We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Compound Interest on Reg Saver

Comments

-

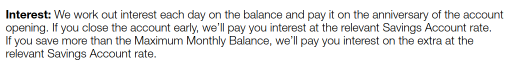

Interest is fixed, is calculated daily and credited at the end of the 12 month fixed term.[Deleted User] said:

FV is a formula used in a spreadsheet to calculate the future value based on an amount paid over a period of time.surreysaver said:What's a FV calc?

When my First Direct Regular Saver matured in December I got £135.95 in interest.

Where's the compounding coming from if it only pays interest once?

Looks like there is no compounding, interest is based on the balance at the end of each month

As a matter of interest, do you have any idea why you did not receive the full 136.50. I'm assuming of course, that you paid 300 in every month.

https://www.firstdirect.com/savings-and-investments/savings/regular-saver-account/Life in the slow lane1 -

£136.50 must be the maximum. I've received £136.18 on my Regular Saver which matured last week.ZeroSum said:As a matter of interest, do you have any idea why you did not receive the full 136.50. I'm assuming of course, that you paid 300 in every month.

It'll have been due to account not getting funded on exact same day, mainly due to weekends since FD are awkward & don't let you manually top up like other banks1 -

Yes, interest is calculated on the daily balance and credited annually at maturity. Therefore there is no compounding. Compounding is earning interest on interest (which isn't included in the balance until after the interest ceases). The total will generally be less than £136.50, but not a lot less.[Deleted User] said:

Interest is indeed credited annually, but must be calculated on the daily balance. And if there is no compounding, it would make the total interest a lot less than £136.50masonic said:Interest is credited annually (at maturity), not monthly, so there is no compound interest.

3 -

I disagree. 7% includes compounding by definition. If, like many other regular savers, this account could be closed without loss of interest, the resulting interest would be calculated by compounding.masonic said:

Yes, interest is calculated on the daily balance and credited annually at maturity. Therefore there is no compounding. Compounding is earning interest on interest (which isn't included in the balance until after the interest ceases).[Deleted User] said:

Interest is indeed credited annually, but must be calculated on the daily balance. And if there is no compounding, it would make the total interest a lot less than £136.50masonic said:Interest is credited annually (at maturity), not monthly, so there is no compound interest.

"7.00% AER/Gross p.a. interest rate. We’ll calculate your interest daily, based on your account balance and the interest earned on previous days." - https://www.firstdirect.com/savings-and-investments/savings/regular-saver-account/0 -

grumpy_codger said:

I disagree. 7% includes compounding by definition. If, like many other regular savers, this account could be closed without loss of interest, the resulting interest would be calculated by compounding.masonic said:

Yes, interest is calculated on the daily balance and credited annually at maturity. Therefore there is no compounding. Compounding is earning interest on interest (which isn't included in the balance until after the interest ceases).[Deleted User] said:

Interest is indeed credited annually, but must be calculated on the daily balance. And if there is no compounding, it would make the total interest a lot less than £136.50masonic said:Interest is credited annually (at maturity), not monthly, so there is no compound interest.

"7.00% AER/Gross p.a. interest rate. We’ll calculate your interest daily, based on your account balance and the interest earned on previous days." - https://www.firstdirect.com/savings-and-investments/savings/regular-saver-account/That statement cannot be correct as the AER and gross rate are the same. So First Direct is wrong. I have calculated the interest for my previous 7% regular saver and assuming no compounding it was correct to the penny. If I had earned interest on £300.06 on day 2 and £300.12 on day 3 etc, I would have been due more interest than I had received.By definition, compounding only takes place over a year if the AER rate is greater than the gross p.a. interest rate.If the account is closed early without loss of interest (which is contrary to the T&Cs which state there is a penalty), then this does not result in compound interest, all you get is the simple interest earned on the balance up to the date of closure.(P.S. I'm very pleased we have found something different do debate about other than the usual "you only get half the headline rate" )7

)7 -

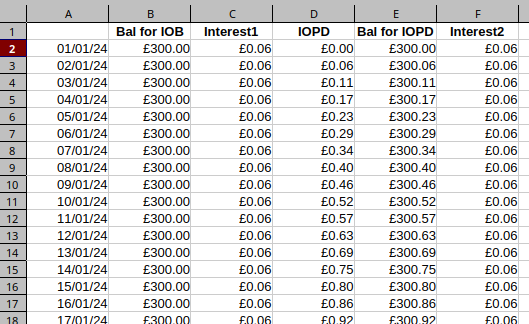

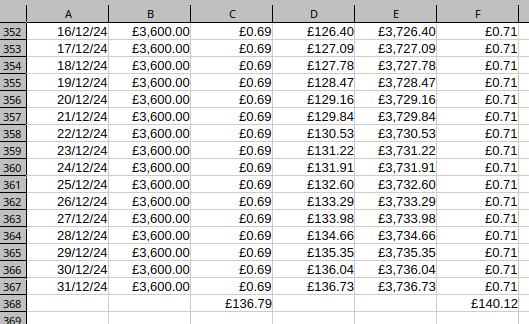

Here is the interest calculation comparing "interest on balance" (IOB) and "interest on balance and interest on previous days" (IOPD). For simplicity I have not moved the £300 credit where the 1st of the month falls on a weekend. You can see it makes little difference initially, but by the final month, accrued interest would result in about 2p per day extra interest compared to where interest is only earned on the balance. So there's about £3.33 extra interest to be had if someone were to hold FD to their website statement (conveniently not repeated in their T&Cs).

(page 37)

(page 37)

2 -

[Deleted User] said:

Interest is indeed credited annually, but must be calculated on the daily balance. And if there is no compounding, it would make the total interest a lot less than £136.50 .masonic said:Interest is credited annually (at maturity), not monthly, so there is no compound interest.

You are correct, interest does get calculated on a daily badis, on the balance at the end of that day. All the daily amounts are then added up and credited to the account at maturity. This is not known as compounding, though

Compounding only happens once the interest has been credited. Since it only gets credited at the end of 12 months, i.e. at maturity, there is no compounding

4 -

If you are petty like me, When they pay less I ask why ?.They then give me the missing amount.1

-

Because of non-working days such as weekends and bank holidays when payments into the account will be later than the monthly-versary[Deleted User] said:

As a matter of interest, do you have any idea why you did not receive the full 136.50. I'm assuming of course, that you paid 300 in every month.surreysaver said:What's a FV calc?

When my First Direct Regular Saver matured in December I got £135.95 in interest.

Where's the compounding coming from if it only pays interest once?I consider myself to be a male feminist. Is that allowed?4 -

Less than what specifically?Bigwheels1111 said:If you are petty like me, When they pay less I ask why ?.They then give me the missing amount.

If you can demonstrate that, based on your individual contribution dates, they paid interest at less than the stated 7% then that's certainly disputable, but if your absolute return is lower than their illustrative figures, due to not having made deposits in exactly the same way, then that's not actually in breach of anything, even if they might choose to settle a vexatious complaint with a tiny goodwill amount to get rid of it.5

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards