We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Cash ISAs Dec 2024

If later on down the line, the Trading 212 cash ISA becomes more profitable, I could just transfer all but £100 from Plum and still keep the same AER. Can anyone think of a reason why I might not want to do this? Thanks!

Comments

-

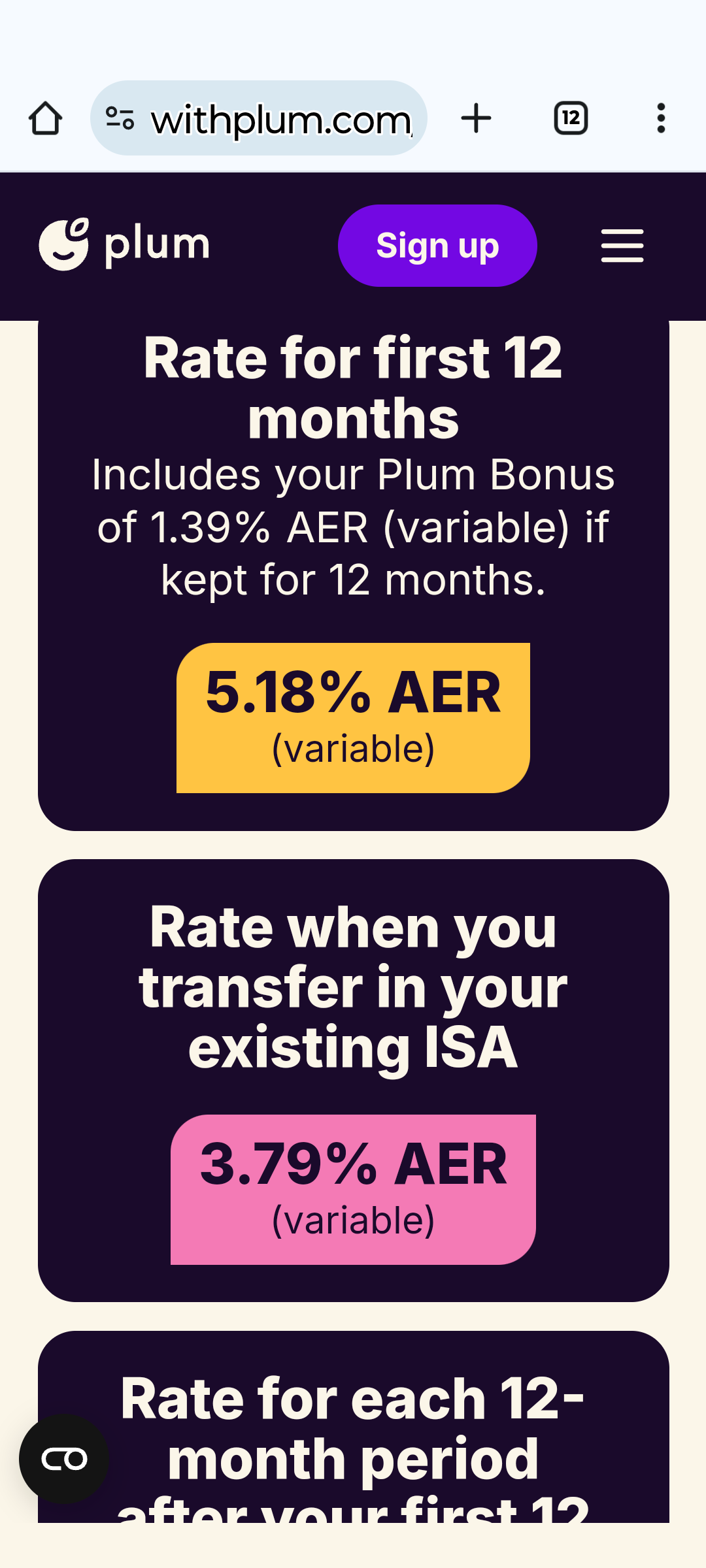

with plum you lose your bonus if you transfer out within the first 12 months.El_Pacho95 said:I currently have a Trading 212 cash ISA (AER 4.90%). I have maxed out my personal savings allowance (PSA) this tax year with this ISA. I am now wondering if it makes more sense for me to transfer £20,000 to the Plum cash ISA (AER 5.18%) as the max 3 withdraws a year will likely not be a problem for me.

If later on down the line, the Trading 212 cash ISA becomes more profitable, I could just transfer all but £100 from Plum and still keep the same AER. Can anyone think of a reason why I might not want to do this? Thanks!0 -

Also 5.18% is just for new money. Transfers in are 3.xx%slinger2 said:

with plum you lose your bonus if you transfer out within the first 12 months.El_Pacho95 said:I currently have a Trading 212 cash ISA (AER 4.90%). I have maxed out my personal savings allowance (PSA) this tax year with this ISA. I am now wondering if it makes more sense for me to transfer £20,000 to the Plum cash ISA (AER 5.18%) as the max 3 withdraws a year will likely not be a problem for me.

If later on down the line, the Trading 212 cash ISA becomes more profitable, I could just transfer all but £100 from Plum and still keep the same AER. Can anyone think of a reason why I might not want to do this? Thanks!2 -

ISAs have nothing to do with your PSA, which relates only to taxable savings interest? Does your reference to transferring some perhaps mean that you're approaching the £85K FSCS protection cap?El_Pacho95 said:I currently have a Trading 212 cash ISA (AER 4.90%). I have maxed out my personal savings allowance (PSA) this tax year with this ISA. I am now wondering if it makes more sense for me to transfer £20,000 to the Plum cash ISA...2 -

The PSA is an allowance that you get on interest on savings that are not in an ISA. A thousand pounds for a 20% taxpayer in most cases.El_Pacho95 said:I currently have a Trading 212 cash ISA (AER 4.90%). I have maxed out my personal savings allowance (PSA) this tax year with this ISA. I am now wondering if it makes more sense for me to transfer £20,000 to the Plum cash ISA (AER 5.18%) as the max 3 withdraws a year will likely not be a problem for me.

If later on down the line, the Trading 212 cash ISA becomes more profitable, I could just transfer all but £100 from Plum and still keep the same AER. Can anyone think of a reason why I might not want to do this? Thanks!

The limit of £20K you can add to an ISA each year is completely different2 -

3.79% for transfers in.

0 -

Sorry everyone, probably could have explained this better.

What if I were to transfer £20,000 (leaving the interest in) from Trading 212 cash ISA to a bank account and then from there, move it to plum? Would that affectively be setting up a new ISA with plum instead of transferring an existing ISA? Also, as long as I kept £1 minimum in the Trading 212 ISA and £100 minimum in the Plum ISA AND didn't go over x3 withdraws in 12 months, I could theoretically get that 5.18% AER, right? Confusing I know, apologies!0 -

In the context of ISAs, the term 'transfer' generally means direct movement of funds from one ISA to another, whereas you're referring to withdrawing and (re)depositing, but yes, you could do what you propose if you haven't used any of your 2024/25 ISA allowance, as the £20K deposit into Plum would count as new money, both for Plum's differential Ts & Cs but also HMRC's rules.El_Pacho95 said:Sorry everyone, probably could have explained this better.

What if I were to transfer £20,000 (leaving the interest in) from Trading 212 cash ISA to a bank account and then from there, move it to plum? Would that affectively be setting up a new ISA with plum instead of transferring an existing ISA? Also, as long as I kept £1 minimum in the Trading 212 ISA and £100 minimum in the Plum ISA AND didn't go over x3 withdraws in 12 months, I could theoretically get that 5.18% AER, right? Confusing I know, apologies!1 -

I see. I have used up my 2024/2025 ISA allowance but it's my understanding that we can now have multiple cash ISAs. So, if I were to withdraw to a bank and stick it in a different ISA (new Plum), I should be fine. Thanks!0

-

No - you can't do this because withdrawing from T212 and paying it back into Plum would mean it would count again towards your 2024/25 ISA allowance, which you've already used up.El_Pacho95 said:I see. I have used up my 2024/2025 ISA allowance but it's my understanding that we can now have multiple cash ISAs. So, if I were to withdraw to a bank and stick it in a different ISA (new Plum), I should be fine. Thanks!

The only way you can move it without it counting again towards your allowance would be to do an ISA transfer (directly from one to the other using the new ISA provider's transfer process), hence the warning about Plum's lower rate for transfers above which would leave you worse off than if you'd stayed with T212.

The latest rule about being able to make use of multiple cash ISAs for new subscriptions simply means that you can spread your current tax year's allowance between them (so pay £10k of new subscriptions into Plum and £10k of new subscriptions into T212, for example).1 -

El_Pacho95 said:

Sorry everyone, probably could have explained this better.

What if I were to transfer £20,000 (leaving the interest in) from Trading 212 cash ISA to a bank account and then from there, move it to plum? Would that affectively be setting up a new ISA with plum instead of transferring an existing ISA? Also, as long as I kept £1 minimum in the Trading 212 ISA and £100 minimum in the Plum ISA AND didn't go over x3 withdraws in 12 months, I could theoretically get that 5.18% AER, right? Confusing I know, apologies!

No, if you've already maxed your ISA allowance (which is not the same as the PSA), then you cannot deposit even a single penny into Plum's ISA as you would breach your allowance. Withdrawing from account A and depositing in account B counts as subscriptions to account B without reducing subscriptions from A, hence why a provider-to-provider ISA 'transfer' is necessary, but Plum's rate for transfers is undesirable.

1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards