We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Best way to pay off multiple

Comments

-

Hamiltonc said:Thanks all - it's a mixture of a previous car balance, holidays, wedding etc

I don't spend on any of those so the balances are static

I pay minimum payment plus a little bit but no real plan around what ones to reduce firstTo be honest, if the balances are more or less static and all you can pay is the minimum payments 'plus a little bit' then perhaps post over in the debt free wannabe forum:Also create a full statement of affairs:The regular folks over on the Debt free wannabe section are really helpful and non judgemental and will be able to help you work through it.0 -

I'd have to work it out as it's difficult to work out, I have all income and outgoings listed so I know the remaining but within that need to take account for general spend so I'd say between £500-£10000

-

You really need to do a statement of affairs, listing all your income and outgoings. This will help you work out where you can trim your spending to pay off those debts and how much money you can feasibility throw at the debts to pay them off.Hamiltonc said:I'd have to work it out as it's difficult to work out, I have all income and outgoings listed so I know the remaining but within that need to take account for general spend so I'd say between £500-£1000

£40k ish on credit cards or loans is a lot of money to owe.

If you're serious about becoming debt free you probably can't go on any fancy holidays for a few years. The sooner you create that SOA the better.0 -

Don't take this the wrong way but you do seem very prone to finding reasons why you haven't yet come up with a plan, rather than knuckling down and getting on with it!Hamiltonc said:I'd have to work it out as it's difficult to work out

Just to be clear, that £500-£1000 is for repayments over and above the minimum ones?Hamiltonc said:I have all income and outgoings listed so I know the remaining but within that need to take account for general spend so I'd say between £500-£1000

As above, it seems likely that you need to take a more radical approach rather than feeling that gradually making inroads while maintaining the same lifestyle will clear the debts within sensible timescales. How much have you reduced your debt by since posting about it ten months ago?0 -

I can't confirm the reduction but things have been added since those ten months but now no transactions go on any of those0

-

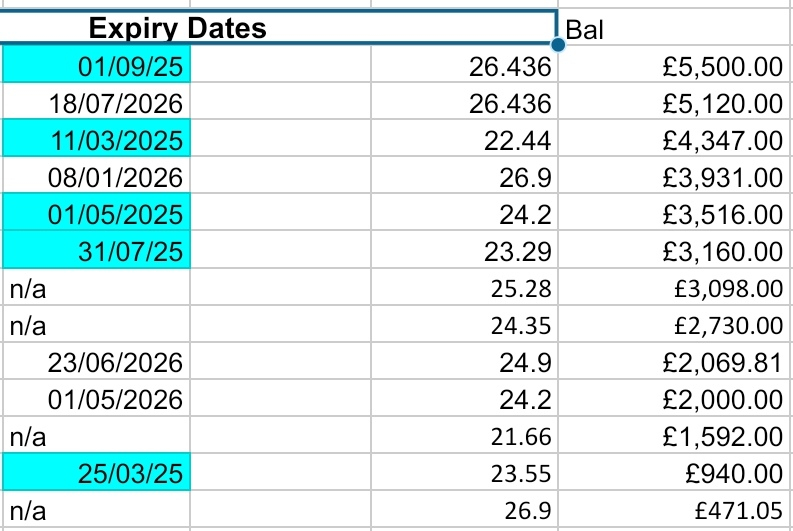

Updated screenshot with interest rate. Some are 0% still and some are not

0 -

Looking at the number of cards you have, personally I would suggest an alternative option to pay them off, rather than the avalanche technique which others have suggested (where debts are paid off highest to lowest interest rate) you may want to consider the other technique (snowball) instead.

Whilst this can mean you get more interest overall, but some find it easier to see quick wins and that can increase the likelihood of actually sticking with a plan.

Basically with the snowball option you pay of minimums off all (or minimum+£1) to all debts except the smallest debt, and throw everything extra on that one.

So as an example on your list below, pay off the £471.05 first, then when that is done, pay off the £940. then then £1592 etc working your way up to then reduce overtime the debts you hold and the different numbers of debts.

This is more suited for those whom find the momentum and benefits of "quicker" wins at seeing progress being made.

I certainly found when clearing my debts this was a better incentive and reduced me from being put off by the time taking to clear off higher ones first.

Also each time a card / debt is paid off in full then that frees up the minimum you were paying on that card to throw to the next debt above it as well, and that rolls up each time and means the payments you make are split over less providers and are more concentrated. So for example once the £471.05 one is paid off, that means you are no longer needing to pay a minim on that card and as such can then pay that minimum to the next card on the list so the £940 and then that continues as you go upwards.

Alternatively you can do a mixture of snowball and averlanche by paying minimums on the 0% cards completely and ordering the interest bearing ones in smallest to largest balance and clear the smallest of each of those in order moving upwards, and once they are cleared move to the 0% cards.MFW#105 - 2015 Overpaid £8095 / 2016 Overpaid £6983.24 / 2017 Overpaid £3583.12 / 2018 Overpaid £2583.12 / 2019 Overpaid £2583.12 / 2020 Overpaid £2583.12/ 2021 overpaid £1506.82 /2022 Overpaid £2975.28 / 2023 Overpaid £2677.30 / 2024 Overpaid £2173.61 Total OP since mortgage started in 2015 = £37,286.86 2025 MFW target £1700, payments to date at April 2025 - £1712.07..0 -

If it was me and I had £500 after paying off all the minimums, I'd get rid of the £471 card. I'd do it now, that would be Novembers win.

That is a lot of debt though, have you got any high value items you can sell?Debt Free: 01/01/2020

Mortgage: 11/09/20240 -

Thank you - yeah currently I am doing minimum payment plus a little bit generally across all just to sort my money in order - once I've got it in order I was going to tackle smaller first but taking into account the larger balances of which some are expiring in the next 6 monthsanna42hmr said:Looking at the number of cards you have, personally I would suggest an alternative option to pay them off, rather than the avalanche technique which others have suggested (where debts are paid off highest to lowest interest rate) you may want to consider the other technique (snowball) instead.

Whilst this can mean you get more interest overall, but some find it easier to see quick wins and that can increase the likelihood of actually sticking with a plan.

Basically with the snowball option you pay of minimums off all (or minimum+£1) to all debts except the smallest debt, and throw everything extra on that one.

So as an example on your list below, pay off the £471.05 first, then when that is done, pay off the £940. then then £1592 etc working your way up to then reduce overtime the debts you hold and the different numbers of debts.

This is more suited for those whom find the momentum and benefits of "quicker" wins at seeing progress being made.

I certainly found when clearing my debts this was a better incentive and reduced me from being put off by the time taking to clear off higher ones first.

Also each time a card / debt is paid off tin full then that frees up the minimum you were paying on that card to throw to the next one above it as well, and that rolls up each time and means the payments you make are split over less providers and are more concentrated.

Alternatively you can do a mixture of snowball and averlanche by paying minimums on the 0% cards completely and ordering the interest bearing ones in smallest to largest balance and clear the smallest of each of those in order moving upwards, and once they are cleared move to the 0% cards.

I just wanted to see if what I am doing seems sensible and I think it could be - just want to get these down as quickly as possible0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.2K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.9K Spending & Discounts

- 246.3K Work, Benefits & Business

- 602.4K Mortgages, Homes & Bills

- 177.9K Life & Family

- 260.2K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards