We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Better rate for bigger £ annuity?

arthur_fowler

Posts: 119 Forumite

I will retire at some point next year age 60 and intend to fund much of my retirement by a level rate 50% spouse annuity.

I have two DC pots from different employments (current employer plus previous one). One will have around £240k in and the other around £500k.

I am thinking about buying one annuity earlier than the other so that I can use mine and Mrs F's 2024/25 ISA allowance for the TFLS before I retire (which will be no earlier than April).

Is there downside to buying two annuities rather than putting them together into a single one? i.e. might I get a better rate for a larger amount?

Thanks

I have two DC pots from different employments (current employer plus previous one). One will have around £240k in and the other around £500k.

I am thinking about buying one annuity earlier than the other so that I can use mine and Mrs F's 2024/25 ISA allowance for the TFLS before I retire (which will be no earlier than April).

Is there downside to buying two annuities rather than putting them together into a single one? i.e. might I get a better rate for a larger amount?

Thanks

0

Comments

-

If you buy two different annuities, then you have two lots of administration fees to pay, which is why you're likely to get a better rate if you simply buy one.arthur_fowler said:I will retire at some point next year age 60 and intend to fund much of my retirement by a level rate 50% spouse annuity.

I have two DC pots from different employments (current employer plus previous one). One will have around £240k in and the other around £500k.

I am thinking about buying one annuity earlier than the other so that I can use mine and Mrs F's 2024/25 ISA allowance for the TFLS before I retire (which will be no earlier than April).

Is there downside to buying two annuities rather than putting them together into a single one? i.e. might I get a better rate for a larger amount?

Thanks

The alternative might be to take just some tax free cash and use that to fund your ISAs, then use the balance(s) to buy one annuity?Googling on your question might have been both quicker and easier, if you're only after simple facts rather than opinions!1 -

Thanks, that's useful.Marcon said:

If you buy two different annuities, then you have two lots of administration fees to pay, which is why you're likely to get a better rate if you simply buy one.arthur_fowler said:I will retire at some point next year age 60 and intend to fund much of my retirement by a level rate 50% spouse annuity.

I have two DC pots from different employments (current employer plus previous one). One will have around £240k in and the other around £500k.

I am thinking about buying one annuity earlier than the other so that I can use mine and Mrs F's 2024/25 ISA allowance for the TFLS before I retire (which will be no earlier than April).

Is there downside to buying two annuities rather than putting them together into a single one? i.e. might I get a better rate for a larger amount?

Thanks

The alternative might be to take just some tax free cash and use that to fund your ISAs, then use the balance(s) to buy one annuity?

I need to maximise the TFLS to keep me out of higher rate tax bracket for some years.0 -

Generally speaking it's a good idea to take the 25% tax free lump sum and buy the annuity with the remaining amount. Reason being that you don't pay tax on the lump sum but any income you get from an annuity is taxable.

It depends on what you're trying to achieve but looking at the pure numbers that's the way to go.1 -

Yes, I appreciate that thanks. My question is how to deal with two DC pots. I will take 25% TFLS from each but would it be better to buy one big annuity or would the rate be the same for two smaller ones.El_Torro said:Generally speaking it's a good idea to take the 25% tax free lump sum and buy the annuity with the remaining amount. Reason being that you don't pay tax on the lump sum but any income you get from an annuity is taxable.

It depends on what you're trying to achieve but looking at the pure numbers that's the way to go.0 -

If you buy the two annuities at different times, they'll most likely be at different rates, so there's no way to know now whether that would be better than buying a single larger annuity at the later date.

In your current pension schemes, do you have to buy the annuity at the time you take enough TFLS to fund the ISAs? If so, then another option might be to transfer to a scheme which gives you that flexibility.1 -

Good idea. I will find out if that is an option.MK62 said:If you buy the two annuities at different times, they'll most likely be at different rates, so there's no way to know now whether that would be better than buying a single larger annuity at the later date.

In your current pension schemes, do you have to buy the annuity at the time you take enough TFLS to fund the ISAs? If so, then another option might be to transfer to a scheme which gives you that flexibility.0 -

if you did buy two separate annuities, you could eg delay one for 10 years, whereby age could increase the amount. But that would depend on whether one could give you enough income for now.

1 -

I have some experience of annuity rate coding.

Larger pots will generally get a worse annuity rate than smaller pots (though there will be some adjustment for fixed initial fees and ongoing fees).

Whilst this may be counter intuitive - if you think about it, it makes sense.

People with larger pots will obviously be more affluent (having been able to save more) and will be deemed to be of a higher / healthier demographic with a higher life expectancy.

Of course it depends on the provider …

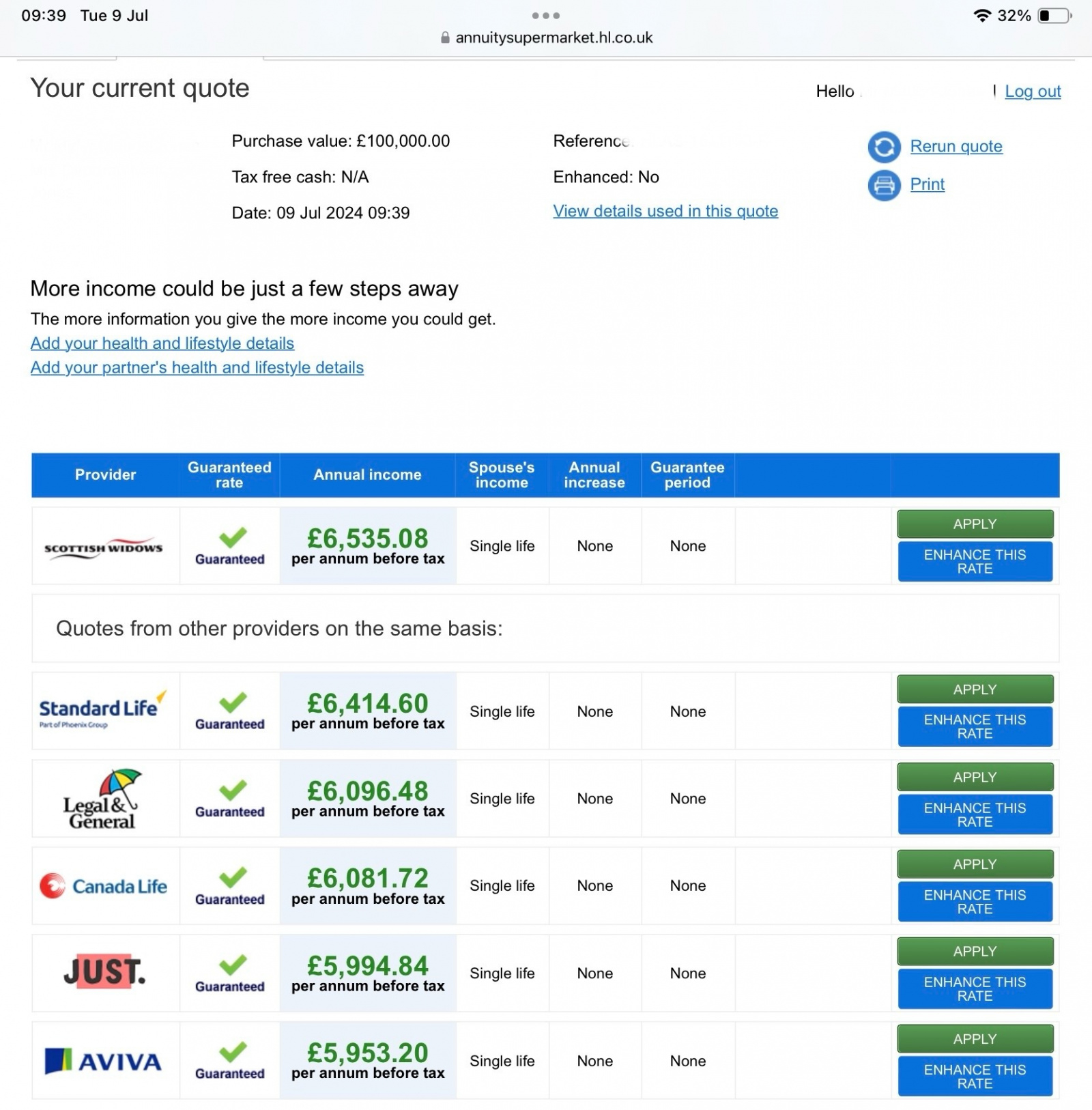

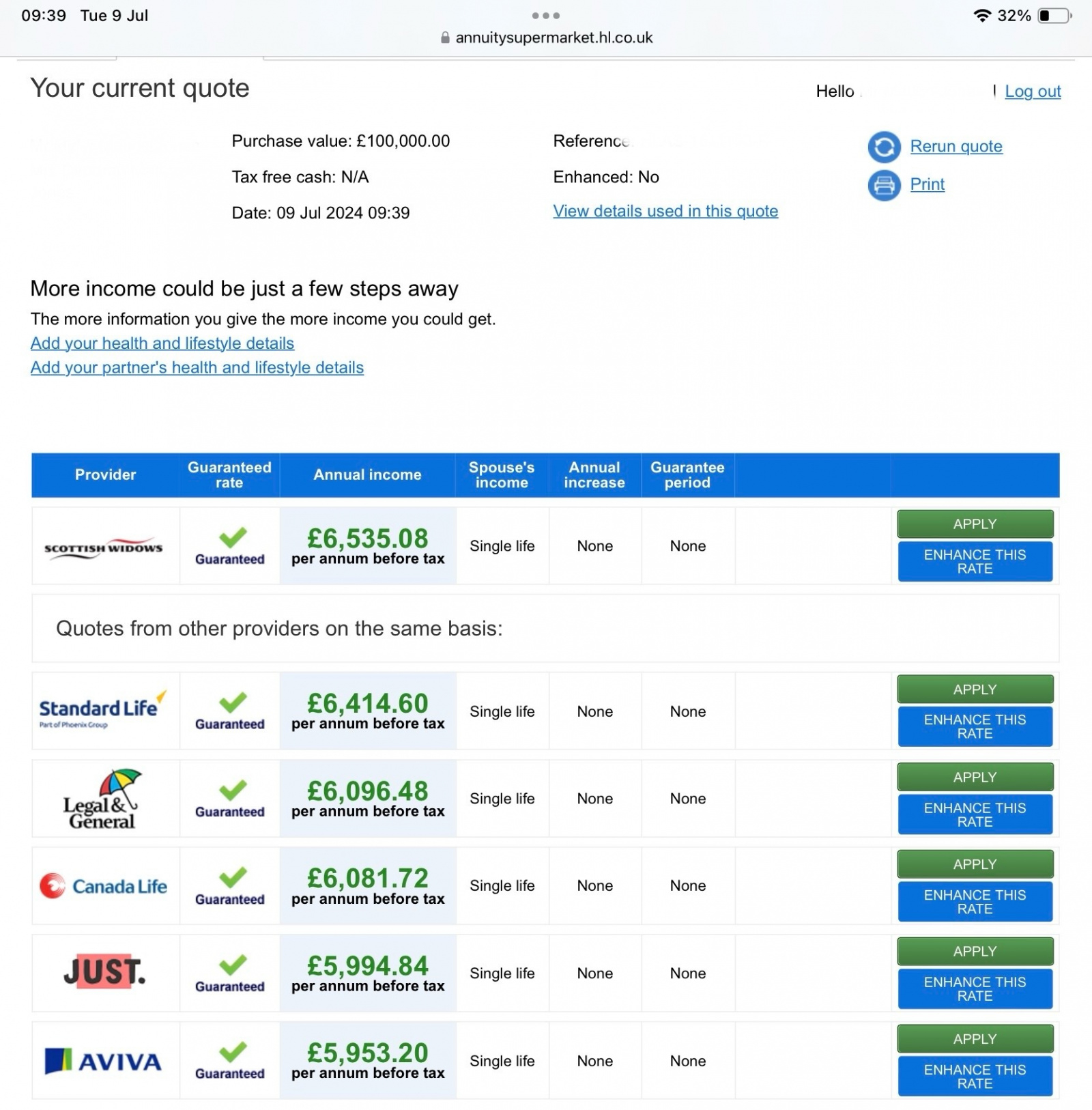

Level annuity, male 60, monthly in arrear with no guarantee period.£100k purchase money

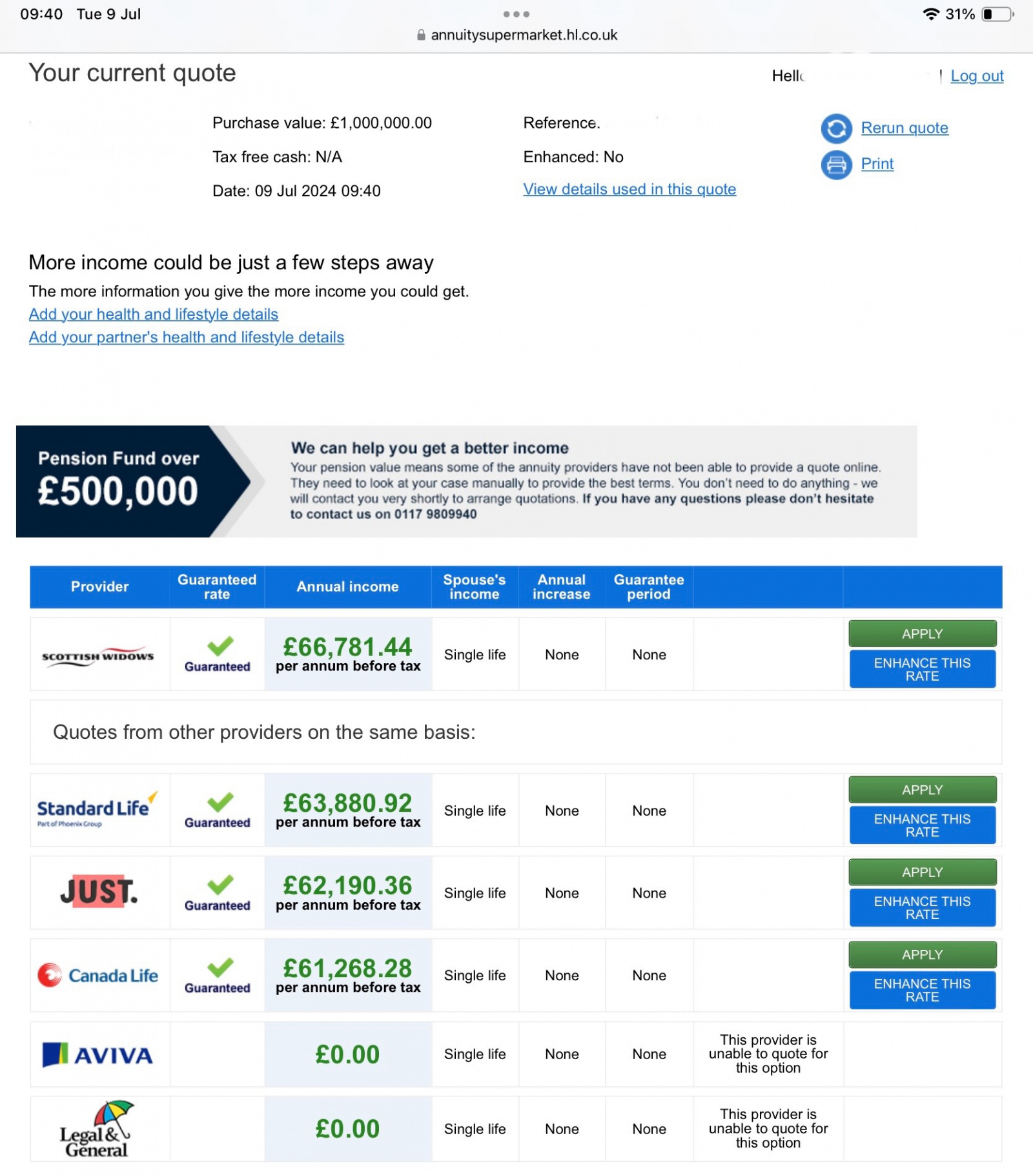

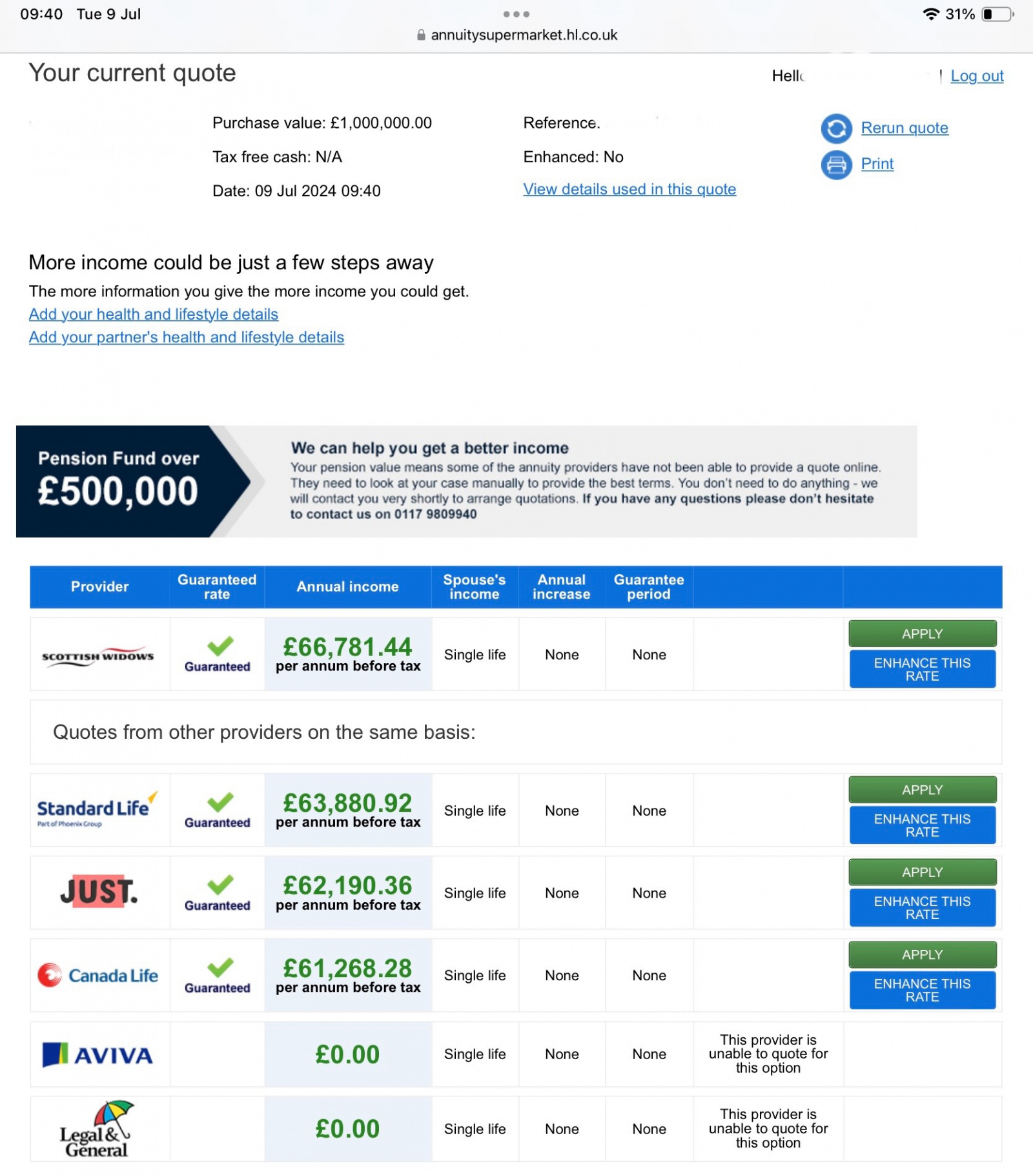

£1M purchase money Look at Standard Life

Look at Standard Life

£100k gets you £6,414.60 so £1M should get you ten times this, i.e. £64,146.00 but they only quote £63,880.92.

Other providers pay more than 10 times the £100k figure and others wont quote at all.2 -

Very interesting, thanks!FIREDreamer said:I have some experience of annuity rate coding.

Larger pots will generally get a worse annuity rate than smaller pots (though there will be some adjustment for fixed initial fees and ongoing fees).

Whilst this may be counter intuitive - if you think about it, it makes sense.

People with larger pots will obviously be more affluent (having been able to save more) and will be deemed to be of a higher / healthier demographic with a higher life expectancy.

Of course it depends on the provider …

Level annuity, male 60, monthly in arrear with no guarantee period.£100k purchase money

£1M purchase money Look at Standard Life

Look at Standard Life

£100k gets you £6,414.60 so £1M should get you ten times this, i.e. £64,146.00 but they only quote £63,880.92.

Other providers pay more than 10 times the £100k figure and others wont quote at all.1 -

There are also some providers that allow you to buy an annuity within a flexible pension where the income is retained in the pension and not taxed as it is still in the pension. You then draw the pension income flexibly. Any unused annuity income can be reinvested or retained in cash.I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.7K Work, Benefits & Business

- 603.1K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards