We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

I hold all the accounts you mention and yes, it seems now is the time to move the remaining Hanley balance elsewhere. I'm struggling to remember why I opened this account in the first place but it must have been competitive at some pointjameseonline said:

You could literally put your money into a Santander Edge Saver, Monmouthshire 6%/7% regular or several other better paying accounts, maybe a Cahoot account?granta said:Hanley Economic BS Online regular saver (NLA)

Just received notification interest will go down to 4.15% from 1st October.

Any reason why this should stay open (it has no end date) especially as you have to hold a minimum balance of £1000?

I might just open an instant access account with them to retain membership but looking for any counter-reasons to closure1 -

FWIW, for continuing membership options for those wishing to close the Hanley Online RS, the Instant Access (ORD01) account, which has a min. opening balance of £100, can be reduced to the min. operating balance of £1, after the 10 day period during which time withdrawals cannot be made.3

-

It was 5.5% at the start, on up to £1000/month, with no end date.granta said:

I hold all the accounts you mention and yes, it seems now is the time to move the remaining Hanley balance elsewhere. I'm struggling to remember why I opened this account in the first place but it must have been competitive at some pointjameseonline said:

You could literally put your money into a Santander Edge Saver, Monmouthshire 6%/7% regular or several other better paying accounts, maybe a Cahoot account?granta said:Hanley Economic BS Online regular saver (NLA)

Just received notification interest will go down to 4.15% from 1st October.

Any reason why this should stay open (it has no end date) especially as you have to hold a minimum balance of £1000?

I might just open an instant access account with them to retain membership but looking for any counter-reasons to closure3 -

I was looking back through my screenshots it seems I selected option 2 (take some money out & move rest into a new savings account) for Principality maturity options.

Not sure if that helps anyone but there you go. 🤣

Not had anything rejected up till now, my next 6 month doesn't mature until 30th November, got a Xmas one maturing on 6th November.0 -

(Though I also understand that some customers will not care about such matters).OrangeBlueGreen said:

On this one though, I don't think Coventry would have a leg to stand on. They can't say Amount A on documentation 1 and then Amount B for transaction, and then be even remotely annoyed if customers point this out when this specific situation is entirely of their own doing. That would be the banking equivalent of victim blaming. (Victim is obviously way too strong for this situation but I can't think an appropriate word). It's the building society's discrepancy, not the customer's. If they don't want the complaints or time spent on this, they should ensure information is always accurate.Hattie627 said:

I mean this in a light-hearted way, but I often don't know if you are being serious or taking the mickey. Either way, it's fine. But with all the talk recently on here about institutions closing accounts and banning customers without explanation, you might try the patience of a bank just once too often by querying a 2p discrepancy in maturity amount. As I say, good on you for being thorough and looking after your interests etc but, jeez, there has to be a limit to a bank's patience.jameseonline said:

Well on principal yes I want them to explain why there's 2p missing, like I said they sent me a letter, the app displays 2p less than the printed letter.schiff said:

For 2p !??!jameseonline said:

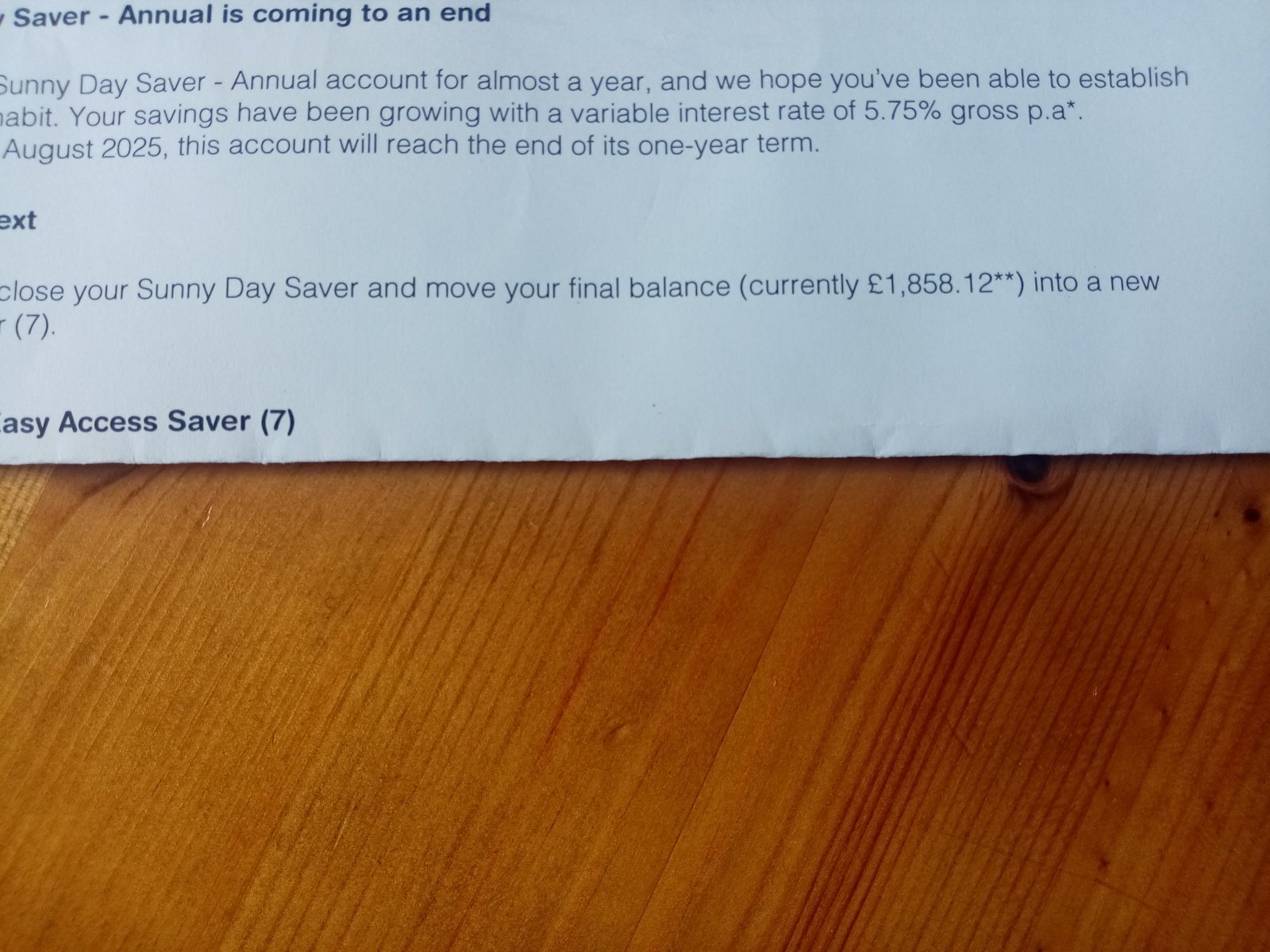

My letter dated 7th August clearly states £1859.29 was my current closing balance at the time, app is still showing £1859.27.saverkev said:

Coventry Sunny Dayjameseonline said:Just checked my CBS app it seems my Sunny Day has been converted to Easy Access 7 but the amount is 2p less than the amount given in letter, hmm, I know the guy on the chat said it gets converted at 12am but yeah 2p less & already converted, I'm a bit confused.

So at the moment I have £1859.27 showing in Easy Access 7, guess I'll see if 2p gets added at 12am yea?🤔

Just checked mine - its converted to Easy Access Saver £2009.20 - withdrawal instruction given to pay into nominated bank tomorrow - don't know what the amount on the letter said as its been filed in the shredder.

So something is clearly wrong here.

Does beg the question can Coventry add things up properly?.

Going to have to do another webchat or something later I think.

But then how can I be sure it's just 2p missing?, I'm probably not going to go down compensation/complaints route (unless they push it & many banks etc do), I'm just after an explanation to be honest.

Also if they've calculated things wrong they've probably done it with other people.

Might just be 2p, but I'm sure there would be several people kicking off if was £30 or something higher right?

I think I know the reason why it's 2p less than expected but they've had plenty of time to explain why it differs from the letter.

Ahh well I've requested a transfer out now so hopefully that will arrive today or tomorrow

I agree when posters talk about the principle. It doesn't really matter whether it's 1p or £100, it's about information or potentially transactions being wrong. (Though I also understand that some customers will not care about such matters).

Exactly. If I saw a 2p coin on the ground I'd pick it up and keep it, but not if it involved me in correspondence of some kind.0 -

Ahh in which case not sure without knowing what you already have but yeah try to find a better paying account elsewhere or at least somewhere paying same rate that doesn't require a high minimum balance etc.granta said:

I hold all the accounts you mention and yes, it seems now is the time to move the remaining Hanley balance elsewhere. I'm struggling to remember why I opened this account in the first place but it must have been competitive at some pointjameseonline said:

You could literally put your money into a Santander Edge Saver, Monmouthshire 6%/7% regular or several other better paying accounts, maybe a Cahoot account?granta said:Hanley Economic BS Online regular saver (NLA)

Just received notification interest will go down to 4.15% from 1st October.

Any reason why this should stay open (it has no end date) especially as you have to hold a minimum balance of £1000?

I might just open an instant access account with them to retain membership but looking for any counter-reasons to closure

Savings week is coming up so that may help.1 -

Yes! Uninstalled the monbs app again & reinstalled without issues so far today.Bob2000 said:Are anybody else having problems with the Monbs app please.

Been just stuck on the intro screen since 8ish last night.# No.2 Save 1p A Day Challenge 2026 £118.34 / £667.95 (2)# No.4 Save £12k in 2026 £3635.93 / £12,000 (2)# No.4 £2 Savers Club 2026 - (25/12 - 24/10) £50 / £200 (2)# No.8 Sealed Pot Challenge 19 - 2026 - 24/12 - 24/10 £60+ / £400 (2)# No.5 Fiver Friday Challenge 2026 £40/£230 (2)# Make £2026 in 2026 £1033.98 / £2026 (2)1 -

I still have my letter from Coventry. My RS matured on 31 August and the amount shown on letter was the amount i received.jameseonline said:

Well that's what I'm thinking but then would that really explain a 2p loss?, hmmAidanmc said:

Maybe the letter you received didn't take into account the rate reduction on 1s Sept?jameseonline said:

My letter dated 7th August clearly states £1859.29 was my current closing balance at the time, app is still showing £1859.27.saverkev said:

Coventry Sunny Dayjameseonline said:Just checked my CBS app it seems my Sunny Day has been converted to Easy Access 7 but the amount is 2p less than the amount given in letter, hmm, I know the guy on the chat said it gets converted at 12am but yeah 2p less & already converted, I'm a bit confused.

So at the moment I have £1859.27 showing in Easy Access 7, guess I'll see if 2p gets added at 12am yea?🤔

Just checked mine - its converted to Easy Access Saver £2009.20 - withdrawal instruction given to pay into nominated bank tomorrow - don't know what the amount on the letter said as its been filed in the shredder.

So something is clearly wrong here.

Does beg the question can Coventry add things up properly?.

Going to have to do another webchat or something later I think.

The figure on the letter has 2 asterisk after it.

3 -

It was competitive (5.5%) when launched, that was my main reason for opening it. The other benefits were £1k pm allowance, no end date and debit card facilities.granta said:

I hold all the accounts you mention and yes, it seems now is the time to move the remaining Hanley balance elsewhere. I'm struggling to remember why I opened this account in the first place but it must have been competitive at some pointjameseonline said:

You could literally put your money into a Santander Edge Saver, Monmouthshire 6%/7% regular or several other better paying accounts, maybe a Cahoot account?granta said:Hanley Economic BS Online regular saver (NLA)

Just received notification interest will go down to 4.15% from 1st October.

Any reason why this should stay open (it has no end date) especially as you have to hold a minimum balance of £1000?

I might just open an instant access account with them to retain membership but looking for any counter-reasons to closure2 -

Newcastle BS

Are withdrawals from the Newcastle BS regular saver same day, instant, next working day, etc?0

This discussion has been closed.

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards