We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The Old Regular Savers Discussion Thread 28/12/24-29/1/26

Comments

-

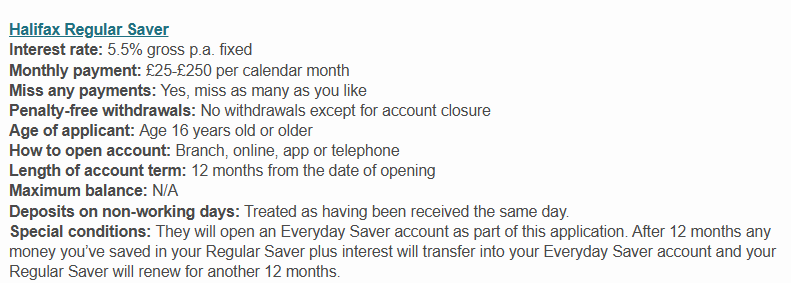

This may already is on the RS list:HALIFAX REGULAR SAVER (new and existing customer can apply)https://www.halifax.co.uk/savings/fixed-term/regular-saver.html

5.50% AER/gross on balances of £1 or more for 12 months from account opening.

Your interest is paid 12 months after you open the account.

Ideal for savers who want to save £25-£250 every month by standing order or a bank transfer. This needs to reach your account by the 25th of the month.

0 -

Fear not it's been included in my lists. It's one of the regular savers that's been on page 1 of this thread since the launch of this version in late 2024 and was also on the previous version run by @Special_Saver2 for a while before that.20122013 said:This may already is on the RS list:HALIFAX REGULAR SAVER (new and existing customer can apply)https://www.halifax.co.uk/savings/fixed-term/regular-saver.html5.50% AER/gross on balances of £1 or more for 12 months from account opening.

Your interest is paid 12 months after you open the account.

Ideal for savers who want to save £25-£250 every month by standing order or a bank transfer. This needs to reach your account by the 25th of the month.

3 -

my first ever principality account 6 month RS has matured today, logging to principality can see its showing as matured, the interest paid and the £200 is in the new rolled over monthly RS. I selected for the remainder to be sent back to my main current account, any idea when I can expect this to be paid in to Santander.MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..0

-

anna42hmr said:my first ever principality account 6 month RS has matured today, logging to principality can see its showing as matured, the interest paid and the £200 is in the new rolled over monthly RS. I selected for the remainder to be sent back to my main current account, any idea when I can expect this to be paid in to Santander.

COB today.1 -

thanks for the reply, I appreciate itMFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..1

-

Last time mine matured, the funds landed in my current account on the same day. Not sure of exact timings, might have been a few hours, but don't panic if it hasn't arrived yet.anna42hmr said:my first ever principality account 6 month RS has matured today, logging to principality can see its showing as matured, the interest paid and the £200 is in the new rolled over monthly RS. I selected for the remainder to be sent back to my main current account, any idea when I can expect this to be paid in to Santander.1 -

Things still seem to be clunky with Furness following their app update across the weekend. Couldn't get into my account yesterday, today it's recognising my face but not loading my account up.Make £2026 in 2026

Prolific £156.37, TCB £8.24, Everup £12.17

Total £176.78 8.7%Make £2025 in 2025 Total £2241.23/£2025 110.7%

Prolific £1062.50, Octopoints £6.64, TCB £492.05, Tesco Clubcard challenges £89.90, Misc Sales £321, Airtime £70, Shopmium £53.06, Everup £106.08, Zopa CB £30, Misc survey £10

Make £2024 in 2024 Total £1410/£2024 70%Make £2023 in 2023 Total: £2606.33/£2023 128.8%0 -

mine also matured today and the balance arrived in my bank just nowanna42hmr said:my first ever principality account 6 month RS has matured today, logging to principality can see its showing as matured, the interest paid and the £200 is in the new rolled over monthly RS. I selected for the remainder to be sent back to my main current account, any idea when I can expect this to be paid in to Santander.1 -

PRAISETHESUN Any way to switch off the monthly fee? Santander will stop 1% debit card spend cashback from Sept 2025. I will be losing money with the monthly fee & 1% bills cashback (water bill is elsewhere)PRAISETHESUN said:

A bit late to the party here @20122013 , but the trick to avoiding the monthly fee for the Santander edge account is to never trigger the requirements for cashback. As long as you never add £500+ AND pay 2x DDs come out in the same month you're golden. If you do this even once, then you will always be charged the monthly fee, even if you don't meet the cashback requirements in subsequent months.20122013 said:friolento said:

It can be funded from any Santander account and it doesn’t require a standing order.Middle_of_the_Road said:

The regular saver can only be funded by standing order from your Edge current account.20122013 said:SANTANDER MONTHLY SAVER - how can I make my monthly payment without incurring the Edge current account monthly fee? I have tried to set up a Standing Order from another bank account as I only have a 'R'account number and no sort code, so it was not possible.PS I have posted this question already but cannot find it to delete it.

Doing so will not trigger the fee. Only direct debits would do that.

If I add funds to my Edge current account to pay into the Monthly Saver, will that not trigger the monthly account fee?

I want to retain edge saver and 5% regular saver. Any way to retain the goods and get rid of the fee?0 -

Not the person you've requested an answer from but you could downgrade the account to an everyday account then open a new Edge Current account, you should be able to retain the lot.ChewyyBacca said:

PRAISETHESUN Any way to switch off the monthly fee? Santander will stop 1% debit card spend cashback from Sept 2025. I will be losing money with the monthly fee & 1% bills cashback (water bill is elsewhere)PRAISETHESUN said:

A bit late to the party here @20122013 , but the trick to avoiding the monthly fee for the Santander edge account is to never trigger the requirements for cashback. As long as you never add £500+ AND pay 2x DDs come out in the same month you're golden. If you do this even once, then you will always be charged the monthly fee, even if you don't meet the cashback requirements in subsequent months.20122013 said:friolento said:

It can be funded from any Santander account and it doesn’t require a standing order.Middle_of_the_Road said:

The regular saver can only be funded by standing order from your Edge current account.20122013 said:SANTANDER MONTHLY SAVER - how can I make my monthly payment without incurring the Edge current account monthly fee? I have tried to set up a Standing Order from another bank account as I only have a 'R'account number and no sort code, so it was not possible.PS I have posted this question already but cannot find it to delete it.

Doing so will not trigger the fee. Only direct debits would do that.

If I add funds to my Edge current account to pay into the Monthly Saver, will that not trigger the monthly account fee?

I want to retain edge saver and 5% regular saver. Any way to retain the goods and get rid of the fee?

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards