We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Withdrawal rate

Comments

-

How much of a scientist do I need to become to make sense of that link?OldScientist said:

For an alternative perspective, I note that a collapsing ladder of index-linked gilts to cover the period of 7 years before DB and SP kick-in would currently have a payout rate of 14% (see https://lategenxer.streamlit.app/Gilt_Ladder ). In other words, to provide your estimated 10% withdrawal rate would cost about 70% of your pot (leaving about 30% of your pot to grow as you have already suggested) and would, in the absence of UK debt default, provide inflation protected income throughout those 7 years.Justso65 said:I often see a safe pension withdrawal rate of around 4-5%. This would seem very low to me. Assuming we expect better than 4-5% on pension investments is the suggested withdrawal rate based on maintaining the pension pot?

I have what I consider a healthy pension pot and ISA savings and will be 60 this year. My plan accepts pot erosion because at 67 I have a modest DB pension along with my state pension, another modest DB spouse pension and a state pension 3 years later. So whilst I don’t want to completely drain my DC pot in the 7 years to 67 I still feel a 10% withdrawal rate would be sustainable. This would give me a greater take home pension than I currently have in salary mainly because my salary is significantly reduced due to my current rate of pension contributions. Assuming the remaining pot has any kind of growth over those 7 years I would have at least 30% of my pot left to use to top up my other guaranteed pension incomes.

At 60 I feel I should benefit from diligently saving for retirement over many years and enjoy it whils I am still fit enough to do so.

Any comments on this strategy are welcome.

JS

None of the % numbers that appear look like 14%: #confused!Plan for tomorrow, enjoy today!0

#confused!Plan for tomorrow, enjoy today!0 -

What would it look like if you were to lose your Wife’s State pension and presumablyhalf her DB ( and vice versa for her)?

People don’t seem to plan for the possibility of losing a partner.

A 10% withdrawal rate in the first 7 years would leave my Wife very short if I were to die after our life insurance ends at 70.1 -

Perhaps I was doing it wrong but I played around with that yesterday and it didn’t seem to save me any money over having the required amount in cash and MMFs.OldScientist saidFor an alternative perspective, I note that a collapsing ladder of index-linked gilts to cover the period of 7 years before DB and SP kick-in would currently have a payout rate of 14% (see https://lategenxer.streamlit.app/Gilt_Ladder ). In other words, to provide your estimated 10% withdrawal rate would cost about 70% of your pot (leaving about 30% of your pot to grow as you have already suggested) and would, in the absence of UK debt default, provide inflation protected income throughout those 7 years.

I need £46000 ( £10k x 4 and £6k ) to cover 4 years 9 months from April 2028 - December 2032 ( my SP age) - the cost to me for a gilt ladder said £45600 so what am I missing?I used £10k a year x 5 in the calculation btw.0 -

Left hand panel, scroll down to where it says 'withdrawal rate' (for an inflation protected income, switch on 'index linked')cfw1994 said:

How much of a scientist do I need to become to make sense of that link?OldScientist said:

For an alternative perspective, I note that a collapsing ladder of index-linked gilts to cover the period of 7 years before DB and SP kick-in would currently have a payout rate of 14% (see https://lategenxer.streamlit.app/Gilt_Ladder ). In other words, to provide your estimated 10% withdrawal rate would cost about 70% of your pot (leaving about 30% of your pot to grow as you have already suggested) and would, in the absence of UK debt default, provide inflation protected income throughout those 7 years.Justso65 said:I often see a safe pension withdrawal rate of around 4-5%. This would seem very low to me. Assuming we expect better than 4-5% on pension investments is the suggested withdrawal rate based on maintaining the pension pot?

I have what I consider a healthy pension pot and ISA savings and will be 60 this year. My plan accepts pot erosion because at 67 I have a modest DB pension along with my state pension, another modest DB spouse pension and a state pension 3 years later. So whilst I don’t want to completely drain my DC pot in the 7 years to 67 I still feel a 10% withdrawal rate would be sustainable. This would give me a greater take home pension than I currently have in salary mainly because my salary is significantly reduced due to my current rate of pension contributions. Assuming the remaining pot has any kind of growth over those 7 years I would have at least 30% of my pot left to use to top up my other guaranteed pension incomes.

At 60 I feel I should benefit from diligently saving for retirement over many years and enjoy it whils I am still fit enough to do so.

Any comments on this strategy are welcome.

JS

None of the % numbers that appear look like 14%: #confused!

#confused!

0 -

I am assuming that there is nothing left at the end of a collapsing gilt ladder?

When I modelled a cash/mmf pot of £46k with interest of 3% and withdrawals of £830 monthly, there is £2000 left at the end.

When I used 14% interest as per your post, then it said there would be £22k left so I am quite confuzzled!On that gilt calculator, the balance says zero.If I buy £46000 in gilts today, the last one maturing in 2032 and take £830 a month flat income for 57 months from April 2028, is there anything left or not? Are the coupons before 2028 not included in the future income so they are extra ?0 -

The reason for using a collapsing gilt ladder is to provide certainty in nominal or inflation linked income, but for short-term nominal income (up to about 5 years) it is just as effective (and probably easier!) to use a combination of fixed-rate savings accounts, savings accounts, and MMFs. I note that in the example you've given, the ladder has provided an additional 3 months of income, so would actually cost about £2k less (say £44k).SVaz said:

Perhaps I was doing it wrong but I played around with that yesterday and it didn’t seem to save me any money over having the required amount in cash and MMFs.OldScientist saidFor an alternative perspective, I note that a collapsing ladder of index-linked gilts to cover the period of 7 years before DB and SP kick-in would currently have a payout rate of 14% (see https://lategenxer.streamlit.app/Gilt_Ladder ). In other words, to provide your estimated 10% withdrawal rate would cost about 70% of your pot (leaving about 30% of your pot to grow as you have already suggested) and would, in the absence of UK debt default, provide inflation protected income throughout those 7 years.

I need £46000 ( £10k x 4 and £6k ) to cover 4 years 9 months from April 2028 - December 2032 ( my SP age) - the cost to me for a gilt ladder said £45600 so what am I missing?I used £10k a year x 5 in the calculation btw.

For fixed-term inflation protected income (which nominal gilts, savings accounts and MMFs do not provide), a collapsing inflation linked gilt ladder provides a solution.

1 -

I have an index linked military pension starting this year ( which is going straight into my Sipp for 3 years) so inflation proofing that short term income isn’t crucial, I could even do a bit of work in extreme circumstances - I’m self employed and would need to renew my qualification in late 2027 to do so, it’s around £1k and a very hard exam so I’d rather not.0

-

Some good posts here t a very common question.

Let me illustrate my thinking. I want a retirement income in the mid £50k area. I am retiring next year aged nearly 58 (so is my wife who is 57) and I will get £30K pa in DB pensions from the get go. I have a £600k DC and I am taking a £100k lump sum day 1 and then £25k + inflation per year from it which is 5%, quite high admittedly but fortune favours the brave. My rationale is that the £100k (which will be instant access ISA at a good rate) is my "buffer" from stock market crashes in which case I'd make no drawdowns until it recovered somewhat.

My soon-to-be-wife has a very small pension (£100 per month) and we will both get two full state pensions. So I can draw heavier on the DC until I hit 67.

This must be a common scenario - people who had a DB earlier in career and then a DC from their 40s.0 -

Yes, we will be taking 10% a year of our Sipps using UFPLS from age 63-67 then dropping to 2% for 8-10 years, just taking tax free cash, crystallising £10k a year until it’s fully done.

Whatever’s left will remain untouched in case of care needs etc. unless one of us dies, especially if I go first, my wife would be down £20k a year after State pension age.0 -

OldScientist said:

For an alternative perspective, I note that a collapsing ladder of index-linked gilts to cover the period of 7 years before DB and SP kick-in would currently have a payout rate of 14% (see https://lategenxer.streamlit.app/Gilt_Ladder ). In other words, to provide your estimated 10% withdrawal rate would cost about 70% of your pot (leaving about 30% of your pot to grow as you have already suggested) and would, in the absence of UK debt default, provide inflation protected income throughout those 7 years.Justso65 said:I often see a safe pension withdrawal rate of around 4-5%. This would seem very low to me. Assuming we expect better than 4-5% on pension investments is the suggested withdrawal rate based on maintaining the pension pot?

I have what I consider a healthy pension pot and ISA savings and will be 60 this year. My plan accepts pot erosion because at 67 I have a modest DB pension along with my state pension, another modest DB spouse pension and a state pension 3 years later. So whilst I don’t want to completely drain my DC pot in the 7 years to 67 I still feel a 10% withdrawal rate would be sustainable. This would give me a greater take home pension than I currently have in salary mainly because my salary is significantly reduced due to my current rate of pension contributions. Assuming the remaining pot has any kind of growth over those 7 years I would have at least 30% of my pot left to use to top up my other guaranteed pension incomes.

At 60 I feel I should benefit from diligently saving for retirement over many years and enjoy it whils I am still fit enough to do so.

Any comments on this strategy are welcome.

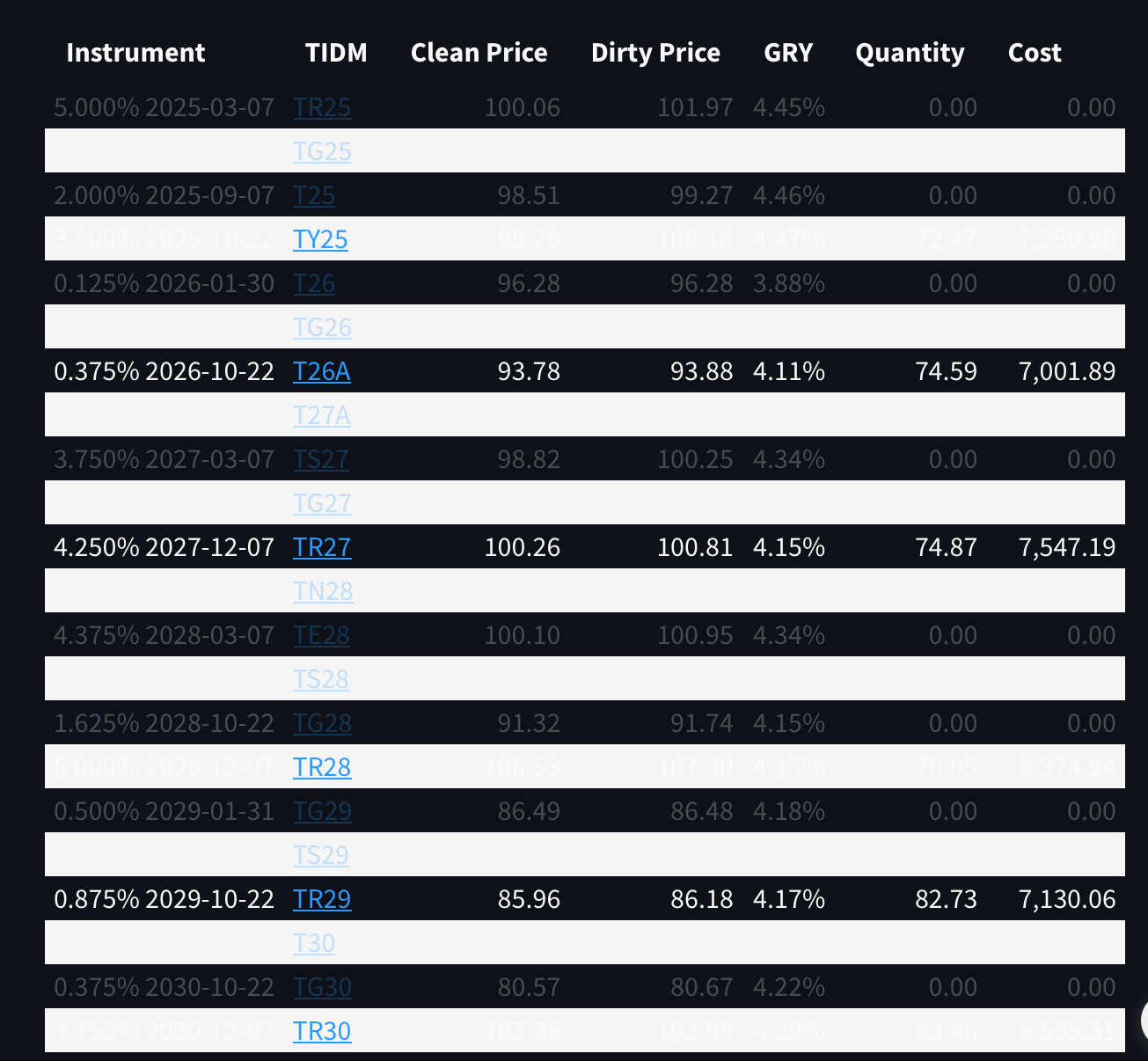

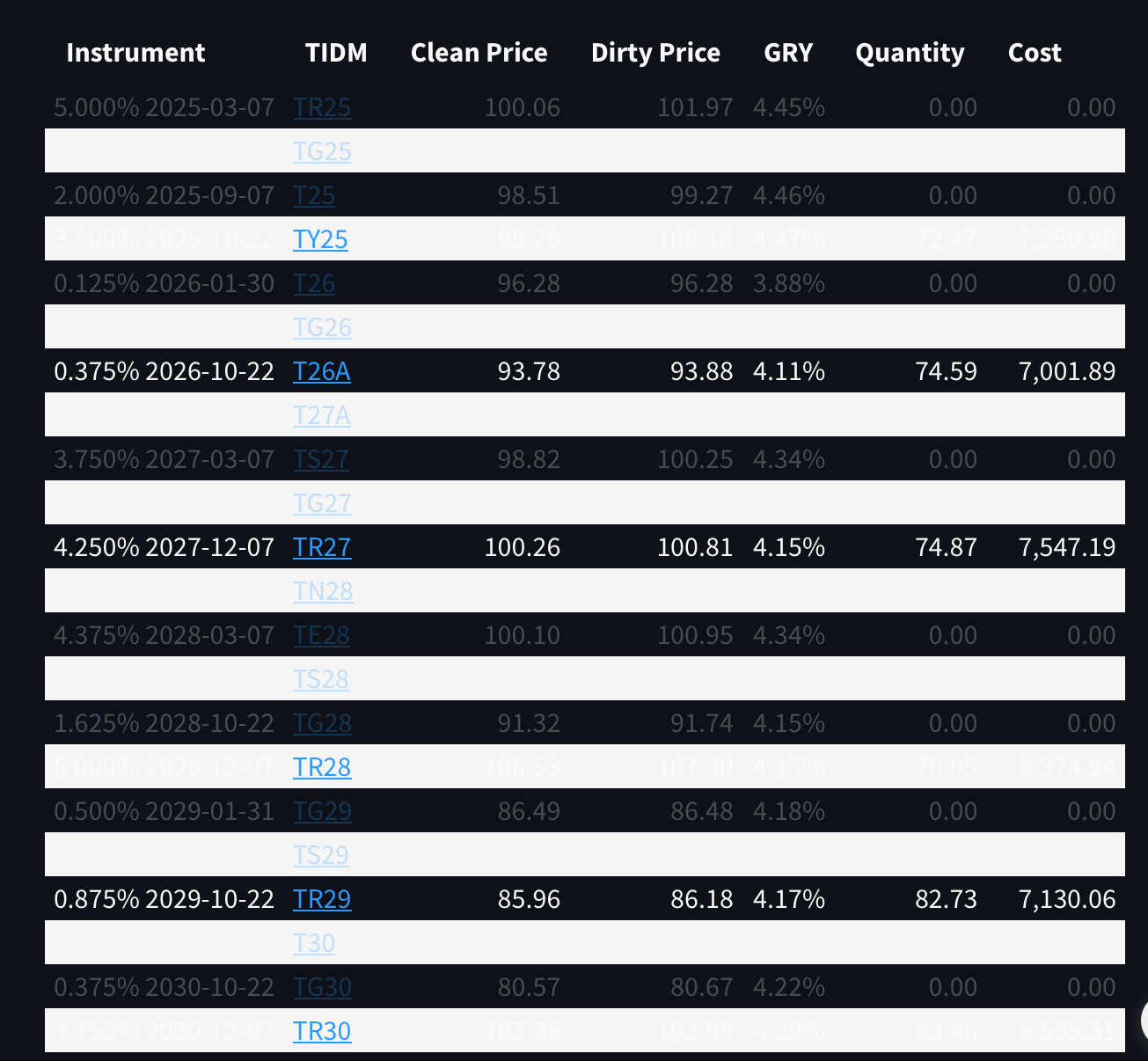

JSI understand the concept of a gilt ladder but I have never looked into the deatils. So I went to that webpage and put in some initial figures.To come out with the pension I want after tax I take £60k per year on a monthly basis and put 7 years as the number of years (until my DB.State pensions) with index linked selected and the tool seems to have thrown out the followingOverview

Cost

£424,499.52Net Real Yield-0.30%Net Nominal Yield2.69%Withdrawal Rate14.13%Essentially it is the cost of 7 x £60k but with index linked built in ?If so that is very appealling to me at it would leave me with £220k of DC pension pot to do something with such as top up my DC/SP at 67.Excuse my ignorance, but are guilt ladders purchaseable products or are the self built and if so are they easy to build?JS.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards