We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

About to send C1 form

Do I need the addresses for the refunds and over 50’s policies?

Thank you in advance.

Comments

-

Not qualified to comment beyond the fact that it is the Clydesdale Bank and not the Clydsdale Bank. Also Item 11 - "Value estimated by..." appears to be missing something.0

-

So there is, thanks for that and the bank name spelling, I will change it now.0

-

Some comments

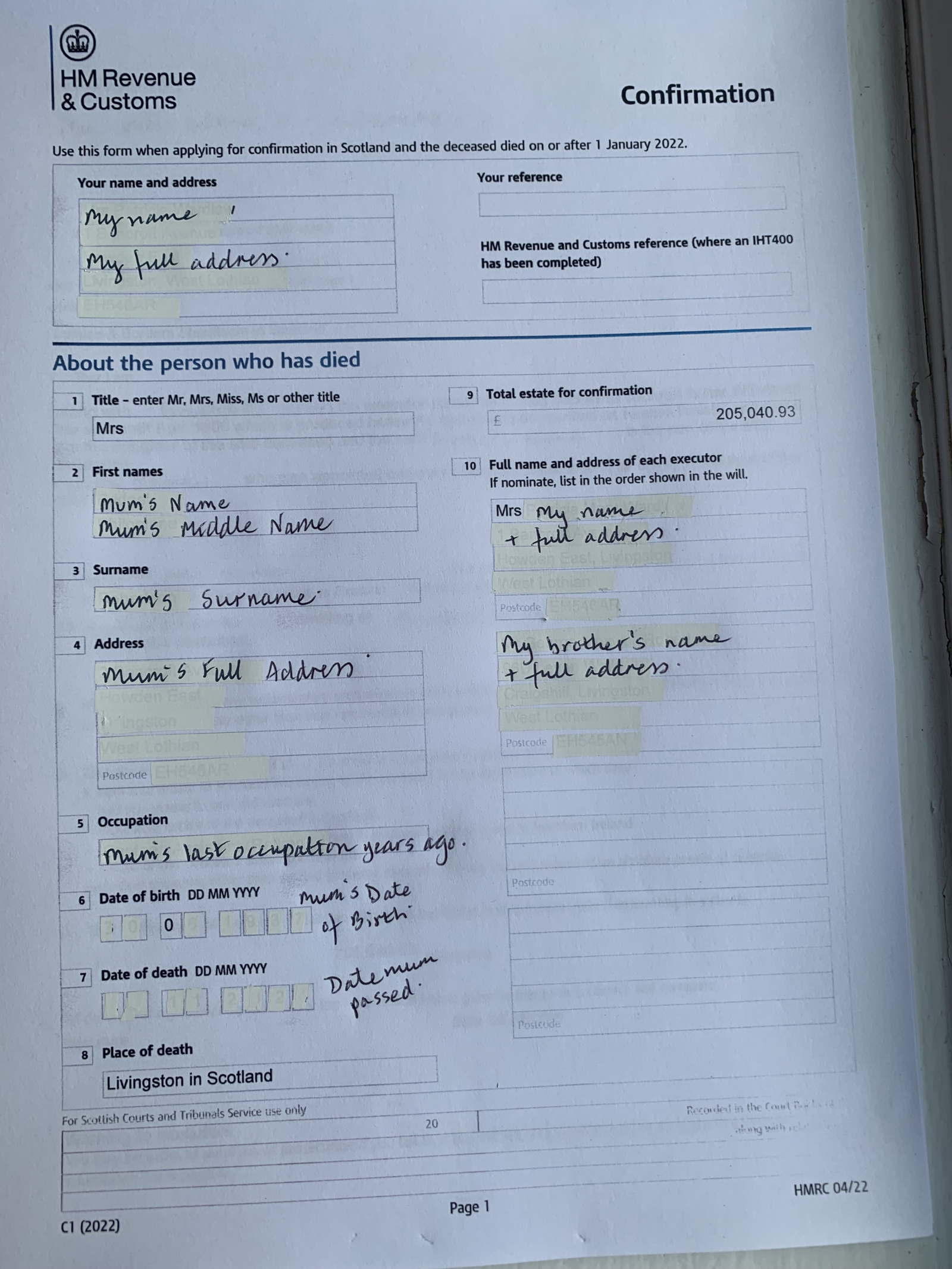

Page 1.

In box 5 add (retired) if accurate.

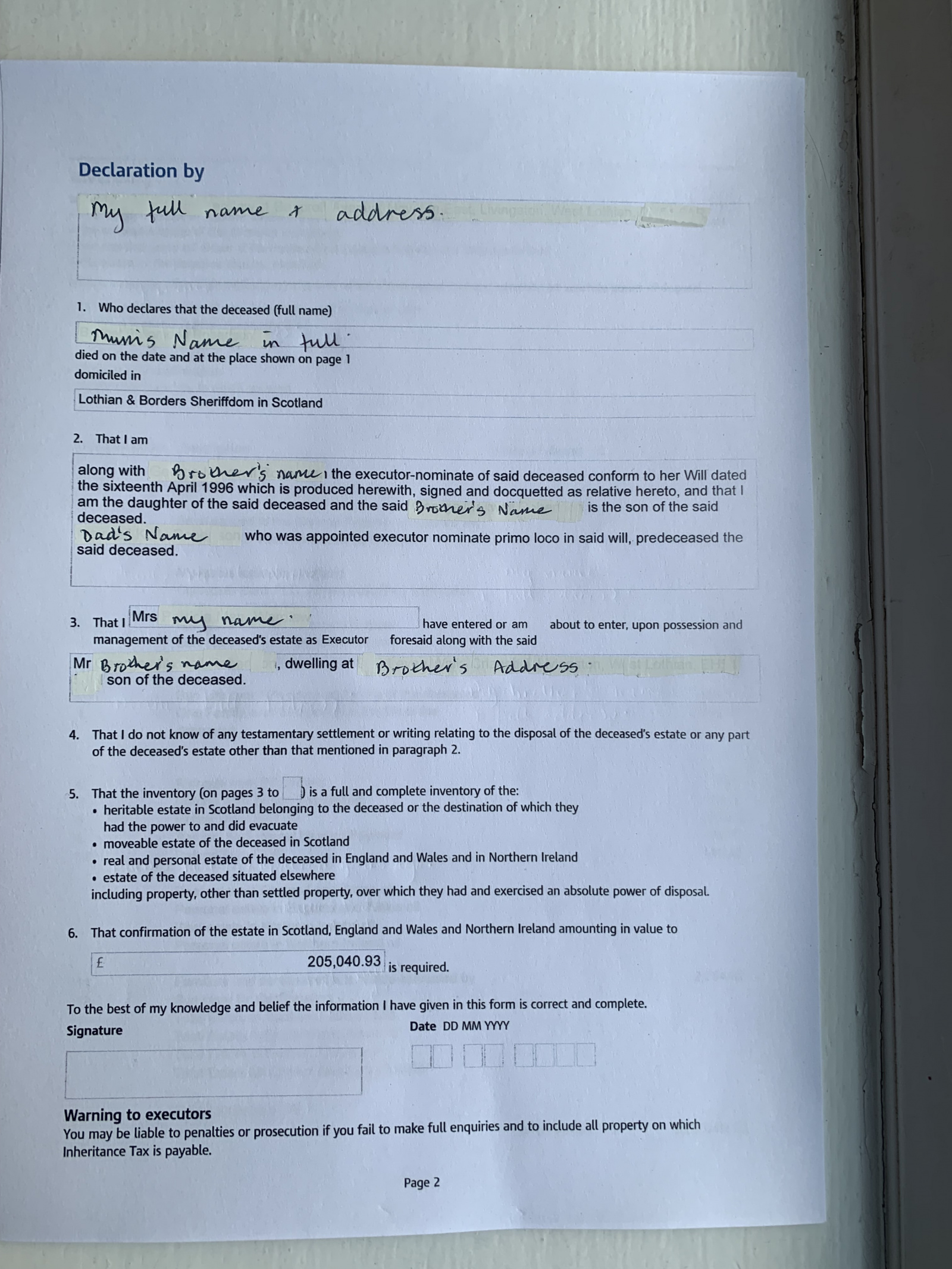

Page 2.

In the second box of para 1 rearrange to read. “The Sheriffdom of Lothian and Borders in Scotland”

In para 2, after the first occurence of brother’s name add his address.

In the second box of para 3, remove brothers address and relationship

Page 3

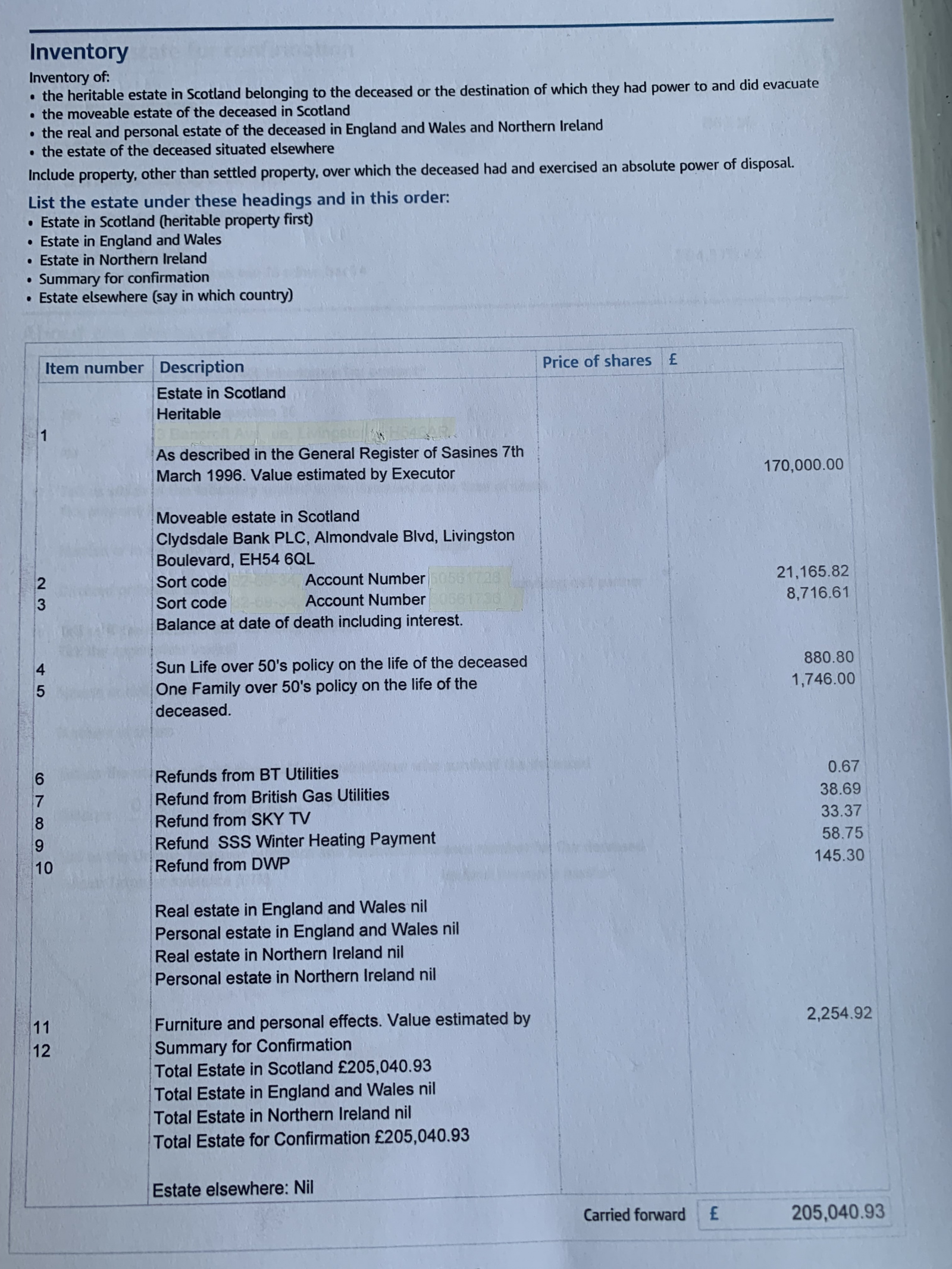

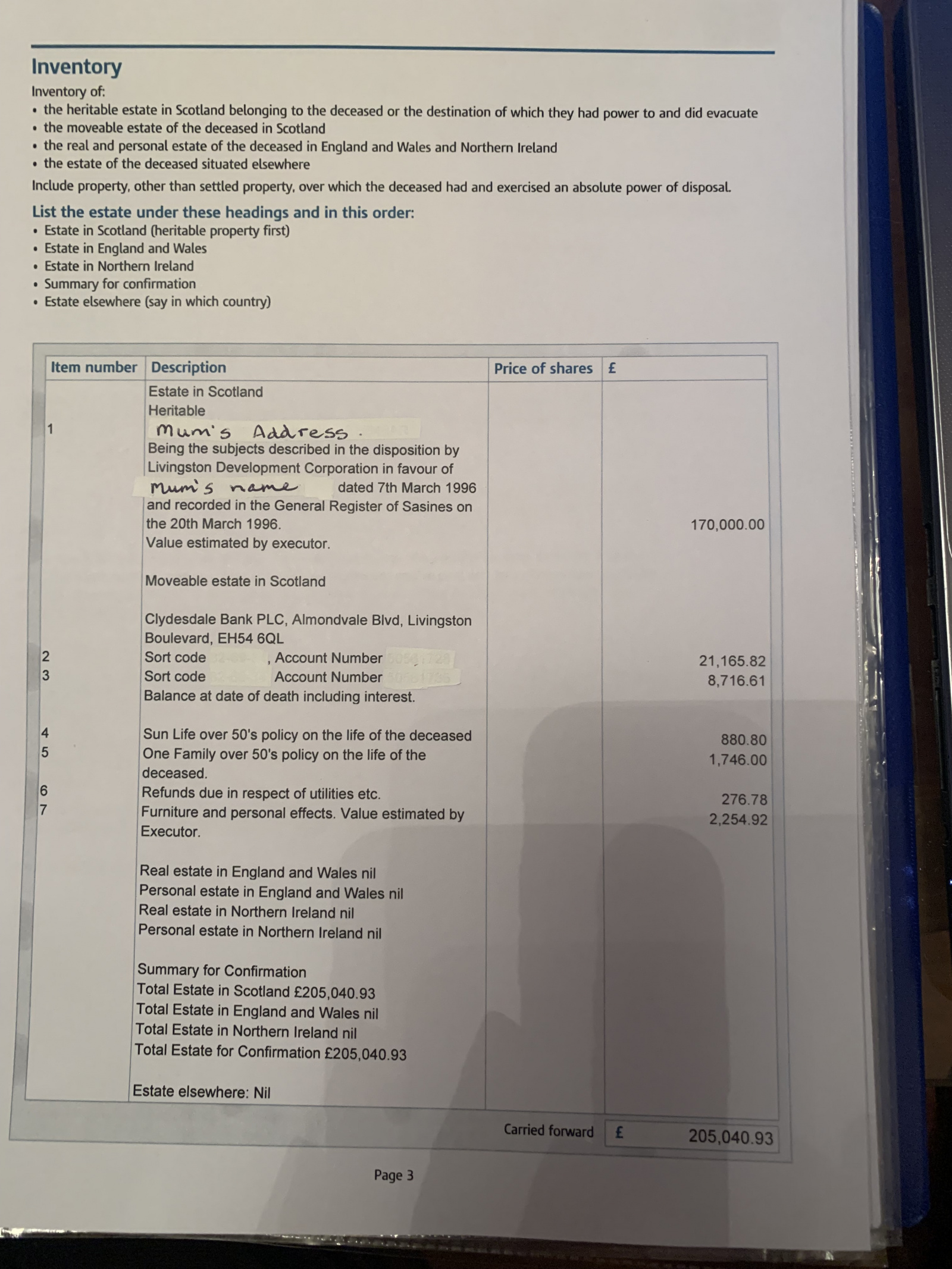

The description of a GRS house might look something like this.

22 Princess View, Doune

Being the subjects described in the disposition by Archibald Ross in favour of James Mcallister Smith dated the fourth of June 1965 and recorded in the General Register of Sasines (Perth) on the seventh of August 1965

Value estimated by executor

Typo in bank name (as pointed out by Kipperman)

Life policies, only if still to pay out and confirmation needs to be exhibited, then include address and policy number.

For items 6 to 10 these could be combined into a single entry entitled ‘refunds due in respect of utilities etc.)

Item 11. Word missing (as pointed out by Kipperman)

Item 11. This entry should be relocated so that it is under the heading ‘moveable estate in Scotland’.

Summary for Confirmation does not need an item number

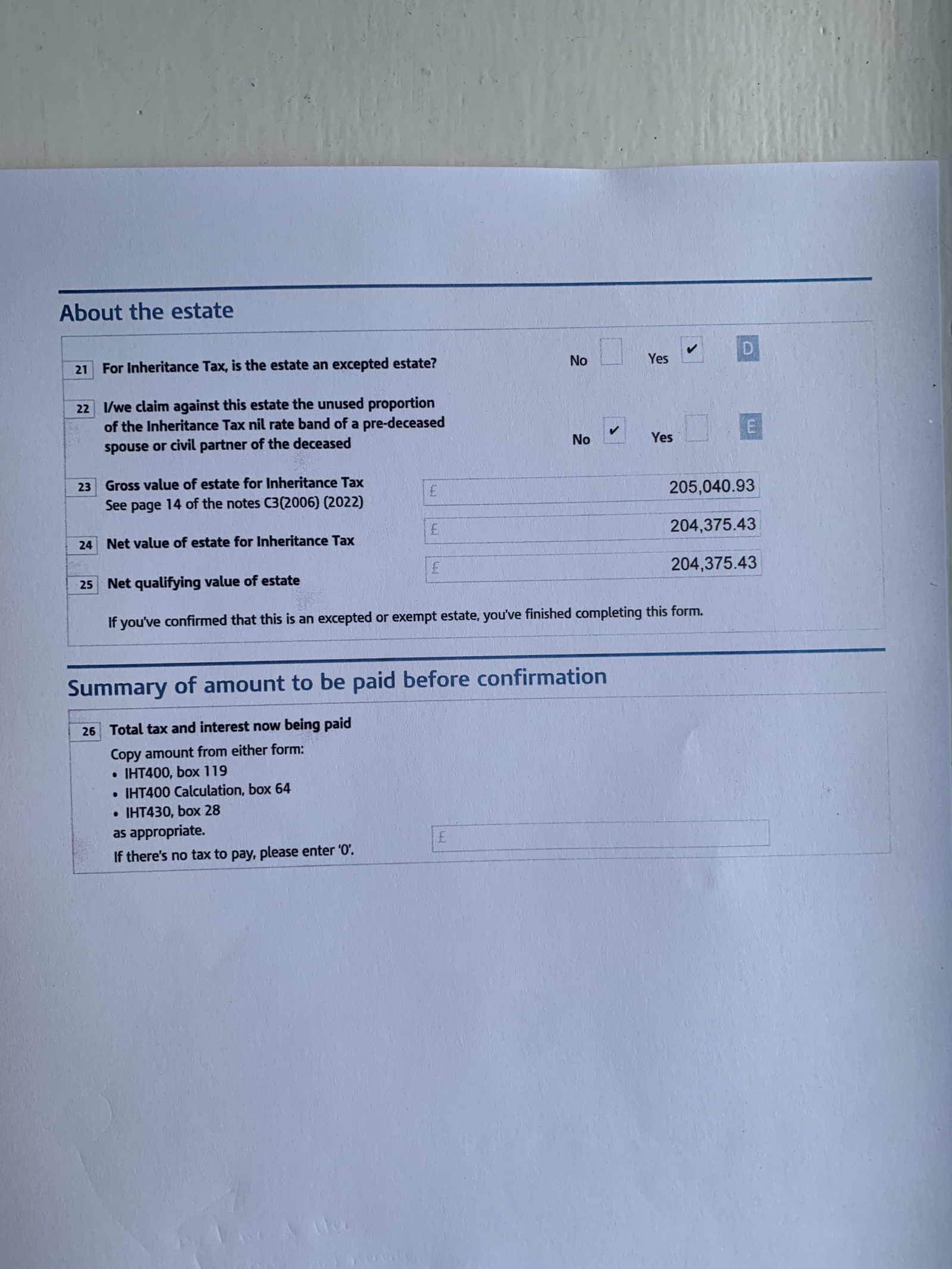

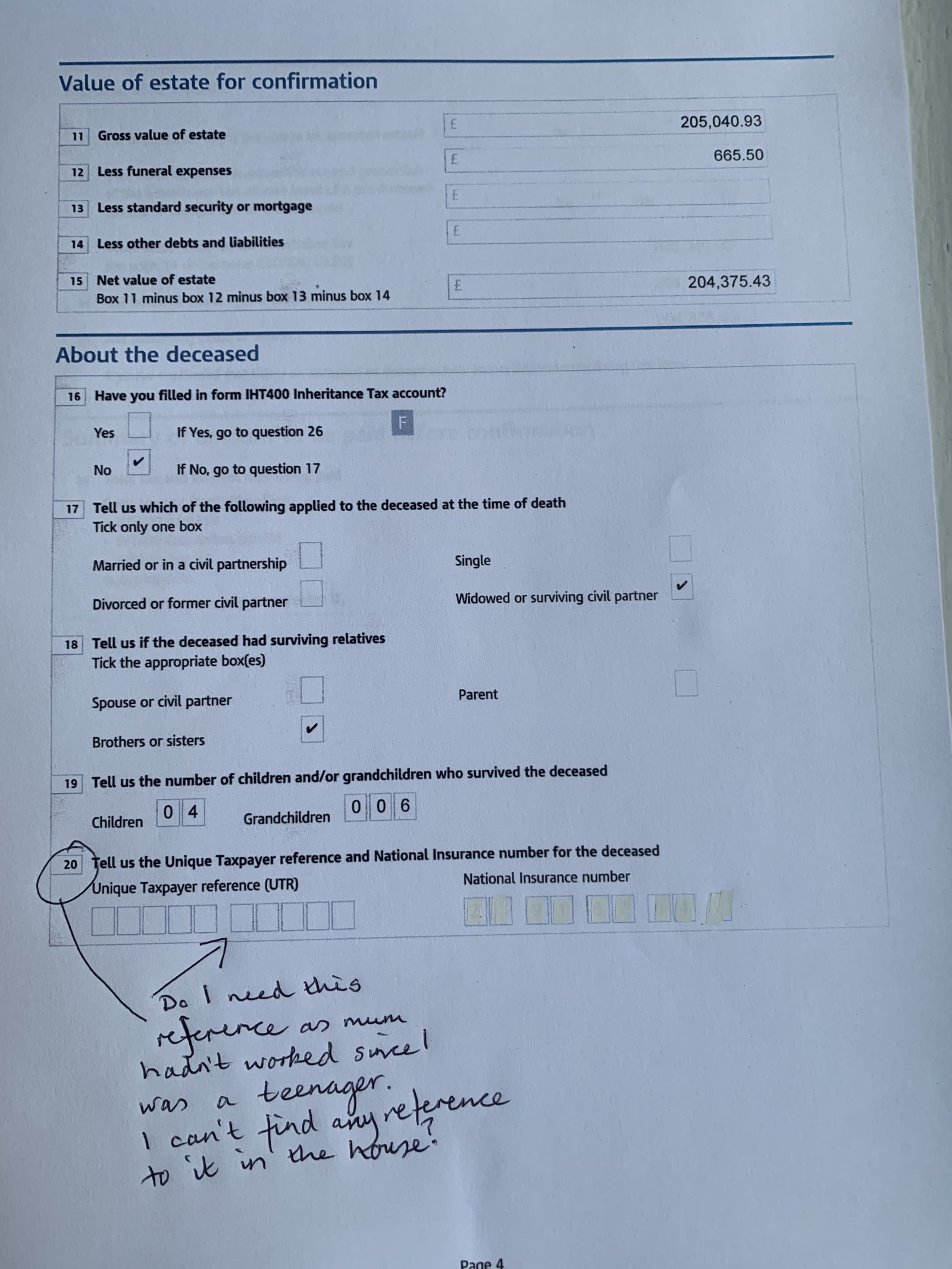

Page 4

In boxes 13 and 14, enter a zero, if accurate.

Item 20, for UTR mark ‘not known

General

Use full names. Assumes that there are no name differences or address differences from that shown in the will.

1 -

Hi buddy9, thank you so much for all your input. I have made the changes you have suggested.Regarding occupation I put Canteen Assistant (retired) because that is what is written on the death certificate. Should I just remove the word retired? Mum hadn’t worked since I was a teenager.

Mum and dad bought the house from the Livingston Development Corporation so I have tried to replicate your GRS suggestion as below. I wasn’t sure if I was to put that or the name of the Solicitors. Does that look correct? 0

0 -

The use of retired isn't a big issue.

If mum and dad purchased the house (with a survivorship provision) then presumably the 1996 disposition included both mum and dad's names. If so you should replicate the title entry with both names.

Do not underestimate the house value. The estate is well away from IHT territory but coud incur CGT if it sells above the valuation.0 -

There is definitely survivorship in the deeds and yes it says mum and dad’s names on the deeds.So will I put ‘in favour of’ and then mum and dad’s name?

Thanks so much for your help with this it’s so valuable.Lastly, looking at forum posts I just want to double check that it is ok to write on the first page not the cover page of the Original Will?

Do I write:

My address and date then ‘This is the Will referred to in my declaration of the date written above relative to the Inventory of the estate of the late (Mums name).Is that correct? I don’t want to write on it and get it wrong.Thanks so much for all this.0 -

See above.Newby2dis said:There is definitely survivorship in the deeds and yes it says mum and dad’s names on the deeds.So will I put ‘in favour of’ and then mum and dad’s name?

If the disposition has both their names then this is what you should enter.

Lastly, looking at forum posts I just want to double check that it is ok to write on the first page not the cover page of the Original Will? Yes

Do I write:

My address and date then ‘This is the Will referred to in my declaration of the date written above relative to the Inventory of the estate of the late (Mums name).

Only needs town name. Needs the same signing date as the C1docquet Will example

https://forums.moneysavingexpert.com/discussion/4965475/grant-of-confirmation/p59

0 -

Thank you so so much Buddy9.I will let you know how I get on and I will over estimate the value of Mum’s house just to be safe. My brother and sister in law said they are going to live in mums house and sell their house but they may change their minds.

Is there a time limit to CGT just so I can let them know?0 -

Thanks Savvy_Sue, I never realised that if someone decides to live in the house they inherited that if they sold years later and it sold for more than the estimated value on the inventory they would still be hit for CGT.I’ve learned so much in this forum.

Thanks very much.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards