We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Index linked gilts and index linked annuities: are you moving money into them, yea or nay?

Comments

-

Over the medium to long term, completely unreliable. Things happen which the markets can't possibly predict, like COVID, wars in Ukraine and the middle east etc which affect inflation.Bobziz said:And what can we say about the markets ability to reliably forecast inflation? If it's reliable then conventional gilts provide the highest yield don't they?

But as above, you don't decide to invest in IL gilts because you think they'll get the best returns. You do it to cover your future liabilities (ie future spending requirements). If you want a gamble on something to get better returns, history shows that's generally equities, not flat gilts.

Personally I'm using IL gilts to cover my essential spending requirements and equities for the non essentials which means I won't starve if equities do badly and may be able to afford a world cruise if they do well.5 -

The break even inflation rate priced into say the 20 year outstanding term ILG is about 3.4%pa. Allowing for RPI being about 0.8% higher than CPIH on average, and RPI is the indexation used until 2030, that would suggest that the break even CPIH inflation rate is around 3.2%paBobziz said:And what can we say about the markets ability to reliably forecast inflation? If it's reliable then conventional gilts provide the highest yield don't they?I'm not sure what other measures of market expectations of inflation there are or what the distribution of variation around any estimate is. So it's impossible to answer your question.It seems plausible that investors overall prefer stable real returns rather than stable absolute returns, and that might get priced into the index linked gilts. But perhaps there are other supply and demand factors that need to be allowed for. Perhaps the ratio of pension schemes index linked liabilities to fixed liabilities is reducing over time and changing what a matched asset might be and that changes what they prefer to invest in and mitigates this. And perhaps the relative supply of new index linked vs conventional gilts causes distortions. I don't know and that was one of the main reasons to start this thread to see if anyone could explain why real yields on ILGs have dramatically increased.But all this aside 3.2%pa doesn't sound a particularly high rate for 20 year CPI inflation.But this is all missing the point that index linked gilts are being suggested here (rightly or wrongly) as a means to create, alongside an equity portfolio, a floor of income or some level of inflation protection. And so it seems logical to invest in gilts that provide the real (rather than absolute) protection that is required in the light of 3.2%pa not being an obviously artificially high rate.

I came, I saw, I melted1 -

No.Bobziz said:And what can we say about the markets ability to reliably forecast inflation? If it's reliable then conventional gilts provide the highest yield don't they?

To take an example, the current spot yields (7 November) on 5 year gilts are ( https://www.bankofengland.co.uk/statistics/yield-curves )

Nominal 4.22%

Inflation linked 0.45%

Implied inflation* is 3.76%

With the nominal gilt after 5 years, £1000 will be worth 1000*(1.0422)^5=£1230 (rounded to nearest pound)

Let's assume annualised inflation over the 5 years is exactly 3.76%. In this case, the value of £1000 invested in the inflation linked gilt will be 1000*(1.0045)^5*(1.0376)^5=£1230.

In other words, if realised inflation is the same as the implied inflation, then whether you held a nominal gilt or an inflation linked gilt you would have the same return. This is why implied inflation is sometimes also known as breakeven inflation.

More generally, if realised inflation was higher than the breakeven inflation it would have been better to hold the inflation linked gilt. Conversely, if realised inflation was lower than the breakeven inflation then it would have been better to hold the nominal gilt. Which of these outcomes will occur is unknown in advance although their potential effects has been discussed above in https://forums.moneysavingexpert.com/discussion/comment/81094784/#Comment_81094784

Historically (since the early 1980s when ILG were first issued), markets have tended to underestimate inflation (which has been good for investors, but bad for the UK government).

* The Fed in the US calls this 'expected inflation'.

2 -

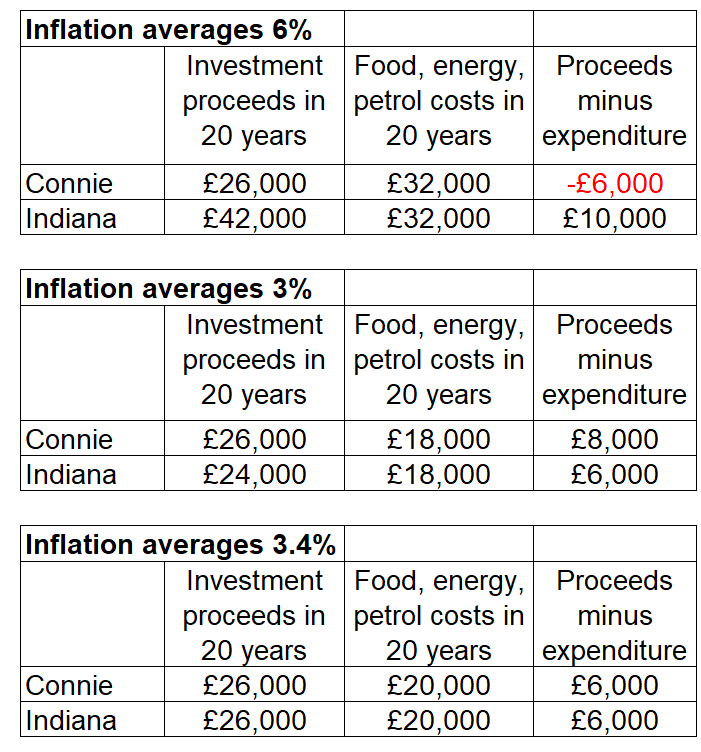

Not quite........if the market's forecast of inflation over the period is accurate, both Connie and Indie would get back the same amount. This is given by the breakeven inflation figure usually quoted with IL gilts........atm the breakeven on a 20 yr IL gilt is 3.4%..........if it turns out lower, the conventional gilt will return more, and if higher the IL gilt will return more, all else being equal.0

-

To some extent (as always, it depends on start and end dates!), the increase in yields of ILG has been less than the increase in nominal yields. For example (all spot yields from https://www.bankofengland.co.uk/statistics/yield-curves ), at the end of October 2019, 10 year nominal gilts had a yield of 0.6% while at the end of October 2024, the yield was 4.41% - an increase of 380 bp. The 10 year ILG had a yield of -2.53% at end of October 2019 and 0.84% at end of October 2024, an increase of 337 bp. In other words, the ILG yield increased by about 50 bp less than the nominal yield or, alternatively, implied inflation increased by about 50 bp between 2019 and 2024. Of course, the results are different for different maturities (e.g., at 20 year maturity, implied inflation only increased by 20 bp from 3.28% to 3.48% between 2019 and 2024).SnowMan said:Bobziz said:And what can we say about the markets ability to reliably forecast inflation? If it's reliable then conventional gilts provide the highest yield don't they?It seems plausible that investors overall prefer stable real returns rather than stable absolute returns, and that might get priced into the index linked gilts. But perhaps there are other supply and demand factors that need to be allowed for. Perhaps the ratio of pension schemes index linked liabilities to fixed liabilities is reducing over time and changing what a matched asset might be and that changes what they prefer to invest in and mitigates this. And perhaps the relative supply of new index linked vs conventional gilts causes distortions. I don't know and that was one of the main reasons to start this thread to see if anyone could explain why real yields on ILGs have dramatically increased.

After a decade of relatively low inflation, clearly the market is now pricing in a bit more over the next 10 to 20 years than it did 5 years ago.

Inflation linked gilts usually have a bit less liquidity than nominal ones, so transaction costs may be higher.

0 -

"Not quite" what? That's exactly what Snowman's example showsMK62 said:Not quite........if the market's forecast of inflation over the period is accurate, both Connie and Indie would get back the same amount. This is given by the breakeven inflation figure usually quoted with IL gilts........atm the breakeven on a 20 yr IL gilt is 3.4%..........if it turns out lower, the conventional gilt will return more, and if higher the IL gilt will return more, all else being equal.1 -

MK62 said:Not quite........if the market's forecast of inflation over the period is accurate, both Connie and Indie would get back the same amount. This is given by the breakeven inflation figure usually quoted with IL gilts........atm the breakeven on a 20 yr IL gilt is 3.4%..........if it turns out lower, the conventional gilt will return more, and if higher the IL gilt will return more, all else being equal.The scenarios I included earlier were 3% future inflation (inflation lower than the market expected) and 6% future inflation (above expected inflation). I don't think anyone was suggesting that if inflation was as expected Connie and Indie wouldn't get back the same amount. But to add in that third scenario 3.4% future inflation (as expected) of course Connie and Indie would get the same amount (ignoring any reinvestment rate complications)

I came, I saw, I melted0 -

Apparently I was viewing a cached version of this thread where it appeared to me that nobody had yet replied to Bobziz' post..........I have patchy internet atm..zagfles said:

"Not quite" what?MK62 said:Not quite........if the market's forecast of inflation over the period is accurate, both Connie and Indie would get back the same amount. This is given by the breakeven inflation figure usually quoted with IL gilts........atm the breakeven on a 20 yr IL gilt is 3.4%..........if it turns out lower, the conventional gilt will return more, and if higher the IL gilt will return more, all else being equal.2 -

Makes sense now!MK62 said:

Apparently I was viewing a cached version of this thread where it appeared to me that nobody had yet replied to Bobziz' post..........I have patchy internet atm..zagfles said:

"Not quite" what?MK62 said:Not quite........if the market's forecast of inflation over the period is accurate, both Connie and Indie would get back the same amount. This is given by the breakeven inflation figure usually quoted with IL gilts........atm the breakeven on a 20 yr IL gilt is 3.4%..........if it turns out lower, the conventional gilt will return more, and if higher the IL gilt will return more, all else being equal.

I came, I saw, I melted0 -

I've been managing my own investments for many decades. Conventional Gilts offer 100% certainty as to their redemption value. There's always a trade that gets jumped on as the latest version of sliced bread. Trouble is the market efficiently remove the edge. If you can predict future inflation and interest rate movements with any degree of certainty then your confirmation bias post may well be proven to be correct.zagfles said:

IL gilts may take a bit of getting your head around but really aren't that complicated for anyone who's capable of managing investments. And there's no certainty of how much a conventional gilt will really be worth in the future.Hoenir said:In 2022 plenty of people who thought that they understood ILG's came unstuck. Certainly far from being straightforward to comprehend. From my personal perspective best left to pension funds or as part of a managed portfolio. More than happy to stick to conventional Gilts where there's complete certainty as to the outcome.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards