We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

The Forum now has a brand new text editor, adding a bunch of handy features to use when creating posts. Read more in our how-to guide

Metro Bank

Comments

-

If depositors' money becomes inaccessible, Metro Bank will be in default and the FSCS will usually pay compensation within weeks.masonic said:Of more concern is the current regulatory action being taken by the FCA. If they move to enforcement, bear in mind your money could be inaccessible for whatever period of time it takes for the situation to either resolve or deteriorate enough to precipitate a FSCS payout.

Once depositors can't get their money out of the bank, the situation doesn't need to deteriorate any further for the FSCS to step in. It is already deterior beyond all recognition. That is what the FSCS is for.0 -

Currently a Metro 1 year fixed ISA is paying 5.71%moneysaver1978 said:Putting aside financial safety, is Metro offering the best rate?

I recently closed my savings account because the interest rates offered weren’t competitive compared to the market.

If you already have a Metro account and if theres a branch that's local to you, their offering is up there with the best.

So, why not ?

Some contributors on this forum are putting me off.0 -

Good to know that Metro is competitive again - it was only last week that I closed/transferred because at that time the interest rate at Shawbrook was a market leader (and Metro wasn't anywhere near). The OP didn't provide a reason or the interest rate that Metro is offering.subjecttocontract said:

Currently a Metro 1 year fixed ISA is paying 5.71%moneysaver1978 said:Putting aside financial safety, is Metro offering the best rate?

I recently closed my savings account because the interest rates offered weren’t competitive compared to the market.

If you already have a Metro account and if theres a branch that's local to you, their offering is up there with the best.

So, why not ?

Some contributors on this forum are putting me off.

Can you clarify what you meant by your statement: "Some contributors on this forum are putting me off."?0 -

I've decided not to go with Metro

Thanks for replies and info0 -

Have you read the whole thread ? I would have thought that the comments regarding regulatory action by the FCA would have been self evident.moneysaver1978 said:

Good to know that Metro is competitive again - it was only last week that I closed/transferred because at that time the interest rate at Shawbrook was a market leader (and Metro wasn't anywhere near). The OP didn't provide a reason or the interest rate that Metro is offering.subjecttocontract said:

Currently a Metro 1 year fixed ISA is paying 5.71%moneysaver1978 said:Putting aside financial safety, is Metro offering the best rate?

I recently closed my savings account because the interest rates offered weren’t competitive compared to the market.

If you already have a Metro account and if theres a branch that's local to you, their offering is up there with the best.

So, why not ?

Some contributors on this forum are putting me off.

Can you clarify what you meant by your statement: "Some contributors on this forum are putting me off."?0 -

Yes I did and offered another angle to look at. What is your point?subjecttocontract said:

Have you read the whole thread ? I would have thought that the comments regarding regulatory action by the FCA would have been self evident.moneysaver1978 said:

Good to know that Metro is competitive again - it was only last week that I closed/transferred because at that time the interest rate at Shawbrook was a market leader (and Metro wasn't anywhere near). The OP didn't provide a reason or the interest rate that Metro is offering.subjecttocontract said:

Currently a Metro 1 year fixed ISA is paying 5.71%moneysaver1978 said:Putting aside financial safety, is Metro offering the best rate?

I recently closed my savings account because the interest rates offered weren’t competitive compared to the market.

If you already have a Metro account and if theres a branch that's local to you, their offering is up there with the best.

So, why not ?

Some contributors on this forum are putting me off.

Can you clarify what you meant by your statement: "Some contributors on this forum are putting me off."?0 -

One of my fixed cash ISAs is maturing in less than a couple of weeks so I'm just keeping an eye on what's available in an ever changing ISA market. I prefer to open/ transfer ISAs in places I already have an account of some kind so that I don't have any hassle with I'D etc. As I have accounts with many places it's not to difficult to find somewhere with a reasonable rate but I may decide that Metro is best avoided. I'm not to bothered if Metro get into further trouble and my money becomes frozen for a few weeks. It rather depends if there is another account elsewhere offering something similar so I can avoid any issues. ISA rates are generally falling everywhere and 2 weeks is a long time in the ISA world where a lot can happen.0

-

I’ve just opened a savings account paid in a quid to test and then tried to take out again it wouldn’t let me and asked me to phone them I did this and they told me my account was frozen and to try again so 24 hours later tried again and still wouldn’t let me withdraw so don’t touch them with a barge pole1

-

Malthusian said:

If depositors' money becomes inaccessible, Metro Bank will be in default and the FSCS will usually pay compensation within weeks.masonic said:Of more concern is the current regulatory action being taken by the FCA. If they move to enforcement, bear in mind your money could be inaccessible for whatever period of time it takes for the situation to either resolve or deteriorate enough to precipitate a FSCS payout.

Once depositors can't get their money out of the bank, the situation doesn't need to deteriorate any further for the FSCS to step in. It is already deterior beyond all recognition. That is what the FSCS is for.- On the 7th January 2015, EBCU (who operated under the brand DotComUnity and offered a market leading cash ISA that featured in the MSE weekly email in 2014) was subject to enforcement action whereby they were prevented from reducing their capital reserves. As a side effect, they were prevented them repaying depositors.

- The measures were initially of a temporary nature, for a period of 2 weeks according to the supervisory notice, but kept being extended. This situation carried on for 18 weeks, during which time depositors were largely kept in the dark. But because they were prevented from meeting their obligations for regulatory reasons, it was not considered that they were insolvent. I suppose this is rather like a bank isn't considered insolvent if it has to freeze someone's account by law.

- EBCU was finally placed in Administration on 14 May 2015 and the FSCS only then was able to start considering claims from depositors.

The whole mess was chronicled in this thread: https://forums.moneysavingexpert.com/discussion/4938603/dot-comunity-credit-union-isaPage 25 is where depositors first learned something was amiss, and page 100 features a post from Cork Gully on the day they were appointed as administrators.So it is technically correct to say the FSCS will pay compensation within weeks, but when the FCA gets involved in a supervisory capacity, it is the number of weeks it can take that may surprise some people.I mentioned this in relation to Metro Bank because of the shared link with an FCA investigation, which may lead to similar action depending on the findings.2 -

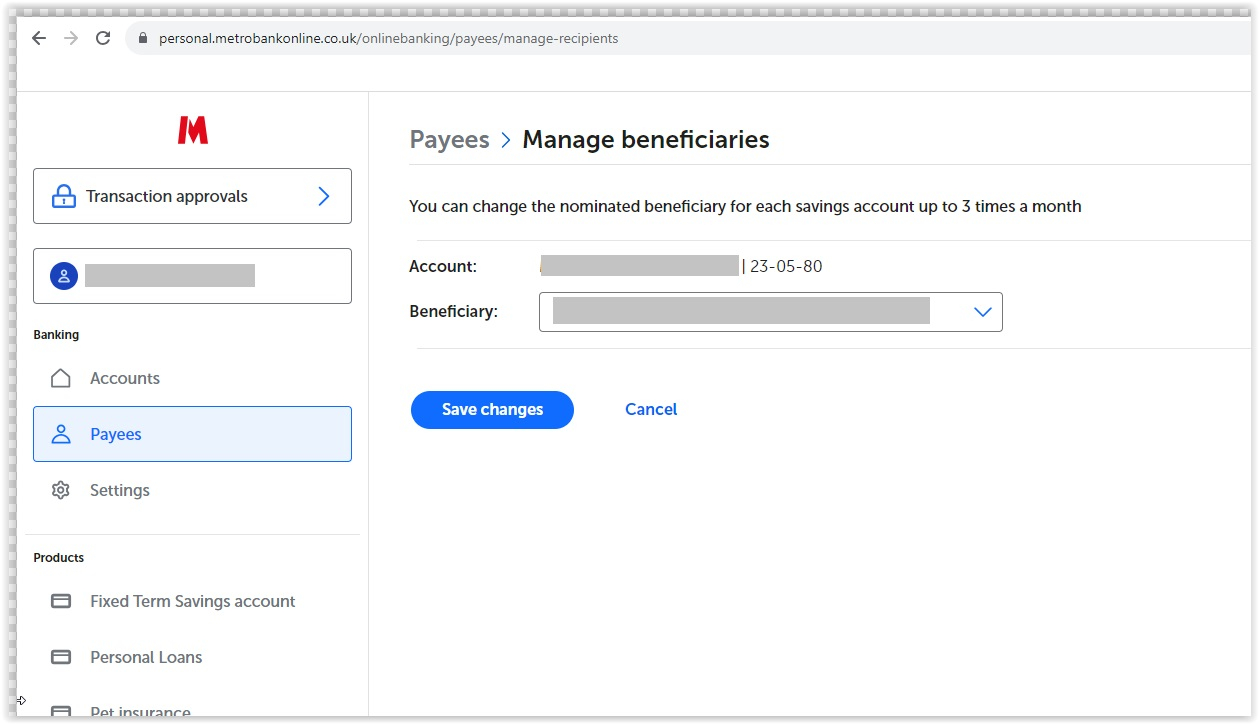

Dexterdobree said:I’ve just opened a savings account paid in a quid to test and then tried to take out again it wouldn’t let me and asked me to phone them I did this and they told me my account was frozen and to try again so 24 hours later tried again and still wouldn’t let me withdraw so don’t touch them with a barge pole

Have you set up a nominated current account for your withdrawal? This is mandatory, and you can only do it in Online Banking, not in the app.

They don't tell you this, and their CS is useless. But it is very easy to do, and withdrawals work like a dream once you have done this.

Look for "Manage beneficiaries"

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 353.6K Banking & Borrowing

- 254.2K Reduce Debt & Boost Income

- 455.1K Spending & Discounts

- 246.6K Work, Benefits & Business

- 603K Mortgages, Homes & Bills

- 178.1K Life & Family

- 260.7K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards