We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Pension Drops.

Comments

-

I'm thinking about taking the money back out and investing in something more tangible like property.

You realise you cannot legally access money in pension until you are at least 55 (currently)? If you do you would be subject to a large tax charge, and if dealing with a dodgy company for the withdrawal as is almost inevitable, likely to never see the funds again.

3 -

What I should have said is that I'm very cautious with money, not "nervous". Making business decisions is fine. Investing for the first time and seeing your pot dwindle by £1000 (as of this morning) can be a bit unsettling when you are new to investing, despite the explanations of 'your money can increase and decrease' etc I'm well aware of this fact, but, as this was a very low risk pension I expected slow growth rather than immediate losses. I was shown charts of course, but it would have been helpful if I was told to - expect drops of XYC and dont be worried by it.dunstonh said:My financial advisor recommended True Potential,Most TP sales are from sales reps of TP.so i brought over 60k from my company to get it going. In the space of 2-3 weeks it's just dropped every day, and now it's around minus £500.A peanuts drop of 0.83%. I think you need to go back to your adviser and get them to explain how investing works.this makes me very nervousHow are you operating a limited company? Don't you make business decisions?

You were no doubt told that investments will go down as well as up. You may well have been shown charts doing this. Even people who have never invested know that investments zig zag in value on a daily basis. So, we are you finding a tiny tiny tiny drop a problem?My advisor just tells me its 'futile' to check before the end of the next year, and doesn't seem to answer my questions on the workings of it all, and how I'm supposed make money on such a thing.If you have used a TP sales rep then they operate different levels and one is little more than a guided process rather than a full advice process. Your adviser, on the full advice process, is there to explain the process and how it works and indeed, should have done this before you signed up. If you used the guided service, then its limited in detail.is this normal or is it a poor starting pension with not much hope.Doing nothing is the worst option. So, using TP is better than that. But it is normal.I'm thinking about taking the money back out and investing in something more tangible like property.If you think property is tangible, then you are wrong there as well. When property values fall, what are you going to do then?

Check the status of your adviser. Are they an IFA or a TP agent/FA? If TP agent/FA, did they use the guided process (which for the benefit of others is little more than a robo service) or was a it a full advice service?

If full advice, did the adviser show you charts showing negative periods and how much they went down by?

Did they explain, in monetary terms the sort of losses you could see during negative periods?

If not, then go back to them and ask them to explain it to you.

What I've asked my advisor to explain (waiting for an answer still) is - once my pot gets above 60k again, what will TP do with the additional funds - do they re-invest in other stocks, does it earn interest, or does the whole thing just go up and down for ever and I hope for the best that its in on an upward curve once I come to need it ?

0 -

Sometimes trying to reduce risk actually increases the chance of a poor outcome in the end. Like trying to jump a ravine in a car doing 5 mph. If you have ten years or more to go, then a diverse, high equity fund would probably give you a better return in the long run. It would however be more of a rollercoaster ride, so it is better to just invest money and forget about it (and trust in your chosen strategy.)

Think first of your goal, then make it happen!1 -

Investing for the first time and seeing your pot dwindle by £1000 (as of this morning) can be a bit unsettling when you are new to investing, despite the explanations of 'your money can increase and decrease' etcLow risk on £60k probably means around £9,000 loss potential. However, low needs to be in context.I'm well aware of this fact, but, as this was a very low risk pension I expected slow growth rather than immediate losses.As it zig zags daily, losses are possible on day one. Indeed, the bonds element of many peoples portfolios are currently down on their value of 7 years ago. Whereas the stockmarket element has doubled.

Going too cautious can create more risk than taking sensible risks. You may reduce investment risk but you increase shortfall risk and inflation risk.What I've asked my advisor to explain (waiting for an answer still) is - once my pot gets above 60k again, what will TP do with the additional funds - do they re-invest in other stocks, does it earn interest, or does the whole thing just go up and down for ever and I hope for the best that its in on an upward curve once I come to need it ?Your questions really suggest that the agent hasn't done their job (or it was the guidance service you used) or you gave them too many positive responses in the meetings and gave them a false impression that you understood it.

You are paying for advice. Yet you are coming to the internet to get answers to things the adviser is there for (again, if it was their guidance service, you wont get the advice).

Returns are made up of growth and income. Income is usually reinvested and can buy more units or increase the unit price. Growth increases the unit price. Depending on your portfolio structure it could be one of several different ways. So, that question is best asked of TP.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.5 -

I’m sure their suitability letter would say about losses and to view over the long term. It is invested already so what do you mean when it gets over £60k? You really need to be asking your adviser (sales rep at TP as I wouldn’t class them as financial planners) these questions. They should fully explain risk, investments and what happens. They should be educating you as well.almost-bankrupt said:

What I should have said is that I'm very cautious with money, not "nervous". Making business decisions is fine. Investing for the first time and seeing your pot dwindle by £1000 (as of this morning) can be a bit unsettling when you are new to investing, despite the explanations of 'your money can increase and decrease' etc I'm well aware of this fact, but, as this was a very low risk pension I expected slow growth rather than immediate losses. I was shown charts of course, but it would have been helpful if I was told to - expect drops of XYC and dont be worried by it.dunstonh said:My financial advisor recommended True Potential,Most TP sales are from sales reps of TP.so i brought over 60k from my company to get it going. In the space of 2-3 weeks it's just dropped every day, and now it's around minus £500.A peanuts drop of 0.83%. I think you need to go back to your adviser and get them to explain how investing works.this makes me very nervousHow are you operating a limited company? Don't you make business decisions?

You were no doubt told that investments will go down as well as up. You may well have been shown charts doing this. Even people who have never invested know that investments zig zag in value on a daily basis. So, we are you finding a tiny tiny tiny drop a problem?My advisor just tells me its 'futile' to check before the end of the next year, and doesn't seem to answer my questions on the workings of it all, and how I'm supposed make money on such a thing.If you have used a TP sales rep then they operate different levels and one is little more than a guided process rather than a full advice process. Your adviser, on the full advice process, is there to explain the process and how it works and indeed, should have done this before you signed up. If you used the guided service, then its limited in detail.is this normal or is it a poor starting pension with not much hope.Doing nothing is the worst option. So, using TP is better than that. But it is normal.I'm thinking about taking the money back out and investing in something more tangible like property.If you think property is tangible, then you are wrong there as well. When property values fall, what are you going to do then?

Check the status of your adviser. Are they an IFA or a TP agent/FA? If TP agent/FA, did they use the guided process (which for the benefit of others is little more than a robo service) or was a it a full advice service?

If full advice, did the adviser show you charts showing negative periods and how much they went down by?

Did they explain, in monetary terms the sort of losses you could see during negative periods?

If not, then go back to them and ask them to explain it to you.

What I've asked my advisor to explain (waiting for an answer still) is - once my pot gets above 60k again, what will TP do with the additional funds - do they re-invest in other stocks, does it earn interest, or does the whole thing just go up and down for ever and I hope for the best that its in on an upward curve once I come to need it ?I am an Independent Financial Adviser (IFA). Any posts on here are for information and discussion purposes only and should not be seen as financial advice.1 -

I suggest you listen to Pete Matthews' "Meaningful Money" podcast. He did a recent edition called "Time In The Markets". That is what investing is all about. Time in the market and the inexorable long-term rise of markets is the name of the game when it comes to investing, not short term drops and peaks.

Meaningful Money Podcast – Meaningful Money with Pete Matthew

2 -

I think you would benefit from reading to understand the basics of investing.

For real beginner the book: DIY Pensions: A Simple Guide to Pensions, SIPPs & Retirement Planning by John Edwards is a good one. His other books are good entry level reading too - covering Income, Investing, Personal Finance.I’m a Senior Forum Ambassador and I support the Forum Team on the Pensions, Annuities & Retirement Planning, Loans

& Credit Cards boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com.

All views are my own and not the official line of MoneySavingExpert.3 -

I'm not familiar with the pension you are using, but normally the pension provider will invest your money in funds - some of them have a huge range of funds that can be chosen, others may only have a few canned options.almost-bankrupt said:

What I should have said is that I'm very cautious with money, not "nervous". Making business decisions is fine. Investing for the first time and seeing your pot dwindle by £1000 (as of this morning) can be a bit unsettling when you are new to investing, despite the explanations of 'your money can increase and decrease' etc I'm well aware of this fact, but, as this was a very low risk pension I expected slow growth rather than immediate losses. I was shown charts of course, but it would have been helpful if I was told to - expect drops of XYC and dont be worried by it.dunstonh said:My financial advisor recommended True Potential,Most TP sales are from sales reps of TP.so i brought over 60k from my company to get it going. In the space of 2-3 weeks it's just dropped every day, and now it's around minus £500.A peanuts drop of 0.83%. I think you need to go back to your adviser and get them to explain how investing works.this makes me very nervousHow are you operating a limited company? Don't you make business decisions?

You were no doubt told that investments will go down as well as up. You may well have been shown charts doing this. Even people who have never invested know that investments zig zag in value on a daily basis. So, we are you finding a tiny tiny tiny drop a problem?My advisor just tells me its 'futile' to check before the end of the next year, and doesn't seem to answer my questions on the workings of it all, and how I'm supposed make money on such a thing.If you have used a TP sales rep then they operate different levels and one is little more than a guided process rather than a full advice process. Your adviser, on the full advice process, is there to explain the process and how it works and indeed, should have done this before you signed up. If you used the guided service, then its limited in detail.is this normal or is it a poor starting pension with not much hope.Doing nothing is the worst option. So, using TP is better than that. But it is normal.I'm thinking about taking the money back out and investing in something more tangible like property.If you think property is tangible, then you are wrong there as well. When property values fall, what are you going to do then?

Check the status of your adviser. Are they an IFA or a TP agent/FA? If TP agent/FA, did they use the guided process (which for the benefit of others is little more than a robo service) or was a it a full advice service?

If full advice, did the adviser show you charts showing negative periods and how much they went down by?

Did they explain, in monetary terms the sort of losses you could see during negative periods?

If not, then go back to them and ask them to explain it to you.

What I've asked my advisor to explain (waiting for an answer still) is - once my pot gets above 60k again, what will TP do with the additional funds - do they re-invest in other stocks, does it earn interest, or does the whole thing just go up and down for ever and I hope for the best that its in on an upward curve once I come to need it ?

Low risk does not mean that the amount will not go down in negative times, it just hopefully means that it won't go down by as much as the higher risk funds.

Also, in this context as long as the investments are properly diversified, risk really refers to the volatility rather than the potential to permanently lose all your money - so when Dunstonh says you might lose £9000, that is what you could lost in a short space of time but it would recover again over the medium/long term. Therefore these investments are designed to be left in place in long term periods - if you need the money soon, you would not invest it in this way.

Further, choosing low risk investments with basic canned options, usually means that you have a higher propertion of bonds, which isn normal times will be less volatile than equities. However, bonds have been unusually volatile in the last couple of years due to various events - bond funds in particular are sensitive to interest rate expectations globally and there has been a lot of uncertainty around where interest rates are going in various countries and how quickly - first they went up much faster than expected, and now they were expected to start going down significantly this year but the latest news has again changed that so bonds have lost a bit again.

When I first joined this board about 2 years ago I knew nothing about any of this but I found out about it by reading some of the books mentioned above and reading lots of posts on these types of forums.

Also as a couple of others mentioned - if you don't need the money for 10 years +, you might want to reconsider your risk level after doing a bit more research as you are very likely to get a better long term result by having a higher portion of equities if you are talking 10+ years.1 -

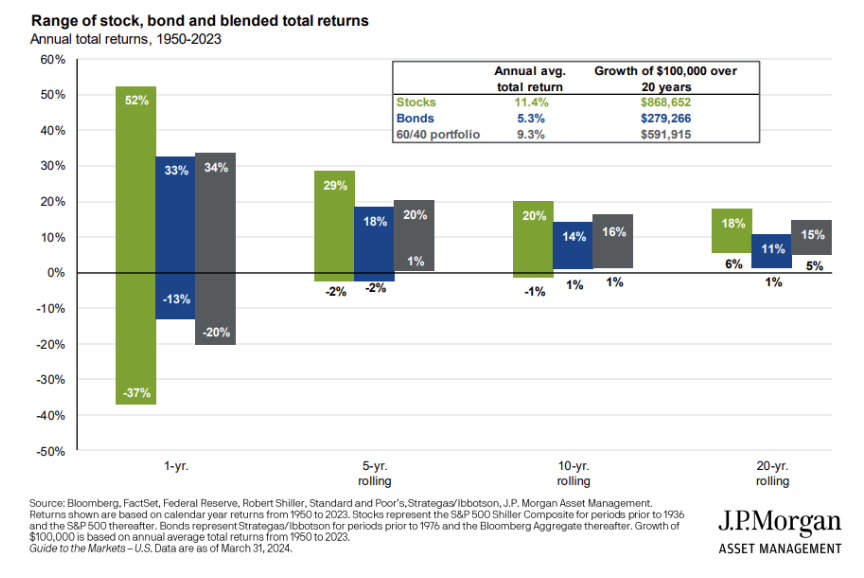

This may help:

Green is the growth assets. e.g. equities. The "riskier" part of your portfolio

Blue is the defensive assets. e.g. bonds. The "less risky" part of the portfolio.

Grey is your medium risk 60% equities/ 40% bonds blend. The most popular ratio.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

The above chart is very useful and informative, but keep in mind that the size of the bars above and below zero don't necessarily show the probability of achieving positive of negative - it just shows the historical range. If you look at the 1 year numbers, nearly half of the green equity graph is below zero, but I think that the probability of making a +ve return on equities in any one rolling year period is more like 75% or so based on some other slides that I saw?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards