We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Index linked gilts and index linked annuities: are you moving money into them, yea or nay?

Comments

-

It's a minority yes, but my point re tax bands is that when working, top rate was 40% for quite a number of years and hence tax relief limited to that. Tax on way out now in Scotland is 42% above c£43k and 45% above £75k as you note.zagfles said:

Again - very niche. Live in Scotland, will have £75k+ income in retirement, but not while working, and used up the full £268k LSA (ie a pension over a million). The implication of your PP was that this was common, I doubt it is, even with fiscal drag.MarkCarnage said:But it's usually better than that because you get the PCLS. So effective tax rate out is only 30% (ie 40% of 75%) So you get £2333 net out. Or even if the tax rate out was 45%, you get £2208 out.Agree if you get that, but I know of a few people, including myself, where that's already been taken.Usually the pension would be much better, particularly if you pay higher rate tax and will withdraw when you're a basic rate taxpayer.If your tax bands go in that direction then yes, less tax (but lower income too). However, the example I quoted above may become increasingly common due to fiscal drag and increased higher rates....already seen in Scotland....which could well mean 40% relief on way in and 45% tax on way out.

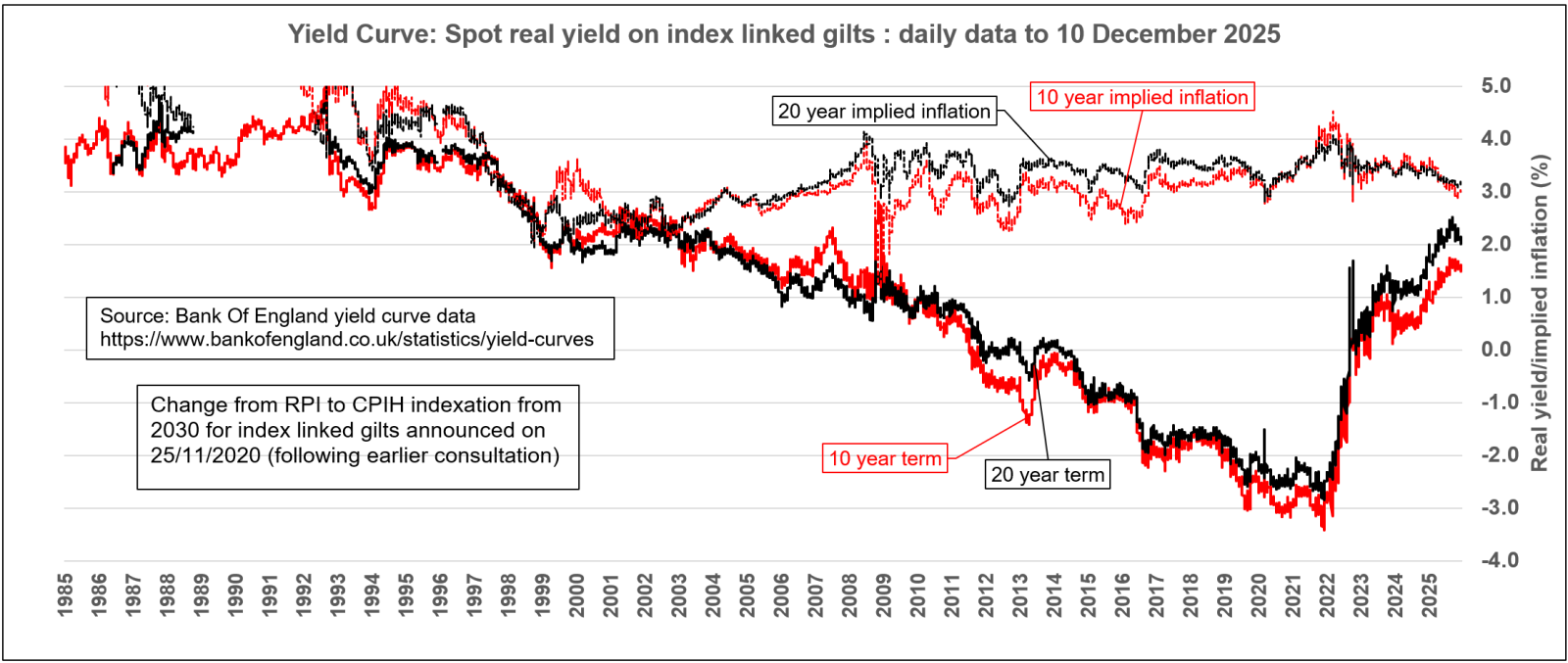

Anyway back to whether IL gilts are a good idea....they are certainly a better idea than they were several years ago. Note that the real yield figures now may include an element of allowing for the change in RPI calculation from 2030, but still look reasonable if held to maturity. Whether we get back to 3-4% real yields is a moot point.1 -

Who knows where interest rates might go in the future. The USA might hack off international buyers of it's Treasury Stock with current policies. That would put the cat amongst the pidgeons. If they were to go out on strike. Make the objective of extending the debt maturity dates longer even more challenging than it already is. Yellen having already left behind a major headache.MarkCarnage said:Whether we get back to 3-4% real yields is a moot point.1 -

Having read through this thread, even as someone with a mathematical mind, IL gilts are complex instruments and I cannot say I totally understand them. Outside of professional investors I bet there aren't more than a few hundred people in the whole country who truly understand them.2

-

If you just think about hold to maturity then all they do is maintain the real value of your money in spending power terms.

Compare this to a 5 year fixed savings account - you know exactly how much interest it will return but if inflation is higher than the interest rate then you end up with less in real spending power terms.I think....0 -

I'm in the 'mostly understand' camp in that I get the principle of liability matching and holding to maturity but I can't say I fully understand the maths. My main thing with them is lumpy cashflows which means from time to time I'll have fairly chunky cash balances that will need to be parked somewhere. So, I'm wondering if, for now, it would be less hassle to just use STMM for my 7.5 year timeframe to state pension and if things change, then change the plan.1

-

That might work out OK as long as interest rates don't fall significantly below inflation, but if they do, and especially if that happens in the earlier part of that 7.5 year period, your STMM fund may not be able to supply SP "matching" levels of income over the whole period.......whether this is crucial though, only you can decide.Storcko14 said:I'm in the 'mostly understand' camp in that I get the principle of liability matching and holding to maturity but I can't say I fully understand the maths. My main thing with them is lumpy cashflows which means from time to time I'll have fairly chunky cash balances that will need to be parked somewhere. So, I'm wondering if, for now, it would be less hassle to just use STMM for my 7.5 year timeframe to state pension and if things change, then change the plan.

The issue you might face if you then wanted to switch from an STMMF funded SP bridge to one funded by an IL gilt ladder, is that the price of the gilts you need may have moved significantly against you in the meantime, and there may not be enough left in the STMMF to buy them.......though there's no way to know beforehand.1 -

I don’t think they are that complex. There’s a really good thread that covers them here:

https://forums.moneysavingexpert.com/discussion/6596493/explain-gilts-bonds-to-me-like-i-am-5-years-old-please/p1I would expect a gilt to outperform the short term money market, and if you buy a low coupon gilt, then it’s (mostly) tax free.I’m only really (potentially) interested in mid- to long- term holdings, so have only bothered about holding to maturity. I can see how the day-to-day price will vary slightly based on the attractiveness of other investments, but this doesn’t interest ne2 -

It's interesting to consider what has happened since I started this thread at the beginning of November 2024.At that time I mentioned the 2048 maturity was for example priced at a real yield of about 1.5%pa. This subsequently increased to about 2.6%pa on 2nd September 2025 and has now fallen back to just over 2%pa currently.Here's the historic real yield chart for 10 and 20 year index linked gilts. Spot real yield is the theoretical real yield on a zero coupon index linked gilt. The implied inflation represents the priced in difference between the nominal maturity yield on conventional gilts and the real yield on equivalent term index linked gilts.

So index linked gilts still looking like a good potential opportunity for someone planning their retirement income, and even more so since November 2024 given the roughly 0.5%pa increase in real yields at the around 20 year term. This can be done directly through the purchase of individual index linked gilts, or a ladder of index gilts maturing at regular dates through someone's retirement and held to maturity, or indirectly through the purchase of an index linked annuity from a SIPP or other pension. This might add secure retirement income to someone's state pension or defined benefit pensions, meeting essential expenditure needs, with the rest of their retirement resources held in more volatile, hopefully higher returning investments.There still seems to be a lot to do in explaining how index linked gilts work. It is a shame to see some forumites avoiding index linked gilts because they don't understand them, especially in circumstances where buying index linked gilts rather than conventional gilts on the surface much better provides cashflows that match their future expenditure needs.I came, I saw, I melted5

So index linked gilts still looking like a good potential opportunity for someone planning their retirement income, and even more so since November 2024 given the roughly 0.5%pa increase in real yields at the around 20 year term. This can be done directly through the purchase of individual index linked gilts, or a ladder of index gilts maturing at regular dates through someone's retirement and held to maturity, or indirectly through the purchase of an index linked annuity from a SIPP or other pension. This might add secure retirement income to someone's state pension or defined benefit pensions, meeting essential expenditure needs, with the rest of their retirement resources held in more volatile, hopefully higher returning investments.There still seems to be a lot to do in explaining how index linked gilts work. It is a shame to see some forumites avoiding index linked gilts because they don't understand them, especially in circumstances where buying index linked gilts rather than conventional gilts on the surface much better provides cashflows that match their future expenditure needs.I came, I saw, I melted5 -

That was my thread. Even though I went ahead and built myself an IL Gilt ladder I still get hopelessly confused looking at the numbers, yields etc. At the end of the day I ignored all the 'noise' and stuck to the following:SimonSeys said:I don’t think they are that complex. There’s a really good thread that covers them here:

https://forums.moneysavingexpert.com/discussion/6596493/explain-gilts-bonds-to-me-like-i-am-5-years-old-please/p1I would expect a gilt to outperform the short term money market, and if you buy a low coupon gilt, then it’s (mostly) tax free.I’m only really (potentially) interested in mid- to long- term holdings, so have only bothered about holding to maturity. I can see how the day-to-day price will vary slightly based on the attractiveness of other investments, but this doesn’t interest ne

1) IL Gilts provide an extremely low risk investment in order to shelter some of my existing pot.

2) Holding to maturity they are inflation proof plus a small % on top.

3) The market as a whole sets the current buy/sell price, cleverer people than me understand how that works but my general understanding (and happy to be corrected here) is that:

a) when the markets are in turmoil investors will head to bonds/gilts as a safe harbour but in doing so the buy/sell price rises.

b) when the price rises then the yield (the amount you get back by holding to maturity) drops - because they cost you more in the 1st place. Thus there is an inverse relationship between the price and the yield. In extreme times investors will even commit at a an overall loss (-ve yield) because that loss is perceived as less than the loss they might face by holding on to equity investments instead.

c) when the markets are steady or rapidly rising then investors head out of bonds/gilts because they can get better returns elsewhere, in doing so the buy/sell price drops and the yield increases.

d) at the moment, whilst not quite at their all time low prices, IL Gilts are cheaper to buy than they have been historically for a long time e.g. T29

I don't pretend to understand the markets well enough to ever consider 'trading' in them but for what I need them for I don't need to. I just need to know that they are giving me that guaranteed return and that I'm not buying them at the 'wrong' time.

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.1K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.2K Work, Benefits & Business

- 602.3K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards