We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

S&S over fixed isa?

Comments

-

Ive Been looking into s&s and wondering what sort of returns (%) have you experienced?There are over 30,000 investment options and a near infinite number of variations.

Each of those 30,000 will have different performance at different times and over different periods. Each blend of those 30,000 will also result in different returns.I am looking to invest for a minimum of 5 years, if not more, i have 20k to place in one this year (drip feed or one off transaction still to be decided? )Phasing results in lower returns in around 3/4 of periods. So, with phasing you are betting on 25% of the time it will be better vs 75% of the time when it is not.Quite clear them s&s is better BUT of course that can and does change but it's the gamble people takeIts not a gamble. Is a decision that will largely be dictated by timescale. The longer you invest, the closer you will get towards the long term average. The shorter you invest, then the odds of losing money become greater.

For example:

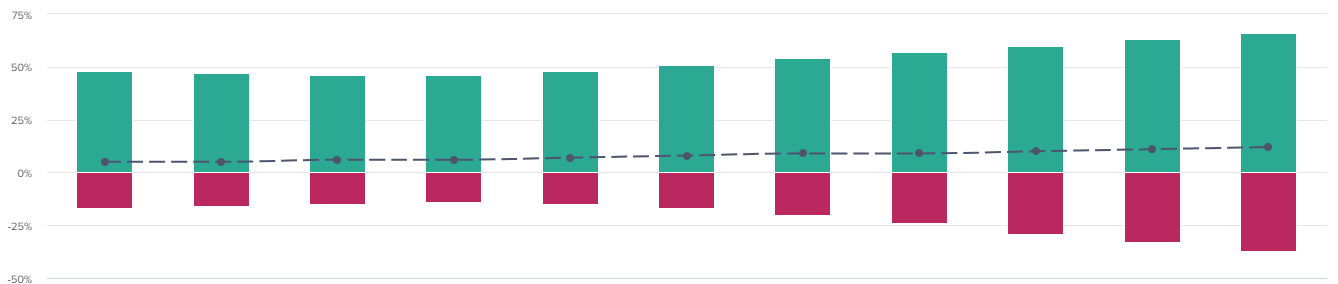

here is the 1 year range of 100% bonds on the left, followed 90% bonds/10% equities and incrementing by10% equities until it gets to 100% equities on the right. Data is from every month since 1915 to 2023 and is based on nominal terms (not inflation adjusted - which I can do but would likely confuse the OP at this stage. Real returns net of inflation changes the outcomes of the best and worst years and the amounts in real terms). Equities are market cap and bonds is a basket across all types (global, global short, UK gilts, UK index linked and sterling corp bond)

The dots are the median. Red is the minimum return year and green is the maximum growth year. If we take 50% equities/50% bonds, June 1975 to May 19761993 was the best growth year at +51%. Dec 1989 to November 1990 was the worst negative year at -17%

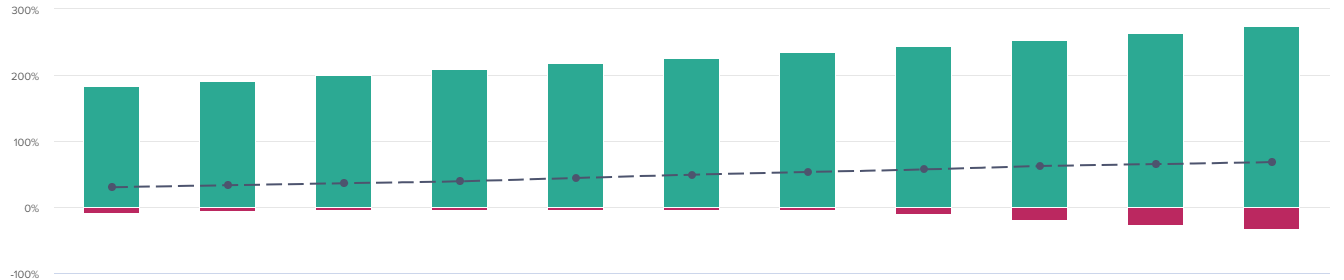

Now lets move it to 5 years:

Notice the median moving upwards but still some loss potential over 5 years but much reduced. 50% equities best period was Dec 1981 to Nov 1986 at +226% but worst was Jan 1917 to Dec 1921 with -5%

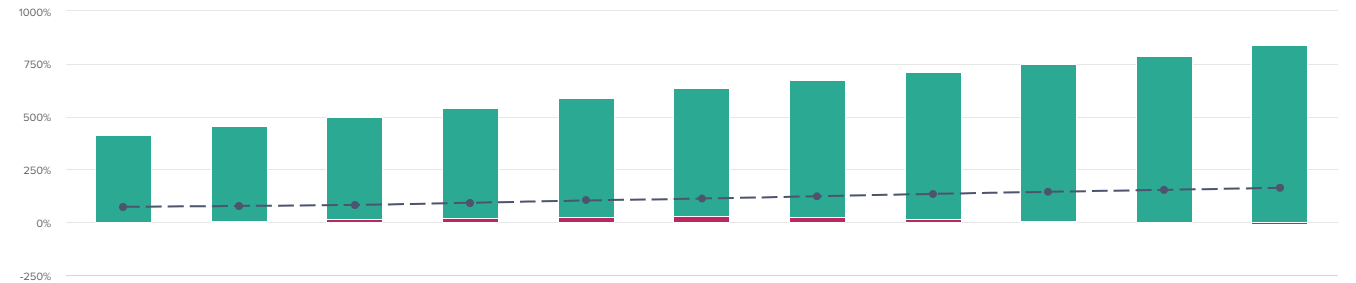

Now 10 years:

Unlike the previous 2 charts all the minimum returns in red are positive. e,g, 50% equities at 31% vs 605% maximum. With the exception of 100% equities which was -9% ( over March 1999 to Feb 2009)

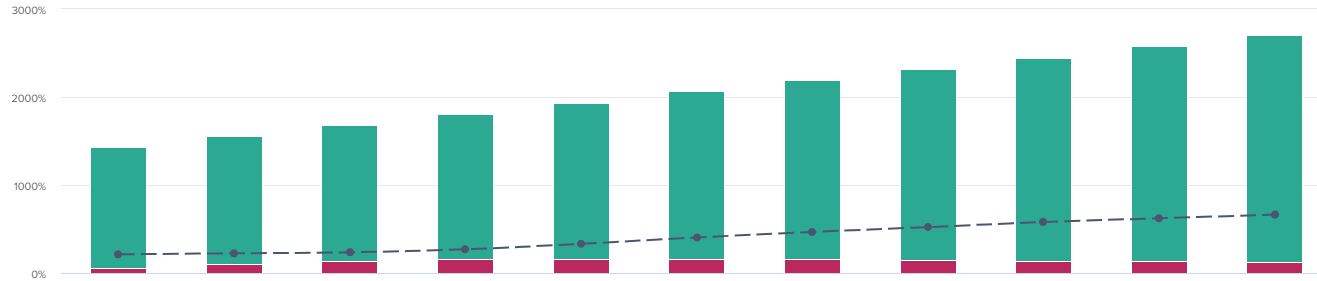

And finally 20 years:

All minimums are positive, with 50% equities being +157% minimum and 1908% being maximum.

When you look at these charts, you soon learn that you don't have a clue what you are going to get as the range from worst period vs best period is so wide and what was best in one period could be the worst in the next. What you need to takeaway from this that it is timescale is what matters most.

So, if you are looking at 5 years and asking what people got as their returns over a 5 year period, on say 50% equities, 50% bonds, then you are looking at a range of -5% to 226% with the median being 49%.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

I have seen better times to invest however I am not so pessimistic as to move heavily into cash. There are likely to be many paths through this madness to beat inflation and cash returns over the medium to long term.Dave05 said:Hi tbh 5 years was just a minimum I'd probally end up leaving it for another 5. Do you think this is a bad time to invest in s&s then?

My thoughts are that 5 years would have been very short especially with US equities at current valuations so don't get your hopes up too high. There are many of us who have done very well with global trackers and avoiding overvalued bonds which sank in recent years but now is probably a good time for investors old and new to be a little bit cautious and consider the benefits of a classic textbook multi asset portfolio to diversify into a broader range of assets.

The robo portfolios are not the cheapest but there is often signup cashback and they are fine for modest amounts of money. If you are feeling a little more adventurous then consider a multi asset fund on a DIY platform.0 -

If you don't use your ISA allowance before April then you'll have lost that allowance and need to use the new one after April. That might or might not be a problem for you but you can pay the money in and not buy immediately if you want to get the allowance used.Dave05 said:

Thanks masonic, my next decision is do i invest full amount into isa this year or drip feed upto the 20kmasonic said:

Yes, that is correct. There is nothing to stop you using such a questionnaire from one provider and using the result to pick an investment elsewhere.Dave05 said:With regards to a multi asset fund is that for example when you see the options of picking 1-5 ie 1 being the lowest and 5 the highest then depending on what number depends where your money is spread as the other option ive seen is you are asked about 6 risk questions and it chooses a risk level for you Remember the saying: if it looks too good to be true it almost certainly is.0

Remember the saying: if it looks too good to be true it almost certainly is.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards