We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Better rate for bigger £ annuity?

Comments

-

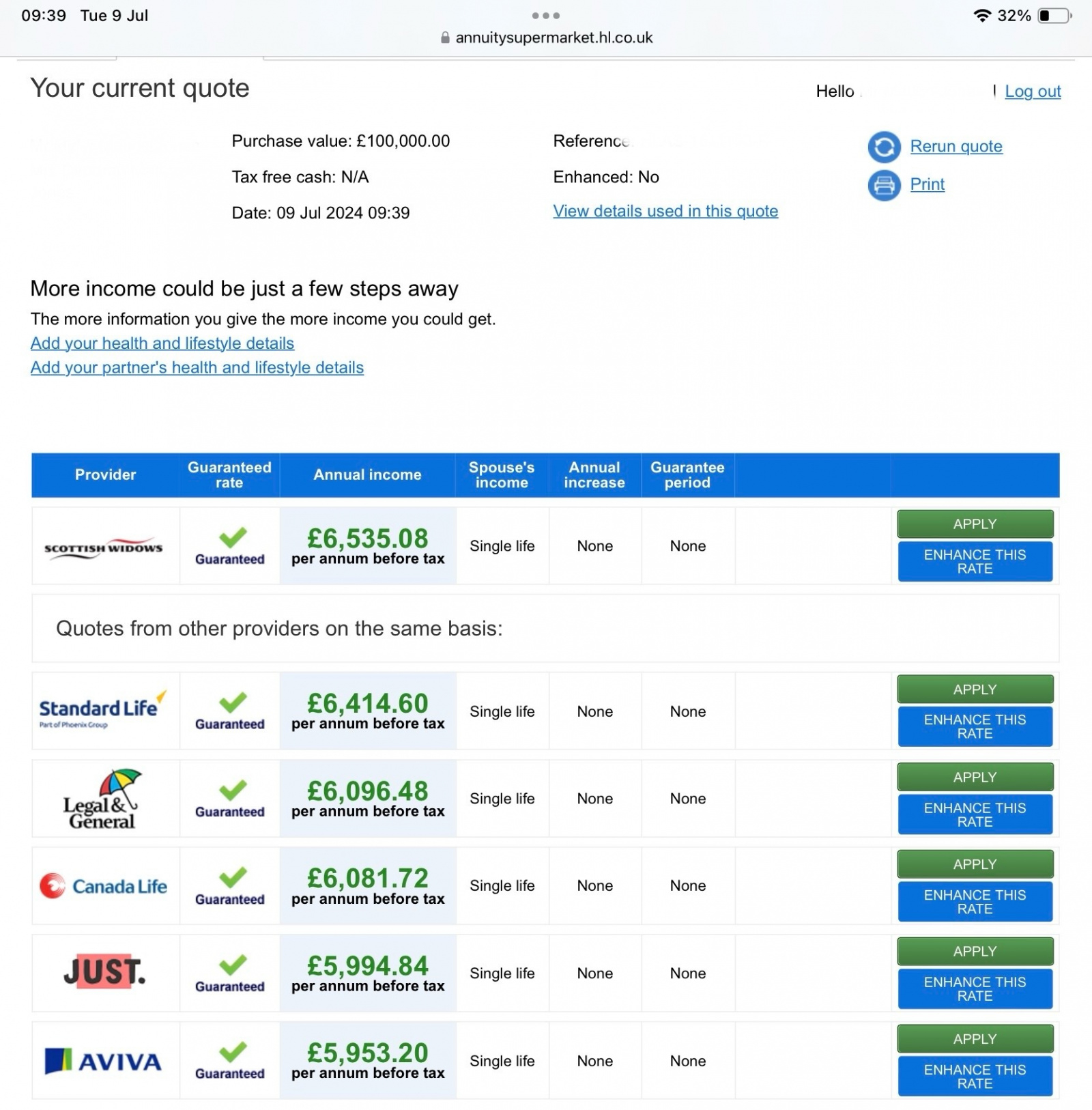

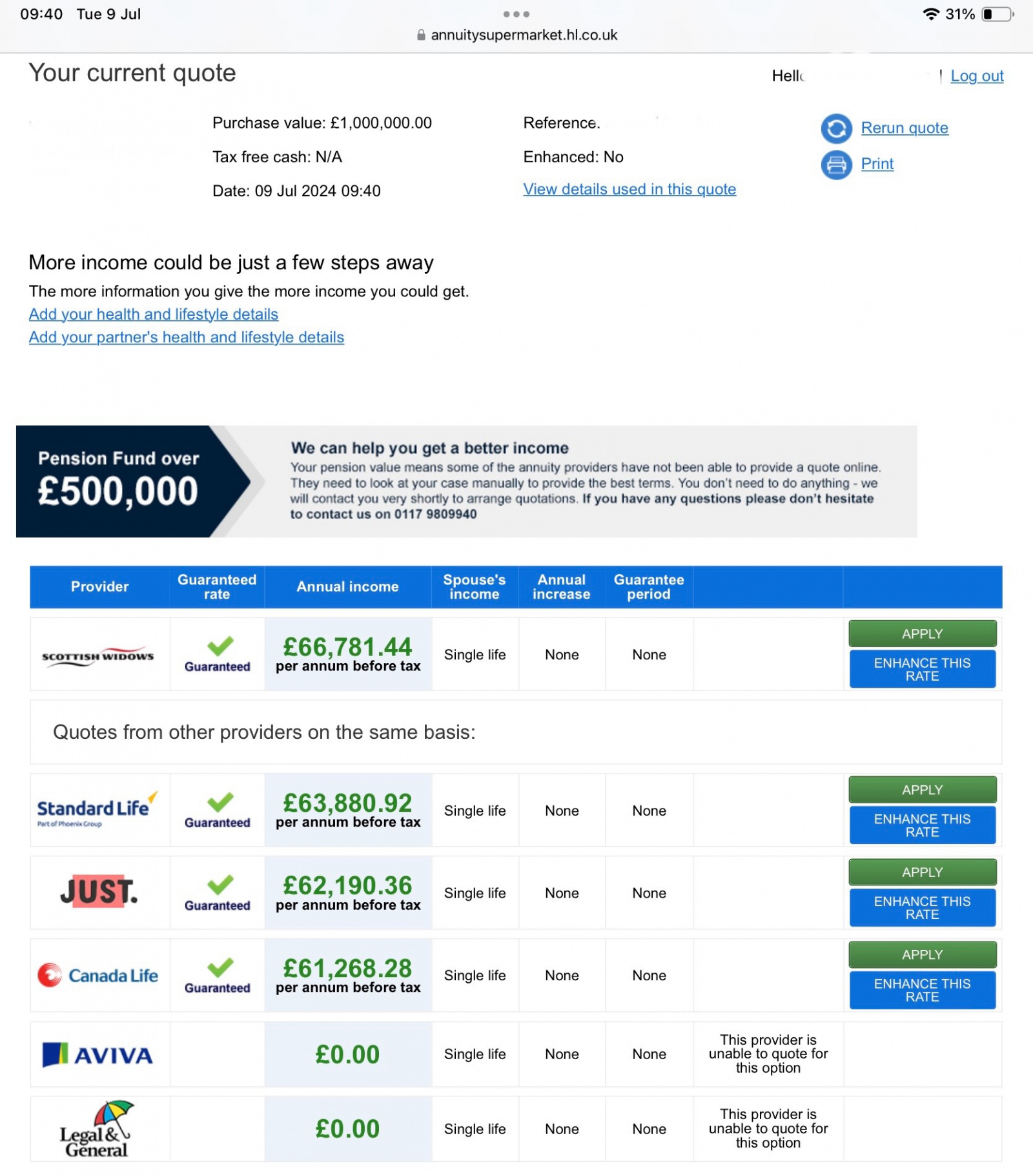

Although not a fixed rule, Scottish Widows offer a better rate for the larger sum.arthur_fowler said:

Very interesting, thanks!FIREDreamer said:I have some experience of annuity rate coding.

Larger pots will generally get a worse annuity rate than smaller pots (though there will be some adjustment for fixed initial fees and ongoing fees).

Whilst this may be counter intuitive - if you think about it, it makes sense.

People with larger pots will obviously be more affluent (having been able to save more) and will be deemed to be of a higher / healthier demographic with a higher life expectancy.

Of course it depends on the provider …

Level annuity, male 60, monthly in arrear with no guarantee period.£100k purchase money

£1M purchase money Look at Standard Life

Look at Standard Life

£100k gets you £6,414.60 so £1M should get you ten times this, i.e. £64,146.00 but they only quote £63,880.92.

Other providers pay more than 10 times the £100k figure and others wont quote at all.

0 -

Or alternatively the OP could buy both now, but on different terms. For example one level annuity and one with increases. Or one with guarantees if you die in 5 years and one not.LHW99 said:if you did buy two separate annuities, you could eg delay one for 10 years, whereby age could increase the amount. But that would depend on whether one could give you enough income for now.

A way to hedge their bets.2 -

Oh that's curious. Could you point me to a term to search for or an example provider please? Many thanksdunstonh said:There are also some providers that allow you to buy an annuity within a flexible pension where the income is retained in the pension and not taxed as it is still in the pension. You then draw the pension income flexibly. Any unused annuity income can be reinvested or retained in cash.0 -

I don't believe there is any providers in the DIY market that offer it at this time. It's an intermediary only option at present.arthur_fowler said:

Oh that's curious. Could you point me to a term to search for or an example provider please? Many thanksdunstonh said:There are also some providers that allow you to buy an annuity within a flexible pension where the income is retained in the pension and not taxed as it is still in the pension. You then draw the pension income flexibly. Any unused annuity income can be reinvested or retained in cash.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

For some reference.

I got a load of annuity quotes a few months back, I used 100K, 200K and 400K with no health issues example and they all essentially gave the same % return, I was surprised the larger amount put in the pot had a tiny negligible difference.

I used two IFAs spending time going over all the details, they produced essentially the same results even though they apparently had special relationships with the providers.

I also used an online company IFA search and it actually gave better results with the same providers, however as mentioned, to get the best rates the online IFA service did require these IFA staff to action the paperwork.

The two private IFA guys said they could match the online IFA finding service.

So in my case I think getting more than one annuity products maybe a possibility to allow more personal flexibility over time, but it's more paperwork.

As I'm posting, I got many PLA quotes, Purchased Life Annuties, now I more understand these PLAs, I would certainly consider PLAs.

Cheers Roger.0 -

That's really helpful, thank you Roger. I haven't heard of PLA's before. I will need to find out about them.RogerPensionGuy said:For some reference.

I got a load of annuity quotes a few months back, I used 100K, 200K and 400K with no health issues example and they all essentially gave the same % return, I was surprised the larger amount put in the pot had a tiny negligible difference.

I used two IFAs spending time going over all the details, they produced essentially the same results even though they apparently had special relationships with the providers.

I also used an online company IFA search and it actually gave better results with the same providers, however as mentioned, to get the best rates the online IFA service did require these IFA staff to action the paperwork.

The two private IFA guys said they could match the online IFA finding service.

So in my case I think getting more than one annuity products maybe a possibility to allow more personal flexibility over time, but it's more paperwork.

As I'm posting, I got many PLA quotes, Purchased Life Annuties, now I more understand these PLAs, I would certainly consider PLAs.

Cheers Roger.0 -

It means using your own cash ( or the tax free cash from the pension pot) rather than using the 75% of the pension pot, which is the usual way.arthur_fowler said:

That's really helpful, thank you Roger. I haven't heard of PLA's before. I will need to find out about them.RogerPensionGuy said:For some reference.

I got a load of annuity quotes a few months back, I used 100K, 200K and 400K with no health issues example and they all essentially gave the same % return, I was surprised the larger amount put in the pot had a tiny negligible difference.

I used two IFAs spending time going over all the details, they produced essentially the same results even though they apparently had special relationships with the providers.

I also used an online company IFA search and it actually gave better results with the same providers, however as mentioned, to get the best rates the online IFA service did require these IFA staff to action the paperwork.

The two private IFA guys said they could match the online IFA finding service.

So in my case I think getting more than one annuity products maybe a possibility to allow more personal flexibility over time, but it's more paperwork.

As I'm posting, I got many PLA quotes, Purchased Life Annuties, now I more understand these PLAs, I would certainly consider PLAs.

Cheers Roger.

They are more of a niche product.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards