We’d like to remind Forumites to please avoid political debate on the Forum.

This is to keep it a safe and useful space for MoneySaving discussions. Threads that are – or become – political in nature may be removed in line with the Forum’s rules. Thank you for your understanding.

The MSE Forum Team would like to wish you all a Merry Christmas. However, we know this time of year can be difficult for some. If you're struggling during the festive period, here's a list of organisations that might be able to help

📨 Have you signed up to the Forum's new Email Digest yet? Get a selection of trending threads sent straight to your inbox daily, weekly or monthly!

Has MSE helped you to save or reclaim money this year? Share your 2025 MoneySaving success stories!

Tax on 5 year fixed rate bonds

Comments

-

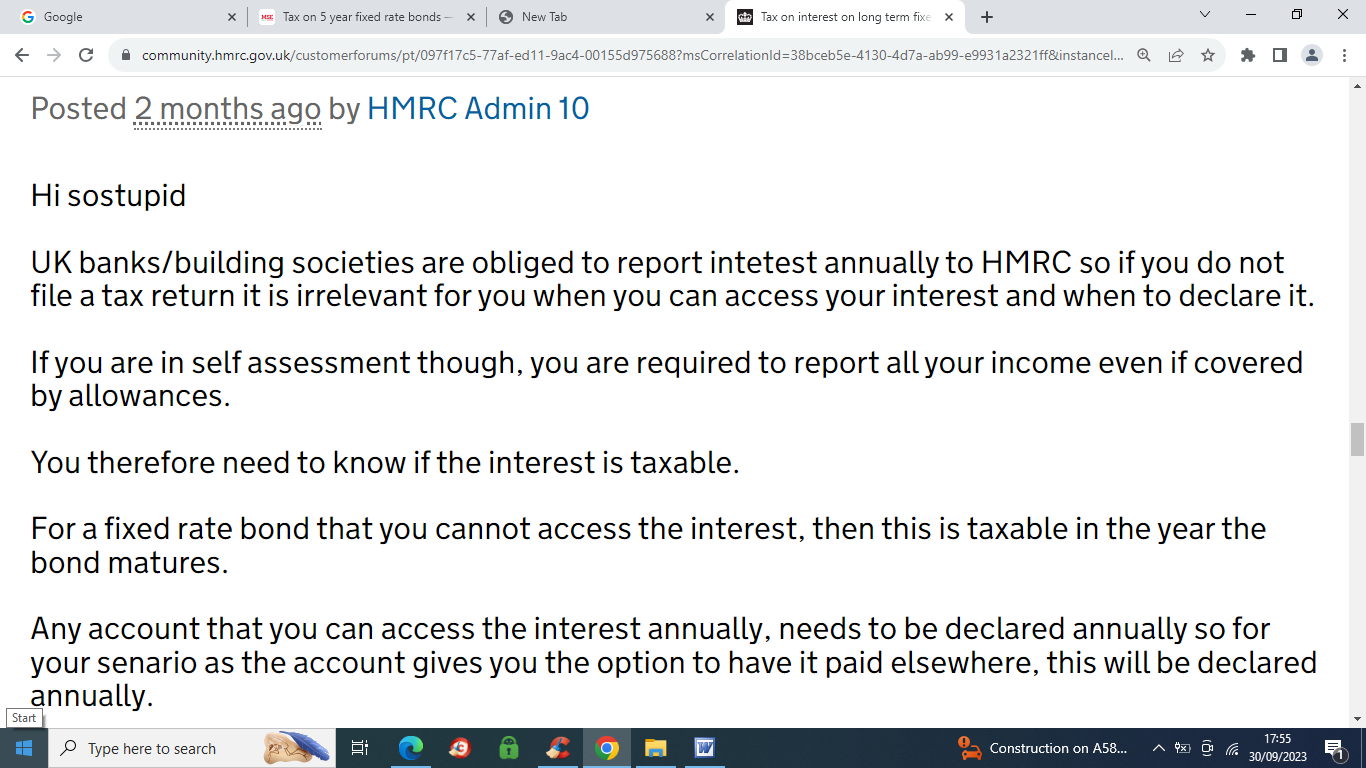

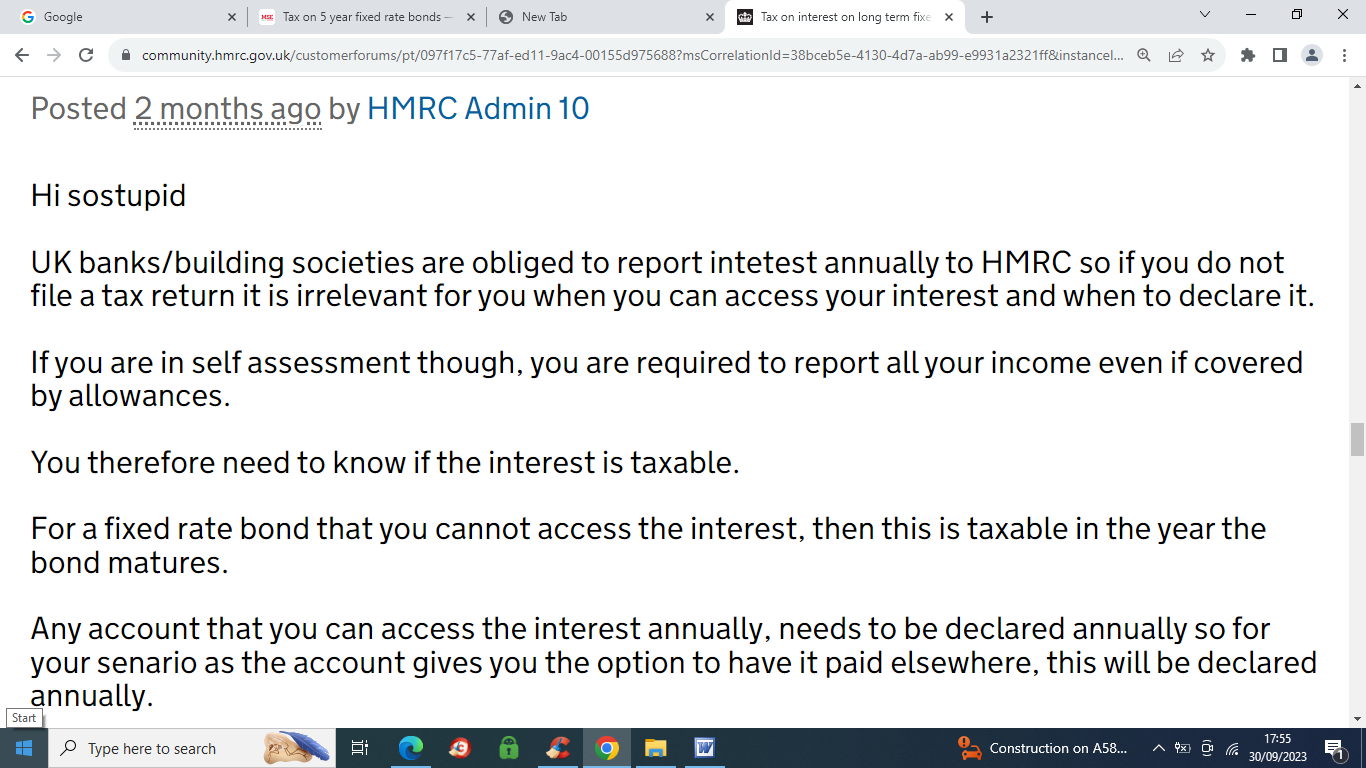

I would like to believe what HMRC Admin 10 said is correct because it benefits my tax situation, however I suspect it cannot be trusted.bristolleedsfan said:

My reading of what HMRC Admin 10 said.fuzzzzy said:

Ok so from what HMRC Admin 10 says, if you choose a 5 year fixed rate account which gives you the option of paying the interest away at any time during the fixed rate term then you should declare the interest annually, even if you choose to have the interest compounded.bristolleedsfan said:

Not an opinion, it is what HMRC have said on the subject.metrobus said:So the consensus of opinion is that HMRC will treat the interest for tax purposes when it’s credited to the account, unless you do a self assessment/ tax return and declare the total multiple years interest for the tax year at maturity?

If you choose a fixed rate account like the OP which gives no option to have the interest paid away then you should declare the interest in the year of maturity.

Consumers who do not self assessment do not have to declare anything, savings providers report interest that has been credited each year.

Consumers who do complete self assessment (see last two paragraphs of quoted screenshot)

Advice from admins on the HMRC forums is often contradictory, goes round and round in circles, lacks clarity and when a question seems to be finally answered it will be followed by some backtracking and a referral to guidance links that don't answer the specific question.3 -

If one had say a five year fix bind with no access and get taxed in year one I wonder what HMRC would do if you challenged it0

-

In this scenario there isn't a grey area of when the interest arises. The interest arises at maturity. However, HMRC will tax it on an annual basis. I guess in this situation HMRC should be contacted and a correction made, but I very much doubt that many people who do not self assess would do this unless it is to their benefit.Albermarle said:

What about the scenario, where there is no option to be paid annually, but the savings provider adds the interest and reports to HMRC annually. As HMRC will not be aware of the terms of the account, presumably they will just treat it as potentially taxable when it is reported . This assumes you are not filling in a SA.fuzzzzy said:

Ok so from what HMRC Admin 10 says, if you choose a 5 year fixed rate account which gives you the option of paying the interest away at any time during the fixed rate term then you should declare the interest annually, even if you choose to have the interest compounded.bristolleedsfan said:

Not an opinion, it is what HMRC have said on the subject.metrobus said:So the consensus of opinion is that HMRC will treat the interest for tax purposes when it’s credited to the account, unless you do a self assessment/ tax return and declare the total multiple years interest for the tax year at maturity?

If you choose a fixed rate account like the OP which gives no option to have the interest paid away then you should declare the interest in the year of maturity.0 -

I think most bonds can be accessed ‘in exceptional circumstances’ and the approach of only declaring all the interest in the year of maturity is a risky one. For example, open a 5 year bond now and become non-UK resident in year 5 when it matures - most of the interest would have been earned in years 1-4 when you would have been liable to uk tax, but if you claim it was all earned when non-uk resident in year 5 would you claim you were not liable to the UK tax now?3

-

For info, similar active thread on the tax forum.

Tax on fixed savings accounts — MoneySavingExpert Forum

3 -

BeachNut said:I think most bonds can be accessed ‘in exceptional circumstances’ and the approach of only declaring all the interest in the year of maturity is a risky one. For example, open a 5 year bond now and become non-UK resident in year 5 when it matures - most of the interest would have been earned in years 1-4 when you would have been liable to uk tax, but if you claim it was all earned when non-uk resident in year 5 would you claim you were not liable to the UK tax now?That would be correct. However, you could be liable to tax in your country of residency depending on their laws around foreign income.The more common situation would be someone who stops working, therefore gaining some personal allowance and the starter savings rate, who could lock in to a 5 year rate and have the full interest covered by tax free bands at maturity.I don't know why you would think it risky to comply with UK tax law. The law is that interest is taxable when it arises, not when it is earned. Even a few days into the fix, some of your interest has been earned, but it has neither been paid, nor is taxable. The saver does not have a choice as to when their interest is taxable.1

-

The more common situation would be someone who stops working, therefore gaining some personal allowance and the starter savings rate, who could lock in to a 5 year rate and have the full interest covered by tax free bands at maturity

On the other hand if you are early retired, and with a low taxable income ( say £12pa), you prefer that the interest is taxed annually before the state pension kicks in in the near(ish) future.

0 -

Is there not a difference though between a multi-year account which gives you the option at the outset of how interest is paid but then locks you into that option, and a multi-year account that allows you to change your options throughout the term of the account.masonic said:

The letter of the law appears to suggest that both should declare all of the interest at maturity. Most of the responses on the HMRC forum support this, but one does not (supporting the view that declining an option to access the money does not mean it wasn't available). The situation still isn't clear. My personal opinion is that the dissenting opinion is the result of a misunderstanding, and if you enter into T&Cs that prevent you from accessing interest, even voluntarily, and are subsequently bound by those terms, then the interest does not arise until you are able to access the interest.intalex said:

And to make it even clearer, saver 1 whose fix had the pay-out interest option but didn't take the option will have to declare annually, whereas saver 2 whose fix did not have the pay-out interest option but otherwise had exactly the same annually credited interest into the fix as saver 1 will be forced to declare at maturity??

Edit: When I say declare, I mean be considered for tax purposes.

In the second scenario you may choose to have your interest compounded for some months/years but paid away at other times. Could this not be interpreted as having access to your interest each year in a way that the first scenario does not allow.

0 -

This second scenario was asked about in the HMRC forum, but it didn't receive a satisfactory answer. I would have thought a case could be made that in this scenario you are just reinvesting accessible interest, much as you could take interest and lock it away in a different account. I suppose the devil is in the detail of such an account, but it probably wouldn't meet the test of forming an agreement where the interest could not be accessed, as it would where you agreed to a binding condition for the interest not to be made available when the contract was formed.fuzzzzy said:

Is there not a difference though between a multi-year account which gives you the option at the outset of how interest is paid but then locks you into that option, and a multi-year account that allows you to change your options throughout the term of the account.masonic said:

The letter of the law appears to suggest that both should declare all of the interest at maturity. Most of the responses on the HMRC forum support this, but one does not (supporting the view that declining an option to access the money does not mean it wasn't available). The situation still isn't clear. My personal opinion is that the dissenting opinion is the result of a misunderstanding, and if you enter into T&Cs that prevent you from accessing interest, even voluntarily, and are subsequently bound by those terms, then the interest does not arise until you are able to access the interest.intalex said:

And to make it even clearer, saver 1 whose fix had the pay-out interest option but didn't take the option will have to declare annually, whereas saver 2 whose fix did not have the pay-out interest option but otherwise had exactly the same annually credited interest into the fix as saver 1 will be forced to declare at maturity??

Edit: When I say declare, I mean be considered for tax purposes.

In the second scenario you may choose to have your interest compounded for some months/years but paid away at other times. Could this not be interpreted as having access to your interest each year in a way that the first scenario does not allow.

0 -

What are people doing who are half way through a 5 year bond that they have been declaring and paying tax on annually, possibly incorrectly according to this forum? HMRC have recommended that I amend my previous tax returns and put in claims for the tax on earlier ones (though some are too early) so that I can then pay the tax at maturity! This would be a huge job (I have nearly 40 accounts) and may not even be correct in some cases as I can get no sense from different providers as to when they report to HMRC (most say they don't!). Is there a risk if I continue as before with the ones I've been paying tax on already that I could end up being taxed at maturity as well?0

Confirm your email address to Create Threads and Reply

Categories

- All Categories

- 352.9K Banking & Borrowing

- 253.9K Reduce Debt & Boost Income

- 454.7K Spending & Discounts

- 246K Work, Benefits & Business

- 602.1K Mortgages, Homes & Bills

- 177.8K Life & Family

- 259.9K Travel & Transport

- 1.5M Hobbies & Leisure

- 16K Discuss & Feedback

- 37.7K Read-Only Boards