We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Small Pension Pots

Comments

-

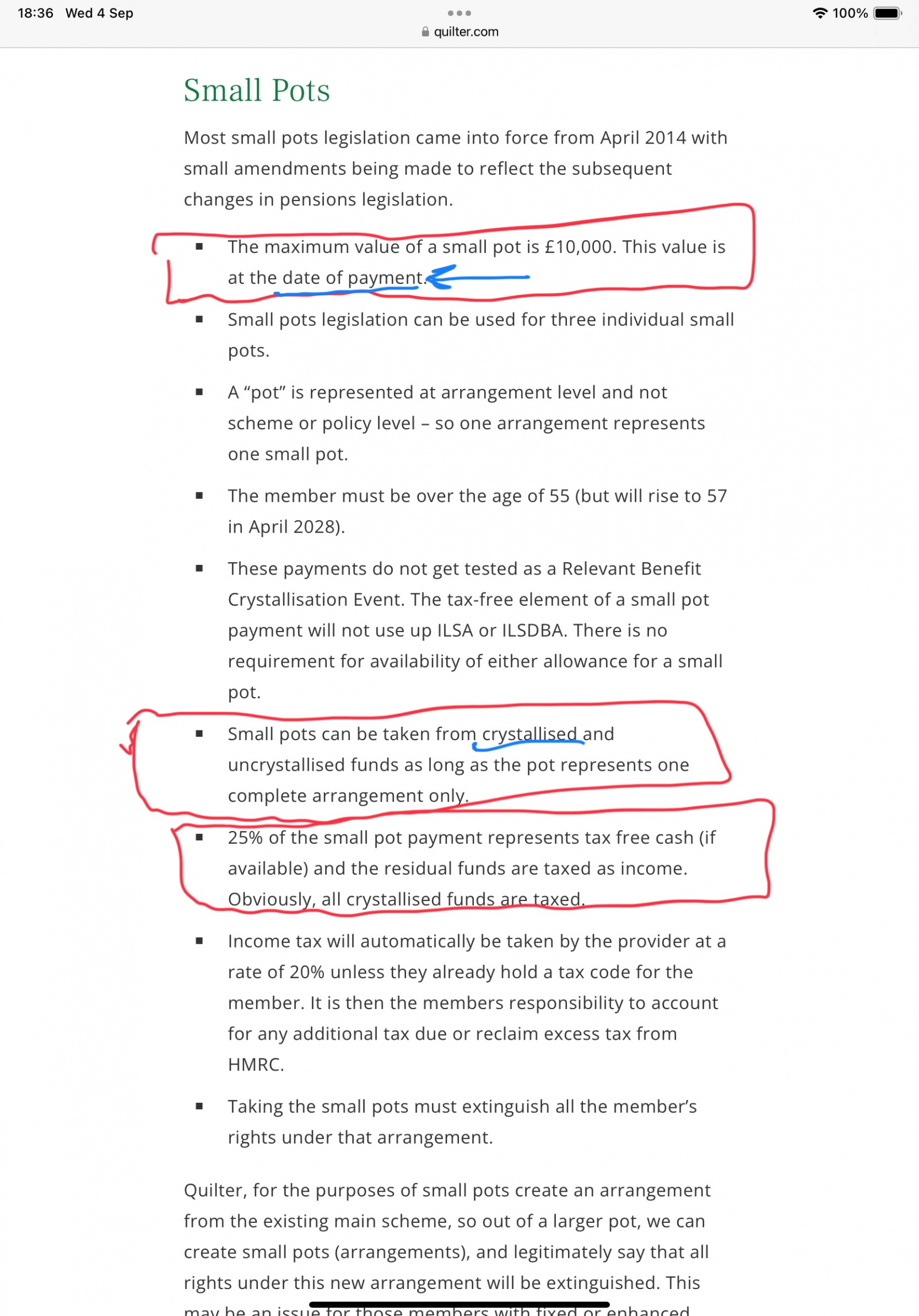

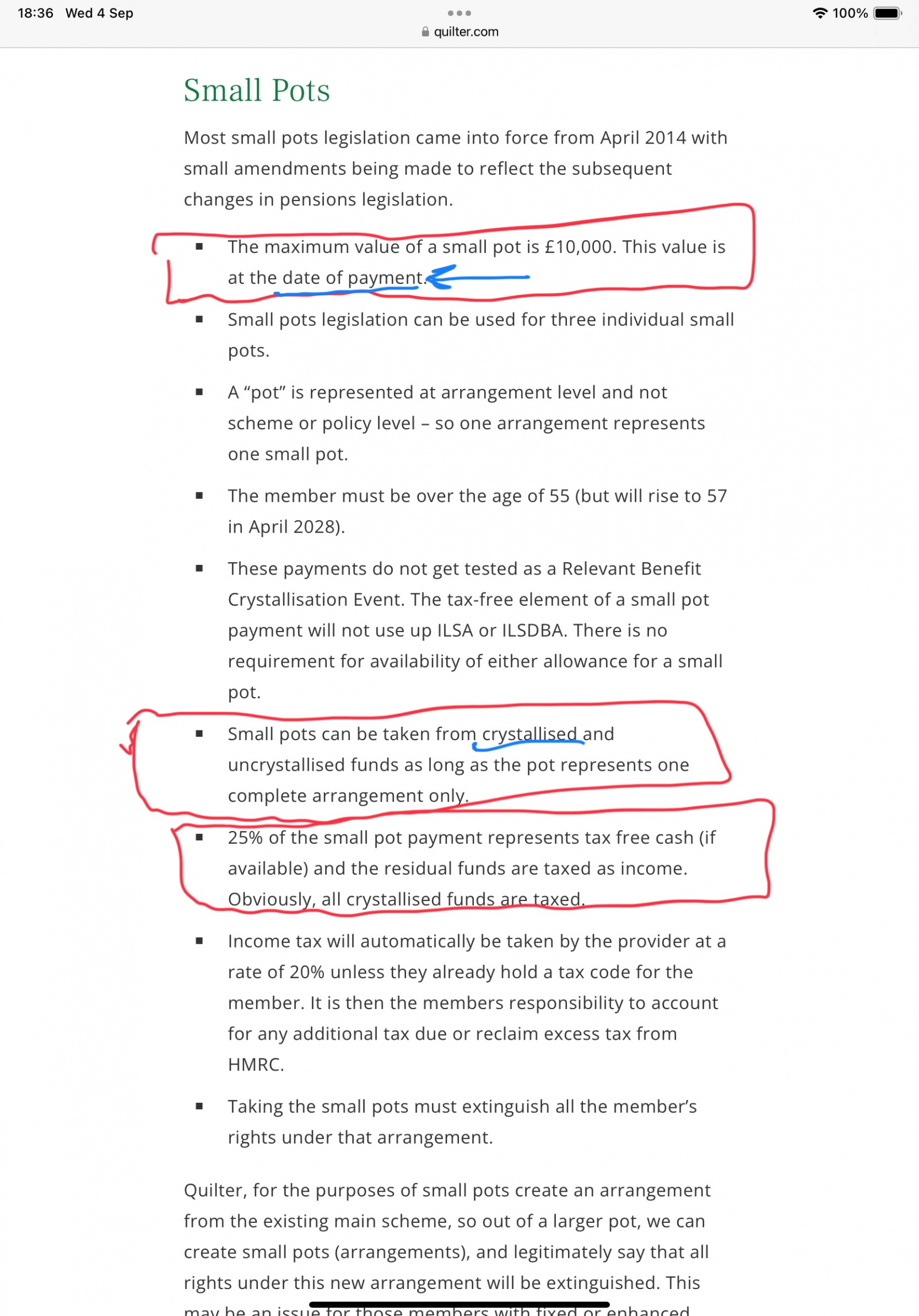

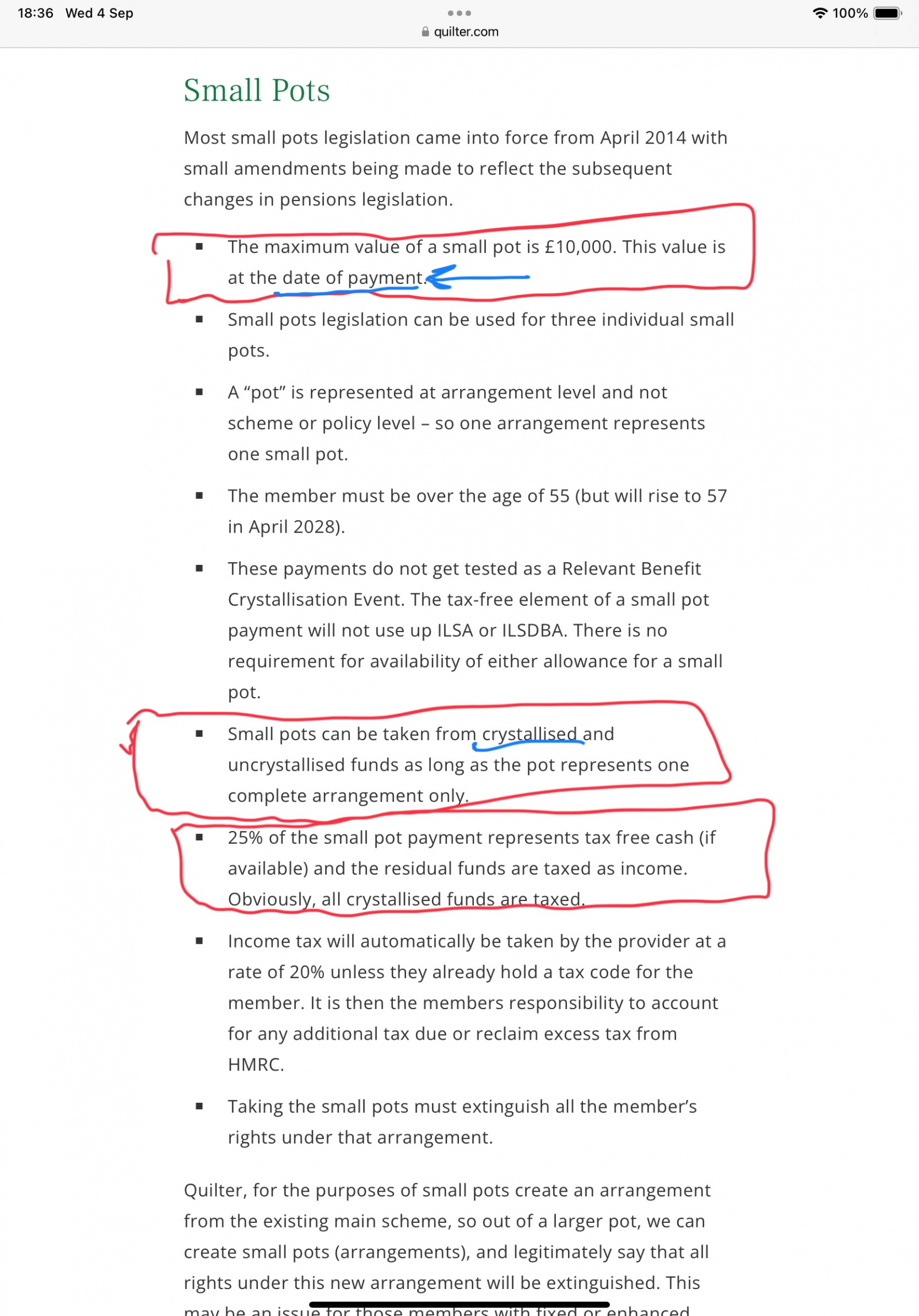

I'm always willing to acknowledge when I'm wrong, and apologise where necessary, but I think what you've posted surely confirms what I've said - especially the last bullet point and the text right at the bottom. Splitting a bigger pot is entirely legitimate (I believe HL also does so when asked), but has to be done before it is accessed as a 'small pot'.FIREDreamer said:

Are you sure?Marcon said:

No. The 'pot' was never small enough to be withdrawn under the small pots rule.FIREDreamer said:

I think you can - but you need to tell them that you want to use the “small pots” facility and not just make a normal taxable withdrawal.Greenwaves said:Hi,If I had a small pension pot of 12k and have taken the 25% tax free cash (3k), can I still cash in the remaining 9K under the small pots rule without triggering the MPAA?Many thanksG

You need to cash in the whole of a small pot in one go and it needs to be under £10K in total (ie including tax free cash) at the time you cash it in. OP has already taken the tax free cash, so the whole of the remaining £9K will be subject to tax and drawing any of it will trigger the MPAA. Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1

Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1 -

You are, and thank you. Maybe you could go back to Quilter and point out that for the average reader, there is an ambiguity in what they say? That really could be helpful to plenty of people who are struggling with this weird world known as pensions.FIREDreamer said:

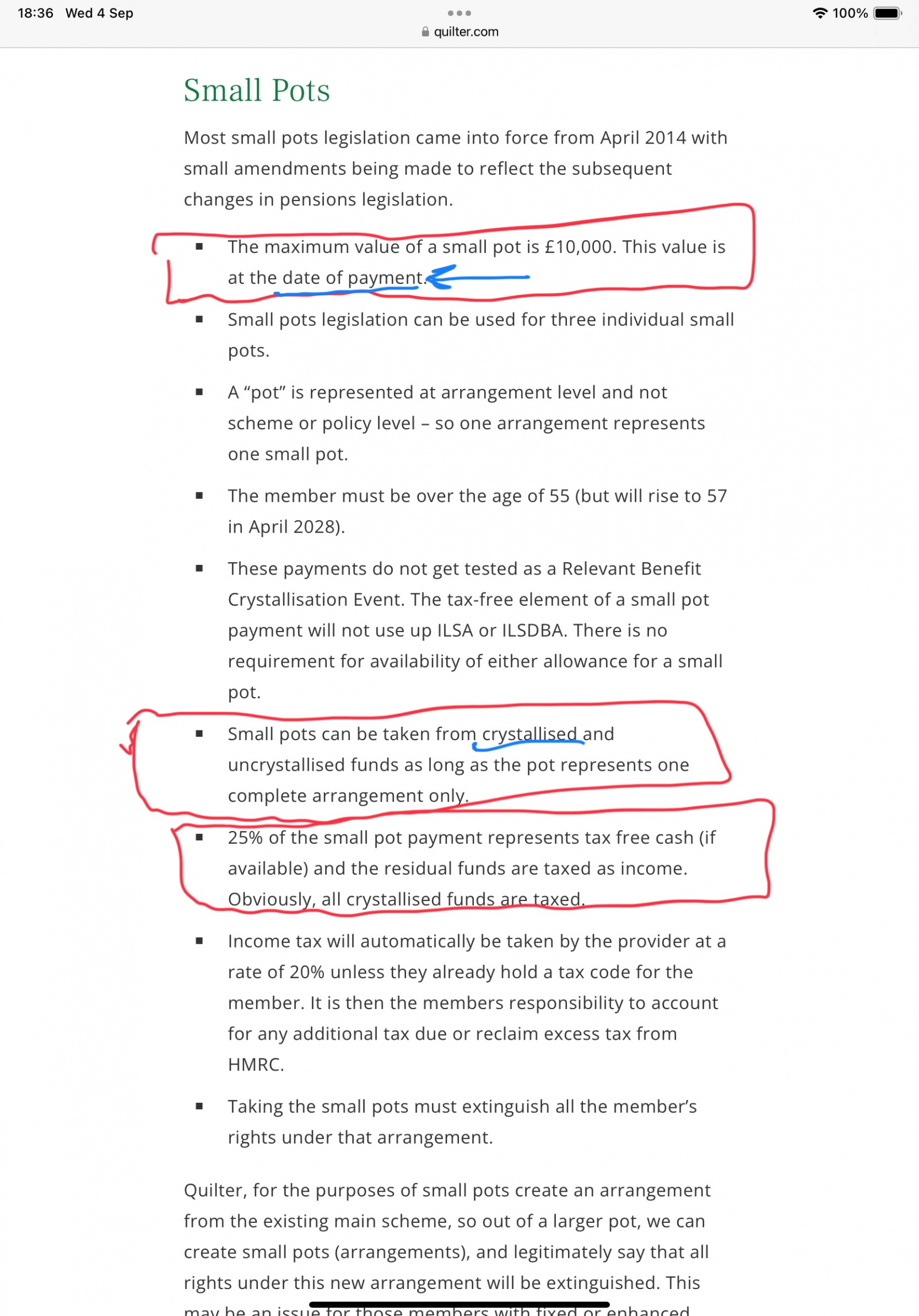

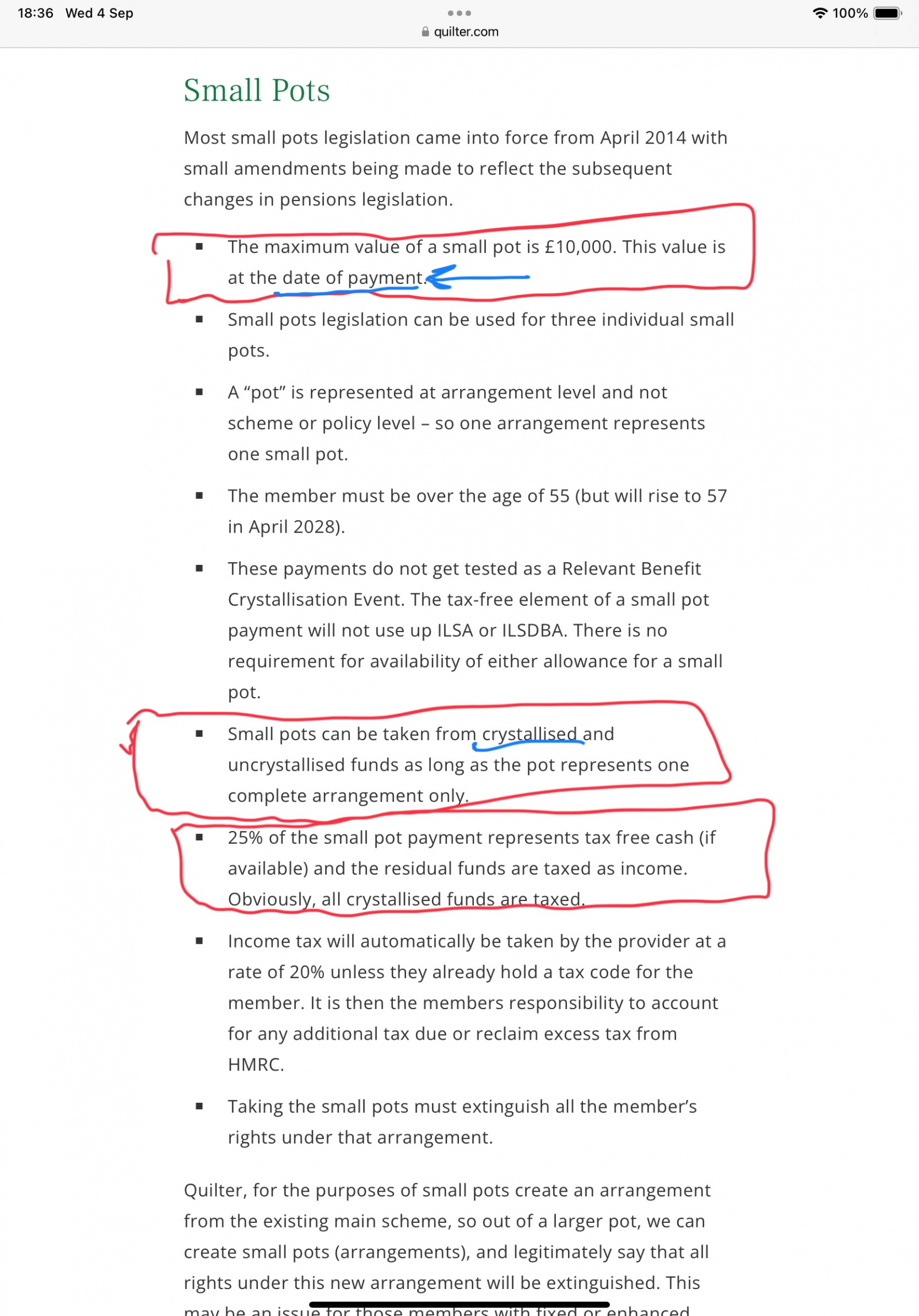

But it mentions value as at date of taking the small pot, which is £9k. And it is still a complete (single) arrangement at that time.Dazed_and_C0nfused said:

Doesn't the second part circled prove MPAA will be triggered?FIREDreamer said:

Are you sure?Marcon said:

No. The 'pot' was never small enough to be withdrawn under the small pots rule.FIREDreamer said:

I think you can - but you need to tell them that you want to use the “small pots” facility and not just make a normal taxable withdrawal.Greenwaves said:Hi,If I had a small pension pot of 12k and have taken the 25% tax free cash (3k), can I still cash in the remaining 9K under the small pots rule without triggering the MPAA?Many thanksG

You need to cash in the whole of a small pot in one go and it needs to be under £10K in total (ie including tax free cash) at the time you cash it in. OP has already taken the tax free cash, so the whole of the remaining £9K will be subject to tax and drawing any of it will trigger the MPAA.

"as long as the pot represents one complete arrangement only"

Which is £12k in this case, the £3k TFLS plus remaining £9k.

I agree this is all ambiguous at best and I am only trying to help.

One of my favourite sites (for both clarity and accuracy) is https://www.litrg.org.uk/pensions/pension-withdrawals/small-pensions#:~:text=For%20personal%20pensions%2C%20up%20to,cannot%20take%20it%20in%20stages.

and they have this to say (my emboldening of text):Small pots

As explained above, the trivial commutation rules apply only to certain occupational pensions.

However, there are ‘small pots’ rules which can also apply to both these and other occupational and personal pensions in which you build up a pot of value (called money purchase or defined contribution schemes).

If you are a member of occupational pension schemes, any number of ‘small pots’ can be paid out as a lump sum to you, as long as the schemes are each valued at £10,000 or less. If the value of a single pot is over £10,000, and the scheme qualifies, the trivial commutation rules might instead apply.

For personal pensions, up to three pots worth up to £10,000 each can also be cashed in under the ‘small pots’ rules.

As with trivial commutations, if you take lump sums under the ‘small pots’ rules, you must take the whole value from each pension pot at once – you cannot take it in stages. If you do not want to take the whole value at once, the pensions flexibility rules might be more appropriate for you.

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.

Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

Here is another view which might suggest no MPAA (perhaps an expert like @dunstonh might confirm yay or nay?Marcon said:

You are, and thank you. Maybe you could go back to Quilter and point out that for the average reader, there is an ambiguity in what they say? That really could be helpful to plenty of people who are struggling with this weird world known as pensions.FIREDreamer said:

But it mentions value as at date of taking the small pot, which is £9k. And it is still a complete (single) arrangement at that time.Dazed_and_C0nfused said:

Doesn't the second part circled prove MPAA will be triggered?FIREDreamer said:

Are you sure?Marcon said:

No. The 'pot' was never small enough to be withdrawn under the small pots rule.FIREDreamer said:

I think you can - but you need to tell them that you want to use the “small pots” facility and not just make a normal taxable withdrawal.Greenwaves said:Hi,If I had a small pension pot of 12k and have taken the 25% tax free cash (3k), can I still cash in the remaining 9K under the small pots rule without triggering the MPAA?Many thanksG

You need to cash in the whole of a small pot in one go and it needs to be under £10K in total (ie including tax free cash) at the time you cash it in. OP has already taken the tax free cash, so the whole of the remaining £9K will be subject to tax and drawing any of it will trigger the MPAA.

"as long as the pot represents one complete arrangement only"

Which is £12k in this case, the £3k TFLS plus remaining £9k.

I agree this is all ambiguous at best and I am only trying to help.

One of my favourite sites (for both clarity and accuracy) is https://www.litrg.org.uk/pensions/pension-withdrawals/small-pensions#:~:text=For%20personal%20pensions%2C%20up%20to,cannot%20take%20it%20in%20stages.

and they have this to say (my emboldening of text):Small pots

As explained above, the trivial commutation rules apply only to certain occupational pensions.

However, there are ‘small pots’ rules which can also apply to both these and other occupational and personal pensions in which you build up a pot of value (called money purchase or defined contribution schemes).

If you are a member of occupational pension schemes, any number of ‘small pots’ can be paid out as a lump sum to you, as long as the schemes are each valued at £10,000 or less. If the value of a single pot is over £10,000, and the scheme qualifies, the trivial commutation rules might instead apply.

For personal pensions, up to three pots worth up to £10,000 each can also be cashed in under the ‘small pots’ rules.

As with trivial commutations, if you take lump sums under the ‘small pots’ rules, you must take the whole value from each pension pot at once – you cannot take it in stages. If you do not want to take the whole value at once, the pensions flexibility rules might be more appropriate for you.

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.

1 -

Thanks everyone for your helpful comments.

My understanding is taking a small pot will not trigger the MPAA.

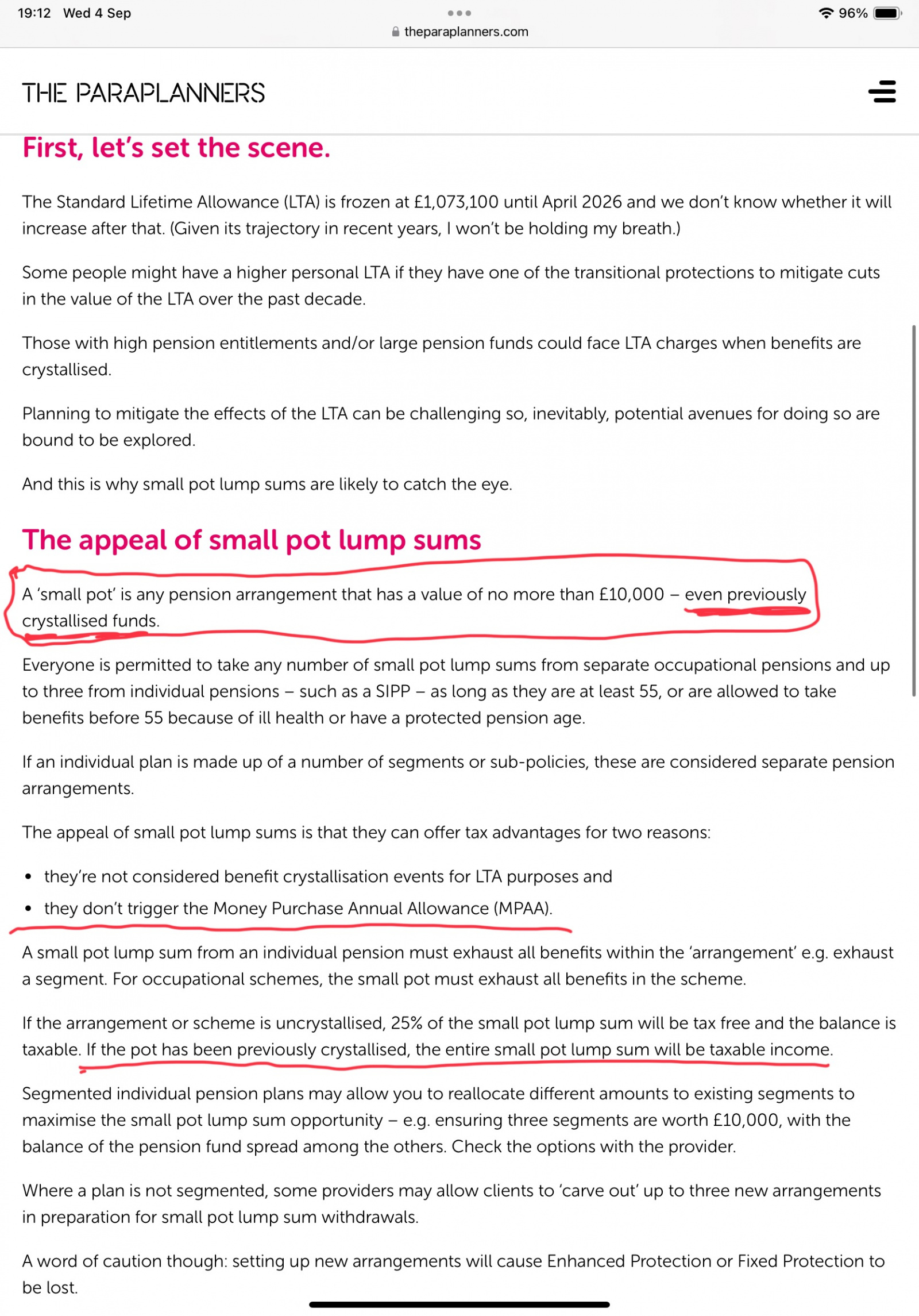

However what is a small pot, the highlighted sections above raise questions "has a value of no more than 10k even crystallised funds". But is the small pot < 10k crystallized or < 10k before crystallisation?

And another section "if the pot is previously crystallized the entire small pot will be taxable", suggests that even after a previous withdrawal you can still take the crystallized amount as a small pot.

So I'm not really any further forward and yes I did read all the previous posts but nothing has become crystal clear :-)0 -

I too am getting interested in an answer from one of the IFAs posting regularly on this forum. Not one of them has ever suggested that a small pot can be taken other than in one go, with a value of under £10K, but maybe none of us has ever really delved sufficiently deeply into the legislation. I might do a deep dive at some point, but if someone else can cite the relevant legislation that would be ever better! I read enough pensions law, and the HMRC manual, quite enough to keep me amused...Greenwaves said:Thanks everyone for your helpful comments.

My understanding is taking a small pot will not trigger the MPAA.

However what is a small pot, the highlighted sections above raise questions "has a value of no more than 10k even crystallised funds". But is the small pot < 10k crystallized or < 10k before crystallisation?

And another section "if the pot is previously crystallized the entire small pot will be taxable", suggests that even after a previous withdrawal you can still take the crystallized amount as a small pot.

So I'm not really any further forward and yes I did read all the previous posts but nothing has become crystal clear :-)Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!0 -

The below section seems to cover it (which now has my head spinning). My naive interpretation is, if what is currently in the pension does not exceed 10k ( I thought it was <10k, but it's quite clear it is <= ) then you can take it all (crystallized or uncrystallized) as a final payment as long as it extinguishes your rights in the scheme. But I love to hear other views as I'm a complete novice at this (but I do like reading regulations). I think this is the SIPP section ...

Section 164(1)(f) Finance Act 2004

Regulation 10 and 11A The Registered Pension Schemes (Authorised Payments) Regulations 2009 - SI 2009/1171

Google PTM063700 , sorry I'm not allowed to post links yet.

0 -

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.Marcon said:

You are, and thank you. Maybe you could go back to Quilter and point out that for the average reader, there is an ambiguity in what they say? That really could be helpful to plenty of people who are struggling with this weird world known as pensions.FIREDreamer said:

But it mentions value as at date of taking the small pot, which is £9k. And it is still a complete (single) arrangement at that time.Dazed_and_C0nfused said:

Doesn't the second part circled prove MPAA will be triggered?FIREDreamer said:

Are you sure?Marcon said:

No. The 'pot' was never small enough to be withdrawn under the small pots rule.FIREDreamer said:

I think you can - but you need to tell them that you want to use the “small pots” facility and not just make a normal taxable withdrawal.Greenwaves said:Hi,If I had a small pension pot of 12k and have taken the 25% tax free cash (3k), can I still cash in the remaining 9K under the small pots rule without triggering the MPAA?Many thanksG

You need to cash in the whole of a small pot in one go and it needs to be under £10K in total (ie including tax free cash) at the time you cash it in. OP has already taken the tax free cash, so the whole of the remaining £9K will be subject to tax and drawing any of it will trigger the MPAA.

"as long as the pot represents one complete arrangement only"

Which is £12k in this case, the £3k TFLS plus remaining £9k.

I agree this is all ambiguous at best and I am only trying to help.

One of my favourite sites (for both clarity and accuracy) is https://www.litrg.org.uk/pensions/pension-withdrawals/small-pensions#:~:text=For%20personal%20pensions%2C%20up%20to,cannot%20take%20it%20in%20stages.

and they have this to say (my emboldening of text):Small pots

As explained above, the trivial commutation rules apply only to certain occupational pensions.

However, there are ‘small pots’ rules which can also apply to both these and other occupational and personal pensions in which you build up a pot of value (called money purchase or defined contribution schemes).

If you are a member of occupational pension schemes, any number of ‘small pots’ can be paid out as a lump sum to you, as long as the schemes are each valued at £10,000 or less. If the value of a single pot is over £10,000, and the scheme qualifies, the trivial commutation rules might instead apply.

For personal pensions, up to three pots worth up to £10,000 each can also be cashed in under the ‘small pots’ rules.

As with trivial commutations, if you take lump sums under the ‘small pots’ rules, you must take the whole value from each pension pot at once – you cannot take it in stages. If you do not want to take the whole value at once, the pensions flexibility rules might be more appropriate for you.

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.

I am not going to contribute to the main discussion ( although will be interested to see a definitive answer).

Just wanted to point out that another advantage of taking a small pot ( although it will affect less people than the MPAA point) is that previously it had no impact on your LTA %, and nowadays it has no impact on your Lump Sum Allowance. So the 25% tax free from the small pot is not included in the maximum tax free amount you can take from pensions.3 -

Update ... I spoke to HL who say you cannot cash in a small pot of 9K crystallized funds, it has to be uncrystallized and a max of 10K.

I also spoke to the financial advisors whose site was so badly worded it led me to conclude it was possible, they are now amending it.

Thanks again, I guess that concludes that!

3 -

Thanks for coming back. It is the only logical answer !Greenwaves said:Update ... I spoke to HL who say you cannot cash in a small pot of 9K crystallized funds, it has to be uncrystallized and a max of 10K.

I also spoke to the financial advisors whose site was so badly worded it led me to conclude it was possible, they are now amending it.

Thanks again, I guess that concludes that!2 -

Indeed. Given the post which started this thread, and @FireDreamer's input, I did wonder if there'd been a change in legislation at the time the LTA was abolished, and the small pots regime was one of the accidental casualties of rushed and incomplete legislation, and I'd simply missed it...Albermarle said:

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.Marcon said:

You are, and thank you. Maybe you could go back to Quilter and point out that for the average reader, there is an ambiguity in what they say? That really could be helpful to plenty of people who are struggling with this weird world known as pensions.FIREDreamer said:

But it mentions value as at date of taking the small pot, which is £9k. And it is still a complete (single) arrangement at that time.Dazed_and_C0nfused said:

Doesn't the second part circled prove MPAA will be triggered?FIREDreamer said:

Are you sure?Marcon said:

No. The 'pot' was never small enough to be withdrawn under the small pots rule.FIREDreamer said:

I think you can - but you need to tell them that you want to use the “small pots” facility and not just make a normal taxable withdrawal.Greenwaves said:Hi,If I had a small pension pot of 12k and have taken the 25% tax free cash (3k), can I still cash in the remaining 9K under the small pots rule without triggering the MPAA?Many thanksG

You need to cash in the whole of a small pot in one go and it needs to be under £10K in total (ie including tax free cash) at the time you cash it in. OP has already taken the tax free cash, so the whole of the remaining £9K will be subject to tax and drawing any of it will trigger the MPAA.

"as long as the pot represents one complete arrangement only"

Which is £12k in this case, the £3k TFLS plus remaining £9k.

I agree this is all ambiguous at best and I am only trying to help.

One of my favourite sites (for both clarity and accuracy) is https://www.litrg.org.uk/pensions/pension-withdrawals/small-pensions#:~:text=For%20personal%20pensions%2C%20up%20to,cannot%20take%20it%20in%20stages.

and they have this to say (my emboldening of text):Small pots

As explained above, the trivial commutation rules apply only to certain occupational pensions.

However, there are ‘small pots’ rules which can also apply to both these and other occupational and personal pensions in which you build up a pot of value (called money purchase or defined contribution schemes).

If you are a member of occupational pension schemes, any number of ‘small pots’ can be paid out as a lump sum to you, as long as the schemes are each valued at £10,000 or less. If the value of a single pot is over £10,000, and the scheme qualifies, the trivial commutation rules might instead apply.

For personal pensions, up to three pots worth up to £10,000 each can also be cashed in under the ‘small pots’ rules.

As with trivial commutations, if you take lump sums under the ‘small pots’ rules, you must take the whole value from each pension pot at once – you cannot take it in stages. If you do not want to take the whole value at once, the pensions flexibility rules might be more appropriate for you.

The key point to the encashments being treated as ‘small pots’ rather than pensions flexibility payments is that you will not then be restricted to the money purchase annual allowance of £10,000 a year on future pension contributions.

I am not going to contribute to the main discussion ( although will be interested to see a definitive answer).

Just wanted to point out that another advantage of taking a small pot ( although it will affect less people than the MPAA point) is that previously it had no impact on your LTA %, and nowadays it has no impact on your Lump Sum Allowance. So the 25% tax free from the small pot is not included in the maximum tax free amount you can take from pensions.

...but happily not, so thank you! I was planning to spend Saturday morning trawling through the legislation, but I can now do something much more enjoyable. Well done you for going back to those who produced a badly worded site to ensure others are not misled. That really is a smart move and one few bother with once they've sorted out their own query.Greenwaves said:Update ... I spoke to HL who say you cannot cash in a small pot of 9K crystallized funds, it has to be uncrystallized and a max of 10K.

I also spoke to the financial advisors whose site was so badly worded it led me to conclude it was possible, they are now amending it.

Thanks again, I guess that concludes that!Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.4K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards