We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Vanguard S&P 500

Comments

-

I like the S&P500 a lot, it has a broad range of industry sectors and a solid set of inclusion and screening criteria. It's a powerful algorithm.

For our invested money, we have been overweight US equities, above the weighting of the global index, for the last 5 years or so via US equity index funds including Vanguard's S&P500 ETF. We have also been overweight Tech even beyond the weightings in the S&P500, We have around 12-15% held in rest of the world stocks only. It's a bet that has paid off and has contributed to allowing me to imminently retire early.

I'm no armchair global economist and have no pretence at being a wily stock picker but when I look broadly across the globe at areas where I am happy to place my money and sleep at night, I form some opinions that shape where I want to place my money.

I don't like the look of Europe, it's growth engine; Germany is in a poor state, the European car sector's woes highlight some of the issues the EU faces economically, along with a war on it's doorstep, which I reckon Trump will force to a negotiated end but the winning aggressor still sits on thier door step.

The UK is meandering, with a government focussed on pouring any money it has into public services. That won't put more money in peoples or businesses pockets, it will lead to less.

China does not look attractive due to the regime in place.

So, apart from Japan, emerging markets and the rest of the pacific region that leaves the US, which I like, but so does everybody else so share prices are high.

So, if you subscribe to mean reversion theory then a period of over average growth for the US should lead to a period of under performance. I have adjusted my expectations on future returns accordingly.

However, I don't agree that just because some areas, like the UK, are cheap that they are a bargain. They may be cheap, but they are cheap for a reason.

For transparency, we haven't added any new money to US or Tech equities in the last year, apart from dividend reinvestment. All new money has gone to our risk off allocation, I have also top sliced some US/Tech equity growth (about 7%) over a couple of times this year and added that money to our cash holding.

While, my US bet had paid off, I can foresee that I will end up with all of our equity investment money held in a single global equity index tracker at some point. Especially, if as we get into retirement and reach a point where growth for our personal consumption is no longer so essential.2 -

dont_use_vistaprint said:InvesterJones said:dont_use_vistaprint said:Hi would this be a sensible choice to put majority of ISA allowance in for the next few years with aim of beating cash ISA returns over 5-7 years.

Why would people choose this vs something like Vanguard Life strategy 60? Or would both make sense ?

No, both wouldn't make sense, unless you were trying to make your own weird ultra-US overweight portfolio - if you were that keen to just invest in one market then might as well go all S&P 500. But if your aim is simply to beat cash returns then you don't need to take on that much risk - a global index, or even a multi-asset fund, should do that in the long run with lower volatility. 5-7 years is kind of medium term, so I'd go with multi-asset and something like VLS60 is not a bad choice if you don't mind overweighting the UK (which is 'value' at the moment).Why are some people on here a little bit negative towards the S&P 500? Other than a few instances in the lost decade after 9/11 it looks like it’s returned above 10% annual returns consistently for over 100 years, often much much higher. it seems you would need to be extremely unlucky not to make money tracking it

Couple of things 1: if you only need to beat cash then why take on more risk than you need? Especially over a medium term investment. 2: We just can't predict the future - in the absence of being able to do so diversification is useful.

2 -

wmb194 said:

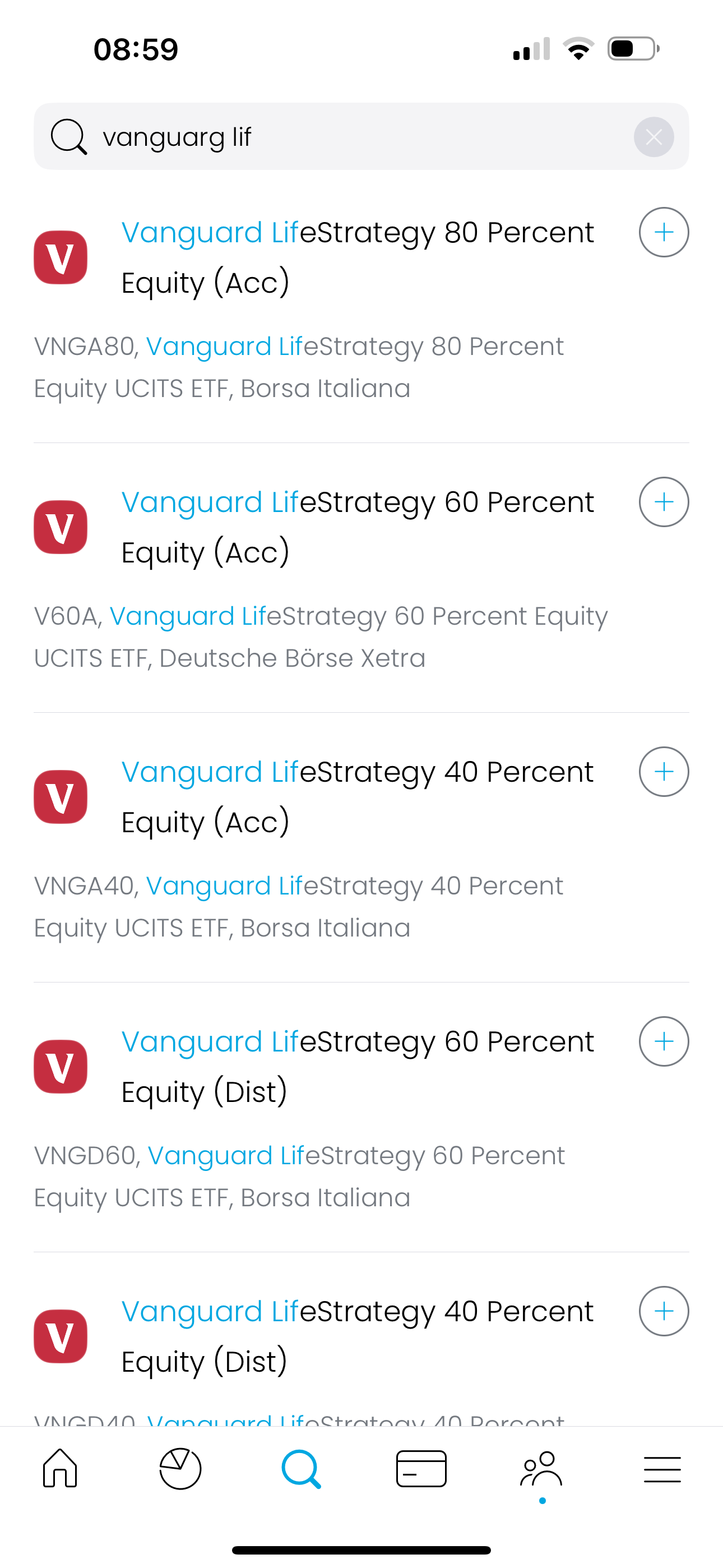

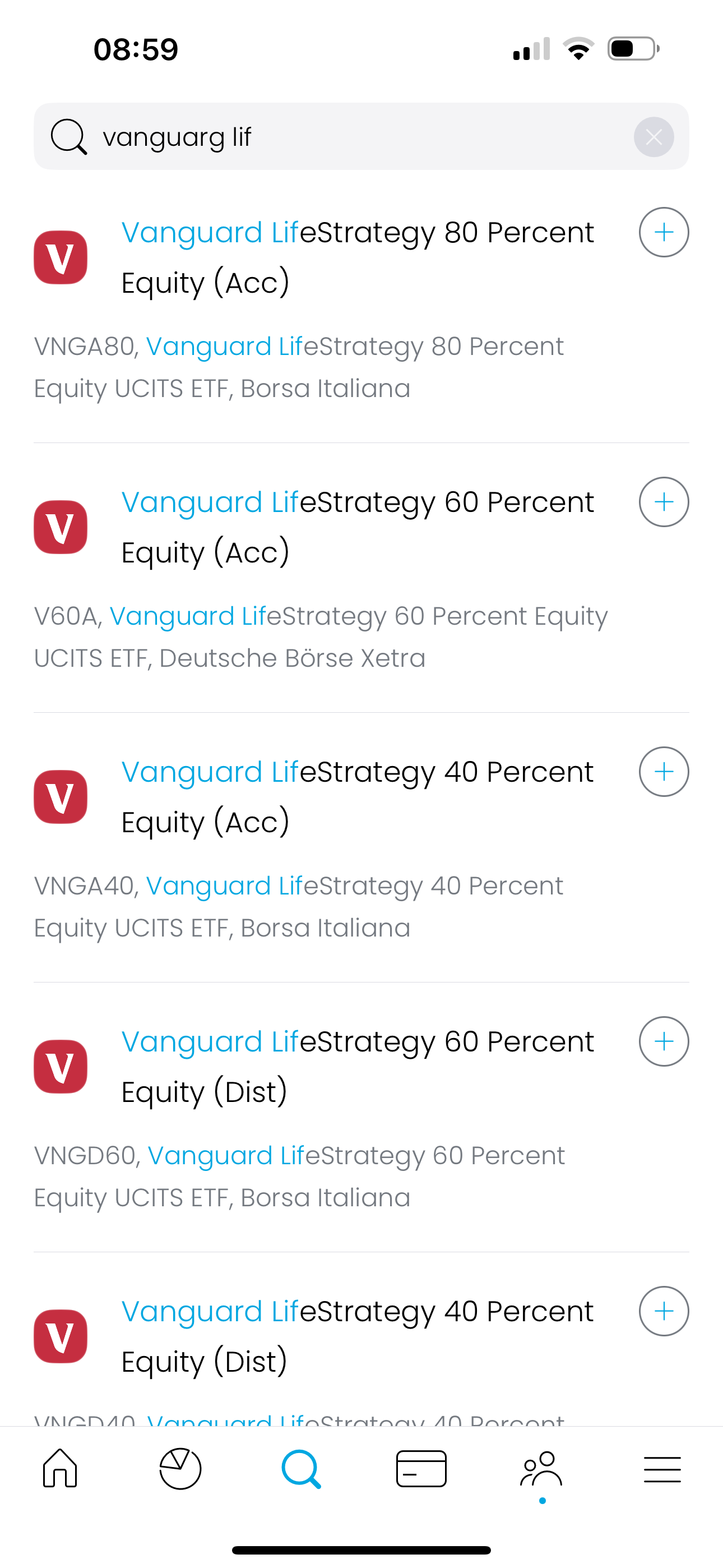

Oh yes, euro denominated ETFs listed in Germany and Italy:dont_use_vistaprint said:

VLS60 is an option on T 212 within S&S ISAmasonic said:VLS60 won't be an option if you are using T212 as per your other thread.

vanguard life strategy 60 percent equity (Acc)

is this not the same thing?Why would certain things not be available on T212 ? What is the specific reason why T212 Does not have the UK listed versions of these ETF? I’m struggling to understand. is T2 12 a problematic choice for a stocks and shares ISA?

What is the specific reason why T212 Does not have the UK listed versions of these ETF? I’m struggling to understand. is T2 12 a problematic choice for a stocks and shares ISA?

it’s not because it is a trading platform because it has ETFs on it just not the UK version of this ETF…..

Also specifically why would you choose to invest in the UK versions over other EU versions of this ETF? What is the benefit or advantage of doing this?The greatest prediction of your future is your daily actions.0 -

Yes clearly I haven’t got a clue what I’m doing. Do you think the pension bee plans would be a better choice?. I am 54, retired with a lot of cash savings built up in ISA and non-ISA that I am looking to simply beat the cash ISA rates over the next 10 to 15 years. I have other pensions from next year so this money isn’t critical to living onInvesterJones said:dont_use_vistaprint said:InvesterJones said:dont_use_vistaprint said:Hi would this be a sensible choice to put majority of ISA allowance in for the next few years with aim of beating cash ISA returns over 5-7 years.

Why would people choose this vs something like Vanguard Life strategy 60? Or would both make sense ?

No, both wouldn't make sense, unless you were trying to make your own weird ultra-US overweight portfolio - if you were that keen to just invest in one market then might as well go all S&P 500. But if your aim is simply to beat cash returns then you don't need to take on that much risk - a global index, or even a multi-asset fund, should do that in the long run with lower volatility. 5-7 years is kind of medium term, so I'd go with multi-asset and something like VLS60 is not a bad choice if you don't mind overweighting the UK (which is 'value' at the moment).Why are some people on here a little bit negative towards the S&P 500? Other than a few instances in the lost decade after 9/11 it looks like it’s returned above 10% annual returns consistently for over 100 years, often much much higher. it seems you would need to be extremely unlucky not to make money tracking it

Couple of things 1: if you only need to beat cash then why take on more risk than you need? Especially over a medium term investment. 2: We just can't predict the future - in the absence of being able to do so diversification is useful.The greatest prediction of your future is your daily actions.0 -

dont_use_vistaprint said:wmb194 said:

Oh yes, euro denominated ETFs listed in Germany and Italy:dont_use_vistaprint said:

VLS60 is an option on T 212 within S&S ISAmasonic said:VLS60 won't be an option if you are using T212 as per your other thread.

vanguard life strategy 60 percent equity (Acc)

is this not the same thing?Why would certain things not be available on T212 ? What is the specific reason why T212 Does not have the UK listed versions of these ETF? I’m struggling to understand. is T2 12 a problematic choice for a stocks and shares ISA?

What is the specific reason why T212 Does not have the UK listed versions of these ETF? I’m struggling to understand. is T2 12 a problematic choice for a stocks and shares ISA?

it’s not because it is a trading platform because it has ETFs on it just not the UK version of this ETF…..

Also specifically why would you choose to invest in the UK versions over other EU versions of this ETF? What is the benefit or advantage of doing this?There is no UK-listed ETF. The UK funds are open-ended and do not trade on a stock exchange. T212 is restricted to exchange traded securities, which means you cannot invest in several thousand UK domiciled funds through T212, of which the VLS range are examples. As mentioned above, the German and Italian ETFs are not the same as the funds we discuss regularly here, so you need to do your research as to their suitability, noting any key differences, if considering them for an investment.The standard process for choosing an investment provider is to decide on some investments first, then pick a provider who lets you hold these. If you want to invest in "our" VLS funds, then you would not pick T212 as your investment platform.2 -

I think there are 2 issues here.dont_use_vistaprint said:Why would people choose this vs something like Vanguard Life strategy 60? Or would both make sense ?

Firstly people would pick a multi asset fund over an 100% equities investment for the reduced volatility particularly in periods where global markets are down for very long periods which they might not have the stomach, inclination or time remaining to wait for the recovery. Even a well informed long term investor may prefer a smoother ride with a more predictable outcome.

Secondly people choose global diversification over a country tracker because looking back there have been long periods where the US underperforms the rest of the world. That usually starts when US shares begin the period at higher relative prices than the rest of the world and is easy to forget as we have just had a couple of decades where the US have mostly overperformed the rest of the world. Maybe it will be another decade run? Who knows? I have noticed that markets often climb curves of pessimism and higher valuations can make it harder for an investment to outperform.

I'm a Developed World (no EM) kind of investor so like GazzaBloom have done well from having a heavy US weighting in my equities by valuation but as the non-US companies are generally cheaper then I still own a good proportion of non-US companies for periods where the US might lag. But then like most of us I am getting older by the day so I hold bonds too now they are attractive again for a smoother ride. I also wear slippers and believe that people who like warm comfortable feet should have a diversified multi asset portfolio.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards