We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Government aiming to make £605m in tax revenue purely from ISAs....

solidpro

Posts: 676 Forumite

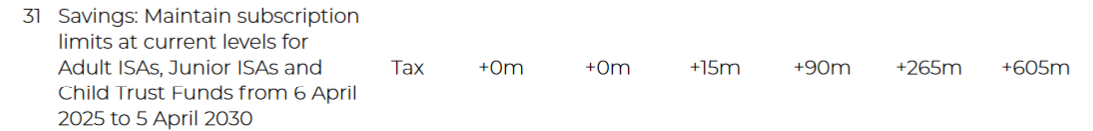

I saw someone discussing the actual 2024 budget document, which says virtually nothing about ISAs, other than freezing the rules until 2030. And yet in the 'repairing the public finances' section, point 31, it shows £605m in tax revenue from 'savings - ISAs and CTFs', by 2030.

His interpretation was that this was by freezing the £20k annual limit until 2030, which was last increased in 2017, the 2017 £20k allowance is, by 2030 worth only about £14k, and that 'extra' 6k (in 2017 terms) would have to go elsewhere - unwrapped investments which incur more tax.

Is this a good assumption? Seems odd that if this was the case, they shows the revenued earned in 2024-26 as £0. Where else would this £605m in ISA and CTF 'tax revenue' come from?

His interpretation was that this was by freezing the £20k annual limit until 2030, which was last increased in 2017, the 2017 £20k allowance is, by 2030 worth only about £14k, and that 'extra' 6k (in 2017 terms) would have to go elsewhere - unwrapped investments which incur more tax.

Is this a good assumption? Seems odd that if this was the case, they shows the revenued earned in 2024-26 as £0. Where else would this £605m in ISA and CTF 'tax revenue' come from?

0

Comments

-

Fiscal drag is often used in figures. In some areas it makes sense to consider fiscal drag but in others there is less sense.

Personally, I am not so sure fiscal drag reporting works as well with contribution allowances as you would have to assume that everyone putting into an ISA is maximising the allowance each and every year.

And even with fiscal drag, most people can put around £50k into a GIA and suffer no taxation. So, if more people use a GIA, it doesn't necessarily result in more tax from all of them.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.5 -

Some 'smoke and mirrors' I think !0

-

And of course this is an annual allowance. Even with a frozen allowance the total amount held in ISAs continues to go up and up. Well over half is now in S&S ISAs, which have generally done better than Cash ISAs in recent years.1

-

solidpro said:I saw someone discussing the actual 2024 budget document, which says virtually nothing about ISAs, other than freezing the rules until 2030. And yet in the 'repairing the public finances' section, point 31, it shows £605m in tax revenue from 'savings - ISAs and CTFs', by 2030.

His interpretation was that this was by freezing the £20k annual limit until 2030, which was last increased in 2017, the 2017 £20k allowance is, by 2030 worth only about £14k, and that 'extra' 6k (in 2017 terms) would have to go elsewhere - unwrapped investments which incur more tax.

Is this a good assumption? Seems odd that if this was the case, they shows the revenued earned in 2024-26 as £0. Where else would this £605m in ISA and CTF 'tax revenue' come from?

This ⬇️ is the actual video if someone want to watch it https://youtu.be/5u75ouA1Q64?si=x8lPCWPD2GD3ZUiA 0

https://youtu.be/5u75ouA1Q64?si=x8lPCWPD2GD3ZUiA 0 -

Yeah, I know nothing about the guy - it just popped up so I didn't want to share what could be naive/fake news. It was an interesting point though. Is it the case that a lot of government projections have to 'find' £bns in their projections and the easiest ways to guess without being 'found out' is to throw £600m projection here and there and hope nobody notices?

Is there any chance they'll suddenly announce a goal to start to put CGT on 'profits' from S&S ISAs?0 -

There was a big increase in the ISA allowance from £15,240 in 2016/2017 to £20,000 in 2017/2018. So understandable that it hasn't increased since. Most people don't have the earnings after expenditure needs to fill it each year.Somebody with money in say a cash ISA should see it increase in real terms into next tax year because best buy savings interest is more than inflation currently, and on top of that they can subscribe another £20,000 next year. That feels like a real terms increase in how much is sheltered from tax.These are the costings (i.e. savings) from the main budget document from 2024/2025 to 2029/2030 but I wouldn't read too much into them.

I came, I saw, I melted1

I came, I saw, I melted1 -

I think they'll be using figures based on how many people typically contribute the maximum in a year. Consider that £605 million is about £10 per adult. If this is for cash ISAs, that's the tax on £50 or £25 savings outside an ISA, by 2030 - assuming everyone maximises an allowance would be far more than that with typical inflation numbers. So this must be about a far smaller group of people - eg the proportion who do typically contribute the maximum, whether to a cash or S&S ISA.dunstonh said:Fiscal drag is often used in figures. In some areas it makes sense to consider fiscal drag but in others there is less sense.

Personally, I am not so sure fiscal drag reporting works as well with contribution allowances as you would have to assume that everyone putting into an ISA is maximising the allowance each and every year.

And even with fiscal drag, most people can put around £50k into a GIA and suffer no taxation. So, if more people use a GIA, it doesn't necessarily result in more tax from all of them.0 -

You're probably right but there are a lot of assumptions - they must have made an assumption that the £20k would have risen in line with inflation (but would it have been RPI or CPI, and would they have rounded it up or down?). And an assumption that the people who would have used a larger ISA allowance save outside of an ISA instead and therefore pay tax on the interest/investment gains. But they might not, they could decide to add the money to a pension, they might invest it and make a loss, they might put it in Premium Bonds, or they might spend it on a little treat. Some could gift it to a spouse to use their allowance instead... so all in all this is just a made up number!EthicsGradient said:

I think they'll be using figures based on how many people typically contribute the maximum in a year. Consider that £605 million is about £10 per adult. If this is for cash ISAs, that's the tax on £50 or £25 savings outside an ISA, by 2030 - assuming everyone maximises an allowance would be far more than that with typical inflation numbers. So this must be about a far smaller group of people - eg the proportion who do typically contribute the maximum, whether to a cash or S&S ISA.dunstonh said:Fiscal drag is often used in figures. In some areas it makes sense to consider fiscal drag but in others there is less sense.

Personally, I am not so sure fiscal drag reporting works as well with contribution allowances as you would have to assume that everyone putting into an ISA is maximising the allowance each and every year.

And even with fiscal drag, most people can put around £50k into a GIA and suffer no taxation. So, if more people use a GIA, it doesn't necessarily result in more tax from all of them.0 -

It would be interesting to see the modelling behind the numbers. I suspect there are some pretty big assumptions in there!The amounts raised for this measure are a lot larger in this budget than the 2023 Autumn statement - that had £130m for 2028-9 compared to £285m this time. Possibly this is due to a secondary effect of other measures. eg bringing SIPPs into IHT can be expected to lead to less cash being put into them in future.0

-

That all being said - the jump from nothing to £15m to £600m in a few years with no real reason given does tend to make a lot of the figures look like they were plucked out of nowhere. It seems that the 'fiscal drag' assumption in the YT video is generally agreed to be correct then...?

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards