We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

club lloyds monthly saver interest earned at maturity

dreaMer001

Posts: 62 Forumite

If we go to lloyds bank website:

we can see:

"What might the future balance be?expandable section

For example, if you deposit £400.00 every month for 12 months you will have a balance of £4950.00 after interest is paid.

This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest.

Interest is calculated each day. As your balance is lower at the start of the term and grows after each monthly deposit, your daily interest calculation also slowly increases. At the end of the term your interest is added into your savings account."

If I deposit £400 each month at the end of 12 months I would've deposited £400 x 12 = £4800. Going by lloyds bank calculation above, the total interest earned (profit) would therefore be = £4950 - £4800 = £150.

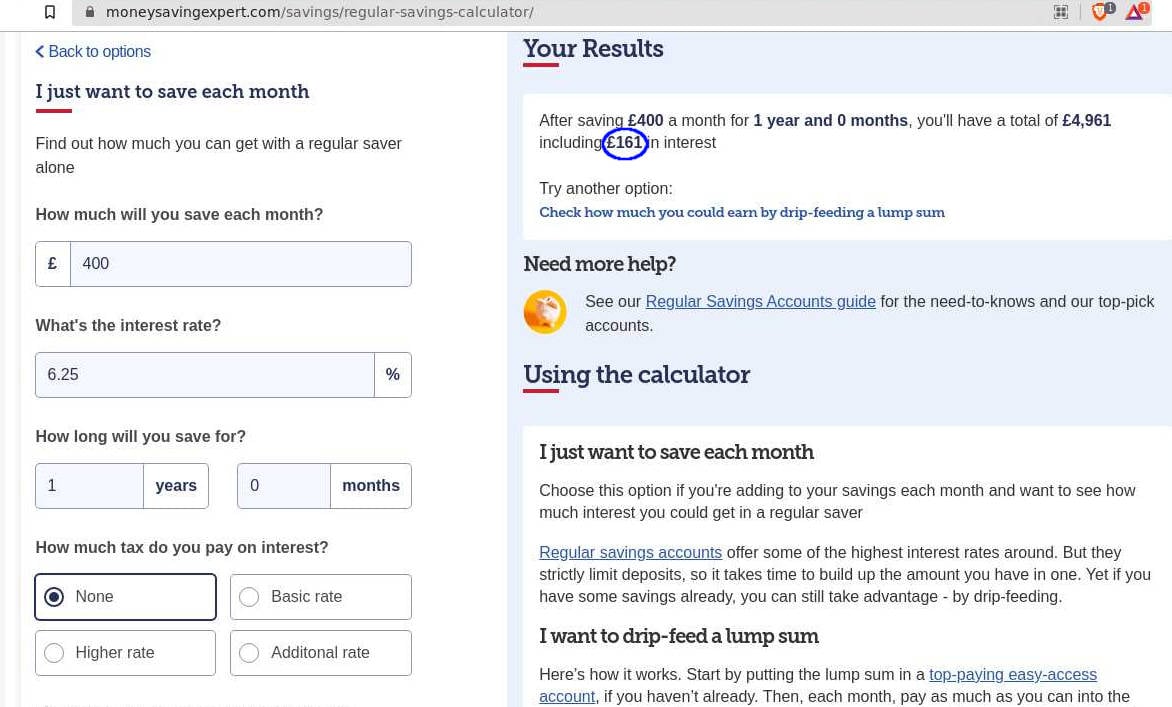

However, if I access:

and enter the values:

How much will you save each month? = £400.00

What's the interest rate? = 6.25%

How long will you save for? = 1 year

result says interest = £161

Is the MSE site interest calculator incorrect or is the lloyds bank website incorrect? Let me guess, they are both correct even though they both produce different results? In maths, I've heard of arriving at the same answer using different methods, but this is completely bizarre - is this different answer based on same method or different answer based on different methods.

0

Comments

-

Did you not read the part that states: "This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest"?The MSE figure looks closer to the truth of what most people would do as it assumes you'll make the payment at the start of each month, but the actual interest you could earn depends on the day of the year you open the account, and the day you make each monthly deposit. If you open it towards the end of a month, then make the second and subsequent deposits on the 1st of each month, including a 13th payment, then you could earn more than the MSE figure.So the different answers are both probably going to be incorrect as they are based on assumptions, which will likely differ from reality in any particular case.4

-

I'll tell you what I didn't do - I certainly didn't read anything of the sort near the result on the MoneySavingExpert (MSE) site regular saver calculator! If I did I would've seen that the two sites were using different assumptions.masonic said:Did you not read the part that states: "This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest"?The MSE figure looks closer to the truth of what most people would do as it assumes you'll make the payment at the start of each month, but the actual interest you could earn depends on the day of the year you open the account, and the day you make each monthly deposit. If you open it towards the end of a month, then make the second and subsequent deposits on the 1st of each month, including a 13th payment, then you could earn more than the MSE figure.So the different answers are both probably going to be incorrect as they are based on assumptions, which will likely differ from reality in any particular case.

I tend to open regular/monthly saver accounts towards the end of the month and then deposit 1st of every month, with a 13th payment to conclude.

I have a spreadsheet that calculates the interest at maturity if the interest rate and monthly amount is entered in to two cells. See:

I believe the formula works with 'making the deposit at the start of the month' strategy. Not sure if it accounts for the first payment being made at the end of the month and/or 13 payments.

Since the MSE website calculator doesn't go in to detail about how it arrived at the result, we are left in the dark about the assumptions!1 -

They can both be correct despite giving different results. Your inputs might be the same but the underlying assumptions can be quite different and thus give different answers. Paying in first at the end of the month and then making payments at the start will have a different result to paying in mid month or end of the month every time.dreaMer001 said:Is the MSE site interest calculator incorrect or is the lloyds bank website incorrect? Let me guess, they are both correct even though they both produce different results? In maths, I've heard of arriving at the same answer using different methods, but this is completely bizarre - is this different answer based on same method or different answer based on different methods.

It's like saying how long does it take to get from London to Newcastle? Lots of answers are valid depending on the inputs you give.Remember the saying: if it looks too good to be true it almost certainly is.2 -

I've earned £166.64. 13 deposits, first on 5th March and subsequent on the 1st of each month. MSE calculator doesn't allow for 13th deposit and a leap year, otherwise is pretty accurate.masonic said:Did you not read the part that states: "This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest"?The MSE figure looks closer to the truth of what most people would do as it assumes you'll make the payment at the start of each month, but the actual interest you could earn depends on the day of the year you open the account, and the day you make each monthly deposit. If you open it towards the end of a month, then make the second and subsequent deposits on the 1st of each month, including a 13th payment, then you could earn more than the MSE figure.So the different answers are both probably going to be incorrect as they are based on assumptions, which will likely differ from reality in any particular case.2 -

Your formula doesn't account for compounding, you can't just divide an annual rate by 12 to get a monthly rate. Doing so will overstate the interest earned. To get a genuine monthly rate you need to use logarithms and exponents, and even then since interest is calculated daily and months are variable length it remains an approximation.dreaMer001 said:

I'll tell you what I didn't do - I certainly didn't read anything of the sort near the result on the MoneySavingExpert (MSE) site regular saver calculator! If I did I would've seen that the two sites were using different assumptions.masonic said:Did you not read the part that states: "This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest"?The MSE figure looks closer to the truth of what most people would do as it assumes you'll make the payment at the start of each month, but the actual interest you could earn depends on the day of the year you open the account, and the day you make each monthly deposit. If you open it towards the end of a month, then make the second and subsequent deposits on the 1st of each month, including a 13th payment, then you could earn more than the MSE figure.So the different answers are both probably going to be incorrect as they are based on assumptions, which will likely differ from reality in any particular case.

I tend to open regular/monthly saver accounts towards the end of the month and then deposit 1st of every month, with a 13th payment to conclude.

I have a spreadsheet that calculates the interest at maturity if the interest rate and monthly amount is entered in to two cells. See:

I believe the formula works with 'making the deposit at the start of the month' strategy. Not sure if it accounts for the first payment being made at the end of the month and/or 13 payments.

Since the MSE website calculator doesn't go in to detail about how it arrived at the result, we are left in the dark about the assumptions!

Proud member of the wokerati, though I don't eat tofu.Home is where my books are.Solar PV 5.2kWp system, SE facing, >1% shading, installed March 2019.Mortgage free July 20231 -

Are you or anyone else aware how the MSE calculator comes up with the result? (how does MSE get from London to Newcastle?) Or is it a secret ?allegro120 said:

I've earned £166.64. 13 deposits, first on 5th March and subsequent on the 1st of each month. MSE calculator doesn't allow for 13th deposit and a leap year, otherwise is pretty accurate.masonic said:Did you not read the part that states: "This assumes you deposit £400.00 in the middle of each month and you don’t withdraw any money or interest"?The MSE figure looks closer to the truth of what most people would do as it assumes you'll make the payment at the start of each month, but the actual interest you could earn depends on the day of the year you open the account, and the day you make each monthly deposit. If you open it towards the end of a month, then make the second and subsequent deposits on the 1st of each month, including a 13th payment, then you could earn more than the MSE figure.So the different answers are both probably going to be incorrect as they are based on assumptions, which will likely differ from reality in any particular case.1 -

To get maximum interest from the regular saver open it with first payment right at the end of the month, the put in the remaining 12 payments on the first of each following month.

This ignores what you might or might not earn from your first £400 where ever you keep it while waiting to open the Monthly Saver.

Also that the later in the month, the less time you'll have to open a new one in the month it matures.0 -

Regular savers that pay annually don't compoundonomatopoeia99 said:Your formula doesn't account for compounding

0 -

I opened Club Lloyds 16th March 2023, funded 1st every month, 12 total payments earned £173.70 in interest0

-

Why didn't you fund it on the 16th and make 12 monthly payments so 13 in all? Every little helps

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards