We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Non woke, non-ethical pensions

Comments

-

Of course you might argue about the ethics of capitalism and decide that investment funds that provide people with gain without them doing any work are fundamentally unethical. But to answer your question I think the closest you'll come to funds that don't have ESG criteria are index tracker funds.And so we beat on, boats against the current, borne back ceaselessly into the past.0

-

[Deleted User] said:

Not quite. It is coincident with the number of people saying "woke". Rarely uttered before then, blabbered all the time after.Universidad said:

Nope, it's definitely because of woke.dunstonh said:Don't you think it is more likely to be due to the credit crunch?It is certainly coincident, but also the other word with the same root.Ironically, for all the people complaining about wokeness, I have literally only ever heard the word "woke" unironically used by those opposed to it.0 -

I would like to comment regarding ESG, Governance, Woke + Authoritarianism but unfortunately this is political.0

-

Empirical evidence is that, over the long term, responsible funds give higher returns.

One to ponder when considering short term volatility possibly.1 -

dunstonh said:Historically, ESG, ethical, responsible or sustainable have all resulted in lower returns over the long term.

Anyone care to substantiate these diametrically competing claims with credible and citable sources?Tammer said:Empirical evidence is that, over the long term, responsible funds give higher returns.0 -

Just shove it into a few index trackers and go and have a G&T or a Margarita. With regards to ESG vs anything else etc., angels and the heads of pins come to mind.eskbanker said:dunstonh said:Historically, ESG, ethical, responsible or sustainable have all resulted in lower returns over the long term.

Anyone care to substantiate these diametrically competing claims with credible and citable sources?Tammer said:Empirical evidence is that, over the long term, responsible funds give higher returns.And so we beat on, boats against the current, borne back ceaselessly into the past.0 -

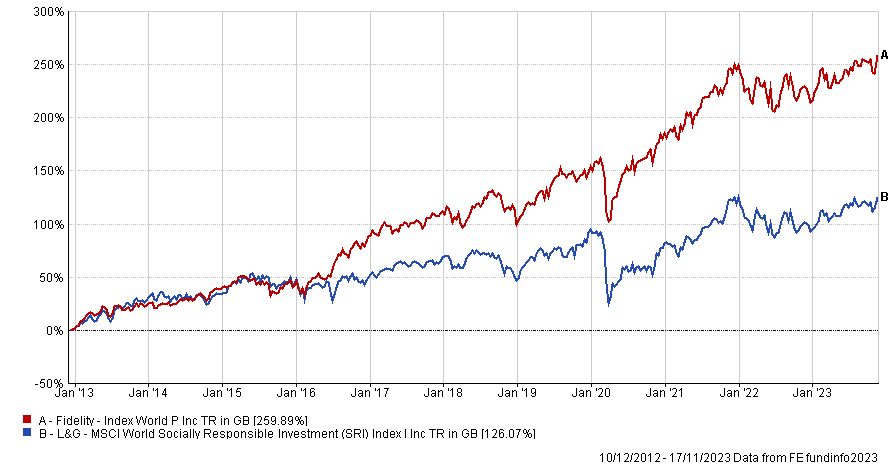

ESG is a difficult one as few ESG funds have a long history. Sustainable/responsible is easier as they have been going longer. However, you are still looking at mostly managed funds.eskbanker said:dunstonh said:Historically, ESG, ethical, responsible or sustainable have all resulted in lower returns over the long term.

Anyone care to substantiate these diametrically competing claims with credible and citable sources?Tammer said:Empirical evidence is that, over the long term, responsible funds give higher returns.

Typically, when you look at past performance, you see the odd year were SRI/ESG does better. In the years following that, you usually see a range of marketing reports or opinion pieces saying that SRI/ESG is the new way. And usually, it's followed by a period of underperformance, and it all goes quiet again.

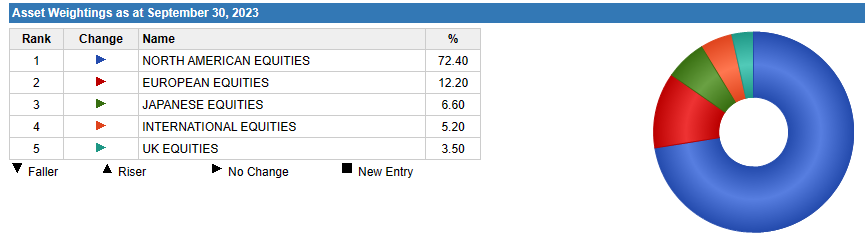

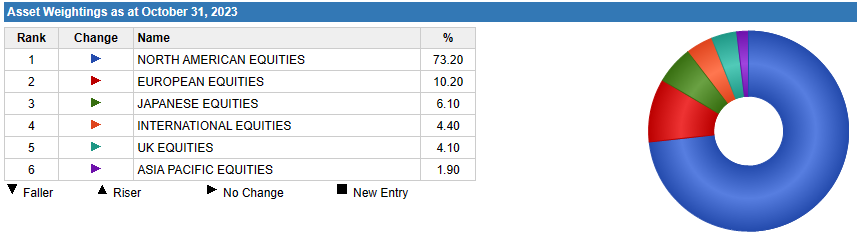

Here are two global trackers with similar regional allocations. It needs to be as close as possible for any comparison to be fair. And the benchmarks as close as possible.L&G MSCI World Socially Responsible Investment (SRI) Index

Benchmark:MSCI World SRI

andFidelity Index World

Benchmark: MSCI World Index (Net)

Very small differences in the regional make up and benchmarks are effectively the same except one is conventional and the other is SRI.

And here is the past performance:

I am an Independent Financial Adviser (IFA). The comments I make are just my opinion and are for discussion purposes only. They are not financial advice and you should not treat them as such. If you feel an area discussed may be relevant to you, then please seek advice from an Independent Financial Adviser local to you.1 -

You would have thought that if a large potion of the global markets is prioritizing investment in certain topics like green energy and decarbonization, those industries are likely to do well. For example, if large investments are made across most countries in buying windmills, companies that make windmills are likely to do well regardless whether you personally agree with wind power or suchlike. You would have thought that in future, companies that are involved in topics that are given regulatory priority by the world's voters and governments should do well.0

-

Yes, but windmills are a very niche investment sector, hardly appropriate for a significant holding in a diversified portfolio. I think you will find that the poor performance of the SRI fund compared with the world tracker is caused by what it does not invest in rather than what it does.Pat38493 said:You would have thought that if a large potion of the global markets is prioritizing investment in certain topics like green energy and decarbonization, those industries are likely to do well. For example, if large investments are made across most countries in buying windmills, companies that make windmills are likely to do well regardless whether you personally agree with wind power or suchlike. You would have thought that in future, companies that are involved in topics that are given regulatory priority by the world's voters and governments should do well.

I think people should look carefully at the SRI fund before investing - Microsoft is its largest holding at 17.2% followed by Tesla at 4.1%. 35% of its total assets are in the top 10 holdings. These figures compare with a developed world tracker's largest holding being Apple at 5.2% followed by Microsoft at 4.6% with 21% of assets in top 10 holdings. So the SRI fund's diversification could be questioned.

Perhaps someone could explain why Microsoft is SRI compliant whilst Apple, Amazon, Google and Meta (Facebook) aren't.

0 -

followed by Tesla at 4.1%

I have to say, I do wonder whether EV manufacture (not just Tesla) is actually any better for the environment than encouraging people to keep their existing cars longer.

For example, the damage caused by the extraction of battery materials is significant.

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards