We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Help with letters of admin P1A1 form

bikeman

Posts: 382 Forumite

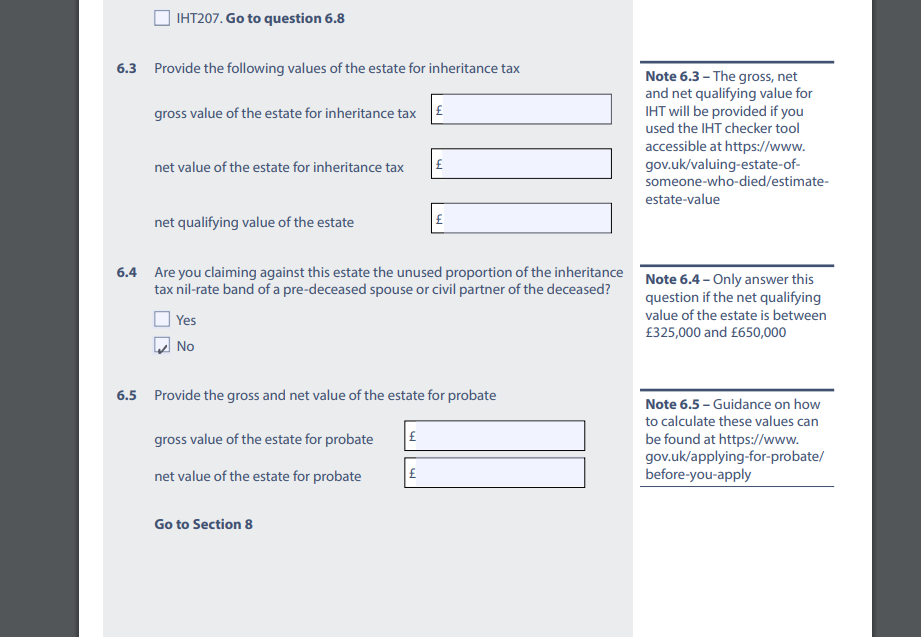

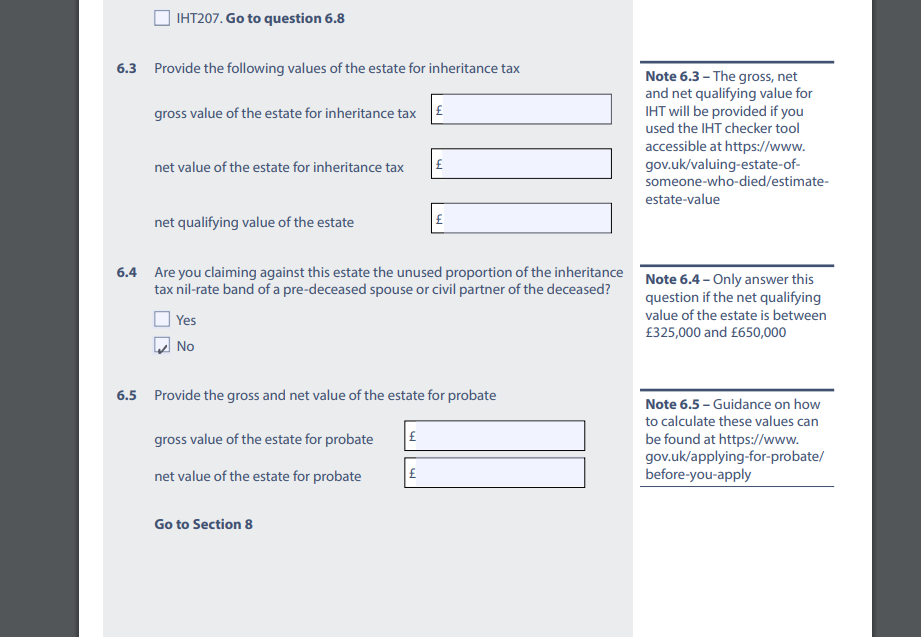

Can anyone provde an explanation of the values entered in 6.3 and 6.5 below on the Letters of Administration form PA1A. Unfortunately its not obvious to me, I cant find the help explanation referred to in the sidebar for this form and the probate offfice dont answer their phones. Thanks

0

Comments

-

Does this help? How to value an estate for Inheritance Tax and report its value: Estimate the estate’s value - GOV.UK (www.gov.uk)#2 Saving for Christmas 2024 - £1 a day challenge. £325 of £3660

-

If you use the IHT calculator as posted above it will provide all the figures for both sections for you to transpose.FYI probate office only answer their phones between 9am-1pm Monday to Friday so they can crack on with the application backlog outside those times. They will answer between 9am-1pm but you'll probably be on hold for 20+ minutes.0

-

I've used the calculator. It doesnt tell me which figures to put in each box.0

-

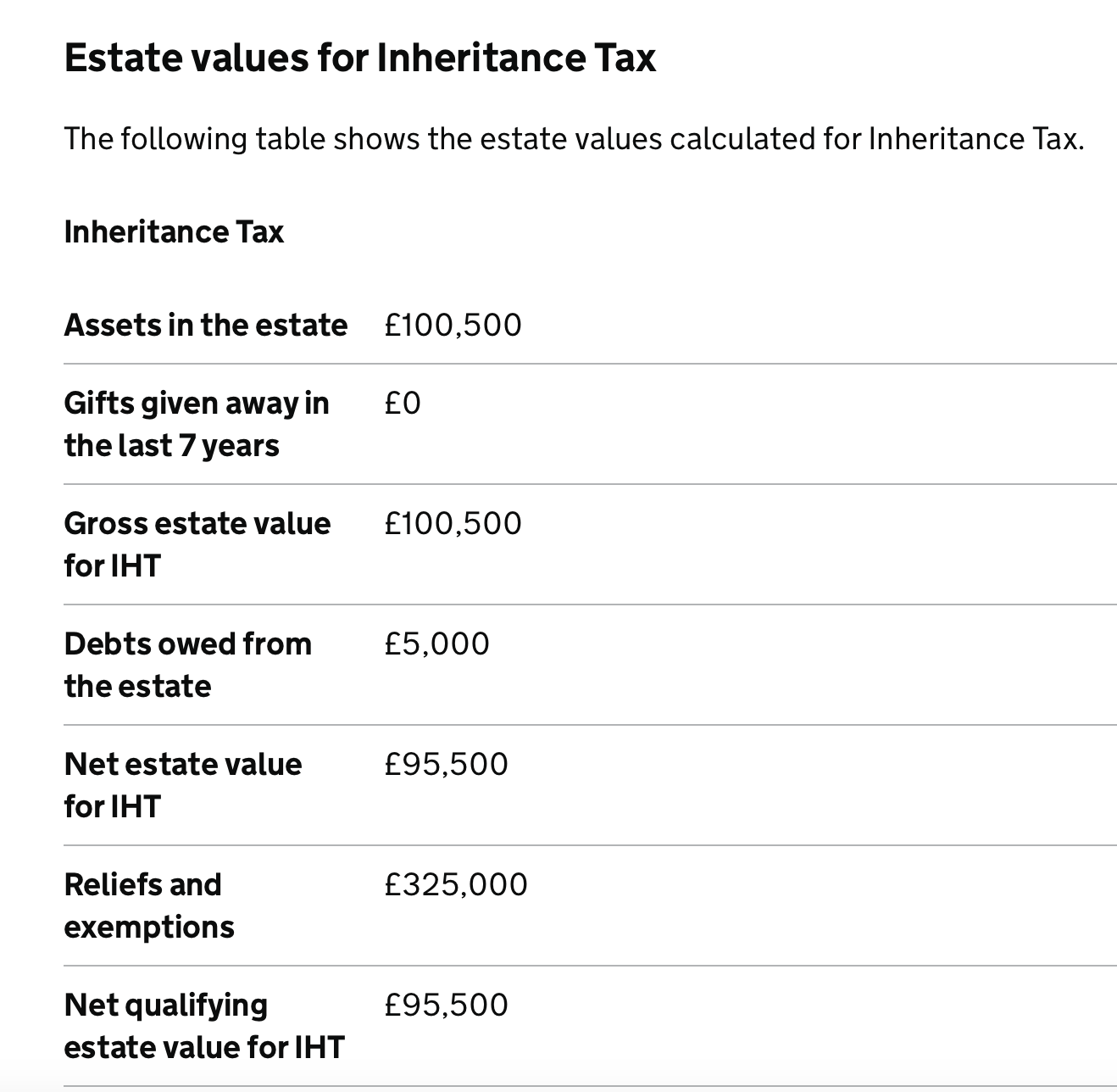

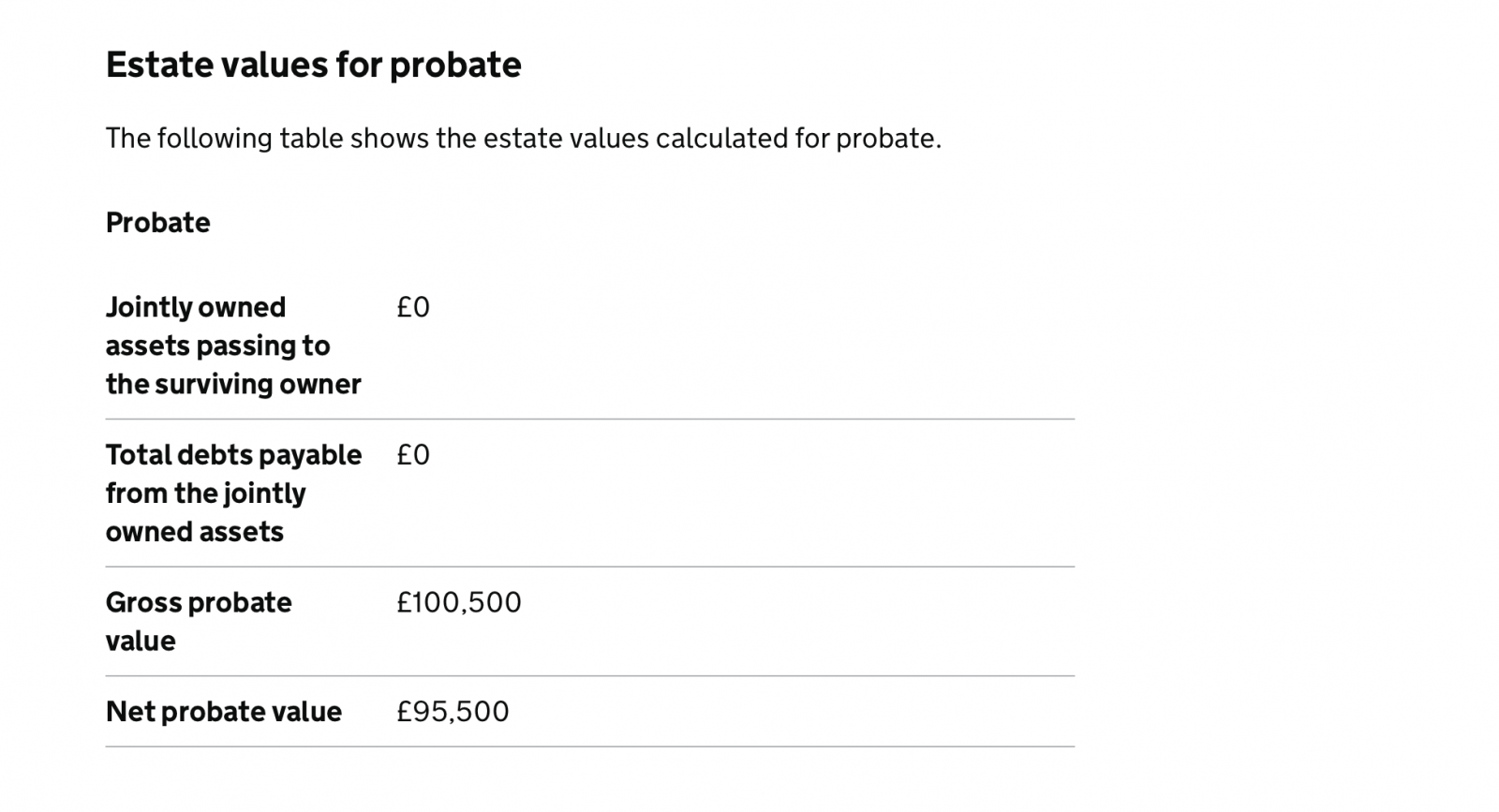

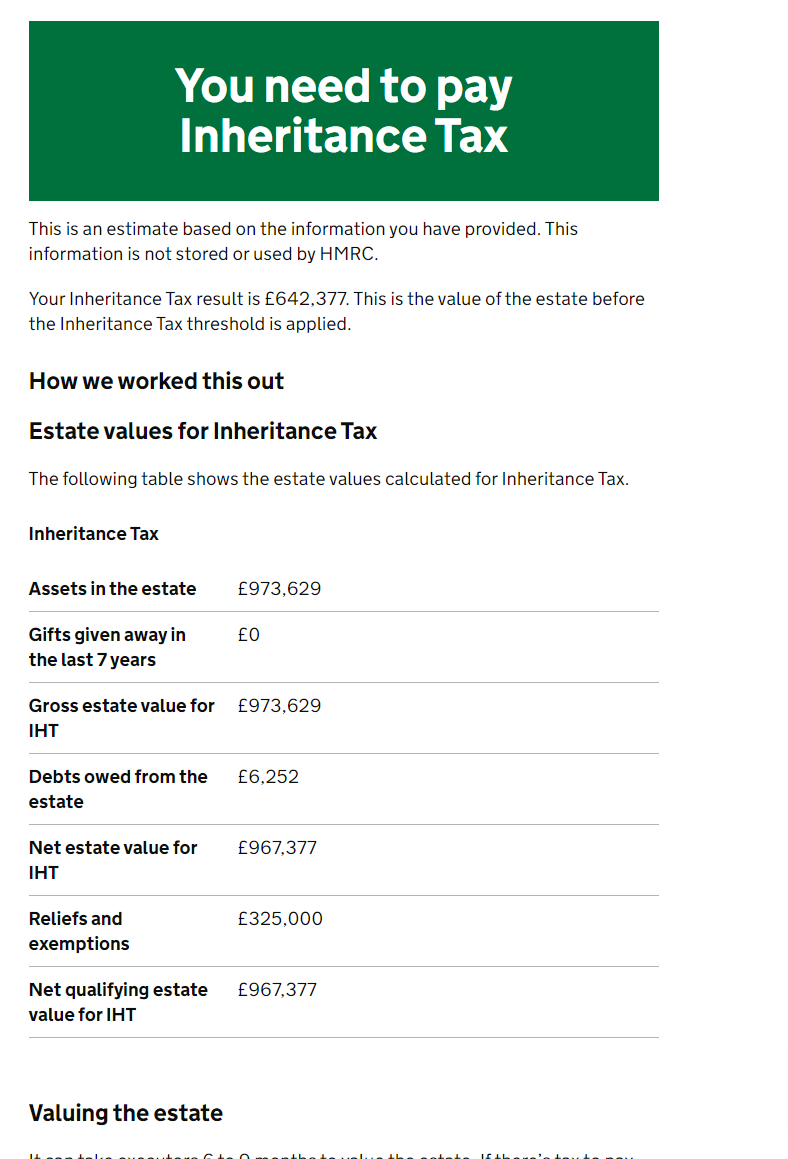

Yes it does, I have created an example for you using the calculator but with dummy figures (you'll have to input your own).Section 6.3 of the form can be taken from lines 3,5 & 7 in order (as per the photo of the calculator output picture 1).Section 6.5 of the form can be taken from lines 3 & 4 in order (as per the photo of the calculator output picture 2

).1

).1 -

Well I dont know what is going on. This is the result I get.

Also it doesnt seem to have included the Residence Nil Rate Band relief.

0 -

If you want to claim the residential NRB then you need to complete a full IHT return before you even apply for probate/letters of administration. Probate won’t be granted until the IHT due is paid.0

-

Yes I know. My issue is with the IHT calculator0

-

The checker will:

- give you an approximate value of the estate

- help you decide whether any Inheritance Tax is likely to be due or not

The checker does not:

- calculate the amount of Inheritance Tax that’s owed

- tell HMRC about the estate’s final value

#2 Saving for Christmas 2024 - £1 a day challenge. £325 of £3660 -

In what way do they seem to be different to you? They look identical - except of course for the amounts as you have put your values in. So can you explain the problem you see.bikeman said:Yes but I'm obviously using the wrong checker, because it's giving different results from the one Jon1970 posted above.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.8K Banking & Borrowing

- 253.8K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 245.9K Work, Benefits & Business

- 601.9K Mortgages, Homes & Bills

- 177.7K Life & Family

- 259.8K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards