We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Investing in one world fund vs multiple regional ones

Comments

-

What we really need is one of the active fund fans to name a fund, then we can see how that stacked. I assume that HSBS fund is a valid passive example, I just picked from Monevator. But it's different from the claims in that paper, it didn't drop as far or recover as quickly. I've no idea if that's a generic US vs UK difference, or even more specifically do their figures only hold for S&P500 sector?0

-

What we really need is one of the active fund fans to name a fund, then we can see how that stackedReally? In one of my links 3000 funds have been studied, in another 600. Is how one fund performed going to add any valid information.

Furthermore, we know very well that some active funds have and likely will beat an index over short and longer periods; but knowing that is useless unless we know how to identify those ones in advance.

0 -

Well because nobody holds all of those 300 funds. We select a few that we hope will react in a certain way to certain situations. So for example to protect against a recession, which effectively is what happened for a short time in 2020, you could hold defensive focused equity funds. You can do this with trackers to a degree too, although there is not a large choice.JohnWinder said:What we really need is one of the active fund fans to name a fund, then we can see how that stackedReally? In one of my links 3000 funds have been studied, in another 600. Is how one fund performed going to add any valid information.

Furthermore, we know very well that some active funds have and likely will beat an index over short and longer periods; but knowing that is useless unless we know how to identify those ones in advance.

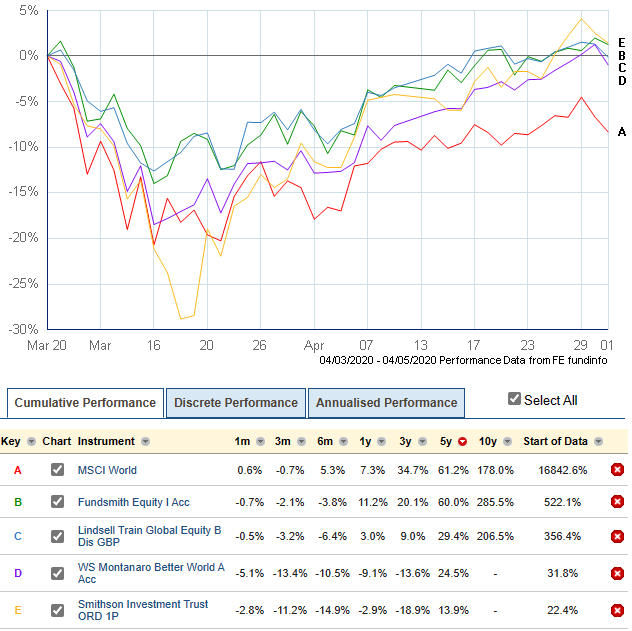

This is what my 2020 looked like. All of these funds were picked ahead of time to be defensive during a crash of this type.

The only one that underperformed that period was a trust that jumped to a very large discount. The NAV did just fine.

It is possible to select funds that behave differently to the index. All of these funds underperformed in 2022 and 2023 but that isn't why I hold them. I sold the Montanaro one at a high because of those concerns, and some other stuff going on in the fund.1 -

Risk is not consistent over time, market risk in particular, and even that varies by geography. Which is why holding multiple geographic sectors in the same funds is useful, I think. I also think it's helpful to have something of a day trader mentality towards funds. Take the BG funds escapade of 2020 and 2021, SMT, Edinburgh and European Growth. Whoever thought such a meteoric rise was going to continue forever needs their heads examined! Part of the problem is investors being too greedy and not knowing when to take a reasonable profit when it's on the table instead of this old buy and hold forever philosophy that many are steeped in. So when you say no equity fund would for such short periods, you can make it be so by getting into and out of individual funds in shorter timescales than intended by the fund.JohnWinder said:I think this misses the point in that most people are not looking for the very best return, most people are looking for an acceptable or good level of return, within the constraints of their personal risk’That makes no sense to me. Most people, having accepted a level of risk would want the best return for that risk, otherwise why not take less risk? Yes, a few will prefer the fund that pays frequent dividends which might compromise their opportunity for the best risk adjusted return, but that doesn’t include any sizeable minority.

‘. In the case of older people and others who still invest in equity funds but may not have the time horizon needed to reach the target return, trackers don't always make sense. They also may not make sense to others who can't wait five or seven years ’Indeed, but no equity fund would for such short periods surely.

As for me knowing what I'm doing....not really! There are far greater and more capable and knowledgeable investors in this forum, I just have a collection of rules and a lose process that works for me and that I understand one that I'm comfortable with.1 -

Part of the problem is investors being too greedy and not knowing when to take a reasonable profit when it's on the table instead of this old buy and hold forever philosophy that many are steeped in. So when you say no equity fund would for such short periods, you can make it be so by getting into and out of individual funds in shorter timescales than intended by the fund.True enough, but getting the timing right can’t be easy. Why? The Morningstar research called ‘mind the gap’ compares fund returns with the returns the average investors in those funds got. They find that the investors’ returns lag the fund returns by >1%/year, partly because some of the investors are in and out of the fund at the wrong times. It’ll be a good strategy when we’ve got some reliable rule(s) for how to get the timing right.0

-

One problem I find is the concept of "best return for the risk" - both parts of the phrase."Best return" as said above depends on exactly what you wish to target. Early on, I wished to target maximum growth in my DC pension, because I had little spare cash to put in it. For the last 8 years however, my target has been to build up a set of funds that will provide the income I need through mainly the dividends produced."Risk" is a wriggling beast that doesn't seem to have one single definition, but frequently seems to relate to volatility. This is probably not what most people think of as risk, except in so far as the psychological effect, which some can tolerate better than others. I suggest many people consider risk in terms of "will I lose all my money?" or "will I always be able to have enough income to support my lifestyle?". While the first question definitely can link to volatility, particularly as decumulation approaches, volatility seems to me to give only a very loose approximation of an answer to the second.0

-

Good stuff. But what is the first question linking to volatility? And the second? Then I’ll have a shot at it.0

-

Risk is always a tricky one. An investment that is guaranteed to lose you all of your money is low risk in investment terms. It does exactly what it says and there is no chance it will do anything else.

Applying that theory to roulette for a moment. Betting on a single number is the lowest risk bet you can make, whereas betting on black is high risk.

You could ask yourself if any stats based on investment style risk are worth much to the average consumer.0 -

Yes, I agree "risk" is impossible to define in a way that is both useful and quantifiable. So for example the value of a risk/return ratio is meaningless for practical purposes. And hence so is an assertion that a particular investment strategy provides an optimal risk/return balance.LHW99 said:One problem I find is the concept of "best return for the risk" - both parts of the phrase."Best return" as said above depends on exactly what you wish to target. Early on, I wished to target maximum growth in my DC pension, because I had little spare cash to put in it. For the last 8 years however, my target has been to build up a set of funds that will provide the income I need through mainly the dividends produced."Risk" is a wriggling beast that doesn't seem to have one single definition, but frequently seems to relate to volatility. This is probably not what most people think of as risk, except in so far as the psychological effect, which some can tolerate better than others. I suggest many people consider risk in terms of "will I lose all my money?" or "will I always be able to have enough income to support my lifestyle?". While the first question definitely can link to volatility, particularly as decumulation approaches, volatility seems to me to give only a very loose approximation of an answer to the second.

When developing ones retirement financial plan I suggest an approach based on developing a list plausible "events" consisting of a cause and effect. Then...

1) Can one's investments sufficiently mitigate the effects of an event? If not forget about it.

2) If the event occurs will most people in one's situation.or the population generally be even worse off than oneself? If so forget about it.

So we are left with specific plausible events with causes and consequences that particularly relate to us and our circumstances. Generally with a suficiently large pot these can be managed and can either be fully mitigated or mitigated to the extent they are ruled out by (1) or (2). Very high inflation may be an example where if it lasts for too long or is too severe only limited mitigation may make sense. At some stage it would lead to the collapse of the world as we know it.

If one's pot is too small then it would be necessary to review the list of events, mitigations and costs and decide which of these to constrain. Or it could lead to a reconsideration of planned retirement expenditure.0 -

JohnWinder said:Good stuff. But what is the first question linking to volatility? And the second? Then I’ll have a shot at it.1) "will I lose all my money?"2) "will I always be able to have enough income to support my lifestyle?"

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards