We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

Newcastle/Monument

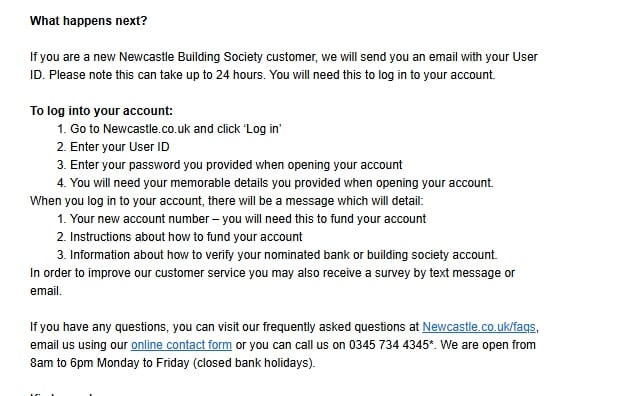

Just applied as a new customer and it took just a couple of minutes to verify me and my nominated account. This is the e mail I just received confirming my application reference number. 2

2 -

Cweb said:Can’t do a QR code…

So how about a direct link instead?

https://newcastle.co.uk/savings/monument-regular-saver

Scroll down to ‘ways to apply’ then this page has a slight difference with an online link as an option.

That web page has changed. It used to specify an appointment in branch or QR code available in branch.1 -

You have to go through it but as I have numerous passwords and memorial information stored I didn't look these up but put in different information to whatever is in my 'home' Newcastle registration. I did keep the same as my account for all other sections, including nominated account though and it was automatically added in the background to my existing account without any other input.ChewyyBacca said:3 -

It's a subtly different page to the branch version of this account.kermchem said:Cweb said:Can’t do a QR code…

So how about a direct link instead?

https://newcastle.co.uk/savings/monument-regular-saver

Scroll down to ‘ways to apply’ then this page has a slight difference with an online link as an option.

That web page has changed. It used to specify an appointment in branch or QR code available in branch.2 -

Two different pages. The difference is whether the ending has the 'branch' suffix.kermchem said:Cweb said:Can’t do a QR code…

So how about a direct link instead?

https://newcastle.co.uk/savings/monument-regular-saver

Scroll down to ‘ways to apply’ then this page has a slight difference with an online link as an option.

That web page has changed. It used to specify an appointment in branch or QR code available in branch.

https://newcastle.co.uk/savings/monument-regular-saver

https://newcastle.co.uk/savings/monument-regular-saver-branch

The former is not linked anywhere to from elsewhere on the site or appears to be indexed in google etc. Presumably is the direct QR landing page. The later is linked to elsewhere on the site.

5 -

I just did this got to and filled out step 7 of 7 with the passwords whenclivep said:Newcastle/MonumentJust applied and have received email with application reference.As existing Newcastle BS member I tried the login route but once in my a/c there was no option to open the Monument regular saver, so I applied using the "Start application" as if I were a new customer.Sorry, our website is currently unavailable.

Update: However, I did get a welcome email

Thank you for applying for a MONUMENT REGULAR SAVER with Newcastle Building Society.1 -

What's the attraction of the Newcastle RS?Is it the 24 month term? Over £600 interest if the max amount deposited each month?

Has anybody any experience of Newcastle BS?0 -

Same happened to me but I do have a confirmation email with an application reference. Whether they’ll accept my application remains to be seenmon3ysav3r said:

I just did this got to and filled out step 7 of 7 with the passwords whenclivep said:Newcastle/MonumentJust applied and have received email with application reference.As existing Newcastle BS member I tried the login route but once in my a/c there was no option to open the Monument regular saver, so I applied using the "Start application" as if I were a new customer.Sorry, our website is currently unavailable.

1 -

Same here.Cweb said:

Mine has now been opened and already added to my existing online account all within 45 minutes.clivep said:Newcastle/MonumentJust applied and have received email with application reference.As existing Newcastle BS member I tried the login route but once in my a/c there was no option to open the Monument regular saver, so I applied using the "Start application" as if I were a new customer.

Although I'm going to send my opening funds via my 6 month saver then transfer over.0 -

Decent account.topyam said:What's the attraction of the Newcastle RS?Is it the 24 month term? Over £600 interest if the max amount deposited each month?

Has anybody any experience of Newcastle BS?

Yes and yes

Yes, got their other regular saver, no problems.1

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards