We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Bucketing strategy. When to de-risk?

Comments

-

I believe Linton has been retired for 15+ years and his plan has been working. Hopefully he’ll explain more as it is good to hear about an outcome rather than just our own theories.GazzaBloom said:

Well you certainly seem quite set on your plan.Linton said:

How do you quickly reduce expenditure? Buy £8 bottles of wine rather than £10 ones? Cancel your planned meal out due that evening? Will that actually make any real difference?GazzaBloom said:

Plough on with the same strategy but use Guyton's guardrails to reduce the drawdown amount taken in downturns or increase it in upswings, any excess gains could be used to increase the cash (risk-off) percentage over time as retirement rolls on.Qyburn said:

If you you'll take 15% of each years income from cash and 85% from equities, what's your plan for years when equities fall substantially (or rise)?GazzaBloom said:My initial plans for retirement are to have 15% (3 years of expenses) in cash/cash equivalent (MMF) and the remaining 85% in the same growth equity index funds I hold in accumulation, but not operate in 2 bucket mode, just draw proportionally and rebalance annually, rather than draw from cash solely in year 1.What about next years booked but not paid-for £30K cruise to celebrate your 40th wedding anniversary? Sorry dear, Mr Guyton says we can’t afford it?

What about when the taps are turned on again? Would you know how to usefully spend the extra? Perhaps a wild binge?

In any case much expenditure is fixed, eg council tax, insurance, utilities

No, in my view it is far better to arrange your finances to avoid short/medium term fluctuations in income. I do not believe you can significantly turn your standard of living up and down just like that.

30% of our annual planned day to day spend is going to be discretionary and a 5% reduction if SWR goes up 20% is what is modelled and it makes a significant difference over time.

So, go with me here, and help me understand in a little more detail how your bucketing plan works. Let's say I need £32K a year in retirement (after tax - I calculate a drawdown amount of £29,700 from DC pension UFPLS) with £6K coming from a DB pension, which after tax should give the £32K or thereabouts. State Pensions are 8 years away. Ignore one off spend items for now.

So for arguments sake let¡s say I need to drawdown £30K in year 1, how much would you put in each of your 3 buckets and how does your drawdown work year to year? And how do your bucket top ups work?

My OH and I have been self employed for 25+ years with quite variable income so would be happy to be adaptable with our expenditure especially as we have a high discretionary budget (mainly travel).Whilst the bucket system seems a good idea I do not see how it combines, positively, with annual rebalancing in a falling market. In addition I might want an increasing equity % when we are older on the basis that part of the pot is in the accumulation phase for our children.0 -

If bonds, equities and property all dropped 50% and didn't move upwards for 10 years then sure - most of them would either fail or provide such a low incomes as to be pointless. However luckily that has never come close to happening so none of the retirement models predict it or plan for it.Qyburn said:

Broadly they all do, if not in detail. I don't think any would succeed if the investments dropped 50% followed by zero growth for the next ten years.I would actually say that most drawdown strategies make no assumptions of the future.0 -

Qyburn said:

Broadly they all do, if not in detail. I don't think any would succeed if the investments dropped 50% followed by zero growth for the next ten years.I would actually say that most drawdown strategies make no assumptions of the future.

It's not just drawdown strategies that make broad assumptions about long term investment growth, it's an assumption of any investment strategy, otherwise there would be no point in investing.

0 -

GazzaBloom said:

Well you certainly seem quite set on your plan.Linton said:

How do you quickly reduce expenditure? Buy £8 bottles of wine rather than £10 ones? Cancel your planned meal out due that evening? Will that actually make any real difference?GazzaBloom said:

Plough on with the same strategy but use Guyton's guardrails to reduce the drawdown amount taken in downturns or increase it in upswings, any excess gains could be used to increase the cash (risk-off) percentage over time as retirement rolls on.Qyburn said:

If you you'll take 15% of each years income from cash and 85% from equities, what's your plan for years when equities fall substantially (or rise)?GazzaBloom said:My initial plans for retirement are to have 15% (3 years of expenses) in cash/cash equivalent (MMF) and the remaining 85% in the same growth equity index funds I hold in accumulation, but not operate in 2 bucket mode, just draw proportionally and rebalance annually, rather than draw from cash solely in year 1.What about next years booked but not paid-for £30K cruise to celebrate your 40th wedding anniversary? Sorry dear, Mr Guyton says we can’t afford it?

What about when the taps are turned on again? Would you know how to usefully spend the extra? Perhaps a wild binge?

In any case much expenditure is fixed, eg council tax, insurance, utilities

No, in my view it is far better to arrange your finances to avoid short/medium term fluctuations in income. I do not believe you can significantly turn your standard of living up and down just like that.

30% of our annual planned day to day spend is going to be discretionary and a 5% reduction if SWR goes up 20% is what is modelled and it makes a significant difference over time.

So, go with me here, and help me understand in a little more detail how your bucketing plan works. Let's say I need £32K a year in retirement (after tax - I calculate a drawdown amount of £29,700 from DC pension UFPLS) with £6K coming from a DB pension, which after tax should give the £32K or thereabouts. State Pensions are 8 years away. Ignore one off spend items for now.

So for arguments sake let¡s say I need to drawdown £30K in year 1, how much would you put in each of your 3 buckets and how does your drawdown work year to year? And how do your bucket top ups work?I am not set on my plan and am keen to learn. The problem is understanding how the various schemes would actually work in practice.A bit more info is required to come up with a numerical example of my ideas based on your data….

How large is the pot?

Please could you untangle your numbers so it is clear how much pre tax drawdown at current prices you want over what time periods.

0 -

Linton said:PGazzaBloom said:

Well you certainly seem quite set on your plan.Linton said:

How do you quickly reduce expenditure? Buy £8 bottles of wine rather than £10 ones? Cancel your planned meal out due that evening? Will that actually make any real difference?GazzaBloom said:

Plough on with the same strategy but use Guyton's guardrails to reduce the drawdown amount taken in downturns or increase it in upswings, any excess gains could be used to increase the cash (risk-off) percentage over time as retirement rolls on.Qyburn said:

If you you'll take 15% of each years income from cash and 85% from equities, what's your plan for years when equities fall substantially (or rise)?GazzaBloom said:My initial plans for retirement are to have 15% (3 years of expenses) in cash/cash equivalent (MMF) and the remaining 85% in the same growth equity index funds I hold in accumulation, but not operate in 2 bucket mode, just draw proportionally and rebalance annually, rather than draw from cash solely in year 1.What about next years booked but not paid-for £30K cruise to celebrate your 40th wedding anniversary? Sorry dear, Mr Guyton says we can’t afford it?

What about when the taps are turned on again? Would you know how to usefully spend the extra? Perhaps a wild binge?

In any case much expenditure is fixed, eg council tax, insurance, utilities

No, in my view it is far better to arrange your finances to avoid short/medium term fluctuations in income. I do not believe you can significantly turn your standard of living up and down just like that.

30% of our annual planned day to day spend is going to be discretionary and a 5% reduction if SWR goes up 20% is what is modelled and it makes a significant difference over time.

So, go with me here, and help me understand in a little more detail how your bucketing plan works. Let's say I need £32K a year in retirement (after tax - I calculate a drawdown amount of £29,700 from DC pension UFPLS) with £6K coming from a DB pension, which after tax should give the £32K or thereabouts. State Pensions are 8 years away. Ignore one off spend items for now.

So for arguments sake let¡s say I need to drawdown £30K in year 1, how much would you put in each of your 3 buckets and how does your drawdown work year to year? And how do your bucket top ups work?I am not set on my plan and am keen to learn. The problem is understanding how the various schemes would actually work in practice.A bit more info is required to come up with a numerical example of my ideas based on your data….

How large is the pot?

Please could you untangle your numbers so it is clear how much pre tax drawdown at current prices you want over what time periods.

Sorry to the OP, I'm de-railing the thread here.

Let's say you need £30K pre-tax drawdown per year for 8 years, then £23,750 for 3 years then £9,300 for rest of retirement, all inflating at say 2.5% a year.

The point I am trying to understand is not to make the pot fit but to understand how your bucking plan could be structured to deliver a stable income at the above levels as you have suggested and what size pot would be required to deliver it.

I'm still not sure I fully understand how time bucketing strategies work, especially the topping up of the cash bucket but keen to understand how it works in practice. Not so bothered about the intricasies of asset allocation detail but generally, bucket 1 cash or equivalent 1-2 years, bucket 2 income generating 3-7 years, bucket 3 equities growth and inflation beating.

How do you draw from these over time? after year 1 when bucket 1 is down to 1 years of cash left what do you do? Do you need enough in bucket 2 to be able to generate enough income to fully top up bucket 1 or do you take the income and take some capital from bucket 2 and so on?

For my planning I have a detailed and historical back tested drawdown plan for my retirement based on a simple proportional drawdown and annual rebalancing using Guyton's guardrails and Guyton's inflation rules.

Obviously back testing against historical data does not predict the future and Guyton's does require adjustments to future spending.

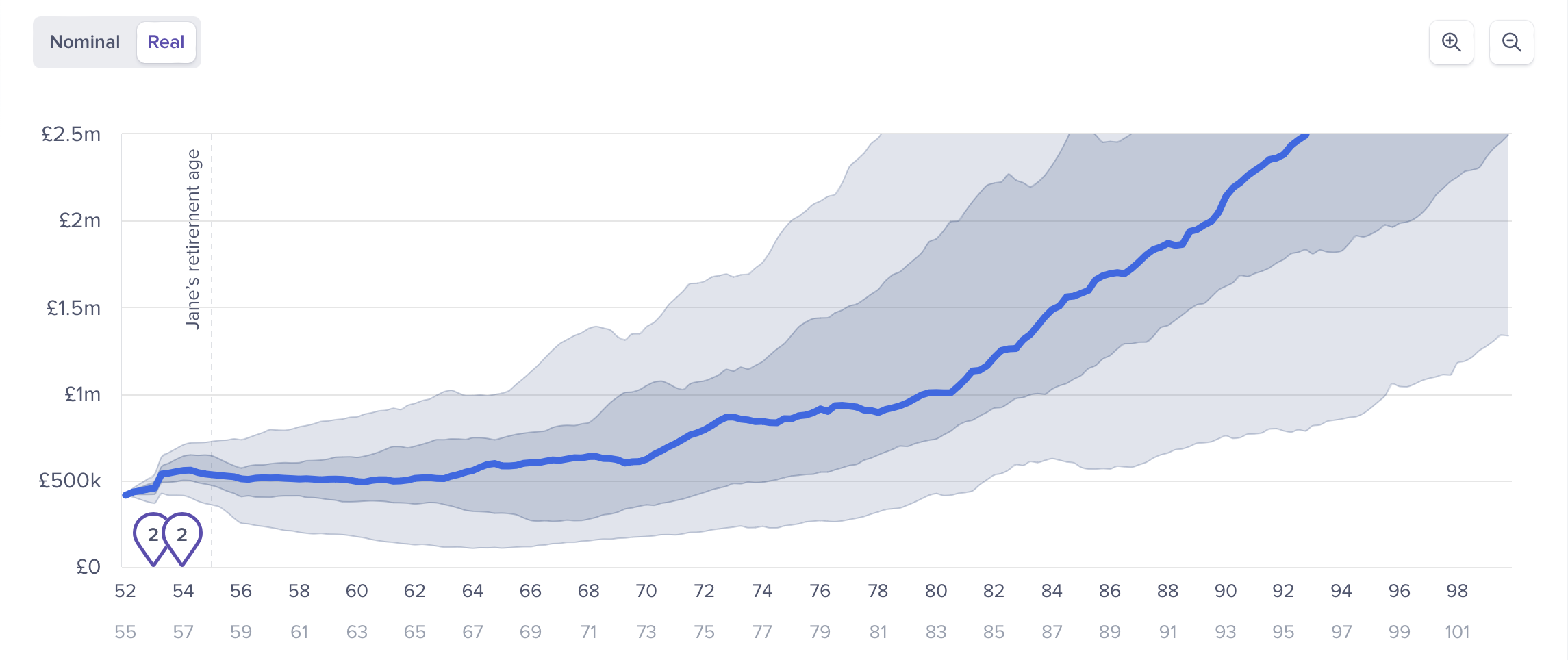

I have modelled this in Timeline and also checked it in FiCalc and both show 100% success rate but as you suggest show a large ending pot, I haven't seen a software model that allows implementation of bucketing but I think it could sort of be set up in Timeline by splitting a DC pension into different "accounts" to act as the buckets and setting a different asset allocation and drawdown order for them.

These software model have plenty of limitations, they assume a static portfolio asset mix and make some assumptions about how drawdown is taken. I would expect my portfolio to change asset mix as time goes on and there is a good chance I will do some part time work rather than hard stop retirement, but currently this isn't factored in my planning.

1 -

The standard approaches have short/medium term problems because they rely on a continuous drawdown from selling very volatile equity capital.GazzaBloom said:Linton said:PGazzaBloom said:

Well you certainly seem quite set on your plan.Linton said:

How do you quickly reduce expenditure? Buy £8 bottles of wine rather than £10 ones? Cancel your planned meal out due that evening? Will that actually make any real difference?GazzaBloom said:

Plough on with the same strategy but use Guyton's guardrails to reduce the drawdown amount taken in downturns or increase it in upswings, any excess gains could be used to increase the cash (risk-off) percentage over time as retirement rolls on.Qyburn said:

If you you'll take 15% of each years income from cash and 85% from equities, what's your plan for years when equities fall substantially (or rise)?GazzaBloom said:My initial plans for retirement are to have 15% (3 years of expenses) in cash/cash equivalent (MMF) and the remaining 85% in the same growth equity index funds I hold in accumulation, but not operate in 2 bucket mode, just draw proportionally and rebalance annually, rather than draw from cash solely in year 1.What about next years booked but not paid-for £30K cruise to celebrate your 40th wedding anniversary? Sorry dear, Mr Guyton says we can’t afford it?

What about when the taps are turned on again? Would you know how to usefully spend the extra? Perhaps a wild binge?

In any case much expenditure is fixed, eg council tax, insurance, utilities

No, in my view it is far better to arrange your finances to avoid short/medium term fluctuations in income. I do not believe you can significantly turn your standard of living up and down just like that.

30% of our annual planned day to day spend is going to be discretionary and a 5% reduction if SWR goes up 20% is what is modelled and it makes a significant difference over time.

So, go with me here, and help me understand in a little more detail how your bucketing plan works. Let's say I need £32K a year in retirement (after tax - I calculate a drawdown amount of £29,700 from DC pension UFPLS) with £6K coming from a DB pension, which after tax should give the £32K or thereabouts. State Pensions are 8 years away. Ignore one off spend items for now.

So for arguments sake let¡s say I need to drawdown £30K in year 1, how much would you put in each of your 3 buckets and how does your drawdown work year to year? And how do your bucket top ups work?I am not set on my plan and am keen to learn. The problem is understanding how the various schemes would actually work in practice.A bit more info is required to come up with a numerical example of my ideas based on your data….

How large is the pot?

Please could you untangle your numbers so it is clear how much pre tax drawdown at current prices you want over what time periods.

Sorry to the OP, I'm de-railing the thread here.

Let's say you need £30K pre-tax drawdown per year for 8 years, then £23,750 for 3 years then £9,300 for rest of retirement, all inflating at say 2.5% a year.

The point I am trying to understand is not to make the pot fit but to understand how your bucking plan could be structured to deliver a stable income at the above levels as you have suggested and what size pot would be required to deliver it.

I'm still not sure I fully understand how time bucketing strategies work, especially the topping up of the cash bucket but keen to understand how it works in practice. Not so bothered about the intricasies of asset allocation detail but generally, bucket 1 cash or equivalent 1-2 years, bucket 2 income generating 3-7 years, bucket 3 equities growth and inflation beating.

How do you draw from these over time? after year 1 when bucket 1 is down to 1 years of cash left what do you do? Do you need enough in bucket 2 to be able to generate enough income to fully top up bucket 1 or do you take the income and take some capital from bucket 2 and so on?

For my planning I have a detailed and historical back tested drawdown plan for my retirement based on a simple proportional drawdown and annual rebalancing using Guyton's guardrails and Guyton's inflation rules.

Obviously back testing against historical data does not predict the future and Guyton's does require adjustments to future spending.

I have modelled this in Timeline and also checked it in FiCalc and both show 100% success rate but as you suggest show a large ending pot, I haven't seen a software model that allows implementation of bucketing but I think it could sort of be set up in Timeline by splitting a DC pension into different "accounts" to act as the buckets and setting a different asset allocation and drawdown order for them.

These software model have plenty of limitations, they assume a static portfolio asset mix and make some assumptions about how drawdown is taken. I would expect my portfolio to change asset mix as time goes on and there is a good chance I will do some part time work rather than hard stop retirement, but currently this isn't factored in my planning.

My objective is to arrange separate buckets so that one always draws down from near to cash reserves and from less volatile equity and bond income, never from selling equity. Depletion of equity should only be necessary on widely separated and flexible occasions over the medium/long term to ensure the other two buckets continue to provide the required continuous Income over the medium term.

To go back to the OP, your intended retirement financial strategy does affect your activities and timescales leading up to retirements, it is not just a question of drawdown vs annuity. As you imply it would be better for any further discussion to be left for a separate thread.0 -

That seems to suggest that your pot is larger proportionally than it needs to be, or maybe than others have. For example, if you can manage to take a required income just from the first two pots without touching the equity pot then that means the overall withdrawal rate is quite low? Certainly not 4-5% of the whole amount. I am also not sure how the cash and income pot provide the required inflation linking in the short and mid term. Very few investments provide that and non guarantee it with the exception of index linked bonds. The 'regular' dividend hero type of trusts don't seem to be up to it either.Linton said:

The standard approaches have short/medium term problems because they rely on a continuous drawdown from selling very volatile equity capital.

My objective is to arrange separate buckets so that one always draws down from near to cash reserves and from less volatile equity and bond income, never from selling equity. Depletion of equity should only be necessary on widely separated and flexible occasions over the medium/long term to ensure the other two buckets continue to provide the required continuous Income over the medium term.

To go back to the OP, your intended retirement financial strategy does affect your activities and timescales leading up to retirements, it is not just a question of drawdown vs annuity. As you imply it would be better for any further discussion to be left for a separate thread.

I think most people won't end up with a total amount that provides that level of control. They will need to start drawing 5% of the whole and hope that the state pension kicks in to makeup any shortfall along the way.1 -

Trouble is there's very few on here with the real world experience of drawdown aided by rainy day cash, state pension say £10K and a DC pension pot. As you read the threads you piece together many have nice little earners in the background , DB pensions , BTL and enough cash to cover years of disaster in the markets. Think I've only read a few examples of real world drawdowns but could be wrong. Myself right or wrong I've got cash and never had bonds . Throw in a small DB pension and shortly a state pension , equities in ISA and small SIPP . I'm sure I will be fine. Analysis can drive you nuts !! Again being honest I've never heard anyone talk about SWR when I'm out and about and believe me they all talk money. Maybe have three targets A , AA, and AAA where first is state pension plus a bit more then take it from there. EG single person , £15K, £20K and £25K. Everybody's different no doubt .3

-

A) since the overall asset allocation is about 60/40 the overall long term return should be the same as that in an SWR based approach with the same total pot size. The proposal is based on using this same return in a different way to protect the equity tranche. All the return in both cases will either end up in expenditure or will be left over on death.Prism said:

That seems to suggest that your pot is larger proportionally than it needs to be, or maybe than others have. For example, if you can manage to take a required income just from the first two pots without touching the equity pot then that means the overall withdrawal rate is quite low? Certainly not 4-5% of the whole amount. I am also not sure how the cash and income pot provide the required inflation linking in the short and mid term. Very few investments provide that and non guarantee it with the exception of index linked bonds. The 'regular' dividend hero type of trusts don't seem to be up to it either.Linton said:k

The standard approaches have short/medium term problems because they rely on a continuous drawdown from selling very volatile equity capital.

My objective is to arrange separate buckets so that one always draws down from near to cash reserves and from less volatile equity and bond income, never from selling equity. Depletion of equity should only be necessary on widely separated and flexible occasions over the medium/long term to ensure the other two buckets continue to provide the required continuous Income over the medium term.

To go back to the OP, your intended retirement financial strategy does affect your activities and timescales leading up to retirements, it is not just a question of drawdown vs annuity. As you imply it would be better for any further discussion to be left for a separate thread.

I think most people won't end up with a total amount that provides that level of control. They will need to start drawing 5% of the whole and hope that the state pension kicks in to makeup any shortfall along the way. To avoid 5.5% income being a bottleneck on extracting the money one option is to use some close to cash reserve capital to supply some income. This would be replenished from equity over the medium term.

To avoid 5.5% income being a bottleneck on extracting the money one option is to use some close to cash reserve capital to supply some income. This would be replenished from equity over the medium term.

C) medium term inflation linking can be provided in a similar way and/or by having say 10% more income generated than needed for expenditure.

In the next few weeks I will put together a spreadsheet model based on 3.5% initial drawdown and long term average inflation and equity returns.3 -

With respect to the speculations of various contributors upthread. If you want to *know* how different access, asset sales and rebalancing strategies react to US, international and artificially stress tested markets - in comparison with one another - then you can do a lot worse than go and read:

Michael McClung - Living off your Money.

Which is not to say I have implemented his final "build out" of a recommendation. But I found the thought process and comparison data very useful in

a) rejecting some options as weaker (a bit) and so not worthy of my further consideration

b) understanding the way "squeezing" the drawdown balloon around risk and variable income (and efficiency of "harvesting" income from remaining capital through volatility i.e. the scope and scale (the limited size) of marginal gains available from methods as demonstrated in various testing

The advantage over a lot of web material is that he uses more than just US. Tests something he tuned up on US on different markets to check it still holds up. And uses simulated "stressed" markets to look for non-linear behavior around bad conditions on the downside. This thought process reflects the asymmetry of risk. Dying (a bit) richer (sometimes) is for most a bonuse, nice for heirs but pretty irrelevant. Running out of pension too early is a much bigger deal for the retiree.

My takeaway was you need a solid plan (that doesn't backtest badly - because that's just stupid - it's already failed to work. That isn't too complex to run. That you are prepared to follow - and to live with the choice.

Good luck

2

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards