We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

About to begin a DMP with £53k of debt.

Comments

-

Thanks everyone, I will just wait then. Yes Virgin are very much dragging their heels and I haven't had any defaults from them yet. Very annoying.0

-

Hi everyone,

Just thought id give you an update. Virgin have now finally sent me all 3 defaults so the state of play is as follows:

Tesco Credit Card - Default sent 13/03/2024.

Santander Credit Card - Default sent 12/04/2024

Virgin Credit Card 1 - Default sent 11/05/2024

Virgin Credit Card 2 - Default sent 18/05/2024

Virgin Credit Card 3 - Default sent 20/05/2024

Still waiting for MBNA.

I have had a letter from Tesco stating they have transferred the debt to Westcot collection services who have just sent me a link to their self service portal to set up a payment plan 'that suits my circumstances'.

I know there isn't an answer to this question as it depends on an individuals budget and circumstances but what is deemed to be an 'appropriate' monthly payment according to the proportion of debt owed? For example, I owe £6203 on my Tesco card but at present, I can only really afford to pay £10 a month, especially as I will soon start having to pay the other creditors. Is that a laughable amount to offer?

Also, my partner has now decided to do the same with all his debts as he is in the same situation. One of his debts is an unsecured loan with TSB. He also banks with TSB so he is in the process of changing his bank account before he stops the payments on the loan. I assume the process is exactly the same as you would do with a credit card?

Thanks everyone

2 -

No, £10 per month isn't a laughable amount to offer, if that is what you can afford. I have 2 debts well over £6,000 that are getting £10 per month from me.1

-

You do a budget.wildstyle2019 said:Hi everyone,

I know there isn't an answer to this question as it depends on an individuals budget and circumstances but what is deemed to be an 'appropriate' monthly payment according to the proportion of debt owed?

You deduct everything you spend money on, your essential payments basically, and what is left is your disposable income, from that you pay your non essential debts, such as loans and credit cards etc.

It is what it is really, you can only pay what your budget allows.

If the debt will take forever to pay at £10 a month, you look at other options, do I qualify for a DRO for example?

If the answer is no, look at asking your lenders to write the debts off, it depends if your circumstances will improve in the future or not.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter2 -

Do you mind if I ask whether any of the Virgin defaults are showing on your credit file yet? I received the default letters, debt appears to have been sold and Moorcroft are managing but this hasn’t updated on my credit report yet so was just wondering? Thankyouwildstyle2019 said:Hi everyone,

Just thought id give you an update. Virgin have now finally sent me all 3 defaults so the state of play is as follows:

Tesco Credit Card - Default sent 13/03/2024.

Santander Credit Card - Default sent 12/04/2024

Virgin Credit Card 1 - Default sent 11/05/2024

Virgin Credit Card 2 - Default sent 18/05/2024

Virgin Credit Card 3 - Default sent 20/05/2024

Still waiting for MBNA.

I have had a letter from Tesco stating they have transferred the debt to Westcot collection services who have just sent me a link to their self service portal to set up a payment plan 'that suits my circumstances'.

I know there isn't an answer to this question as it depends on an individuals budget and circumstances but what is deemed to be an 'appropriate' monthly payment according to the proportion of debt owed? For example, I owe £6203 on my Tesco card but at present, I can only really afford to pay £10 a month, especially as I will soon start having to pay the other creditors. Is that a laughable amount to offer?

Also, my partner has now decided to do the same with all his debts as he is in the same situation. One of his debts is an unsecured loan with TSB. He also banks with TSB so he is in the process of changing his bank account before he stops the payments on the loan. I assume the process is exactly the same as you would do with a credit card?

Thanks everyone 0

0 -

To be honest, I haven't checked my credit report so I don't know.0

-

Whilst I am on here, I am trying to set up a payment plan with Moorcroft using their online payment arrangement system where you have to put in your income and expenditure. It's awful and it keeps suggesting I have more to pay to my creditors than I actually have. I dont want to speak to them on the phone. Can I just write to them with an offer of payment or will I have to give them my budget no matter what?

Thanks0 -

Could people just pay a minimal amount like £10 a month, which over the course of 6 years will not total anywhere near their debt to the provider, and then the debt is written off on your credit report? Presumably it disappears from your credit report but you still owe the money?sourcrates said:

You do a budget.wildstyle2019 said:Hi everyone,

I know there isn't an answer to this question as it depends on an individuals budget and circumstances but what is deemed to be an 'appropriate' monthly payment according to the proportion of debt owed?

You deduct everything you spend money on, your essential payments basically, and what is left is your disposable income, from that you pay your non essential debts, such as loans and credit cards etc.

It is what it is really, you can only pay what your budget allows.

If the debt will take forever to pay at £10 a month, you look at other options, do I qualify for a DRO for example?

If the answer is no, look at asking your lenders to write the debts off, it depends if your circumstances will improve in the future or not.0 -

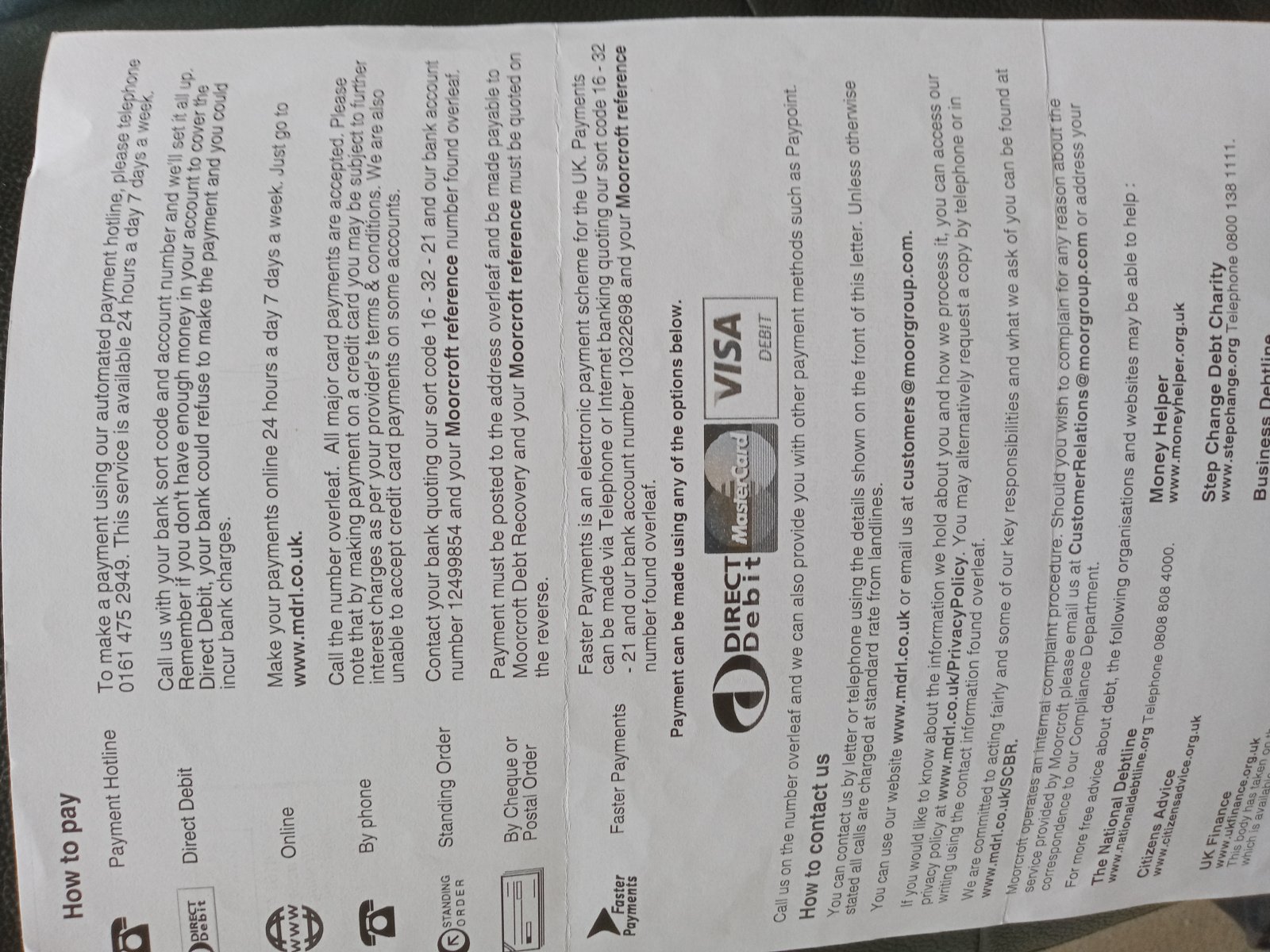

do a standing order with them, see above picture I attached,their details are on any moorcroft letter on the back, you set it up at your bank with the monthly amount you fancy and add your moorcroft reference number as reference on the SO. wildstyle2019 said:Whilst I am on here, I am trying to set up a payment plan with Moorcroft using their online payment arrangement system where you have to put in your income and expenditure. It's awful and it keeps suggesting I have more to pay to my creditors than I actually have. I dont want to speak to them on the phone. Can I just write to them with an offer of payment or will I have to give them my budget no matter what?

wildstyle2019 said:Whilst I am on here, I am trying to set up a payment plan with Moorcroft using their online payment arrangement system where you have to put in your income and expenditure. It's awful and it keeps suggesting I have more to pay to my creditors than I actually have. I dont want to speak to them on the phone. Can I just write to them with an offer of payment or will I have to give them my budget no matter what?

Thanks

I had done this and sent moorcroft an email to say I've done it, they wrote back saying acknowledgedChristians Against Poverty solved my debt problem, when all other debt charities failed. Give them a call !! ( You don't have to be a Christian ! )

https://capuk.org/contact-us3 -

"Could people just pay a minimal amount like £10 a month, which over the course of 6 years will not total anywhere near their debt to the provider, and then the debt is written off on your credit report? Presumably it disappears from your credit report but you still owe the money?"

Nothing gets "written off" unless you specifically ask a creditor to do that.

The accounts shows on your credit file for 6 years from date of default, then it will automatically be removed.

The debt, however is still live and payable, and will remain that way.I’m a Forum Ambassador and I support the Forum Team on the Debt free wannabe, Credit file and ratings, and Bankruptcy and living with it boards. If you need any help on these boards, do let me know. Please note that Ambassadors are not moderators. Any posts you spot in breach of the Forum Rules should be reported via the report button, or by emailing forumteam@moneysavingexpert.com. All views are my own and not the official line of MoneySavingExpert.For free non-judgemental debt advice, contact either Stepchange, National Debtline, or CitizensAdviceBureaux.Link to SOA Calculator- https://www.stoozing.com/soa.php The "provit letter" is here-https://forums.moneysavingexpert.com/discussion/2607247/letter-when-you-know-nothing-about-about-the-debt-aka-prove-it-letter2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards