We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

Virgin Money 12%

Comments

-

I did see that yesterday but I had long deleted the app (I switched in early 2022!) and so when I got the letter about the account being closed due to lack of money in there, I had no idea it was even active so I didn't have login details (except the password). As I spoke to customer services to say I didn't want the paperwork and they said they'd close it - that was back in Feb - I didn't think about it until the offer came in!PRAISETHESUN said:

For what it's worth, you can close the linked savings account yourself online with minimal fuss. I switched away from VM last year and was assuming like you that the savings account would be closed. After lodging a complaint, the customer service rep told me that there's an option in your online banking profile settings somewhere that takes you to an account closure form. Although it has "close your current account" all over the page, I put the details for my linked savings account into the form and it was closed a few days later.Nasqueron said:

Once I was able to get the customer number I could login to the VM site as I had the password still and I could see I only had the old M Saver which they hadn't closed - though their letter said they would close it anyway at some point, the point of the call for me was to just avoid getting a load of pointless papers through the post. I then restarted the process with Snoop, clicked the link to go to Virgin, followed the steps, opened the app, logged in and applied, then did the switch. I'm not 100% sure it'll track but we'll see, I did everything I could to do it by their termsele7z said:

I switched my VM current out months ago and today realised the linked saver was kept open despite the terms saying it gets closed with switching out. Due to this when I try to open a current account again to take advantage of this offer it says they recognise my details and I should log in instead, how do you open an account if you have an existing customer number/switched out previously?Nasqueron said:

I did it in the app and had to keep restarting when I was getting blocked by Virgin as I wanted to ensure it was tracked but no idea if it will or not, I'll just close Snoop if they refuse it but have opened and done the switch so the £120 interest should be good enoughTheElectricCow said:

Very similar situation here, luckily Virgin were quite happy to accept my email address in place of a customer number although my application is now awaiting a manual verification (I suspect this is related to an address formatting issue that I wasn’t able to alter as it was what they already had on record for me).Nasqueron said:Have to say this was a bit of a pain to do - application straightforward enough but Virgin still had me as a customer but I had no idea of the customer number. I had to dig around in the shredding pile as I remember they wrote to me about an old empty savings account which I spoke to them about closing and not sending me the paperwork - it was still open despite being told it was closed! Tip here - if you don't know your customer number you can actually verify and get it via SMS with your address etc if you don't know your account number - I only had the last 4 digits. Finally got my login and the app working again and applied - annoying you have to do the switch inside the app rather than doing it in the application process but anyway. Now to close the Co-Op saver in case it blocks the transfer.

Did it via Snoop for the £30 Amazon vouchers - annoying too you have to give it access to a bank account during setup (just used a donor account which is empty) as you obviously don't have the Virgin account yet. Successfully linked so hopefully the switch will go ok and get the vouchers + take advantage of interest for a year.

Also went via Snoop but it’s unclear at this stage whether that’s tracked correctly as I was having some connection issues this morning, will have to keep tabs on that one and see what happens when the everything is processed.Sam Vimes' Boots Theory of Socioeconomic Unfairness:

People are rich because they spend less money. A poor man buys $10 boots that last a season or two before he's walking in wet shoes and has to buy another pair. A rich man buys $50 boots that are made better and give him 10 years of dry feet. The poor man has spent $100 over those 10 years and still has wet feet.

1 -

That's a bit concerning, and not mentioned in the T&Cs. Usually for these switch offers I like to set up some "free" direct debits (things like PayPal and Moneybox where you fund your own accounts) But sometimes if pushed for time or I can't use the free options (eg, if Moneybox is currently set up for another switch) I go for something like 50 pence direct debit. But I'd really rather not have that taking payments for a whole year. Hopefully they do mean when the bonus is applied like you say, so once it's applied at the start of July then we can cancel them. But still, no mention of this in the T&Cs...Jazzking said:I was also wondering this but spotted a comment on the VM ad on facebook that implies otherwise - unless "bonus is paid" actually means bonus is applied? 0

0 -

The thing is, because the "bonus" is an interest rate tied to the account, if it is removed, you're basically stuck - I appreciate you might not want to leave the 2x DD on there for 12 months, if it helps, I use my mobile phone bill and an old CC I rarely use except to keep it active - so both are fixed and simple DDs I can just top up for every month the day before they're due.GreenScepter said:

That's a bit concerning, and not mentioned in the T&Cs. Usually for these switch offers I like to set up some "free" direct debits (things like PayPal and Moneybox where you fund your own accounts) But sometimes if pushed for time or I can't use the free options (eg, if Moneybox is currently set up for another switch) I go for something like 50 pence direct debit. But I'd really rather not have that taking payments for a whole year. Hopefully they do mean when the bonus is applied like you say, so once it's applied at the start of July then we can cancel them. But still, no mention of this in the T&Cs...Jazzking said:I was also wondering this but spotted a comment on the VM ad on facebook that implies otherwise - unless "bonus is paid" actually means bonus is applied?

Sam Vimes' Boots Theory of Socioeconomic Unfairness:

People are rich because they spend less money. A poor man buys $10 boots that last a season or two before he's walking in wet shoes and has to buy another pair. A rich man buys $50 boots that are made better and give him 10 years of dry feet. The poor man has spent $100 over those 10 years and still has wet feet.

1 -

I'm just placing 2 non-paying direct debits on the donor account prior to switching. One is a PayPal direct debit and the other is for an old credit card which is no longer used. They'll remain active but unused for the year that the promotion runs.

The terms just say "Transfer at least two direct debits to your new account as part of the switch". Nothing about how long they need to be left there for.

1 -

I'm also using PayPal and Moneybox as my direct debits for the VM offer. My understanding is that Direct Debits go inactive 13 months after the last payment. And it's about 14 months from now to the interest ending.So if the DDs do have to be left on they will also have to be used at some point which is a bit of a faff!1

-

I have chat with Virgin customer service,they have confirmed it for me direct debit must be kept it active on the account up to and including 26 June 2024 .The direct debit can be cancelled anytime after 26 June 2024.Jazzking said:

I was also wondering this but spotted a comment on the VM ad on facebook that implies otherwise - unless "bonus is paid" actually means bonus is applied?PRAISETHESUN said:

There's nothing in the VM terms that says the DDs need to stay active after the switch, just that you need to include 2x DDs on the account you are switching. You can cancel/move them somewhere else manually after the switch completes.Thi800 said:Is it direct debit must to be kept active after a switch? and direct debit must to be taken out from Virgin account 12 months? Please anyone let me know. Thanks 6

6 -

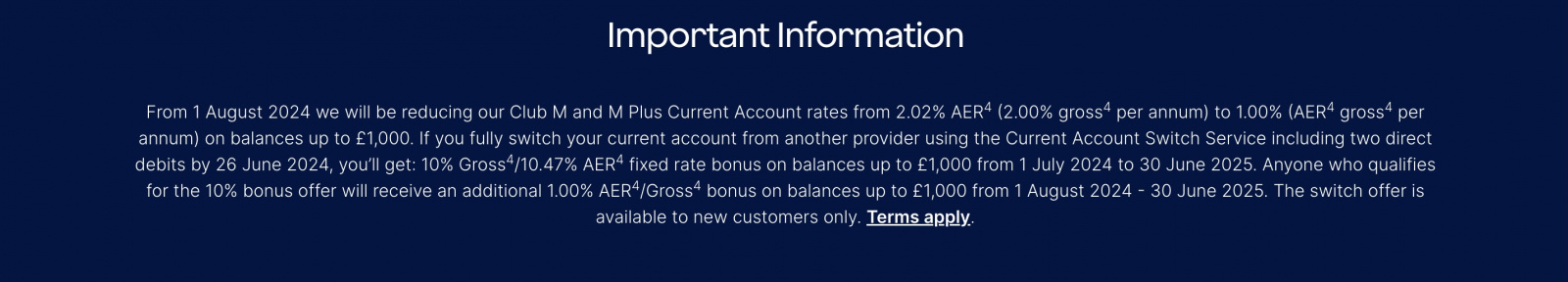

For anyone taking part in this offer, the rate is reducing from 2% to 1% on 1st August. 10% bonus remains the same.

So you'll now get the 12% rate only for the month of July, and 11% for the remaining 11 months.

Putting in £1,000 for the entire year will now earn you £110.85 instead of £120. :'(7 -

Poor show, Virgin Money.

1 -

My interpretation of that is that from August, if you qualified for the switch bonus, you’ll still get the full 12% as there’s an extra 1% bonus included for switchers (plus the 10% switch bonus and the 1% base rate).danny13579 said:

For anyone taking part in this offer, the rate is reducing from 2% to 1% on 1st August. 10% bonus remains the same.

So you'll now get the 12% rate only for the month of July, and 11% for the remaining 11 months.

Putting in £1,000 for the entire year will now earn you £110.85 instead of £120. :'(Moo…2 -

Looks to me as you describe. Basically instead of getting 2% + 10%, you'll now be getting 1% + 11%...TheElectricCow said:

My interpretation of that is that from August, if you qualified for the switch bonus, you’ll still get the full 12% as there’s an extra 1% bonus included for switchers (plus the 10% switch bonus and the 1% base rate).danny13579 said:

For anyone taking part in this offer, the rate is reducing from 2% to 1% on 1st August. 10% bonus remains the same.

So you'll now get the 12% rate only for the month of July, and 11% for the remaining 11 months.

Putting in £1,000 for the entire year will now earn you £110.85 instead of £120. :'(

EDIT: looking at other posts after this, it does seem this might not be the case and it might actually be 1% + 10% going forward awaiting clarification... 0

awaiting clarification... 0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 254K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246.1K Work, Benefits & Business

- 602.2K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260.1K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards