We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Saving vs investing

Comments

-

How has cash both beaten and lagged inflation, are you meaning over different periods?Albermarle said:

Statistically you are right that there have been other periods where cash has just beaten inflation, but has still lagged badly compared to inflation.0 -

I think most research uses money market rates that can often be less than the best easy access rate.Albermarle said:

AFAIK the historical data uses typical easy access rates.coyrls said:

I am not sure that's true, I think you might be forgetting how low inflation has been in the "recent past", I set up a ladder of fixed rate savings account in 2016 and I have beaten or more or less matched inflation every year from 2017 to 2022. The only year where I was significantly under inflation (CPI) was 2023 (a 5 year fixed account that matured in February 2023).Albermarle said:So, either the benefit of investing rather than saving is quite small, or I'm missing something (for example the instant access accounts will sneakily reduce their interest rate and hope the savers don't notice/can't be thered to switch).Disregarding bank strategy ( which has been explained above), it is true for the individual they can currently earn a higher interest rate than inflation, in some savings accounts. Compared to the recent past this is a quite unusual situation, which may or may not last for a while in future. So the balance between saving and investing has shifted a little.

0 -

I meant lagged 'investing' . Have now edited my post .eskbanker said:

How has cash both beaten and lagged inflation, are you meaning over different periods?Albermarle said:

Statistically you are right that there have been other periods where cash has just beaten inflation, but has still lagged badly compared to inflation.0 -

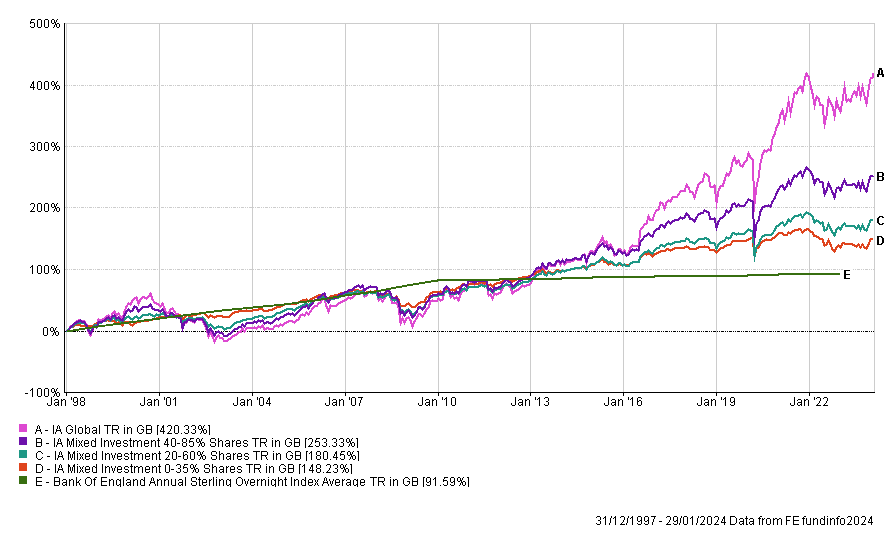

Global shares – as represented by the FTSE All-World index – have delivered an average annual return since 1993 of 9.3% in sterling terms. However, projected returns in Global equities (estimated by Vanguard at September 2023 levels) are only 5.4 - 7.4% over 10 years, again not allowing for inflation. Of course this estimate is itself highly speculative.

With some savings accounts offering over 5% at present I can see why this appears to be a more attractive proposition. However, savings accounts aren't really risk free since they also run the risk of falling behind inflation, thereby losing value in real terms. In fact unless you are prepared to move your money around the best paying accounts, savings accounts are unlikely to keep up with inflation. In contrast, investments such as equities and property have beaten inflation over the long term.

There have however been some excellent safe opportunities in the past. I'm stick kicking myself for selling most of my Index linked NS&I bonds!2 -

James Shack covered the attractiveness of high savings interest recently: https://youtu.be/oeob9z27-gA?si=eBhmpOIL-CGkr96KNo one has ever become poor by giving0

-

My point was that real savings returns after inflation were actually better a few years ago. Yes, interest rates are high but so is inflation. I had a 3% five year fixed account that matured in February 2021 when the annual inflation figure was 0.7%, with the four previous years' inflation figures at 1.8%, 1.8%, 3% and 1.8%.

2 -

I'm just considering what to do with my 1 yr fixed isa , £13500, which matures in March. I have VLS60 and been invested for 2 years and my rate of return is 3.77%....so 1.89% per year, less inflation. Its only these last 2 months that the return has gone positive. Because i probably started investing at the wrong time, end of january 2022, i worried about putting more in and thats why i chose the 1 yr cash isa. However, i now realise if i'd put more in VLS60 when the price was low my returns would look much better. I'm invested for the long haul, c.10 yrs and wondered what i could expect from it. I'm hoping to beat inflation or at least keep up with it. All my cash accounts are now above inflation; a 5 yr fixed since November 2022 at 4.98% monthly, a 3 y fixed @ 5% since May 23, a 1 yr fixed @ 6.2% matures in July and the cash isa @ 4.1% which matures end of March. Thanks.

0 -

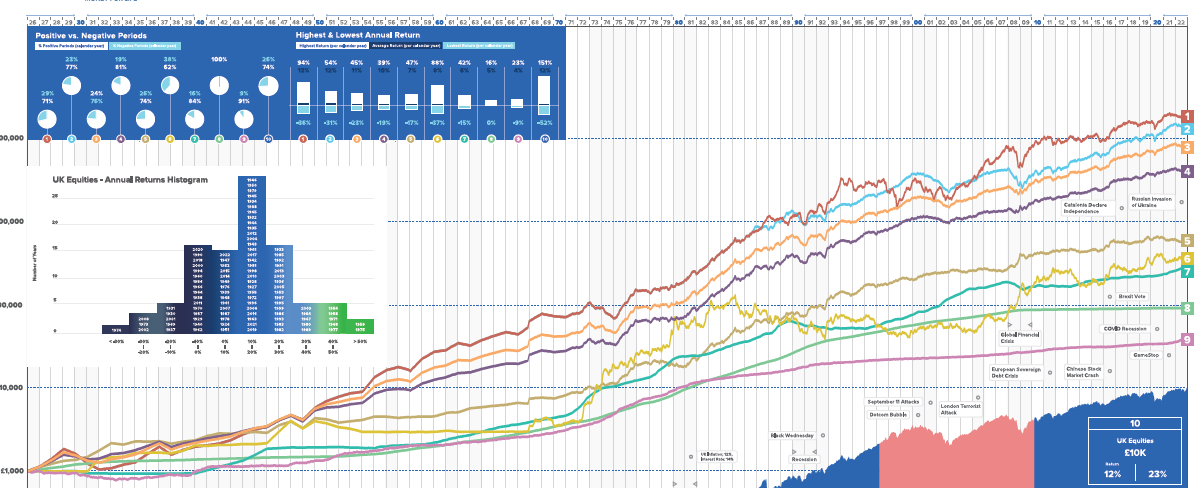

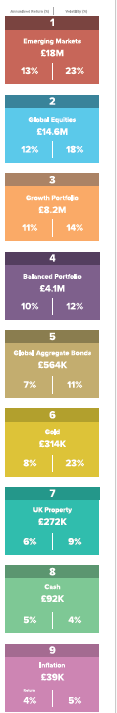

We're often told that it's wise to invest long-term in the stock market rather than put all one's money in cash, because the long-term expected return is much greaterThey are two ends of the scale but you also have other asset classes in between. Most people use multi-asset investments that include cash, bonds, gilts, property and equities. They don't do cash and stockmarket alone.Stockmarket returned 10-15% over 2023

So, for the banks (TSB, Tesco) offering the 5.9% rate, then even if no-one defaulted and there were no other costs, the maximum return is 5.9%. That must surely be more than they would expect to get by investing on the stock market, otherwise they would just do that.Can someone enlighten me?You are understating the long term average returns on investments.

2000 to 2009 was a very bad period for investing. Multiple major events happened in that decade but that is why you are told that investing is long term and not short term.

The green line is SONIA. That is in line with the best rates you can get on cash savings.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.3 -

This one isnt going to work well due to size limitations. I have snipped the bottom but looking at the lines, this is 1925 to 2022 and the key below including the value if £1000 was invested in 1925.

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.0 -

That estimate is probably based on an assumption of inflation being about 2.5% p.a. over that period, which would make the real return about 4%. Real returns on savings are likely to be much less. Still, I wouldn't be surprised if the gap between equities and risk-free savings/bonds (the risk premium) is significantly lower over the next 10 years than the historical average.peter021072 said:However, projected returns in Global equities (estimated by Vanguard at September 2023 levels) are only 5.4 - 7.4% over 10 years, again not allowing for inflation. Of course this estimate is itself highly speculative.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.5K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455K Spending & Discounts

- 246.6K Work, Benefits & Business

- 602.9K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.6K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards