We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

2k investment

Comments

-

For most normal people, a global tracker fund/etf will do the job and should allow you to retire comfortably in old age.

For the experienced investors, individual stock picking is the preferred option.0 -

Quite right. With those new to investing, the path can be very confusing. A lot of the newer investing apps can make investing seem easy and like a game and is so convenient on a phone.eskbanker said:

Yes, I was careful to carve out "those with the time, capacity and willingness to conduct detailed due diligence on individual companies" from the more typical long-term investor who'd simply be looking for financial growth rather than the 'thrill of the chase' - it's perhaps a generalisation but I'd maintain that those (like OP) who are posting to ask for basic guidance on where to start are less likely to be inquisitive and motivated enough to make a success of investing in individual shares!DasTechniker said:

Exactly. My mistake as I should have said Highest Dividend paying shares in the FTSE. In that scenario you tend to get shares that have dropped in price while the dividend yield rises and can lead to a bunching of companies such as the banks in 2007 - 2008. The upshot of all this is how far you want to go when investing. Personally, I enjoyed studying the various companies and could be an anorak when asked to comment by friends. 😁 In my case, I would have found ETF’s or trackers a bit boring. It all depends how deep you want to get with stock market investing. I certainly treated it as a hobby in the hope of making a few bucks and wouldn’t have made my future finances dependent on it as some do.eskbanker said:

Except for those with the time, capacity and willingness to conduct detailed due diligence on individual companies, diversification has to be the best approach for investors, especially inexperienced ones. It's often pointed out on here that the FTSE100 itself isn't particularly well diversified, and obviously that's even more true for a small subset of it, so, while ten equities are likely to be better than one, and a hundred better than ten, the usual recommendation is to diversify globally, to minimise risks from underperforming sectors or markets.DasTechniker said:But for what it’s worth- and you shouldn’t take this as a recommendation- I used to use the O’ Higgins system mostly. Buying the top ten shares in the FTSE, holding for a year, collecting the dividends as they came along and after the twelve months, reviewing which shares had dropped out of the top ten and then the new ones that had entered. As ever, there is still a danger that a company can go bust!

There are many options, including global equity funds and multi-asset funds, available to today's investor (far more so than 35 years ago!), so OP is likely to be better served by using such collective products rather than individual shares.0 -

Agree. Don't invest in what you don't understand.PropertyGuru_Wannabe said:For most normal people, a global tracker fund/etf will do the job and should allow you to retire comfortably in old age.

For the experienced investors, individual stock picking is the preferred option.1 -

DasTechniker said:

As zagfles said, it’s best to try to educate yourself or at least get an understand of how the market works before committing. I’ve been investing for 30 years and still learning! I first got interested in share dealing because of our company share scheme and some of us formed a share dealing club - that is a good way of getting a feeling of what is going on. In those days, you had to phone up a broker to place an order as trading platforms were only just emerging.rockchick113 said:I’m looking to maybe start a stock and share savings. But unsure on where to start, how do people make money in shares? Or is it just another form of gambling ? I’m looking for long term investment

Nowadays, I use online dealing via iWeb at £5 a throw. I still sometimes buy and sell, but have in recent times become more interested in regular savings accounts as my time horizon is getting shorter.But for what it’s worth- and you shouldn’t take this as a recommendation- I used to use the O’ Higgins system mostly. Buying the top ten shares in the FTSE, holding for a year, collecting the dividends as they came along and after the twelve months, reviewing which shares had dropped out of the top ten and then the new ones that had entered. As ever, there is still a danger that a company can go bust!

Edit to above: Over 35 years. Time does fly 😁

Edit to the edit: I should have said: Highest yielding dividend shares in the ftse. 🫣I've not heard of the O'Higgins system before but this is IC's summary in 2009 (my bold):"The system is based on dividend yields. The method is to take the 10 highest-yielding stocks in the Dow Jones index (or, in this case, the FT 30), and then invest an equal amount in the five that, at the time, have the lowest absolute share prices in dollars (or, in this case, pence). The selections are then left undisturbed for 12 months."

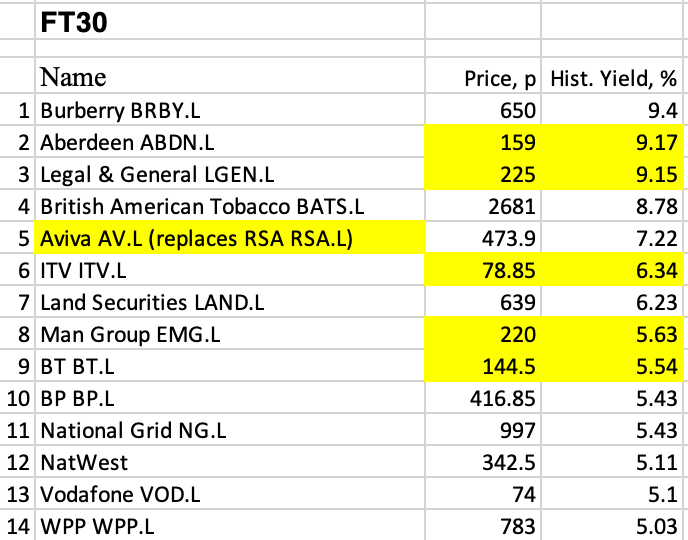

So five 'dog' companies, not even ten. If we use the FTSE100 ranking by historical dividend yield* and the lowest absolute share price it looks like you'd end up with Phoenix, L&G, Aviva, Schroders and M&G: definitely not a good way for a newb to go. FT30 would be something like Aberdeen, L&G, ITV, Man Group & BT. Hmmm...! Amusing to think about, though.*Excludes Vodafone as it's already announced that the dividend is to be halved and this puts it behind Schroders.0 -

DasTechniker said:

Exactly. My mistake as I should have said Highest Dividend paying shares in the FTSE. In that scenario you tend to get shares that have dropped in price while the dividend yield rises and can lead to a bunching of companies such as the banks in 2007 - 2008. The upshot of all this is how far you want to go when investing. Personally, I enjoyed studying the various companies and could be an anorak when asked to comment by friends. 😁 In my case, I would have found ETF’s or trackers a bit boring. It all depends how deep you want to get with stock market investing. I certainly treated it as a hobby in the hope of making a few bucks and wouldn’t have made my future finances dependent on it as some do.eskbanker said:

Except for those with the time, capacity and willingness to conduct detailed due diligence on individual companies, diversification has to be the best approach for investors, especially inexperienced ones. It's often pointed out on here that the FTSE100 itself isn't particularly well diversified, and obviously that's even more true for a small subset of it, so, while ten equities are likely to be better than one, and a hundred better than ten, the usual recommendation is to diversify globally, to minimise risks from underperforming sectors or markets.DasTechniker said:But for what it’s worth- and you shouldn’t take this as a recommendation- I used to use the O’ Higgins system mostly. Buying the top ten shares in the FTSE, holding for a year, collecting the dividends as they came along and after the twelve months, reviewing which shares had dropped out of the top ten and then the new ones that had entered. As ever, there is still a danger that a company can go bust!

There are many options, including global equity funds and multi-asset funds, available to today's investor (far more so than 35 years ago!), so OP is likely to be better served by using such collective products rather than individual shares.Be careful and understand what data you are looking at.Statistics for shares usually quote yesterday's prices and the current percentage yield which is last year's dividend income divided by the latest price. The danger is that if the share's price drops because the company has just announced a dividend reduction, the yield will automatically rise! - the share price reflects how the market perceives the prospects for the company in the future, but the yield is based on dividend income in the past. Just picking the top yielding shares is high risk if you don't monitor why there is a high yield. If you go for a collective investment either a fund or investment trust with a track record of steady growth & yield, then you're less likely to face unexpected problems.There are costs involved in making and holding investments in stocks & shares. If the individual investment is small, then the costs or charges for making that investment may wipe out any potential gains! I would suggest that if your total investment is £2k, then a single investment in a collective low-cost fund is your best option - trying to diversify yourself would lead to tiny uneconomic individual purchases.

0 -

Yes, The Dogs of the Dow theory was a system of stock picking devised by Michael B. O'Higgins in the nineties. I've got a copy of his book in front of me now, published in 2000, called Beating the Dow. Essentially, it's based on the Dow Jones index of U.S. major companies. Nowadays, although that index is still quoted in the new etc, the S&P 500 is a better representation of the health of the U.S. markets as it's obviously more diverse. The FT 30 is an old index which is not used much any more and was dropped when the FT 100 was devised. In reality the dogs of the Dow is a type of value investing system - shares that are down on their luck and will recover in time (hopefully). While waiting for the recovery, you will collect the dividends. That is the essence of the theory. The buying signal for these shares is obviously the high dividend yield.wmb194 said:DasTechniker said:

As zagfles said, it’s best to try to educate yourself or at least get an understand of how the market works before committing. I’ve been investing for 30 years and still learning! I first got interested in share dealing because of our company share scheme and some of us formed a share dealing club - that is a good way of getting a feeling of what is going on. In those days, you had to phone up a broker to place an order as trading platforms were only just emerging.rockchick113 said:I’m looking to maybe start a stock and share savings. But unsure on where to start, how do people make money in shares? Or is it just another form of gambling ? I’m looking for long term investment

Nowadays, I use online dealing via iWeb at £5 a throw. I still sometimes buy and sell, but have in recent times become more interested in regular savings accounts as my time horizon is getting shorter.But for what it’s worth- and you shouldn’t take this as a recommendation- I used to use the O’ Higgins system mostly. Buying the top ten shares in the FTSE, holding for a year, collecting the dividends as they came along and after the twelve months, reviewing which shares had dropped out of the top ten and then the new ones that had entered. As ever, there is still a danger that a company can go bust!

Edit to above: Over 35 years. Time does fly 😁

Edit to the edit: I should have said: Highest yielding dividend shares in the ftse. 🫣I've not heard of the O'Higgins system before but this is IC's summary in 2009 (my bold):"The system is based on dividend yields. The method is to take the 10 highest-yielding stocks in the Dow Jones index (or, in this case, the FT 30), and then invest an equal amount in the five that, at the time, have the lowest absolute share prices in dollars (or, in this case, pence). The selections are then left undisturbed for 12 months."

So five 'dog' companies, not even ten. If we use the FTSE100 ranking by historical dividend yield* and the lowest absolute share price it looks like you'd end up with Phoenix, L&G, Aviva, Schroders and M&G: definitely not a good way for a newb to go. FT30 would be something like Aberdeen, L&G, ITV, Man Group & BT. Hmmm...! Amusing to think about, though.*Excludes Vodafone as it's already announced that the dividend is to be halved and this puts it behind Schroders.

When I was using this system, I didn't stick too rigidly to the criteria. If a share didn't seem all it was made out to be, I would just move on to the next. eg, it might have a large yield but some very negative comments about it circulating might make me look very hard at it.

It worked ok for me and very profitable at times. Of course being the FTSE, when hard times hit, it all takes a hit. You just have to not panic and ride it out. I'll give an example; When the banking crisis hit I had shares in all the banks. I was getting hammered as you can imagine. I took a gamble of selling all except Barclays. They had arranged a private fundraising via middle east funding. Placed all my remaining cash into Barclays, and they were the first to recover because they didn't have to take cash from the government so avoided "Nationalisation". Luckily came out just ahead with a very small profit. Such is life.0 -

As things stand with commission free brokers like Trading212, Robinhood UK, Freetrade and CMC Invest this is a non-issue. Apart from Robinhood, these brokers also offer ETFs and Investment Trusts so collective investments are cheap to own via them as well.pafpcg said:DasTechniker said:

Exactly. My mistake as I should have said Highest Dividend paying shares in the FTSE. In that scenario you tend to get shares that have dropped in price while the dividend yield rises and can lead to a bunching of companies such as the banks in 2007 - 2008. The upshot of all this is how far you want to go when investing. Personally, I enjoyed studying the various companies and could be an anorak when asked to comment by friends. 😁 In my case, I would have found ETF’s or trackers a bit boring. It all depends how deep you want to get with stock market investing. I certainly treated it as a hobby in the hope of making a few bucks and wouldn’t have made my future finances dependent on it as some do.eskbanker said:

Except for those with the time, capacity and willingness to conduct detailed due diligence on individual companies, diversification has to be the best approach for investors, especially inexperienced ones. It's often pointed out on here that the FTSE100 itself isn't particularly well diversified, and obviously that's even more true for a small subset of it, so, while ten equities are likely to be better than one, and a hundred better than ten, the usual recommendation is to diversify globally, to minimise risks from underperforming sectors or markets.DasTechniker said:But for what it’s worth- and you shouldn’t take this as a recommendation- I used to use the O’ Higgins system mostly. Buying the top ten shares in the FTSE, holding for a year, collecting the dividends as they came along and after the twelve months, reviewing which shares had dropped out of the top ten and then the new ones that had entered. As ever, there is still a danger that a company can go bust!

There are many options, including global equity funds and multi-asset funds, available to today's investor (far more so than 35 years ago!), so OP is likely to be better served by using such collective products rather than individual shares.There are costs involved in making and holding investments in stocks & shares. If the individual investment is small, then the costs or charges for making that investment may wipe out any potential gains!0 -

For the first sentence probably more accurate to say .' For inexperienced investors with a highish risk tolerance, then a global tracker fund will do the job, but for the majority who would not like the volatility, a multi asset fund would also be suitable'PropertyGuru_Wannabe said:For most normal people, a global tracker fund/etf will do the job and should allow you to retire comfortably in old age.

For the experienced investors, individual stock picking is the preferred option.0 -

1. Yes the O'Higgins way was called "Dogs of the Dow"

When it travelled to the UK it became "Dogs of the FTSE" and popped up in the motley fool & some UK newspapers and mags.Then someone started a High Five Fund based on it, if I remember correctly it did not last too long.

2 There was an O'Higgins Optimum single share approach, where you buy the "SECOND lowest price" of the top ten in the DOW". When Jim Slater wrote about it he modified it saying to buy the

"SECOND highest dividend yielding FTSE 100 share", as this provided a more consistent yearly performance.

3. Investing may be made as simple or as complicated as you care to make it. The simple approach of having a diversified portfolio of 1000's of shares at the lowest cost, is going to serve newbies best. They can do this today by choosing a passive low cost Global Index or Global Index Multi Asset Fund & staying away from individual shares..

Academic research keeps showing professionals can not after charges beat a simple index fund.

So unless we are are very lucky or can see into the future I doubt we will either.1 -

Quite agree.Eyeful said:1. Yes the O'Higgins way was called "Dogs of the Dow"

When it travelled to the UK it became "Dogs of the FTSE" and popped up in the motley fool & some UK newspapers and mags.Then someone started a High Five Fund based on it, if I remember correctly it did not last too long.

2 There was an O'Higgins Optimum single share approach, where you buy the "SECOND lowest price" of the top ten in the DOW". When Jim Slater wrote about it he modified it saying to buy the

"SECOND highest dividend yielding FTSE 100 share", as this provided a more consistent yearly performance.

3. Investing may be made as simple or as complicated as you care to make it. The simple approach of having a diversified portfolio of 1000's of shares at the lowest cost, is going to serve newbies best. They can do this today by choosing a passive low cost Global Index or Global Index Multi Asset Fund & staying away from individual shares..

Academic research keeps showing professionals can not after charges beat a simple index fund.

So unless we are are very lucky or can see into the future I doubt we will either.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards