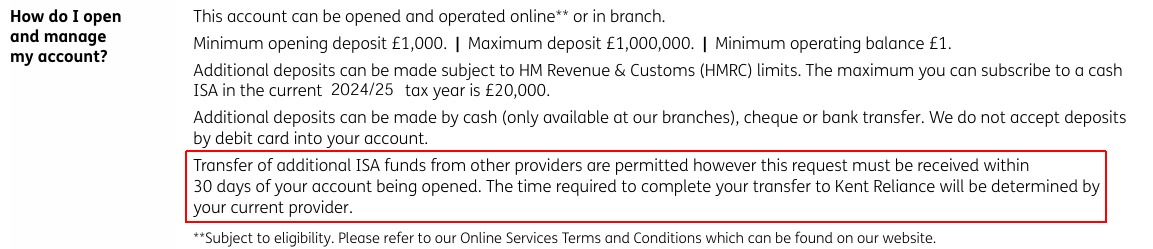

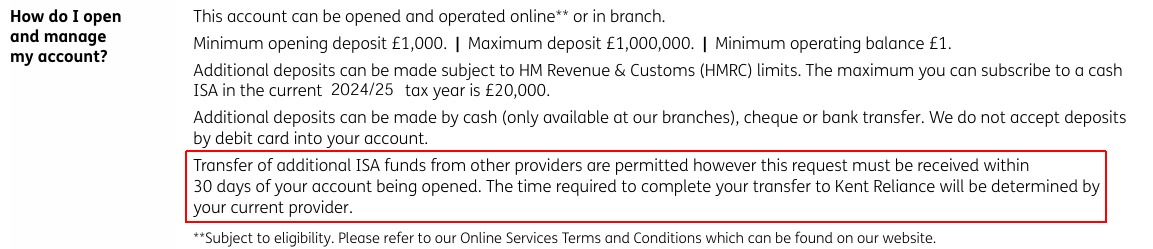

So, will this blur the situation even more ..... or not, in that it appears that KR have chosen to include the bit highlighted in the red box in the current T&C's for the 1 year fixed ISA product? What we don't know is whether they will enforce this condition if you open the product a week or so before 6th of April with the intention of only funding it on or after the 6th April.eskbanker said:

Re this last quote, the pre-2024/25 regulations and guidance required reactivation, but this is no longer mandatory and so it's the ISA provider's choice whether to oblige savers to jump through that particular hoop:Bobblehat said: https://www.gov.uk/government/publications/tax-free-savings-newsletter-11/tax-free-savings-newsletter-11

https://www.gov.uk/government/publications/tax-free-savings-newsletter-11/tax-free-savings-newsletter-111.3 Remove the requirement for an investor to make a new ISA application where an existing ISA account has received no subscription in the previous year

This change is not mandatory and, as an ISA manager, you can choose whether or not you want to request a new ISA application each subscription year or following a gap in subscriptions. Similarly, you can choose whether to require an ISA application to be completed with new terms before adopting this change, or to apply this change to your existing accounts.

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

Yorkie1 said:Re. Kent Reliance, that's what it says on the general conditions, but the flyer for the 2 year fixed rate ISA when I opened it earlier this year said 30 days (see below).

I transferred 2 other ISAs into the empty ISA online, but also want to transfer in my NS&I ISA, which needs to be done by posting the form off to them.

I did that quite late - after the 14 days window but before the 30 days. Kent R have notified me that they've contacted NS&I; I assume that if I was way outside the funding window, they wouldn't be doing that and that they'd have told me I was too late.

My understanding is that the 30 day window specifically applies to "Transferring in" from another provider, and not new money. Jimexbox didn't say if he would be funding the initial deposit by transfer or new money. All I'm trying to say, albeit in an unavoidable long graphical manner, is that to avoid disappointment, it might be better to be very specific in asking KR what is allowed and what is not! That's what I'm going to do before opening another KR product, as KR are a possible contender for my next year's new money in either a Fix or an EA ISACompiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum2 -

I was after opening a KR fixed rate ISA early to basically hedge against any new tax year rate drops. When banks could drop rates to suit their funding needs for the year ahead.

The KR fix is also attractive as I can drop in maturing bonds as and when, up to your ISA allowance.0 -

The "dropping in" of maturing bonds are subject to the 30 day rule (from opening) as mentioned earlier .... so not quite "as and when"!jimexbox said:I was after opening a KR fixed rate ISA early to basically hedge against any new tax year rate drops. When banks could drop rates to suit their funding needs for the year ahead.

The KR fix is also attractive as I can drop in maturing bonds as and when, up to your ISA allowance.

Edit: In addition .... from the General Savings T&C's .....

Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

As mentioned in one of the other threads, my plan is to open a Chip easy access ISA towards the end of March (to get the bonus), but not fund it until the 7th April (within 14 days of opening the account)0

-

I'm not talking about transferring in an Isa in on opening. KR allow you to top up a fixed Isa within your yearly allowance at any time. So maturing fixed bonds, not an ISA, can be dropped in at any time.Bobblehat said:

The "dropping in" of maturing bonds are subject to the 30 day rule (from opening) as mentioned earlier .... so not quite "as and when"!jimexbox said:I was after opening a KR fixed rate ISA early to basically hedge against any new tax year rate drops. When banks could drop rates to suit their funding needs for the year ahead.

The KR fix is also attractive as I can drop in maturing bonds as and when, up to your ISA allowance.

Edit: In addition .... from the General Savings T&C's ..... 0

0 -

No problem then!jimexbox said:

I'm not talking about transferring in an Isa in on opening. KR allow you to top up a fixed Isa within your yearly allowance at any time. So maturing fixed bonds, not an ISA, can be dropped in at any time.Compiler of the RS League Table.

Being nosey... How many Regular Saver accounts do you have? — MoneySavingExpert Forum0 -

KR unilaterally closed unfunded FT ISAs at FY end, last year. You had to re-apply in the current year.1

-

Assume you mean cash ISA but S&S ISA can be opened at anytime and fund in future yearscheckly said:What is the earliest possible date to open an ISA but hold off actually funding it until 2025/26? Also got two ISAs to transfer into it from 23/24 & 24/25.Any suggestions greatly appreciated.Remember the saying: if it looks too good to be true it almost certainly is.0 -

I have just had to close an application with Cynergy (great rate) because i applied to early. Online it said 35 to fund (mind you that was AL) but on the phone they said 14 days.

Here's hoping the rate will still be the same when I reapply 28th March (added a day as 6th April is a Sunday)0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.4K Work, Benefits & Business

- 602.7K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards