We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

SIPP - is everything in 'HSBC FTSE All-World Index' enough?

Comments

-

I didn't move away from bonds because the price fell - but because I decided to be more aggressive with equities, which would be better in the longer term (e.g. if bonds are not likely to recover?)

Equities are unpredictable in the short term ( < 5 years ) still not that predictable in the medium term ( 5 to 10 years), but we all hope that in the longer term they will follow historical patterns and there will be some real growth ( above inflation).

Bonds, particularly government bonds, are more predictable ( to a point ) , as they react in a rational manner to the economy, interest rates etc. The recent bloodbath in bond prices was not a surprise to those 'in the know', and there were many signals on this forum from the more experienced posters ( not me) to get out/significantly reduce bond/gilt allocations. The planned unwinding of QE and the prospect of a rise from historically low/zero interest rates meant that bond yields would go up and prices down. The extent of the drops were probably worse than expected though.

Although they are still under some short term pressure, there is now a case for buying government bonds again.

It is likely they will take many years to recover, but they look a potentially attractive buy depending on your outlook/what you are trying to achieve.

1 -

Entirely off topic, I am doing very badly at helping my DD2 with her Economics A level: depth, nuance and using external knowledge all receive nil points as the ask is to look at the supplied material, treat it as gospel and answer in a very prescribed manner directly aligned to how the topic has been taught which always aligns to what many would describe as 'progressive' politics.Pat38493 said:

LOl well I would obviously fail in school today because my answer to the exam question would be - I can't answer this question without more clarifying informationmichaels said:

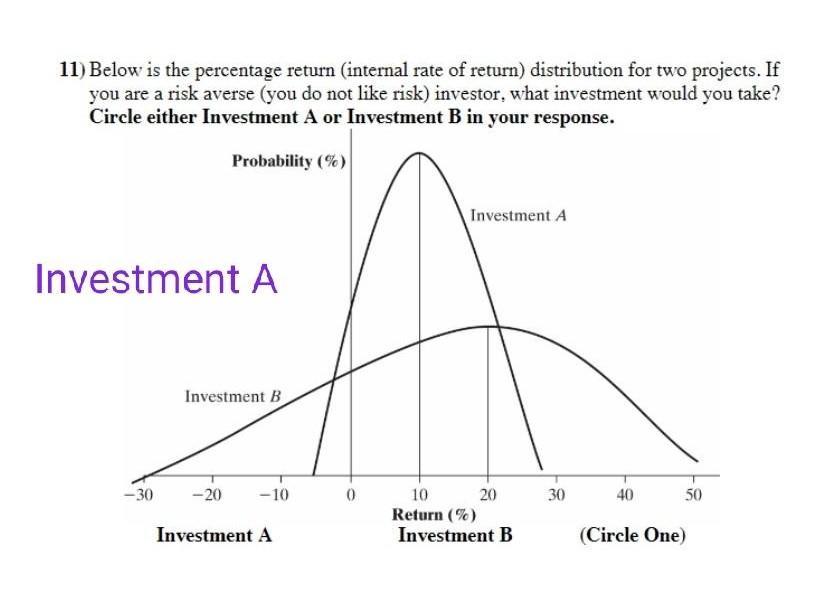

The diagram was the first one I could find on google showing two distributions, one with a higher mean but wider spread, it is not specific to the conversation so should not be looked at in detail but to generally represent the historic performance of a diversified portfolio vs 100% equities over the sort of time horizon that SWR analysis is applied to.Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

What I don't know is if you increase your time horizon over the typical 30 years of the SWR research (for example to include the accumulation period) whether diversification becomes less important in avoiding sequence risk? I think....0

I think....0 -

Ditto when my daughter was doing Economics A level!michaels said:

Entirely off topic, I am doing very badly at helping my DD2 with her Economics A level: depth, nuance and using external knowledge all receive nil points as the ask is to look at the supplied material, treat it as gospel and answer in a very prescribed manner directly aligned to how the topic has been taught which always aligns to what many would describe as 'progressive' politics.Pat38493 said:

LOl well I would obviously fail in school today because my answer to the exam question would be - I can't answer this question without more clarifying informationmichaels said:

The diagram was the first one I could find on google showing two distributions, one with a higher mean but wider spread, it is not specific to the conversation so should not be looked at in detail but to generally represent the historic performance of a diversified portfolio vs 100% equities over the sort of time horizon that SWR analysis is applied to.Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

What I don't know is if you increase your time horizon over the typical 30 years of the SWR research (for example to include the accumulation period) whether diversification becomes less important in avoiding sequence risk? 1

1 -

You don't really need the y axis scale. The integrated area under each curve is 100%.Pat38493 said:

This diagram has no y axis scale information which already worries me ...michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

I would estimate the peak of the A curve as something like 4-5%. Would that help at all?

N. Hampshire, he/him. Octopus Intelligent Go elec & Tracker gas / Vodafone BB / iD mobile. Ripple Kirk Hill member.

2.72kWp PV facing SSW installed Jan 2012. 11 x 247w panels, 3.6kw inverter. 34 MWh generated, long-term average 2.6 Os.Not exactly back from my break, but dipping in and out of the forum.Ofgem cap table, Ofgem cap explainer. Economy 7 cap explainer. Gas vs E7 vs peak elec heating costs, Best kettle!0 -

The y-axis is Probability (%) - it's actually written on the y-axis. I read it as a Probability vs Return.Pat38493 said:This diagram has no y axis scale information which already worries me,0 -

I know that but I am just generally getting a flashing alert when I see graphs without a numbers on the axis- no particular reason for them to be omitted.CorseyEdge said:

The y-axis is Probability (%) - it's actually written on the y-axis. I read it as a Probability vs Return.Pat38493 said:This diagram has no y axis scale information which already worries me,

However as said before my bigger issue is that there is no indication over what time period the money is invested. If it’s long term (15 years plus) I don’t think there has ever been a historical situation where equities lost 30% as indicated in the graph.0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards