We'd like to remind Forumites to please avoid political debate on the Forum... Read More »

SIPP - is everything in 'HSBC FTSE All-World Index' enough?

Comments

-

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

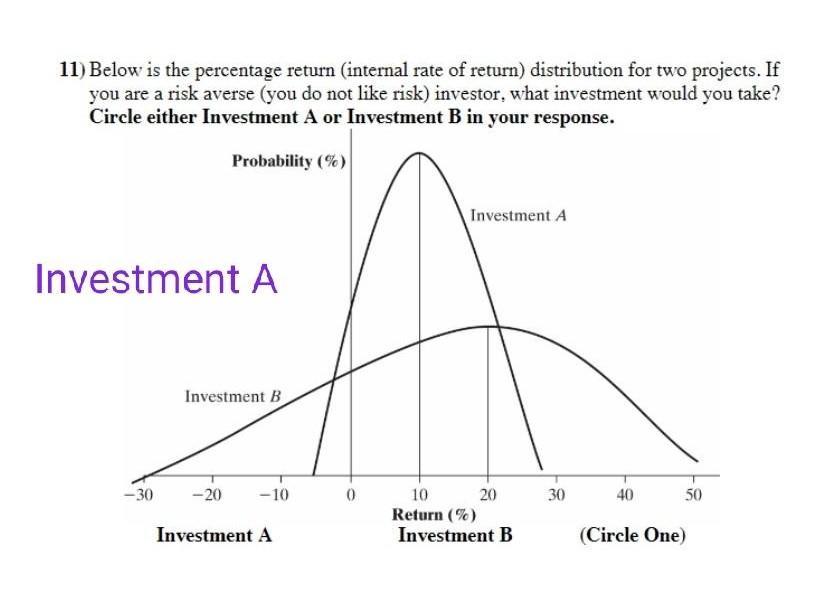

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equitiesI think....0 -

Nice diagram - illustrative of the "value of diversification across asset types" argument. A lot of time and effort has gone into analysing this under the topic of modern portfolio theory and how the "efficient frontier" can be used to select between investments with different packages of risk level and potential return level. Non trivial.

In the drawing a pension case, in deaccumulation - there are going to be "unlucky" cohorts who for a combination of reasons - start date, investment mix chosen, deaccumulation through a crash/slump so that their assets are depleted by income drawn before a later recovery cycle. Good old sequence risk.

So if Investment A outcomes in the -15 to -30 range cause a gap in "essential" income this pool of retirees who happen to fall on these particular paths through no unique fault of their own. While others with the same approach at a different moment might well see +40. These retirement failures once numerous make Investment A rather unsuitable.

You can't isolate asset allocation entirely from how income is taken, whether income is variable, whether buffering exists.

It is possible to backtest (which spots terrible choices but does not tell us the future). And simulate (monte carlo random returns or adjusted real market data series). This too does not act as a crystal ball but it supports methods testing of A vs B, or portfolio A vs B

Based on my reading the "mixes" in the 40 - 70 ish range have enough equities for long term growth and income generation. And not too many - as in more volatilty - where you die richer very possibly, but also with an increased chance of an actual retirement failure occuring. Historic data and market simulation seems to support this argument beyond mere anecdote.

There will be people who are more aggressive about investing. And there will be people who need so little income from a large pot as a % that they can go to either pole. Risk off. Index linked gilts the lot and just draw. Or fully risk on - as the scenario where their retirement fails is so remote as to not be a realistic concern. So there can never be guidance that suits all, or which handles other issues like inheritance objectives or their absence.

3 -

I should not be amused but within 2 paragraphs you say:

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

I see how that looks like contradictory actions, I didn't move away from bonds because the price fell - but because I decided to be more aggressive with equities, which would be better in the longer term (e.g. if bonds are not likely to recover?)

I am paying in via salary sacrifice to my workplace pension, and my point about the falling market was about the 'simmering' markets giving my current contributions this time to increase in value over the next few years.

The diagram is very informative thanks (I think I've seen it before, probably on a James Shack video). As above, I have become more focused on higher risk and ignoring the short term bumps.

1 -

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities0 -

And we now know that if Investment A represents bonds then do fall -25% to -40%, so that curve line needs to go to the left quite a bit and off the chart!0

-

Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

It's an exam question and the y axis is irrelevant as you are simply comparing Investment A vs B...I think I'd go for B because of the skew.Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equitiesAnd so we beat on, boats against the current, borne back ceaselessly into the past.0 -

For years I was in 100% equity global trackers and had a great time. Last year I retired and decided I'd move some of the funds into a "less risky" Vanguard Lifestrategy 60% equity 40% bonds mix, only to watch in dismay a few months later as the "safe" bonds went down the toilet. This fund is now approx 25% down from when I started, but "I'm in it for the long term" so won't be realising any losses in this fund soon. I'm hoping that I don't need to wait fifteen years for a recovery, but who knows? The older I get them more I think that William Hill should be a fund provider in the market.0

-

The diagram was the first one I could find on google showing two distributions, one with a higher mean but wider spread, it is not specific to the conversation so should not be looked at in detail but to generally represent the historic performance of a diversified portfolio vs 100% equities over the sort of time horizon that SWR analysis is applied to.Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

What I don't know is if you increase your time horizon over the typical 30 years of the SWR research (for example to include the accumulation period) whether diversification becomes less important in avoiding sequence risk?I think....0 -

Unfortunately you picked literally the worst time in the past 100 years to move into bonds - I have a relative that took a bath on that as well. Personally I can't complain too much as I'd held them for over 20 years so had benefitted from abnormally large returns over that period.jim8888 said:For years I was in 100% equity global trackers and had a great time. Last year I retired and decided I'd move some of the funds into a "less risky" Vanguard Lifestrategy 60% equity 40% bonds mix, only to watch in dismay a few months later as the "safe" bonds went down the toilet. This fund is now approx 25% down from when I started, but "I'm in it for the long term" so won't be realising any losses in this fund soon. I'm hoping that I don't need to wait fifteen years for a recovery, but who knows? The older I get them more I think that William Hill should be a fund provider in the market.Anyway, back to the OP, and about half of my pension is in this fund, and also in HMWO (which is broadly the ETF equivalent) - most of the rest is in the Vanguard all world fund, which is enough diversification for me, especially given the number of platforms it's spread across!0 -

LOl well I would obviously fail in school today because my answer to the exam question would be - I can't answer this question without more clarifying informationmichaels said:

The diagram was the first one I could find on google showing two distributions, one with a higher mean but wider spread, it is not specific to the conversation so should not be looked at in detail but to generally represent the historic performance of a diversified portfolio vs 100% equities over the sort of time horizon that SWR analysis is applied to.Pat38493 said:

This diagram has no y axis scale information which already worries me, but more importantly it does not specify over what time period the investments are . Historically you would not have lost 30% on 100% well diversified equity portfolio over 15 years - that has never happened as far as I know.michaels said:

I should not be amused but within 2 paragraphs you say:SamDude said:

Thanks @Albermarle and all.Albermarle said:Is there anything that I am missing out on with the HSBC FTSE All-World Index fund that would be covered with a different fund?If you mean is it worth investing in an alternative global equity index fund, then the answer is probably not.

If you mean is it worth looking at the thousands of investments that are not global equity index funds, then that would be a wider question.

I've watched the James Shack video series about riding the long term, so I understand the nature of holding (and buying more when there is a 'sale' on during the down times).

Over the long term there is more growth in equities, so when I switched my workplace pension to GP7, I did it to reduce the percentage of bonds because they have sunk recently in favour of more equities.

The wider question in bold is what I'm looking to learn more about - if I should consider spreading between different funds, what are the complimentary non global equity index funds that I should consider?

(I'm not asking for advice on 'what to pick', but it would be good to get a shortlist to work from...)

1) A price fall is a buying opportunity

2) You sold a bond heavy fund because its price had fallen

Hmm

As above, (historically) on average you will do better with 100% equities but a proportion of bonds will reduce the extremes of the distribution at the expense of a lower average. For many the most import 'possible outcome' is the worst case and a proportion of bonds has historically given a higher (eg less bad) worst case

Informative image, investment A is a mixed portfolio, investment B is all equities

What I don't know is if you increase your time horizon over the typical 30 years of the SWR research (for example to include the accumulation period) whether diversification becomes less important in avoiding sequence risk? 0

0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 351.1K Banking & Borrowing

- 253.1K Reduce Debt & Boost Income

- 453.6K Spending & Discounts

- 244.1K Work, Benefits & Business

- 599K Mortgages, Homes & Bills

- 177K Life & Family

- 257.4K Travel & Transport

- 1.5M Hobbies & Leisure

- 16.1K Discuss & Feedback

- 37.6K Read-Only Boards