We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Santander

wincott

Posts: 2 Newbie

We’ll biggest mistake was to leave first director Santander

so far they have failed to pay 2 direct debits costing me £29 in interest also they blocked the credit card they gave me after only 2 days told me to speak with the fraud team who never got back to me. They have cost me over 5 hours on the phone what a waste.

And now I’m switching back to first Direct

happy days at least they answered my calls in record time

so far they have failed to pay 2 direct debits costing me £29 in interest also they blocked the credit card they gave me after only 2 days told me to speak with the fraud team who never got back to me. They have cost me over 5 hours on the phone what a waste.

And now I’m switching back to first Direct

happy days at least they answered my calls in record time

0

Comments

-

Doesn't sound like an enjoyable experience, are you submitting a complaint to get your costs reimbursed?0

-

Were you using the Current Account Switch Service ? Were the DD's identified by First Direct ? Is your Credit Card still blocked ?Never pay on an estimated bill. Always read and understand your bill0

-

I've been a customer for years with no issues, but my daughter is trying to open a basic savings account to sit alongside a current account she has had for about 6 years. The whole process is becoming a severe act of patience to the point she is looking at moving current and savings to another provider.0

-

daveyjp said:I've been a customer for years with no issues, but my daughter is trying to open a basic savings account to sit alongside a current account she has had for about 6 years. The whole process is becoming a severe act of patience to the point she is looking at moving current and savings to another provider.

May I ask what attracts her to a currently available Santander basic savings account? What are the difficulties she experiences, as usually Santander savings accounts open near instantly for existing customers?

0 -

The issue with posts like this is that all banks will have issues from time to time. I've had nothing ever go wrong with Santander. I've called them a few times and have been shocked when they picked up straight away. First Direct on the other hand took over 45 mins to pick up the phone when I needed to add my card to Google Pay.

I'm not saying don't move away from Santander, but rather these sorts of issues can appear at any bank, including First Direct.

2 -

14 million customers:One complaint here. I have not had any serious problems. People complain about all the other banks too.0

-

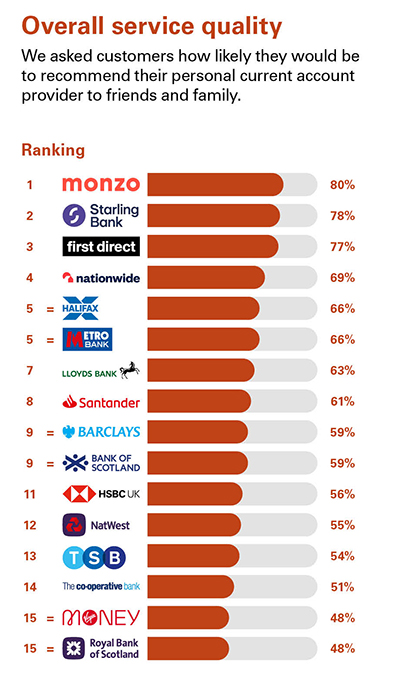

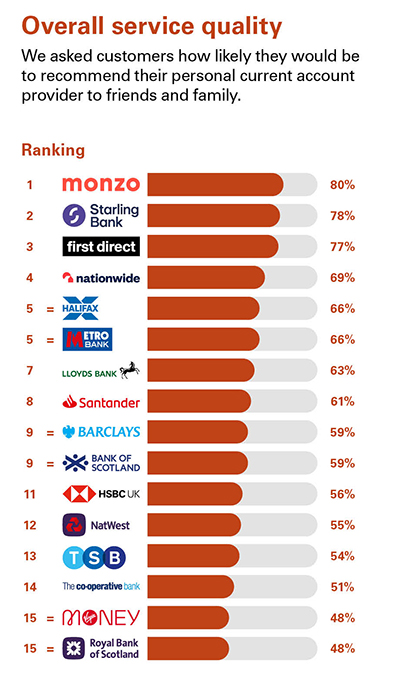

You see far more complaints about Santander than First Direct on here and the results of the customer satisfaction surveys back that up.

0 -

Her current account balance is too high and she just needs a savings account to park the money while she sorts out longer term savings accounts. These are all taking time to open due to ID requirements.friolento said:daveyjp said:I've been a customer for years with no issues, but my daughter is trying to open a basic savings account to sit alongside a current account she has had for about 6 years. The whole process is becoming a severe act of patience to the point she is looking at moving current and savings to another provider.

May I ask what attracts her to a currently available Santander basic savings account? What are the difficulties she experiences, as usually Santander savings accounts open near instantly for existing customers?

The Santander issue is apparently becuase she has just turned 18, yet this wasn't an issue with changing her current account from a child to adult account.0 -

I am a customer of both and find they both have their good and their bad points but Santander offers me much better value than FD.400ixl said:You see far more complaints about Santander than First Direct on here and the results of the customer satisfaction surveys back that up. Examples:

Examples:

FD refused to increase my overdraft from (the free) £250 to £300. Santander offered me £5,000 straight away. None of the Santander overdraft is free of charge but as I will settle any overdraft immediately, this doesn’t matter to me.

Santander pay cashback on certain DDs. This is worth over £60 a year for me (YMMV). I can’t get anything like this from FD.

As I have been with FD for well over a decade, I never qualify for their switch offer. Santander paid me over £700 in switch offers to date. Unlikely that FD can ever match this.

FD has a lovely Regular Saver, paying 7% and allowing £300 a month. Santander RS is 5% and £250 a month only.

Other Santander savings accounts usually beat anything available from FD. E.g. the lovely 7% Edge Saver account, which easily beats the FD RS in flexibility.

Santander currently have a lovely 2% cashback credit card. No cashback from the FD credit card.

Both have relatively decent online and app support, allowing me to do nearly everything I need to do without having to call them. I have had one or two disappointing experiences with Santander CS which usually resulted in a compensation payment. I have not much experience with FD CS - last time I remember calling them was a few years ago to sort my online access which had stopped because I had changed my phone.The prospect/ hope of better CS would not make me switch from Santander to FD. I will keep both - FD for its RS, and Santander for everything else (that’s everything else apart from other, better, things I can get from yet other providers , such as ISAs and easy access savings).0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.1K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.5K Work, Benefits & Business

- 602.8K Mortgages, Homes & Bills

- 178K Life & Family

- 260.5K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards