We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a very Happy New Year. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

FIRE Girls Pension Diary - Aim High & Dream Big

Comments

-

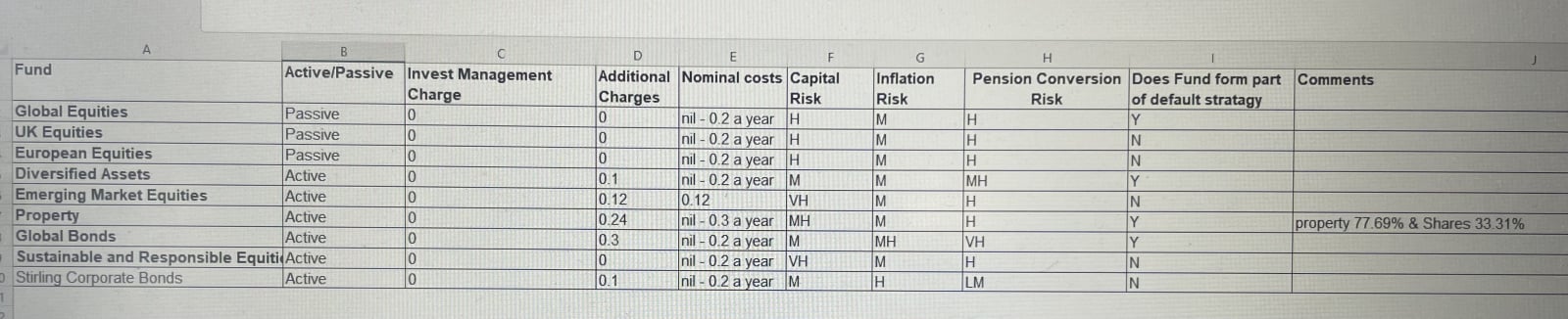

Well I’ve gathered so more info today on the funds that I might be interested in. Below is some info on charges and risk. I also looked into the property fund and although there is health properties it’s not all hospitals etc so I’ll reduce that to a lower percentage.

I will definitely choose approx 80% Global Equities. I notice that the default flex selection that automatically derisks has 40% global equities,I have to say it is tempting just to go with the default selection rather than having the responsibility of choosing myself! Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5000 -

Hi Firegirl, some thoughts on your plan (which is great, and very doable):

If you accept that no one can predict the future, you may be better off focusing on reducing fees rather than trying to pick funds.I’d suggest the only fund you need is HSBC All World Index (0.15% annual fee).Paying active fees for a small part of the portfolio doesn’t seem rational. Emerging markets are covered in the global tracker.A cheap ISA platform is iWeb (no platform

fee). A cheap SIPP for a bigger pension pot is ii (£156 pa platform fee)There will be temptation to tinker, but the best results will come from setting this up right and then try not to look at it for a decade or so…If you have nerves of steel, you can stay in 100% equities till a few years before retirement. If you don’t know when that’s going to be, perhaps keep 10-20% in a medium term government bond fund like iShares IGLH.1 -

@Happy_planner

Thanks so much for your comments.

The pension I’m opening is a company pension so I only have specific funds to choose from.I feeling the pressure to choose the right funds so I can just leave it and not make changes. As I’m putting so much in each month I really want to get it right!Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5000 -

Any more info on the Diversified Assets fund?

Think first of your goal, then make it happen!0 -

Some updates to figures…

I have moved the money saved to my kids to 2 different funds, and are now separate from mine. My oldest son pays digs money so I will add it to his fund and keep saving for him. I’ll do the same when my younger son gets a job. So I’ve taken that out of my ISA totals now. See update below.

Pension 1-£240, 000 (No more to be added)

Pension 2-£65, 000 (No more to be added)

Pension 3-£13, 500 (planning transfer)

Pension 4-£500 (Current work pension)

ISA-£100,000

Total- £419,000

Pension 4 fund selection. I keep changing my mind so I’ve decided to get some advice regarding fund selection.

In the next few months when I settle into the new routine of the lower salary I’ll see what I can put towards my ISA. Maybe £50/£100 monthly that will gradually build over the years.Have a good week everyone!Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5001 -

Early update for TYE 2025

Pension 1-£230,000 (No more to be added)

Pension 2-£63,000 (No more to be added)

Pension 3-£13,500 (in progress of transfer)

Pension 4-£8,000 (Current work pension)

ISA-£95,000

Money Owed - £10,000

Total- £419, 500

2nd comment in diary also updated to track progress. You can see the volatility in the market has affected my totals so I’ve added in money owed to bring up my totals 😆

Age 46 - 2025 - Target £420,061/ Actual £419,500

Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5004 -

I don't dare to check any invested pot these day

2

2 -

@LL_USS

i won’t be checking again until next year! It’s frightening but we know we need to ride the wave!Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5001 -

Firegirl said:@LL_USS

i won’t be checking again until next year! It’s frightening but we know we need to ride the wave!Indeed I checked just for curiosity. I wanted to see how much the impact could be. But yes hopefully it'll just be a bump in a long journey.I am actually still going to invest my LISAs soon after the pot is with Dodl. I've been told investing in the US markets could yield more but the exchange rates do eat in the profit. And that even when we choose a couple of funds to put the money in, people don't just leave the money there for 10-15 years later but still need to check and move around sometimes. I feel I need to try to know what it's like - people all take differently.I hope you still reach your targets for next year easily despite this funny period for the stock markets.1 -

@LL_USS

Thanks for the encouragement and hope looking at your investments isn’t causing concern for you. I’m not too worried as I’m a long way off retirement so there’s plenty time for market recovery. Remember to zoom out when you look at your graphs as that will reduce the panic!

It will be really interesting to see at the end of my journey how the market fluctuations pan out and really that was a reason I wanted to do this diary so others can see that you need to hold your nerve.As I’m currently still investing such a lot each month then a market drop may end up being a good thing. A long sale! BUT it’s a stark reminder that this could happen when retired and to be prepared for a market crash by choosing lower risk stock or having some in cash.

I’ll keep a wee eye on my investments out of interest. Will be interesting to see what the next few years brings!Mortgage balance Feb 2015 start of MFW Journey-£245316.06/Aim to be mortgage neutral 2022 — Target for May 2024 14 Year Target Balance MF50 = £89,535 — Mortgage Balance £106, 000—Target for May 2024! £89,535

Retirement Planning

Starting Position (Jan 2024) : Pension 1-£165,000/Pension 2-£50,000/Pension 3-£9,500/ISA-£87,000/Total-£311,5002

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.8K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 260K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards